Upscale restaurant company The One Group Hospitality (NASDAQ: STKS) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 148% year on year to $211.1 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $207.5 million was less impressive, coming in 2.3% below expectations. Its non-GAAP profit of $0.14 per share was significantly above analysts’ consensus estimates.

Is now the time to buy The ONE Group? Find out by accessing our full research report, it’s free.

The ONE Group (STKS) Q1 CY2025 Highlights:

- Revenue: $211.1 million vs analyst estimates of $203.4 million (148% year-on-year growth, 3.8% beat)

- Adjusted EPS: $0.14 vs analyst estimates of -$0.14 (significant beat)

- Adjusted EBITDA: $25.2 million vs analyst estimates of $24.51 million (11.9% margin, 2.8% beat)

- The company reconfirmed its revenue guidance for the full year of $852.5 million at the midpoint

- EBITDA guidance for the full year is $105 million at the midpoint, above analyst estimates of $102.7 million

- Operating Margin: 5.1%, up from 1.1% in the same quarter last year

- Same-Store Sales fell 3.2% year on year (-7.9% in the same quarter last year)

- Market Capitalization: $94.94 million

Company Overview

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ: STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $799.5 million in revenue over the past 12 months, The ONE Group is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can grow faster because it has more white space to build new restaurants.

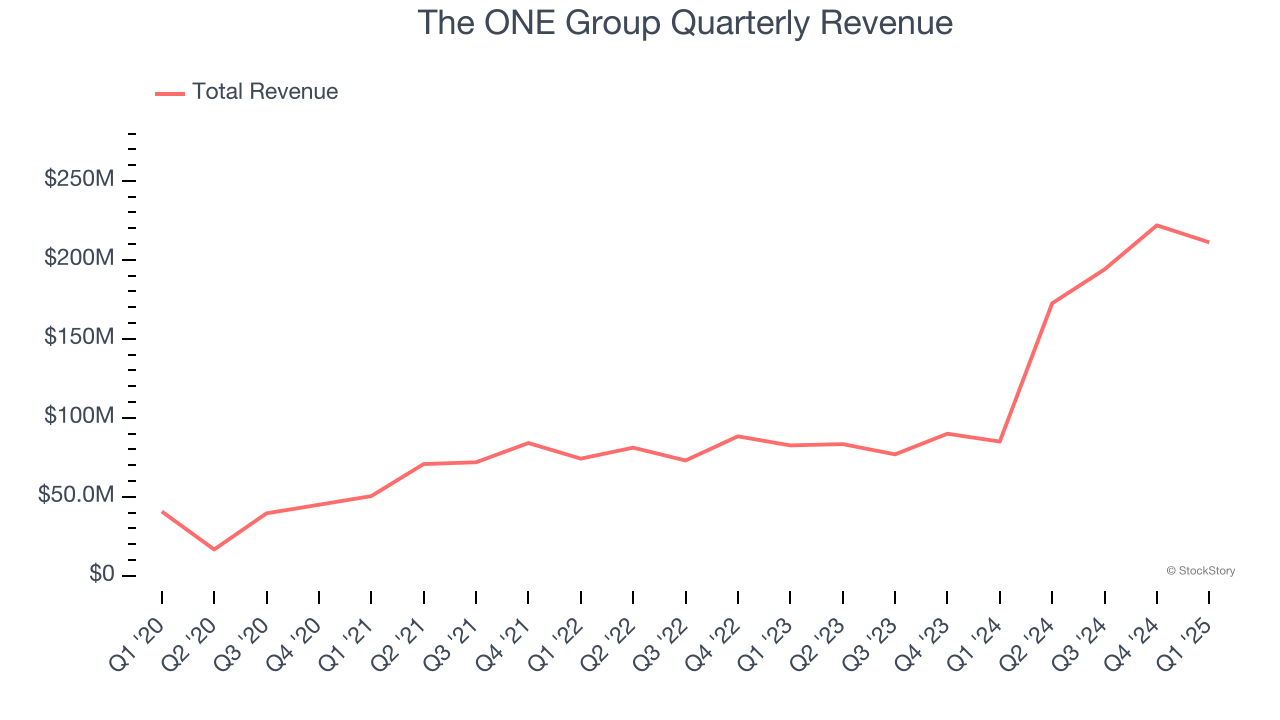

As you can see below, The ONE Group’s 44.2% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was incredible as it opened new restaurants and expanded its reach.

This quarter, The ONE Group reported magnificent year-on-year revenue growth of 148%, and its $211.1 million of revenue beat Wall Street’s estimates by 3.8%. Company management is currently guiding for a 20.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and suggests its menu offerings will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Restaurant Performance

Number of Restaurants

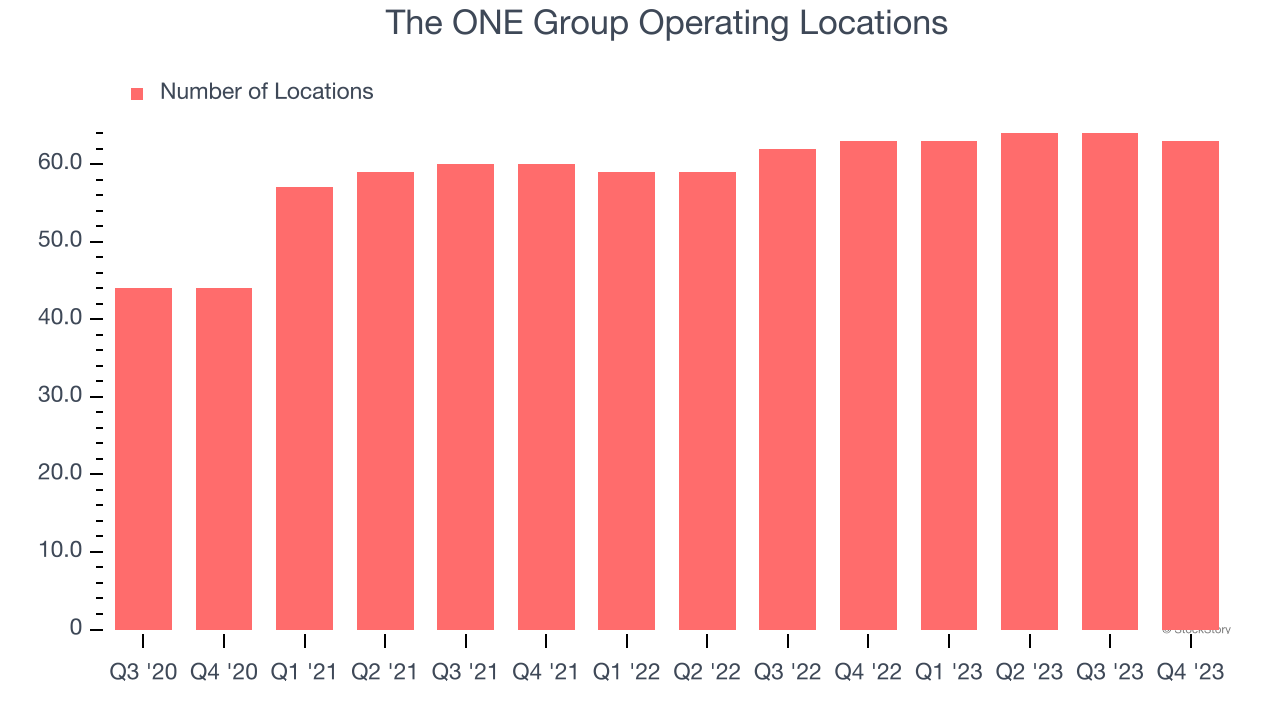

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Over the last two years, The ONE Group opened new restaurants at a rapid clip by averaging 3.9% annual growth, among the fastest in the restaurant sector. This gives it a chance to scale into a mid-sized business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Note that The ONE Group reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

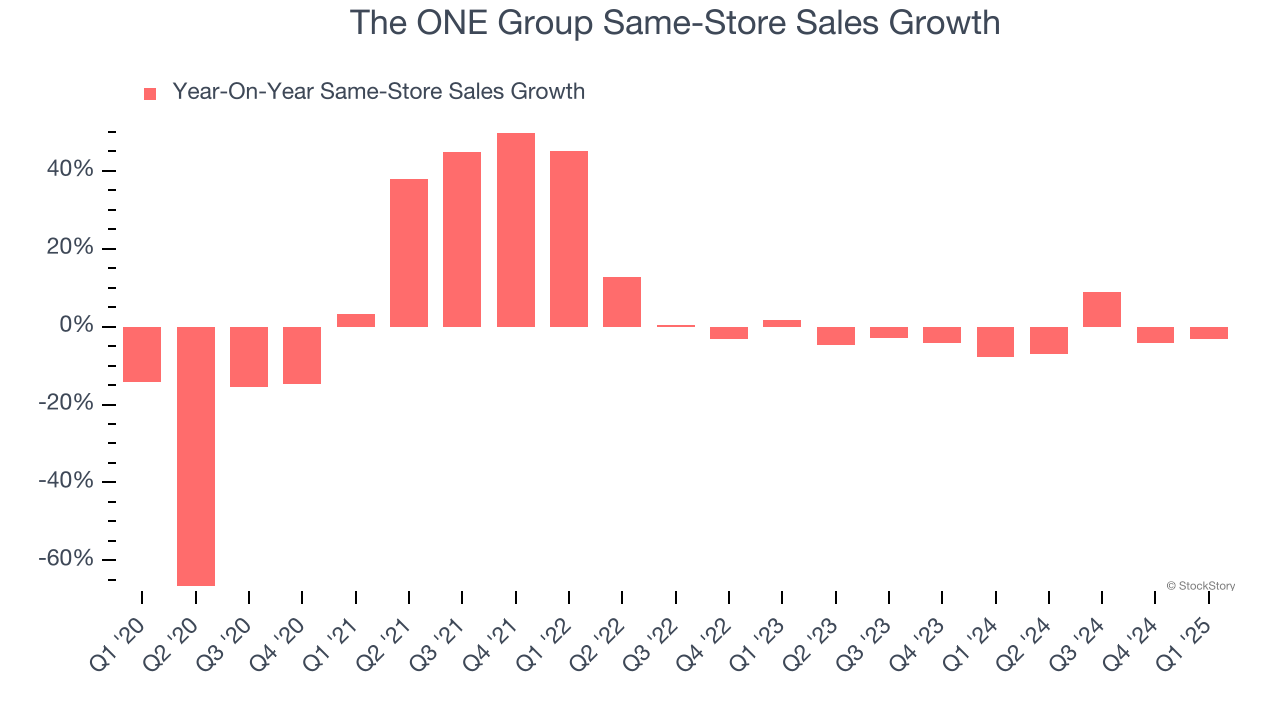

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

The ONE Group’s demand has been shrinking over the last two years as its same-store sales have averaged 3.2% annual declines. This performance is concerning - it shows The ONE Group artificially boosts its revenue by building new restaurants. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its restaurant base.

In the latest quarter, The ONE Group’s same-store sales fell by 3.2% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from The ONE Group’s Q1 Results

We were impressed by how significantly The ONE Group blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue guidance for next quarter missed significantly and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 4% to $3.23 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.