Genomics company Pacific Biosciences of California (NASDAQ: PACB) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 32.8% year on year to $39.22 million. Its non-GAAP loss of $0.20 per share was 15.5% below analysts’ consensus estimates.

Is now the time to buy PacBio? Find out by accessing our full research report, it’s free.

PacBio (PACB) Q4 CY2024 Highlights:

- Revenue: $39.22 million vs analyst estimates of $39.96 million (32.8% year-on-year decline, 1.8% miss)

- Adjusted EPS: -$0.20 vs analyst expectations of -$0.17 (15.5% miss)

- Operating Margin: -387%, down from -150% in the same quarter last year

- Market Capitalization: $400.3 million

"2024 was a challenging yet transformative year for PacBio, marked by the successful launch of new products, disciplined cost management, and strategic progress in our clinical strategy. Despite macroeconomic pressures, we have continued to innovate and expand accessibility to HiFi sequencing,” said Christian Henry, President and CEO of PacBio.

Company Overview

Founded in 2000 by Dr. Stephen Turner, a scientist from Cornell University, along with investments from Mohr Davidow Ventures, Pacific Biosciences of California (NASDAQ: PACB) develops and sells advanced sequencing technologies for genetic analysis.

Genomics & Sequencing

Genomics and sequencing companies within the life sciences industry provide the technology for increasingly personalized medicine, drug discovery, and disease research. These firms leverage cutting-edge platforms for high-throughput sequencing and genomic analysis, enabling researchers and healthcare providers to better understand genetic underpinnings of diseases. While the industry enjoys high barriers to entry due to proprietary technology and intellectual property, the business model also faces significant R&D costs, reliance on continued innovation, and exposure to shifts in academic, biotech, and clinical research funding. Over the next few years, the subsector is well-positioned to benefit from tailwinds such as increasing adoption of precision medicine, expanded applications for sequencing technologies in areas like oncology and rare disease diagnostics, and growing use of genomic data in drug development. Advances in artificial intelligence could further enhance the speed and accuracy of genomic insights. However, potential headwinds include price sensitivity among research institutions and healthcare systems that are constantly trying to contain and lower costs. Additionally, regulations around data privacy and genomic testing are not yet set in stone, adding uncertainty to the industry.

Sales Growth

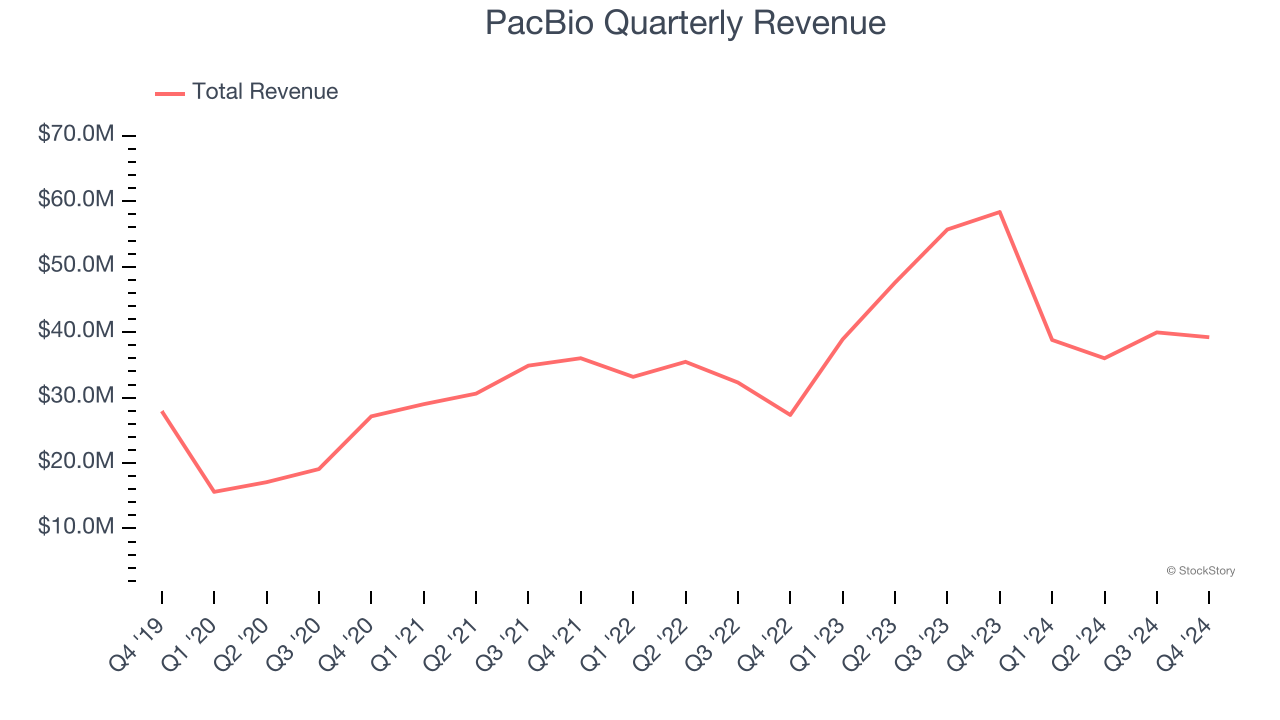

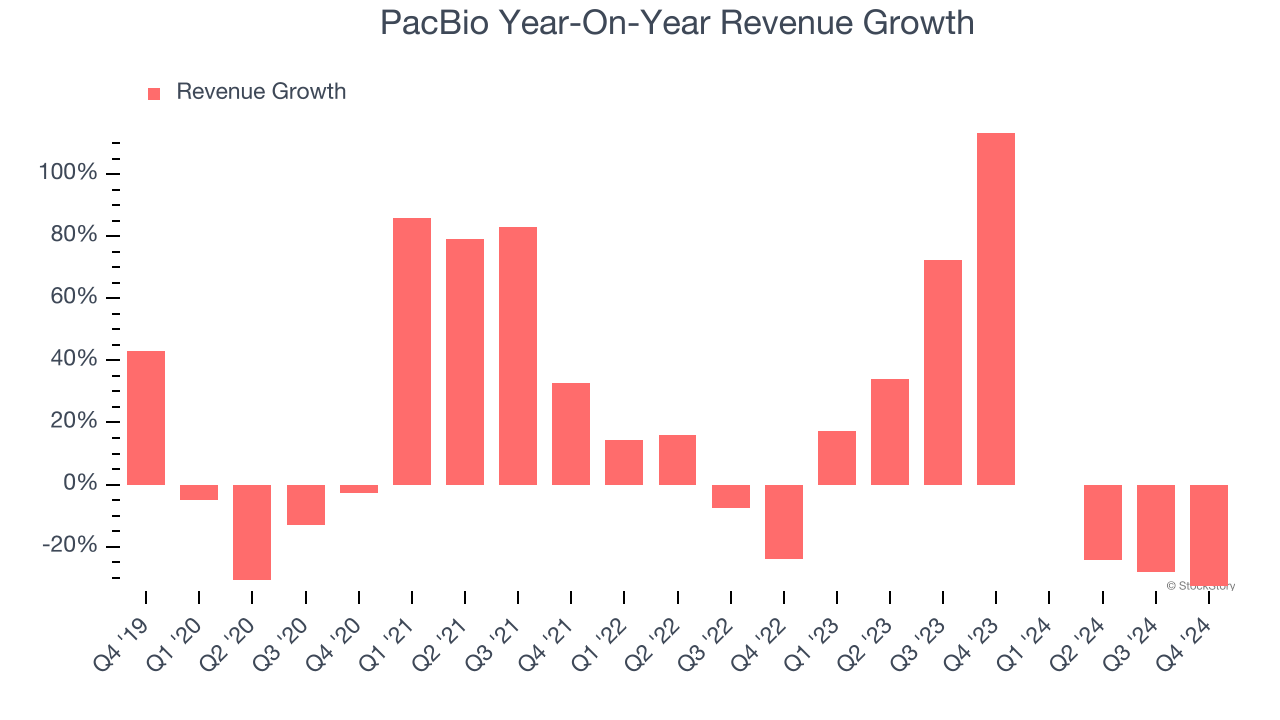

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, PacBio grew its sales at a decent 11.1% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. PacBio’s annualized revenue growth of 9.6% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, PacBio missed Wall Street’s estimates and reported a rather uninspiring 32.8% year-on-year revenue decline, generating $39.22 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 20.5% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will spur better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

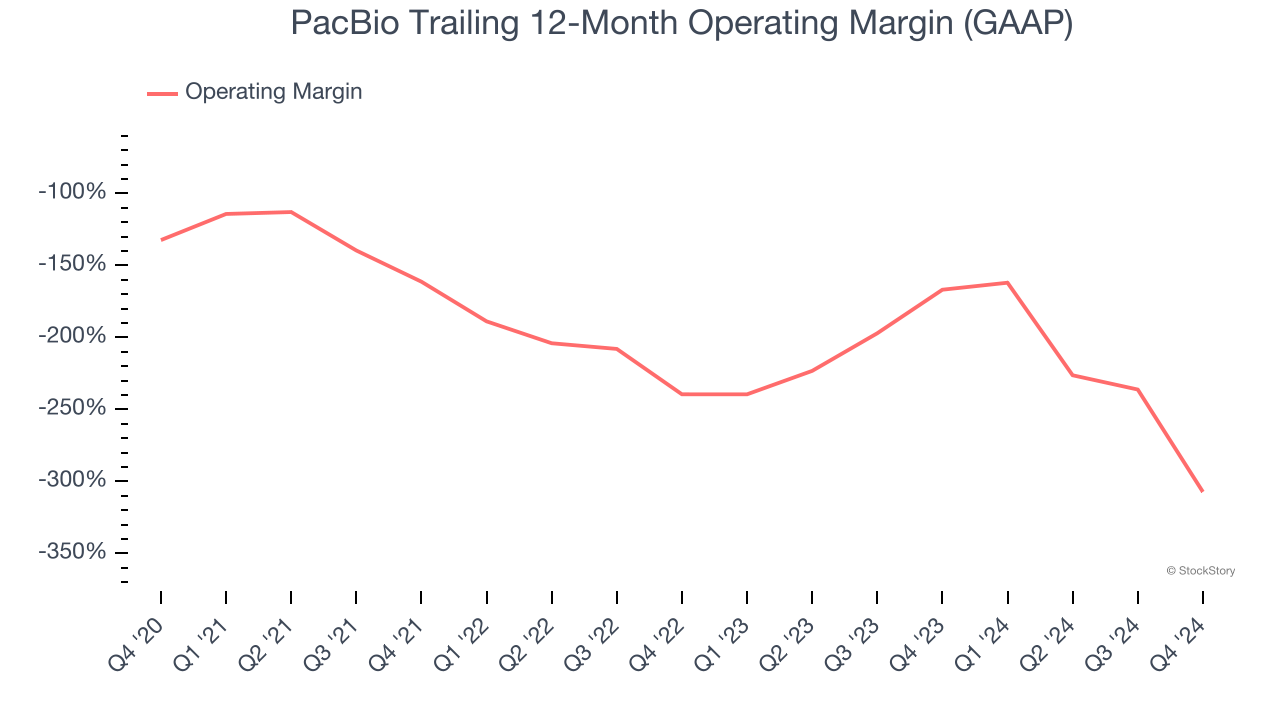

Operating Margin

Analyzing the trend in its profitability, PacBio’s operating margin decreased significantly over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 67.8 percentage points. This performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, PacBio generated a negative 387% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

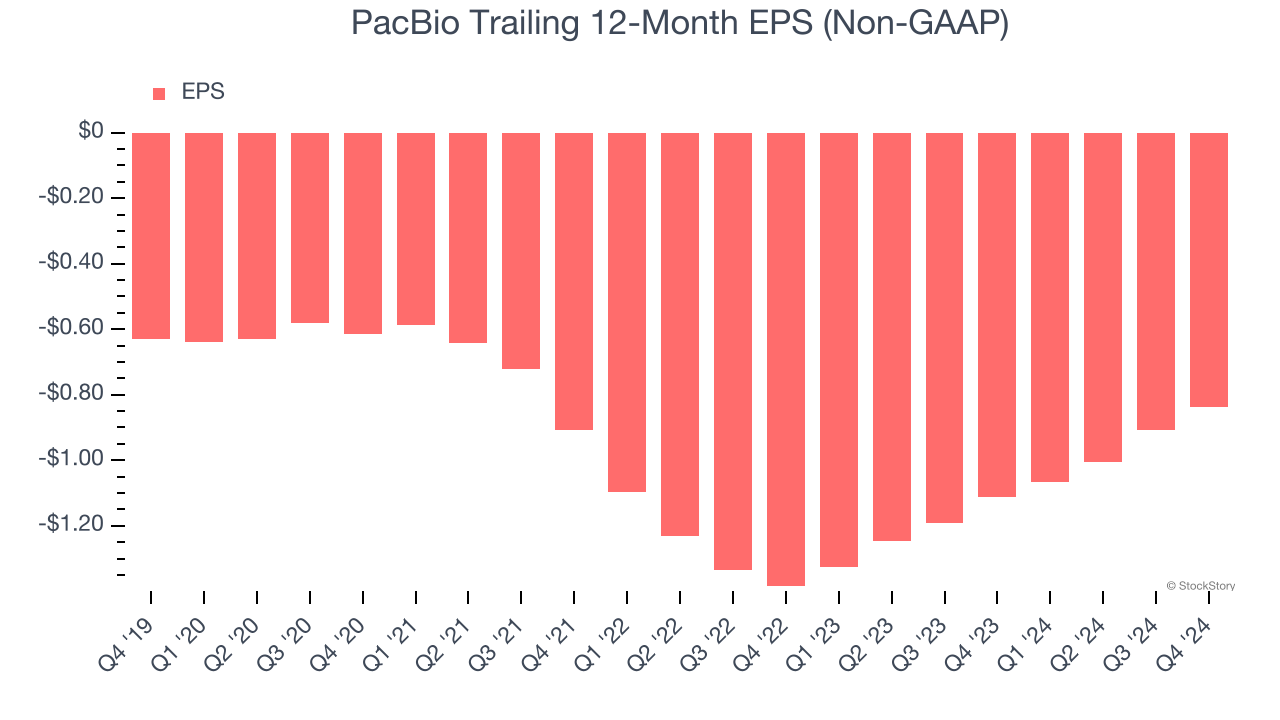

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

PacBio’s earnings losses deepened over the last five years as its EPS dropped 5.8% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, PacBio’s low margin of safety could leave its stock price susceptible to large downswings.

In Q4, PacBio reported EPS at negative $0.20, up from negative $0.27 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects PacBio to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.84 will advance to negative $0.63.

Key Takeaways from PacBio’s Q4 Results

We struggled to find many positives in these results. Its EPS missed significantly and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.7% to $1.43 immediately following the results.

The latest quarter from PacBio’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.