Off-price retail company Ross Stores (NASDAQ: ROST) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 2.6% year on year to $4.98 billion. On the other hand, next quarter’s revenue guidance of $5.37 billion was less impressive, coming in 2.3% below analysts’ estimates. Its GAAP profit of $1.47 per share was 2.5% above analysts’ consensus estimates.

Is now the time to buy Ross Stores? Find out by accessing our full research report, it’s free.

Ross Stores (ROST) Q1 CY2025 Highlights:

- Revenue: $4.98 billion vs analyst estimates of $4.96 billion (2.6% year-on-year growth, 0.5% beat)

- EPS (GAAP): $1.47 vs analyst estimates of $1.43 (2.5% beat)

- Adjusted EBITDA: $761.7 million vs analyst estimates of $710.4 million (15.3% margin, 7.2% beat)

- Revenue Guidance for Q2 CY2025 is $5.37 billion at the midpoint, below analyst estimates of $5.50 billion

- EPS (GAAP) guidance for Q2 CY2025 is $1.48 at the midpoint, missing analyst estimates by 10.3%

- Operating Margin: 12.2%, in line with the same quarter last year

- Free Cash Flow Margin: 4.1%, similar to the same quarter last year

- Locations: 2,205 at quarter end, up from 2,127 in the same quarter last year

- Same-Store Sales were flat year on year (3% in the same quarter last year)

- Market Capitalization: $50.21 billion

Company Overview

Selling excess inventory or overstocked items from other retailers, Ross Stores (NASDAQ: ROST) is an off-price concept that sells apparel and other goods at prices much lower than department stores.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $21.26 billion in revenue over the past 12 months, Ross Stores is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To expand meaningfully, Ross Stores likely needs to tweak its prices or enter new markets.

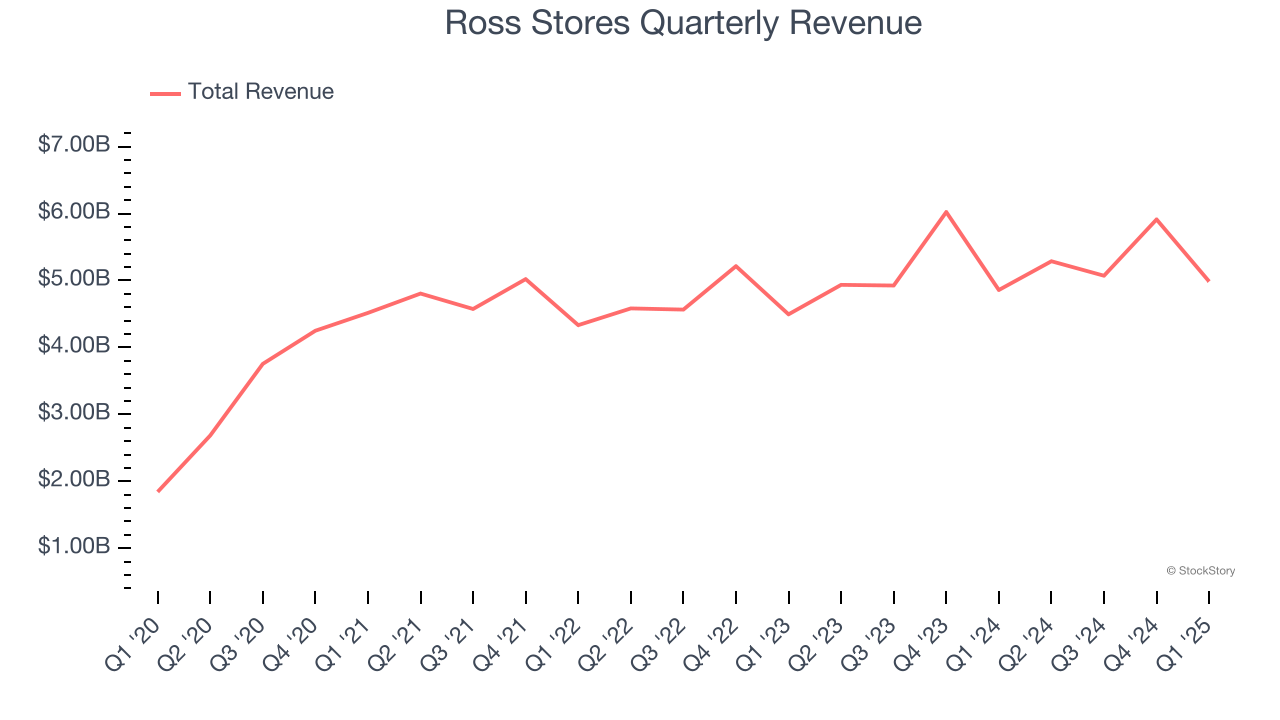

As you can see below, Ross Stores grew its sales at a tepid 5.8% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, Ross Stores reported modest year-on-year revenue growth of 2.6% but beat Wall Street’s estimates by 0.5%. Company management is currently guiding for a 1.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, similar to its six-year rate. We still think its growth trajectory is satisfactory given its scale and indicates the market sees success for its products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

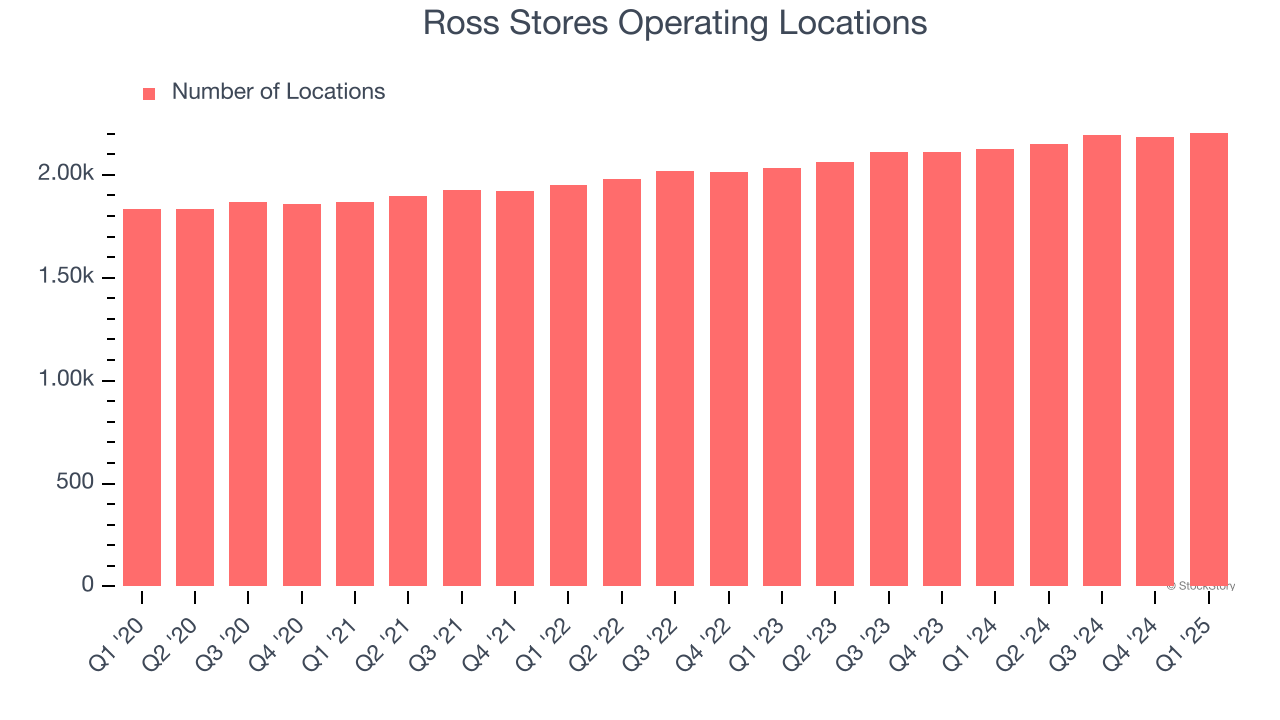

Ross Stores sported 2,205 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 4.2% annual growth, among the fastest in the consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

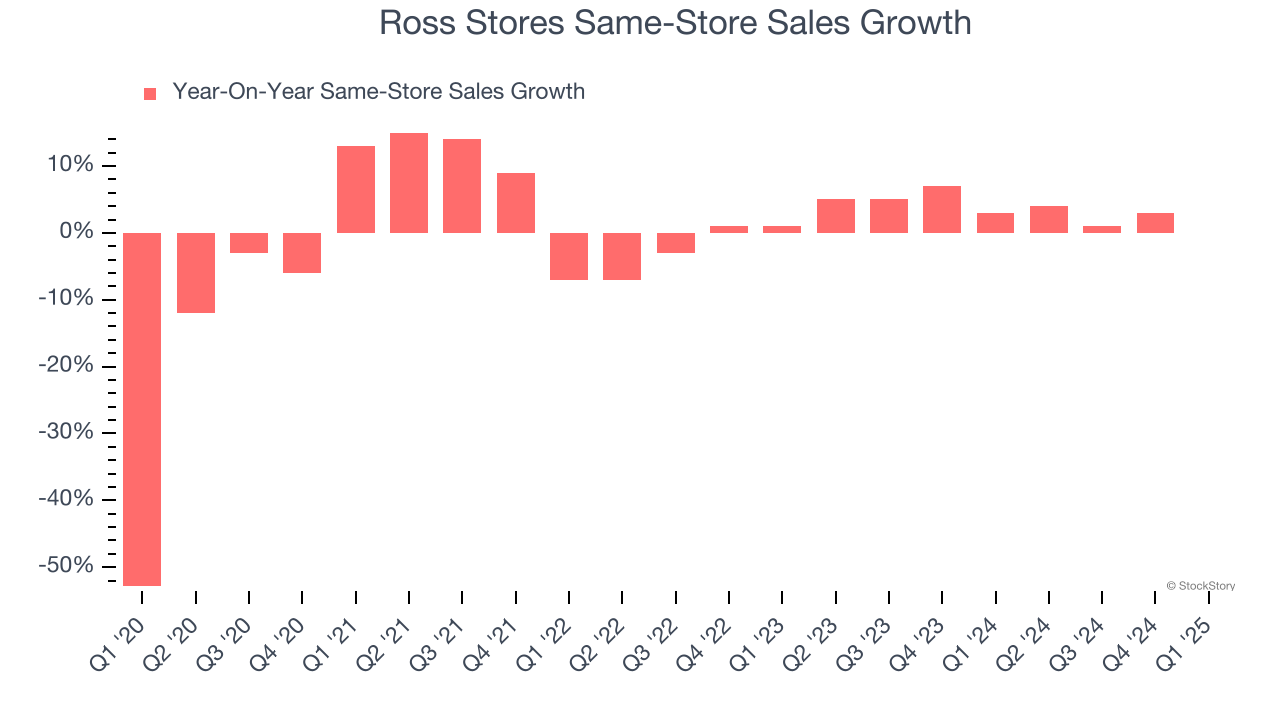

Ross Stores’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.5% per year. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Ross Stores multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Ross Stores’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Ross Stores can reaccelerate growth.

Key Takeaways from Ross Stores’s Q1 Results

We enjoyed seeing Ross Stores beat analysts’ revenue, EPS, and EBITDA expectations this quarter. On the other hand, its revenue and EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 9% to $138.50 immediately following the results.

Is Ross Stores an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.