As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the pharmaceuticals industry, including Jazz Pharmaceuticals (NASDAQ: JAZZ) and its peers.

The pharmaceuticals sector is pivotal in the development, manufacturing, and distribution of drugs and treatments across a wide range of therapeutic areas. These companies benefit from diversified portfolios, including blockbuster drugs, vaccines, and specialty treatments, along with the ability to generate substantial revenue from both branded and generic medications. Advantages include large-scale manufacturing capabilities, significant resources for research and development, and the ability to generate revenue from multiple channels. However, challenges include patent expirations leading to generic competition, high regulatory hurdles, and the inherent risk of drug development failure in clinical trials. Looking ahead, the pharmaceuticals sector is poised to benefit from several strong tailwinds. Innovations in precision medicine, including genetic therapies and advanced biologics, should drive growth, particularly in oncology, rare diseases, and chronic conditions. The increasing role of artificial intelligence in drug discovery and patient care is another key to better, more efficient drug development. However, the sector also faces potential headwinds like regulatory pressure on drug pricing, with patients and the government on both sides of the political divide in the US agreeing that consumers are spending too much on healthcare. There is also the growing scrutiny of patent practices to protect consumers as well as evolving competition from biosimilars.

The 16 pharmaceuticals stocks we track reported a mixed Q1. As a group, revenues were in line with analysts’ consensus estimates.

While some pharmaceuticals stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.2% since the latest earnings results.

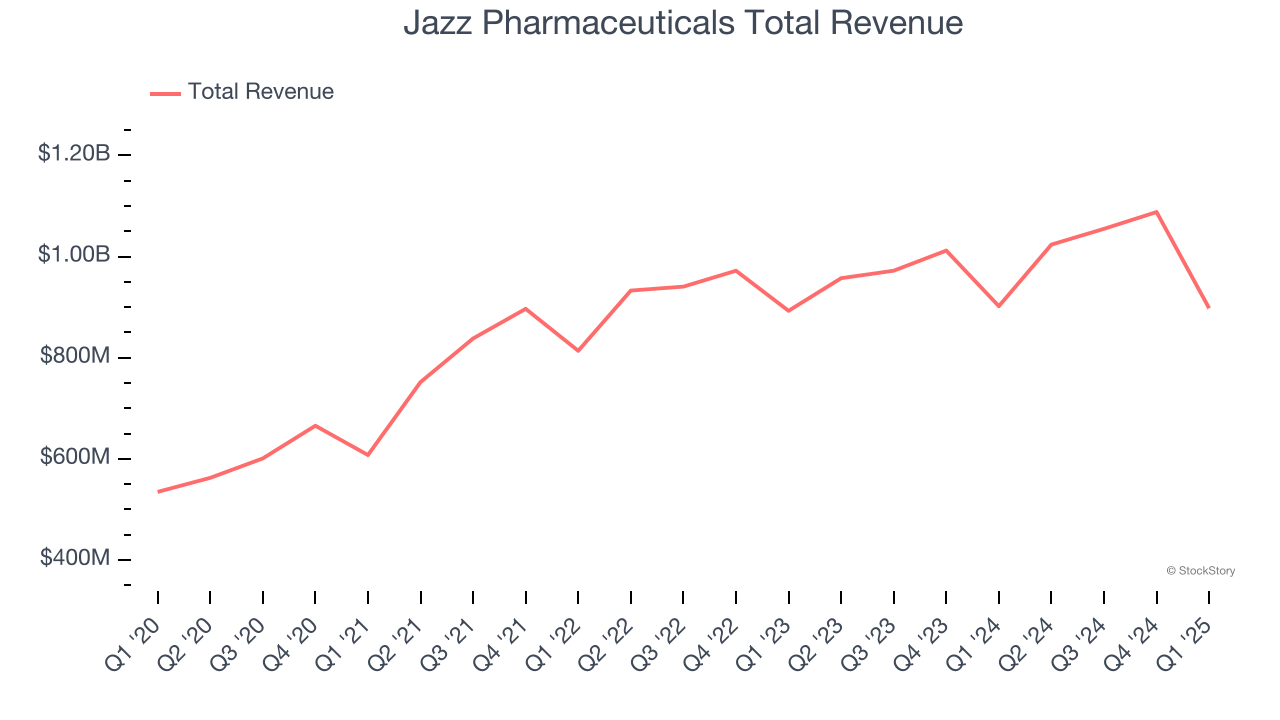

Weakest Q1: Jazz Pharmaceuticals (NASDAQ: JAZZ)

Originally founded in 2003 and now headquartered in Ireland following a 2012 tax inversion merger, Jazz Pharmaceuticals (NASDAQGS:JAZZ) develops and markets medicines for sleep disorders, epilepsy, and cancer, with a focus on treatments for patients with limited therapeutic options.

Jazz Pharmaceuticals reported revenues of $897.8 million, flat year on year. This print fell short of analysts’ expectations by 9%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ full-year EPS guidance estimates.

"In the first quarter of 2025, our focus on commercial execution resulted in total revenues of $898 million, led by the strong performance of Xywav and Epidiolex. In addition, our team continues to receive positive feedback from healthcare providers on the launch of Ziihera® in its first approved indication of 2L HER2+ BTC. We are affirming our 2025 total revenue guidance range of $4.15 - $4.40 billion, reflecting our confidence in our commercial portfolio delivering top-line growth this year," said Bruce Cozadd, chairman and chief executive officer, Jazz Pharmaceuticals.

The stock is down 6% since reporting and currently trades at $104.39.

Read our full report on Jazz Pharmaceuticals here, it’s free.

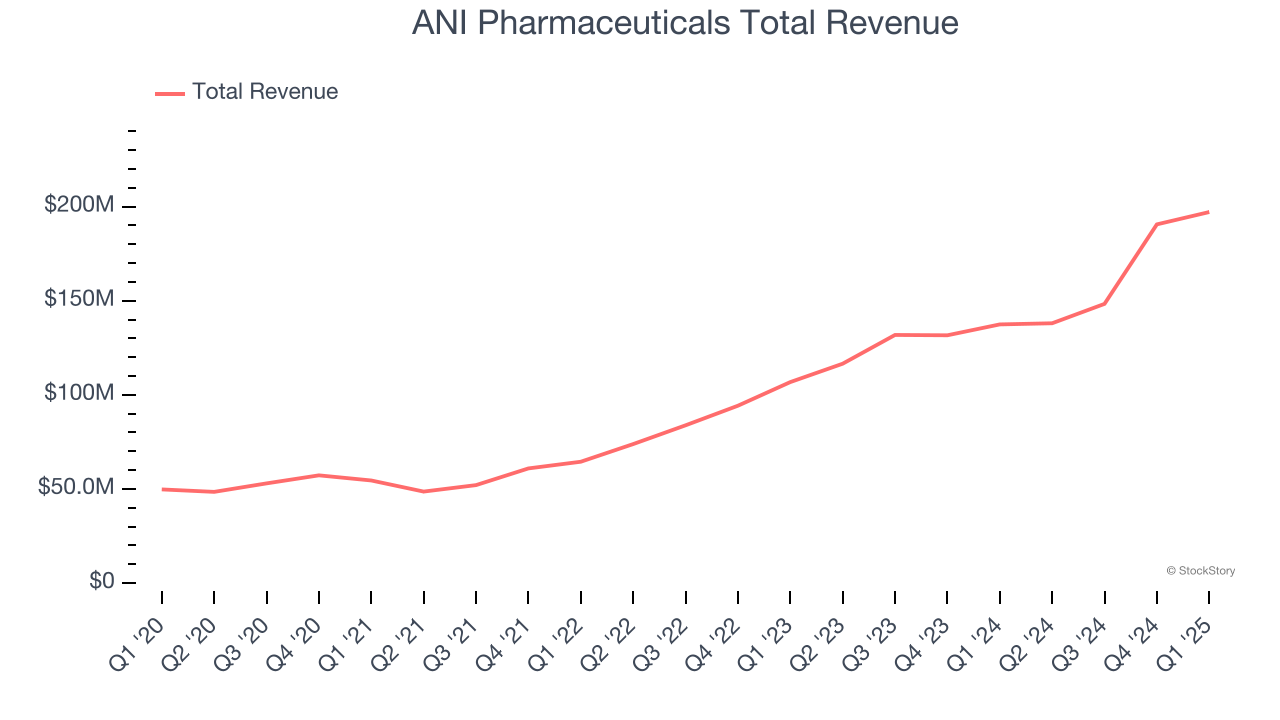

Best Q1: ANI Pharmaceuticals (NASDAQ: ANIP)

With a diverse portfolio of 116 pharmaceutical products and a growing rare disease platform, ANI Pharmaceuticals (NASDAQ: ANIP) develops, manufactures, and markets branded and generic prescription pharmaceuticals, with a focus on rare disease treatments.

ANI Pharmaceuticals reported revenues of $197.1 million, up 43.4% year on year, outperforming analysts’ expectations by 9.8%. The business had a very strong quarter with an impressive beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

ANI Pharmaceuticals scored the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 13.5% since reporting. It currently trades at $62.

Is now the time to buy ANI Pharmaceuticals? Access our full analysis of the earnings results here, it’s free.

Viatris (NASDAQ: VTRS)

Created through the 2020 merger of Mylan and Pfizer's Upjohn division, Viatris (NASDAQ: VTRS) is a healthcare company that develops, manufactures, and distributes branded and generic medicines across more than 165 countries worldwide.

Viatris reported revenues of $3.25 billion, down 11.2% year on year, falling short of analysts’ expectations by 0.7%. It was a mixed quarter as it posted a narrow beat of analysts’ full-year EPS guidance estimates but full-year revenue guidance slightly missing analysts’ expectations.

Viatris delivered the slowest revenue growth in the group. Interestingly, the stock is up 2.6% since the results and currently trades at $8.81.

Read our full analysis of Viatris’s results here.

Elanco (NYSE: ELAN)

Originally established as a division of pharmaceutical giant Eli Lilly before becoming independent in 2018, Elanco Animal Health (NYSE: ELAN) develops and sells medications, vaccines, and other health products for pets and farm animals across more than 90 countries.

Elanco reported revenues of $1.19 billion, flat year on year. This result beat analysts’ expectations by 2.4%. It was a strong quarter as it also recorded a solid beat of analysts’ EPS and constant currency revenue estimates.

The stock is up 36.9% since reporting and currently trades at $13.02.

Read our full, actionable report on Elanco here, it’s free.

Corcept (NASDAQ: CORT)

Focusing on the powerful stress hormone that affects everything from metabolism to immune function, Corcept Therapeutics (NASDAQ: CORT) develops and markets medications that modulate cortisol to treat endocrine disorders, cancer, and neurological diseases.

Corcept reported revenues of $157.2 million, up 7.1% year on year. This number lagged analysts' expectations by 11.6%. More broadly, it was actually a satisfactory quarter as it produced an impressive beat of analysts’ EPS estimates.

Corcept delivered the highest full-year guidance raise but had the weakest performance against analyst estimates among its peers. The stock is down 5.5% since reporting and currently trades at $70.00.

Read our full, actionable report on Corcept here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.