International Game Technology (IGT) was just upgraded from a B POWR rating to a Strong Buy A POWR rating.

Valuation View

The fundamentals look solid for IGT going forward. The company handily beat expectations last quarter when they reported on November 9. EPS came in at 31 cents per share, handily beating estimates of 21 cents by 47%. Revenues also exceeded expectations and the company guided higher. Analysts also liked the report, as shown by the comments of Deutsche bank below:

“This (Tuesday) morning, IGT reported a strong third quarter, beating our model handily on both the revenue and adjusted cash flow lines,” Carlo Santarelli, a New York-based analyst for Deutsche Bank, said in a note to investors. “Net revenue of $984 million was up 21 percent year over year and was $21 million ahead of our $963 million forecast. Net-net, we think the beat, coupled with the implied higher-than-consensus fourth quarter, as well as the dividend institution, should bode well for shares,” he said.

Since that report, however, shares have dropped by over 25%. IGT stock has fallen from $32 to under $24 in the past month. The combination of better earnings and a lower stock price makes for a much more attractive multiple going forward. The current P/E now stands at 22.42x and the lowest level of the year. P/S is at similar trough valuations. The current dividend yield of over 3% also looks attractive compared to the 10-year Treasury yield of around 1.5%.

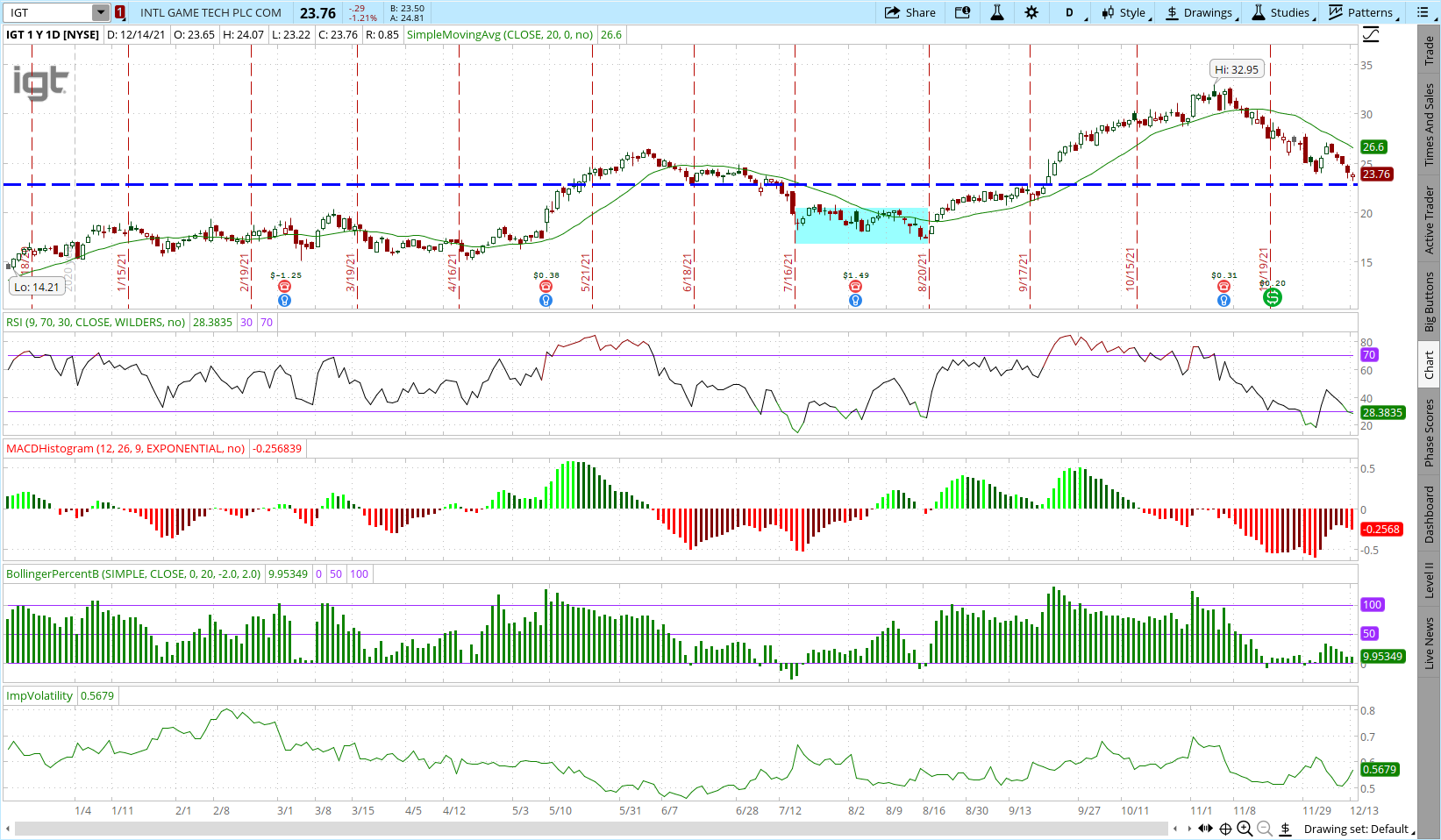

Technical Take

IGT stock is getting oversold on a technical basis as it nears major support at the $31 area. 9-day RSI breached the 30 level. Bollinger Percent B briefly dipped negative before turning slightly positive. MACD got to the lowest levels of the previous twelve months before firming. Shares are trading at the largest discount to the 20-day moving average over the past year. The last time all these indicators aligned in a similar fashion marked a meaningful low in IGT stock (highlighted in the chart).

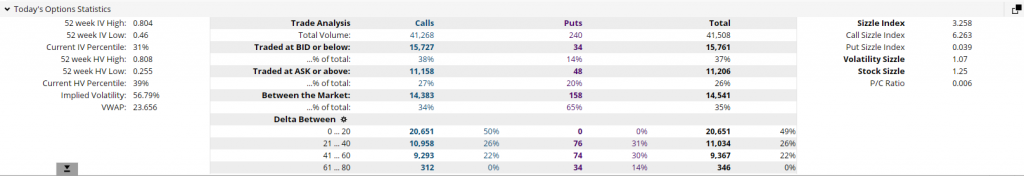

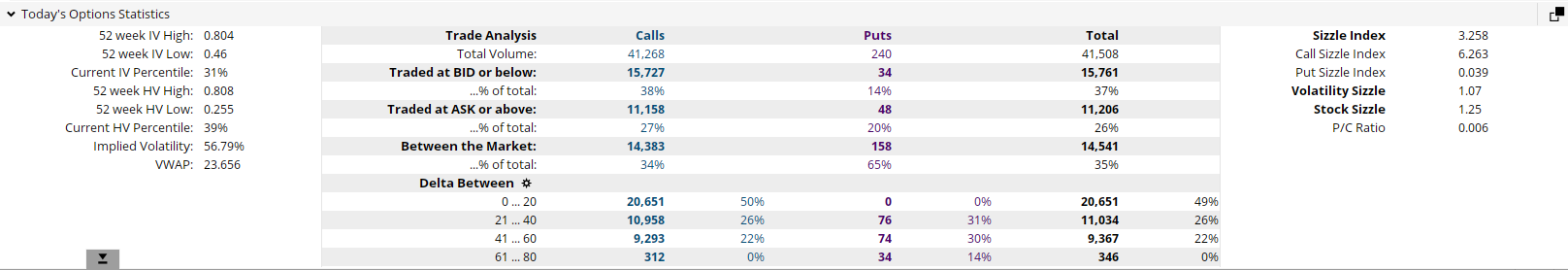

Interesting to note that on the day IGT was upgraded there was a sizeable uptick in call option volume on IGT. Over 41,000 calls traded Tuesday on IGT compared to only 240 puts. In all my many years of option trading I can't ever remember such a huge divergence. Certainly some big time players are likely positioning for a pop in IGT stock. Usually not a bad idea to tag along and follow the bullish call flow.

This big-time call buying also led to an uptick in implied volatility (IV). The April $25 calls were unchanged on the day even with IGT stock down 29 cents as IV jumped from 55 to over 58 due to the enormous call volume.

This sets up ideally for a covered call trade in IGT-buying the stock and selling the inflated April $25 call against that purchase. Using the closing prices, one would buy IGT at $23.76 and sell 1 IGT April $25 call for each 100 shares purchased. The IGT April $25 calls were priced around $2.50, so the total cost for the trade would be $23.76 less $2.50, or $21.26.

Selling the calls cushions the downside by over 10% ($2.50/$23.76). Since there is no free lunch, the call sale also limits the upside on gains past $25. If IGT closes above $25 at April expiration the trade would realize a 17.59% return over the 120-day holding period. This equates to over a 60% annualized return. The fact that IGT pays a healthy 3.3% dividend would boost the overall return accordingly.

Investors looking for solid returns with lower risk may want to consider adding a hedged A Rated IGT position to the portfolio near current levels.

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings, where we show you how you can consistently find the top options trades.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

IGT shares were unchanged in premarket trading Wednesday. Year-to-date, IGT has gained 41.28%, versus a 25.19% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

The post International Game Technology: A Safer Way To Bet On A Rebound After the Recent POWR Rating Upgrade appeared first on StockNews.com