The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how wireless, cable and satellite stocks fared in Q1, starting with Altice (NYSE: ATUS).

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

The 8 wireless, cable and satellite stocks we track reported a mixed Q1. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.7% below.

While some wireless, cable and satellite stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.6% since the latest earnings results.

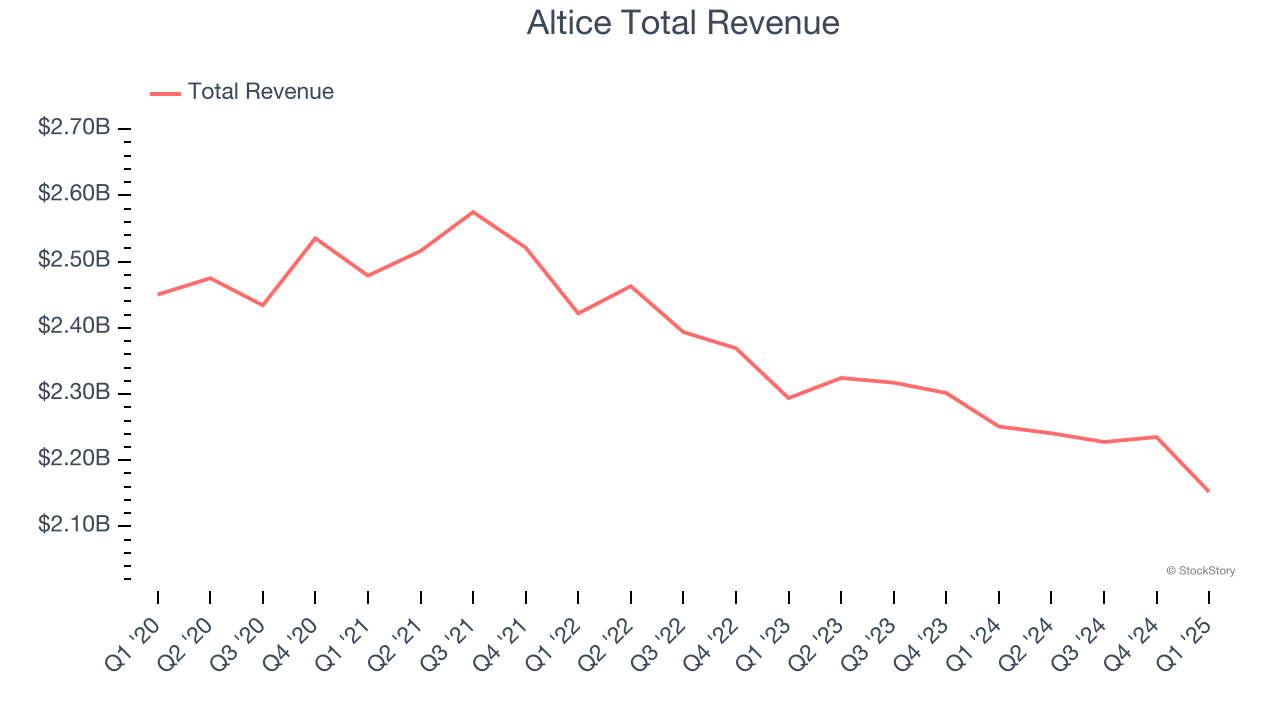

Weakest Q1: Altice (NYSE: ATUS)

Based in Long Island City, Altice USA (NYSE: ATUS) is a telecommunications company offering cable, internet, telephone, and television services across the United States.

Altice reported revenues of $2.15 billion, down 4.4% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ EPS estimates and a miss of analysts’ adjusted operating income estimates.

Dennis Mathew, Altice USA Chairman and Chief Executive Officer, said: "Our first quarter results reflect steady progress against our operational and financial priorities. We achieved record customer growth in our fiber and mobile businesses and saw sequential improvement in our broadband subscriber performance, all while successfully completing two major programming negotiations with favorable outcomes and minimal disruptions to our customers. We are activating competitive strategies with enhanced go-to-market effectiveness, deepening penetration of both new and existing products, and transforming our operations to drive efficiency, leading to our lowest churn levels in three years. Based on our continued progress and momentum we expect to deliver approximately $3.4bn of Adjusted EBITDA in Full Year 2025, representing a meaningful improvement from prior year trends, as we stay focused on sustainable growth, shareholder value, and delivering best-in-class services to the communities we serve."

Unsurprisingly, the stock is down 21.6% since reporting and currently trades at $2.07.

Read our full report on Altice here, it’s free.

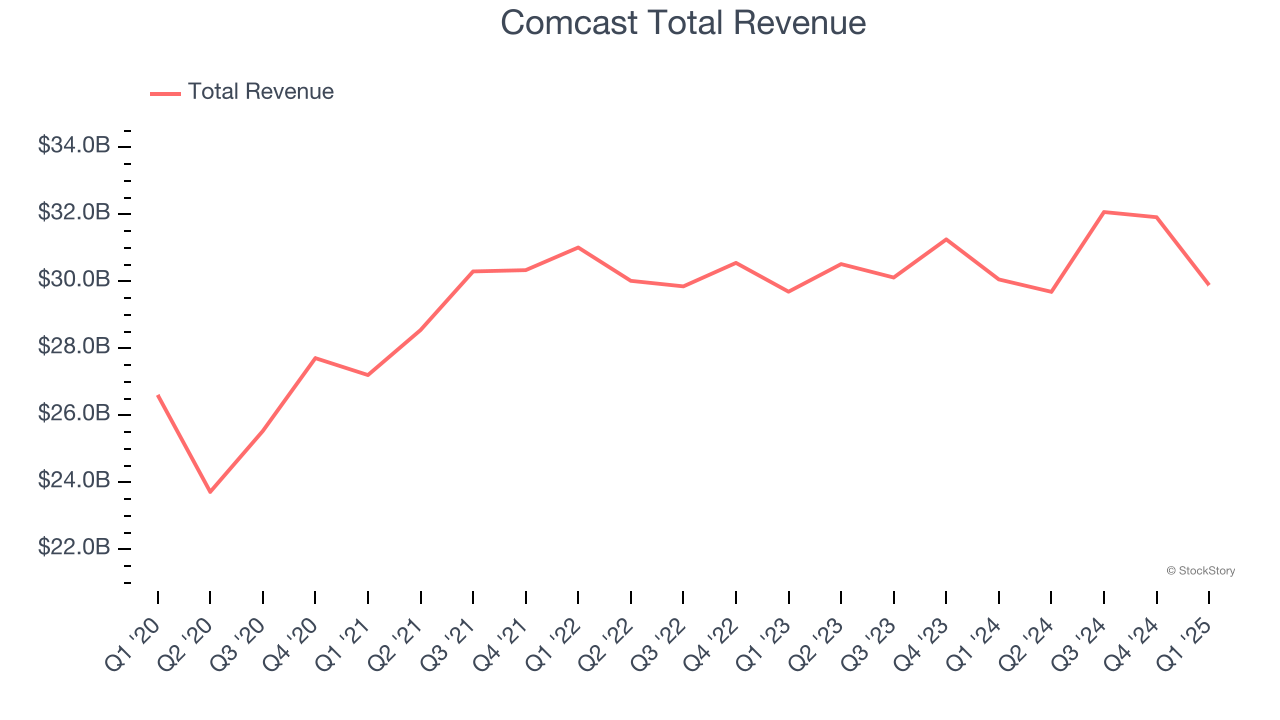

Best Q1: Comcast (NASDAQ: CMCSA)

Formerly known as American Cable Systems, Comcast (NASDAQ: CMCSA) is a multinational telecommunications company offering a wide range of services.

Comcast reported revenues of $29.89 billion, flat year on year, in line with analysts’ expectations. The business had a satisfactory quarter with a decent beat of analysts’ EPS estimates.

The market seems content with the results as the stock is up 3.2% since reporting. It currently trades at $35.50.

Is now the time to buy Comcast? Access our full analysis of the earnings results here, it’s free.

Cable One (NYSE: CABO)

Founded in 1986, Cable One (NYSE: CABO) provides high-speed internet, cable television, and telephone services, primarily in smaller markets across the United States.

Cable One reported revenues of $380.6 million, down 5.9% year on year, falling short of analysts’ expectations by 1.5%. It was a slower quarter as it posted a miss of analysts’ adjusted operating income and residential video subscribers estimates.

Cable One delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 48.3% since the results and currently trades at $135.81.

Read our full analysis of Cable One’s results here.

Verizon (NYSE: VZ)

Formed in 1984 as Bell Atlantic after the breakup of Bell System into seven companies, Verizon (NYSE: VZ) is a telecom giant providing a range of communications and internet services.

Verizon reported revenues of $33.49 billion, up 1.5% year on year. This print was in line with analysts’ expectations. More broadly, it was a mixed quarter as it underperformed in some other aspects of the business.

The company added 1,194,000 customers to reach a total of 146 million. The stock is flat since reporting and currently trades at $43.14.

Read our full, actionable report on Verizon here, it’s free.

AT&T (NYSE: T)

Founded by Alexander Graham Bell, AT&T (NYSE: T) is a multinational telecomm conglomerate providing a range of communications and internet services.

AT&T reported revenues of $30.63 billion, up 2% year on year. This number surpassed analysts’ expectations by 1%. More broadly, it was a mixed quarter as it also recorded a decent beat of analysts’ adjusted operating income estimates but a slight miss of analysts’ EPS estimates.

AT&T achieved the fastest revenue growth among its peers. The stock is up 7% since reporting and currently trades at $28.83.

Read our full, actionable report on AT&T here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.