Breakfast restaurant chain First Watch Restaurant Group (NASDAQ: FWRG) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 7.6% year on year to $263.3 million. Its GAAP profit of $0.01 per share was in line with analysts’ consensus estimates.

Is now the time to buy First Watch? Find out by accessing our full research report, it’s free.

First Watch (FWRG) Q4 CY2024 Highlights:

- Revenue: $263.3 million vs analyst estimates of $263 million (7.6% year-on-year growth, in line)

- EPS (GAAP): $0.01 vs analyst estimates of $0.01 (in line)

- Adjusted EBITDA: $24.3 million vs analyst estimates of $23.31 million (9.2% margin, 4.2% beat)

- EBITDA guidance for the upcoming financial year 2025 is $127 million at the midpoint, below analyst estimates of $128.9 million

- Operating Margin: 1.5%, down from 2.8% in the same quarter last year

- Locations: 572 at quarter end, up from 524 in the same quarter last year

- Same-Store Sales were flat year on year (5% in the same quarter last year)

- Market Capitalization: $1.10 billion

“2024 was a pivotal year as we surpassed $1 billion in total revenues and $100 million in adjusted EBITDA for the first time. These milestones were supported and augmented by our teams’ operational acuity, successfully enhancing a variety of critical KPIs including labor efficiency, ticket times and customer experience scores, among others,” said Chris Tomasso, First Watch CEO and President.

Company Overview

Based on a nautical reference to the first work shift aboard a ship, First Watch (NASDAQ: FWRG) is a chain of breakfast and brunch restaurants whose menu is heavily-focused on eggs and griddle items such as pancakes.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.02 billion in revenue over the past 12 months, First Watch is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

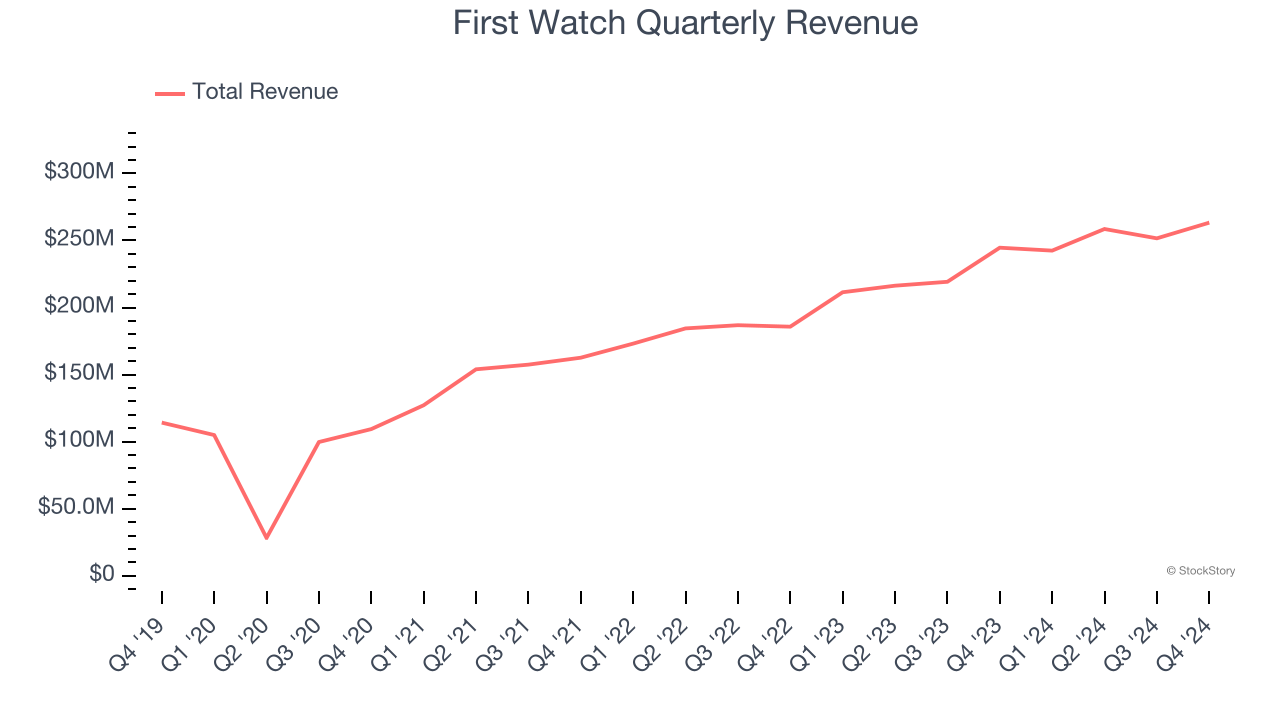

As you can see below, First Watch grew its sales at an excellent 18.4% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, First Watch grew its revenue by 7.6% year on year, and its $263.3 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 16.1% over the next 12 months, a slight deceleration versus the last five years. Despite the slowdown, this projection is healthy and implies the market is forecasting success for its menu offerings.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Restaurant Performance

Number of Restaurants

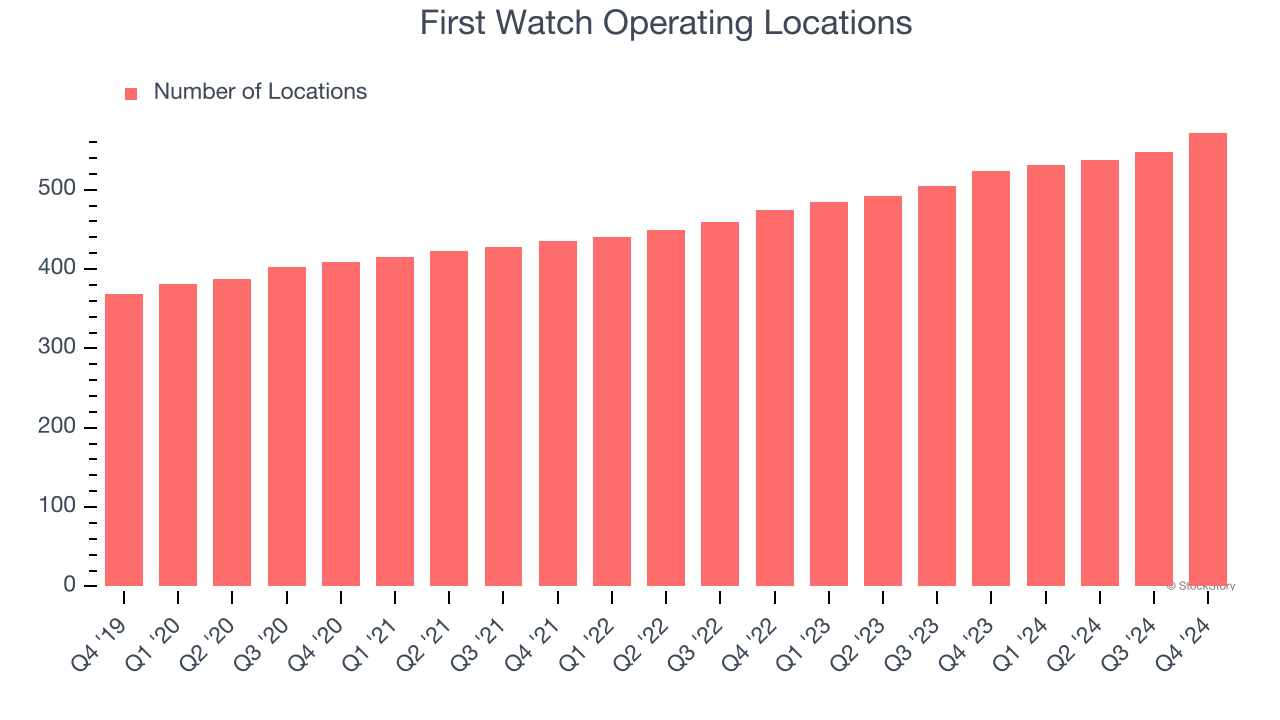

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

First Watch sported 572 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 9.6% annual growth, among the fastest in the restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

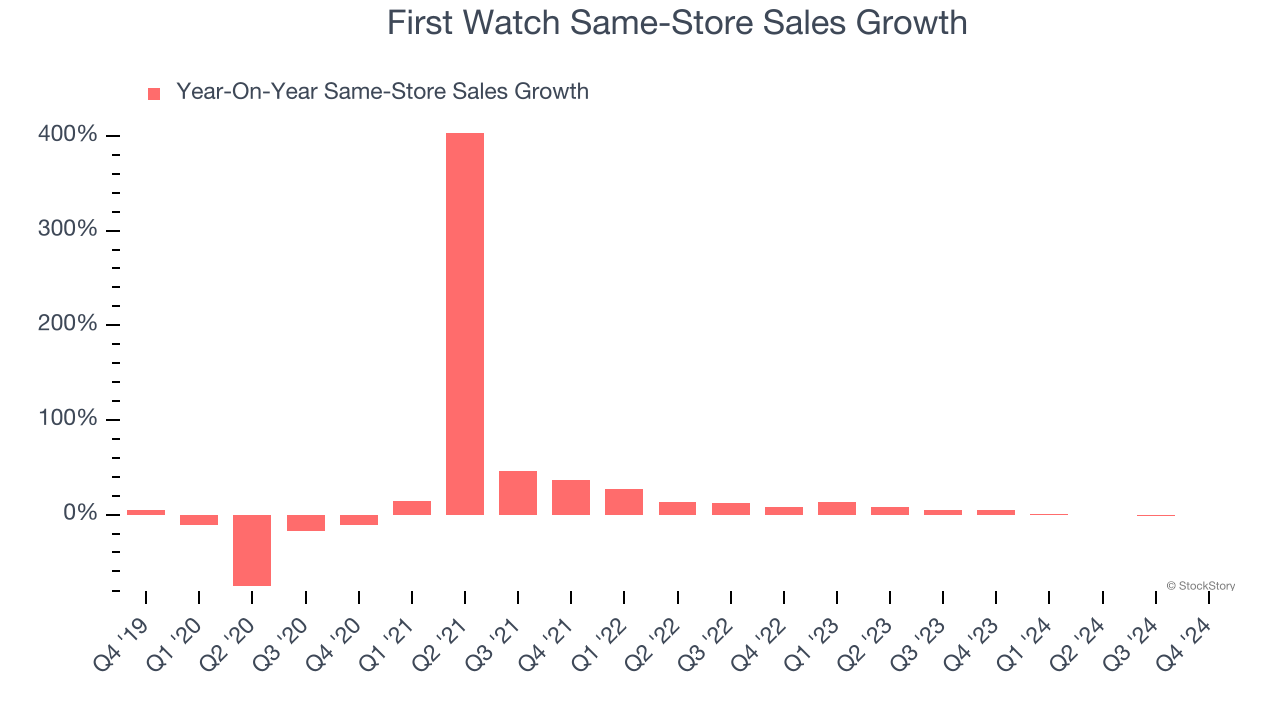

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

First Watch’s demand has been spectacular for a restaurant chain over the last two years. On average, the company has increased its same-store sales by an impressive 3.6% per year. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop because it gives First Watch multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, First Watch’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if First Watch can reaccelerate growth.

Key Takeaways from First Watch’s Q4 Results

We enjoyed seeing First Watch beat analysts’ same-store sales and EBITDA expectations this quarter. On the other hand, its EPS missed and its full-year EBITDA guidance fell slightly short of Wall Street’s estimates. Overall, this quarter was mixed. The stock remained flat at $18 immediately following the results.

So should you invest in First Watch right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.