Carlyle trades at $65.68 and has moved in lockstep with the market. Its shares have returned 11.4% over the last six months while the S&P 500 has gained 11.1%.

Is now the time to buy CG? Find out in our full research report, it’s free.

Why Is CG a Good Business?

Founded in 1987 with just $5 million in capital and named after the iconic New York hotel where the founders first met, The Carlyle Group (NASDAQ: CG) is a global investment firm that raises, manages, and deploys capital across private equity, credit, and investment solutions.

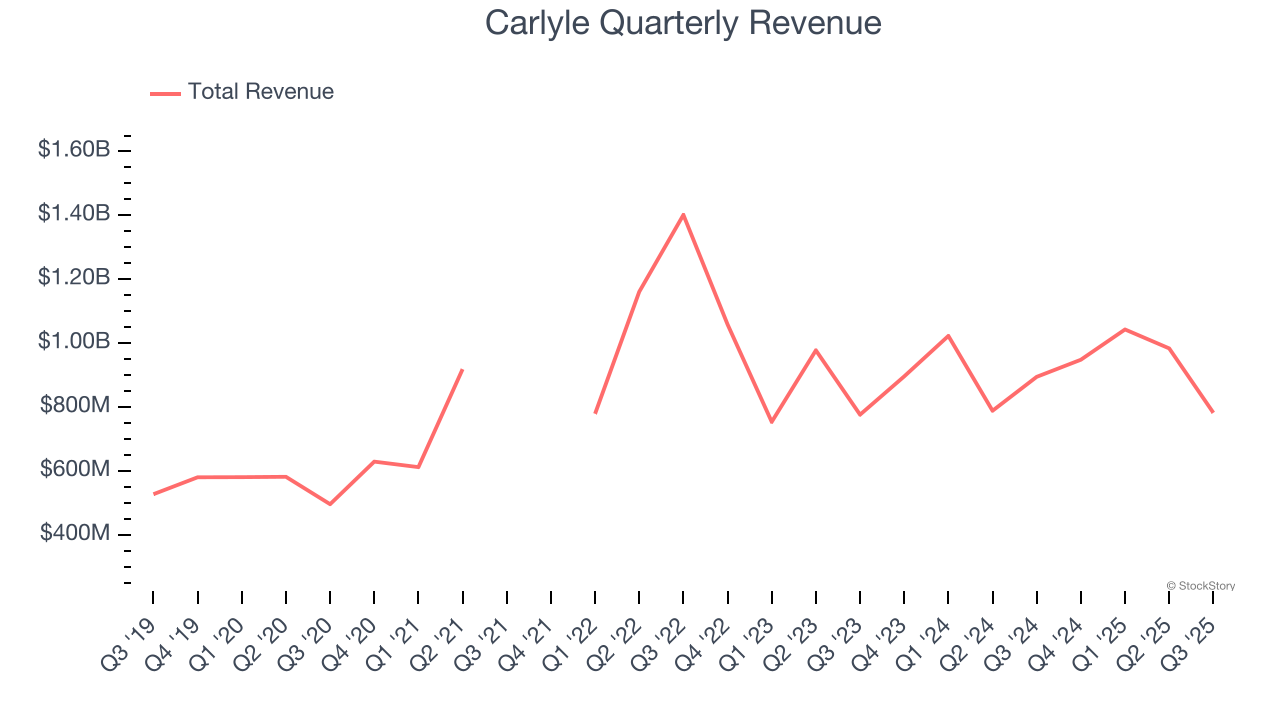

1. Long-Term Revenue Growth Shows Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Luckily, Carlyle’s revenue grew at a decent 10.9% compounded annual growth rate over the last five years. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.2. Strong Fee-Related Earnings Performance

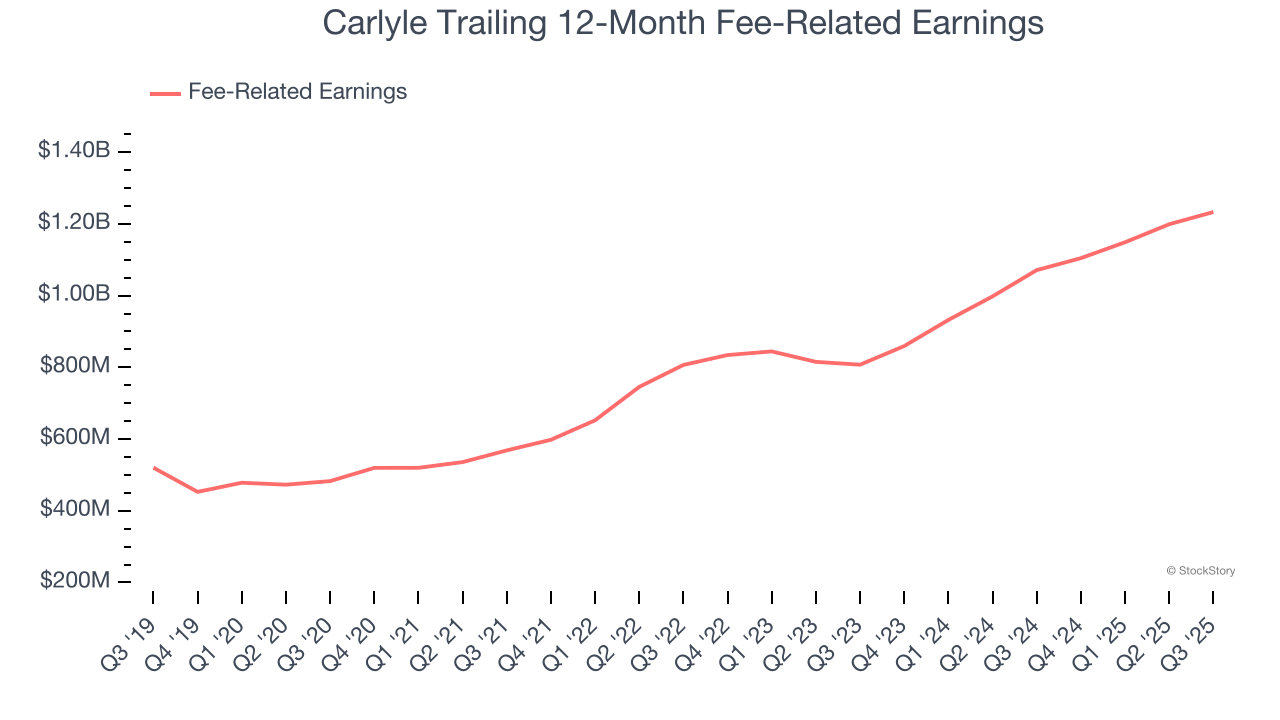

While revenue growth captures attention, the quality of that growth is what truly drives shareholder value. For asset management firms, fee-related earnings represent the stable, predictable profits from their core fee-based services, excluding the more unpredictable elements like performance fees and investment returns. This metric reveals the sustainable earnings power of the business.

Carlyle’s annual fee-related earnings growth over the last five years was 20.6%, a solid result.

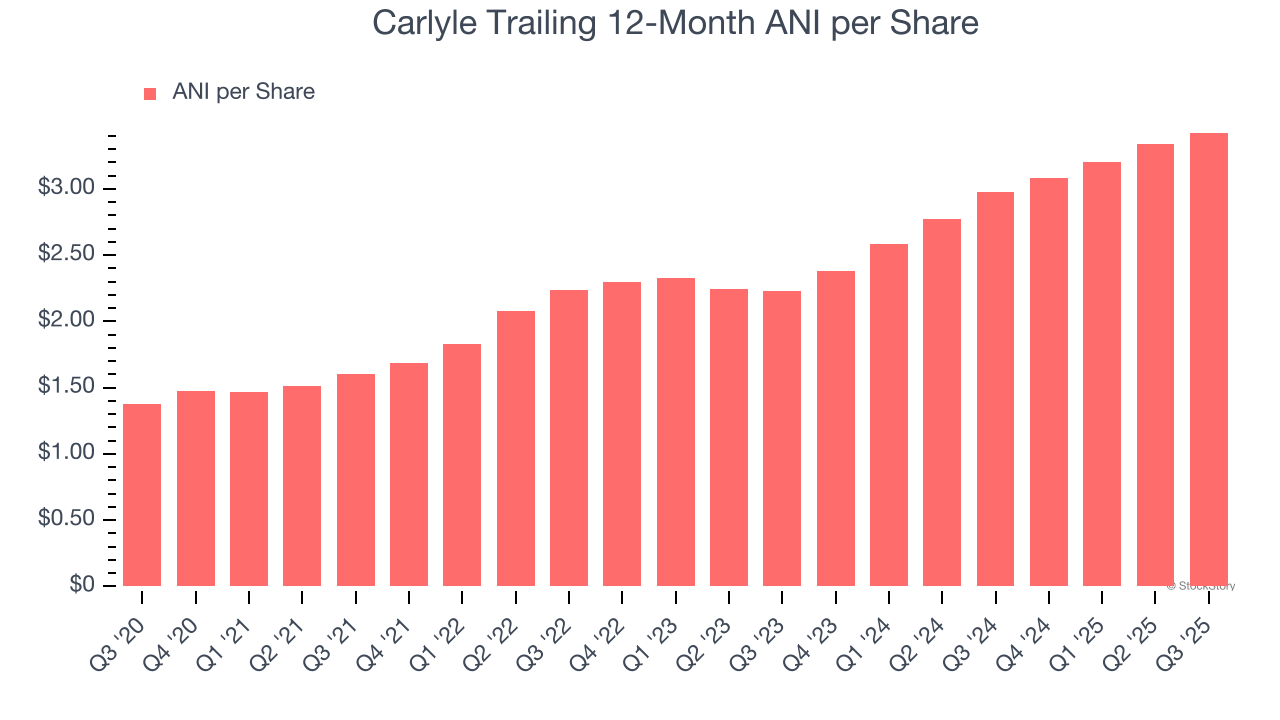

3. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Carlyle’s EPS grew at a remarkable 20% compounded annual growth rate over the last five years, higher than its 10.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think Carlyle is a high-quality business, but at $65.68 per share (or 14.4× forward P/E), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.