Meritage Homes’s stock price has taken a beating over the past six months, shedding 22.2% of its value and falling to $74.61 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Meritage Homes, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why you should be careful with MTH and a stock we'd rather own.

Why Do We Think Meritage Homes Will Underperform?

Originally founded in 1985 in Arizona as Monterey Homes, Meritage Homes (NYSE: MTH) is a homebuilder specializing in designing and constructing energy-efficient and single-family homes in the US.

1. Backlog Declines as Orders Drop

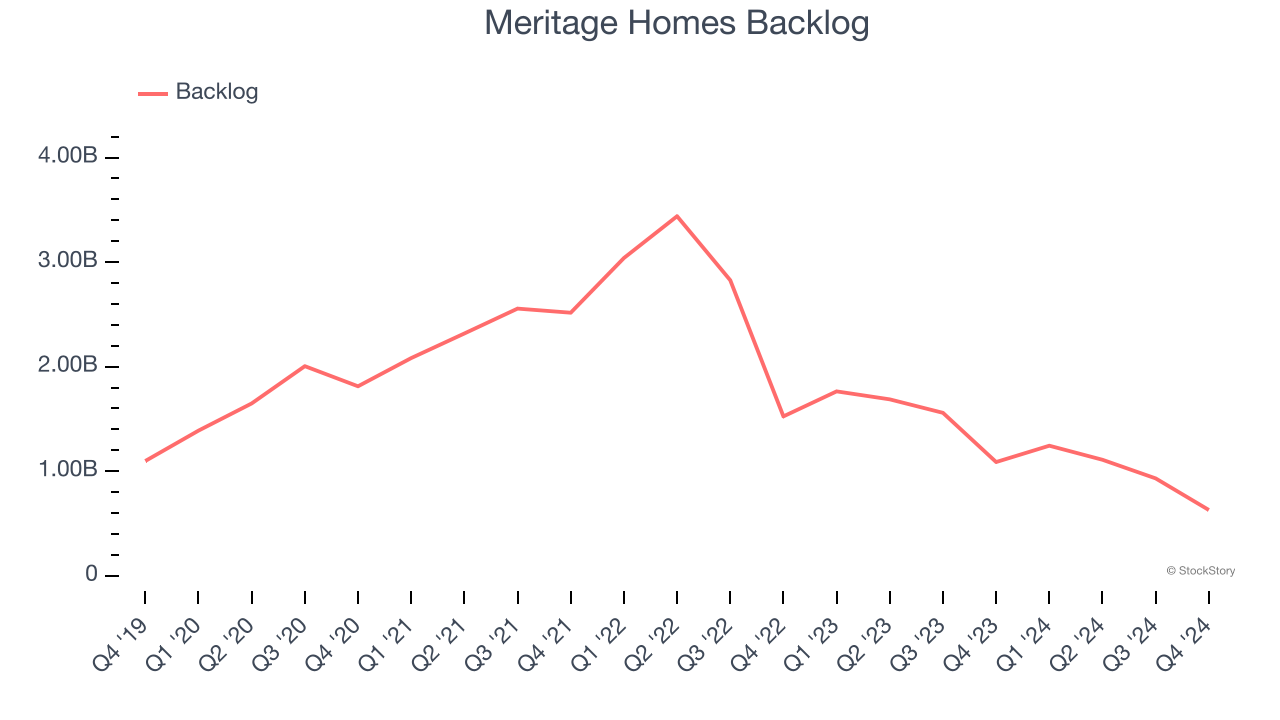

Investors interested in Home Builders companies should track backlog in addition to reported revenue. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Meritage Homes’s future revenue streams.

Meritage Homes’s backlog came in at $629.5 million in the latest quarter, and it averaged 39.1% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. Free Cash Flow Margin Dropping

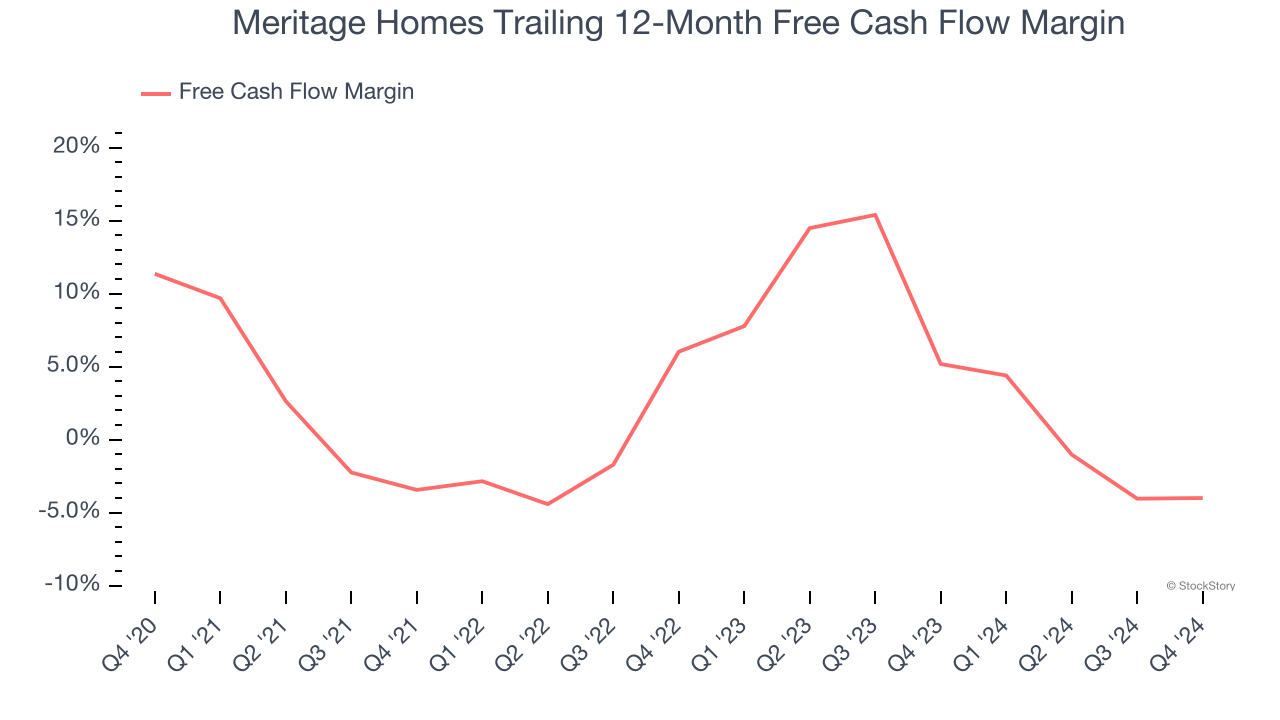

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Meritage Homes’s margin dropped by 15.4 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Meritage Homes’s free cash flow margin for the trailing 12 months was negative 4%.

3. New Investments Fail to Bear Fruit as ROIC Declines

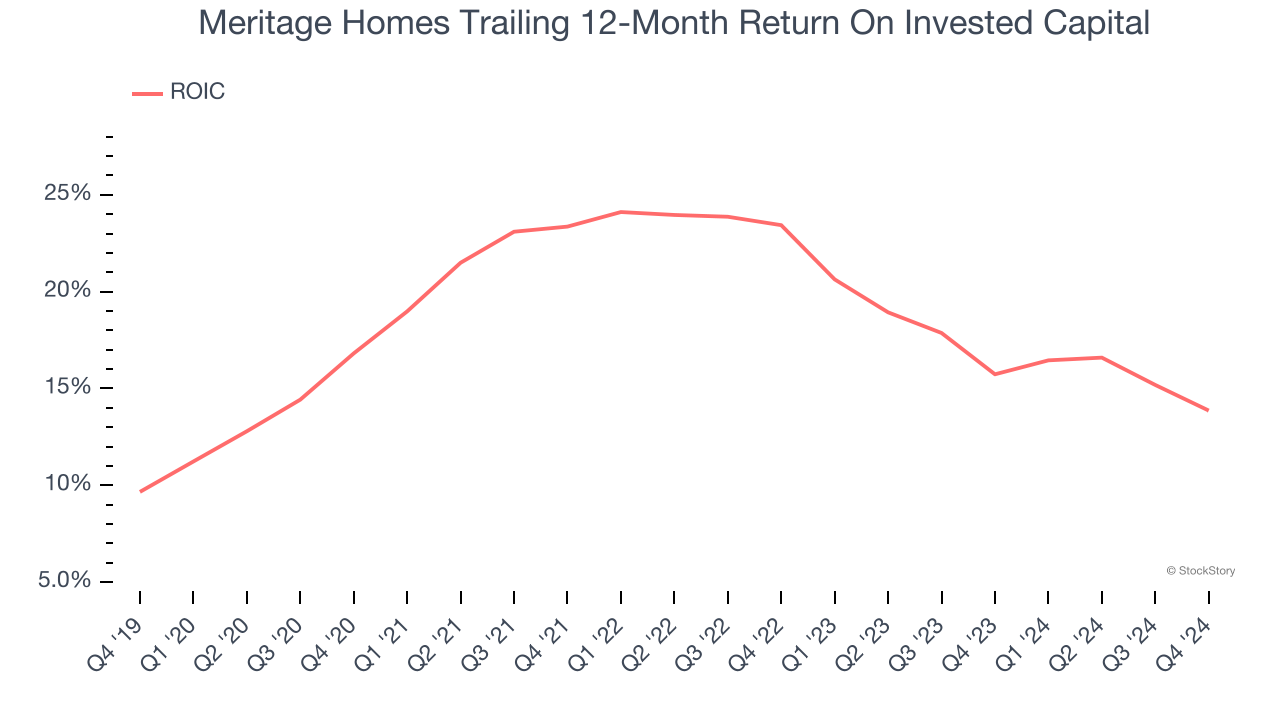

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Meritage Homes’s ROIC has unfortunately decreased. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Meritage Homes doesn’t pass our quality test. Following the recent decline, the stock trades at 7.1× forward price-to-earnings (or $74.61 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Meritage Homes

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.