Since August 2025, Costco has been in a holding pattern, posting a small return of 3.3% while floating around $1,011.

Given the underwhelming price action, is now a good time to buy COST? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does Costco Spark Debate?

Designed to be a one-stop shop for the suburban consumer, Costco (NASDAQ: COST) is a membership-only retail chain that sells groceries, apparel, toys, and household items, often in bulk quantities.

Two Positive Attributes:

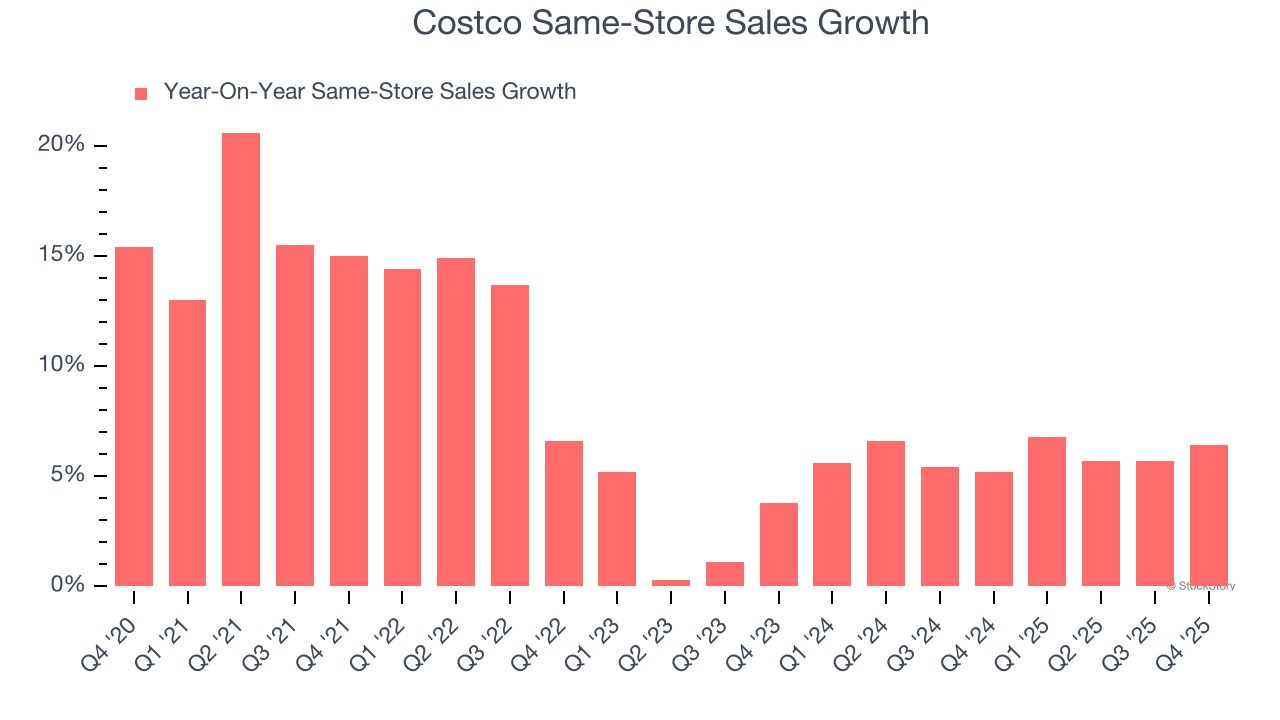

1. Surging Same-Store Sales Show Increasing Demand

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Costco has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 5.9%.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

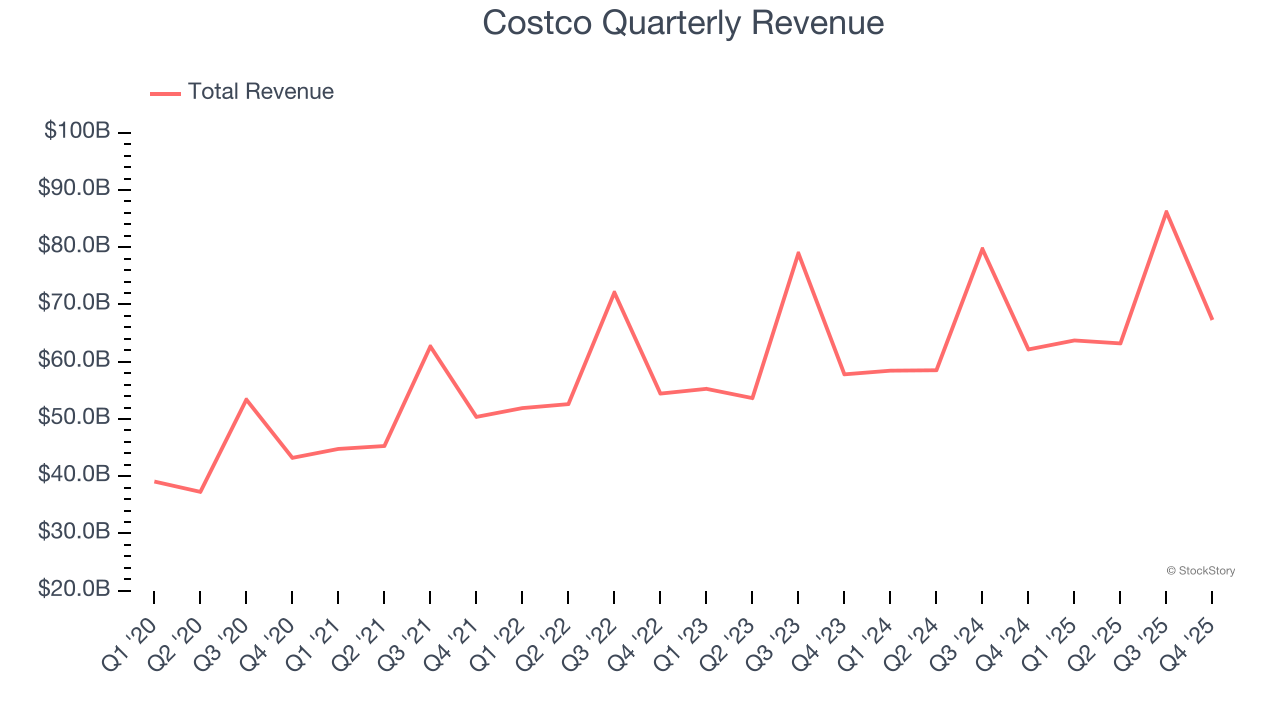

With $280.4 billion in revenue over the past 12 months, Costco is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To accelerate sales, Costco likely needs to optimize its pricing or lean into international expansion.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Costco’s 6.7% annualized revenue growth over the last three years was tepid. This wasn’t a great result compared to the rest of the consumer retail sector, but there are still things to like about Costco.

Final Judgment

Costco has huge potential even though it has some open questions, but at $1,011 per share (or 49.4× forward P/E), is now the right time to buy the stock? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.