Home-building design and manufacturing company Masco Corporation (NYSE: MAS) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 2.9% year on year to $1.83 billion. Its non-GAAP profit of $0.89 per share was 1.9% above analysts’ consensus estimates.

Is now the time to buy Masco? Find out by accessing our full research report, it’s free.

Masco (MAS) Q4 CY2024 Highlights:

- Revenue: $1.83 billion vs analyst estimates of $1.84 billion (2.9% year-on-year decline, 0.5% miss)

- Adjusted EPS: $0.89 vs analyst estimates of $0.87 (1.9% beat)

- Adjusted EBITDA: $328 million vs analyst estimates of $328.8 million (17.9% margin, in line)

- Adjusted EPS guidance for the upcoming financial year 2025 is $4.33 at the midpoint, missing analyst estimates by 1.8%

- Operating Margin: 15.9%, up from 13.1% in the same quarter last year

- Free Cash Flow Margin: 19.2%, down from 22.5% in the same quarter last year

- Market Capitalization: $16.74 billion

“In 2025, we believe demand across the global repair and remodel markets will be flat to down low single digits. We expect our sales to be approximately flat to up low-single digits when adjusted for divestitures and currency, as we expect to continue to outperform the market in 2025,” said Keith Allman, Masco’s President and Chief Executive Officer.

Company Overview

Headquartered just outside of Detroit, MI, Masco (NYSE: MAS) designs and manufactures home-building products such as glass shower doors, decorative lighting, bathtubs, and faucets.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Sales Growth

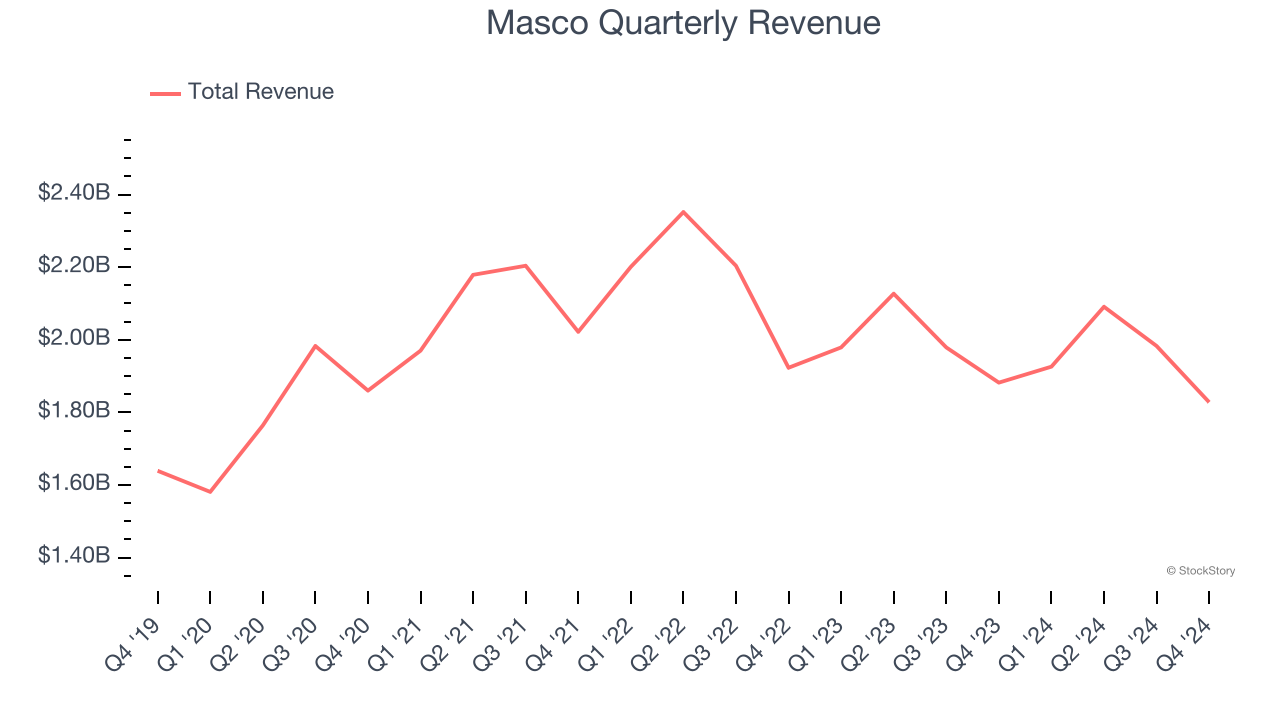

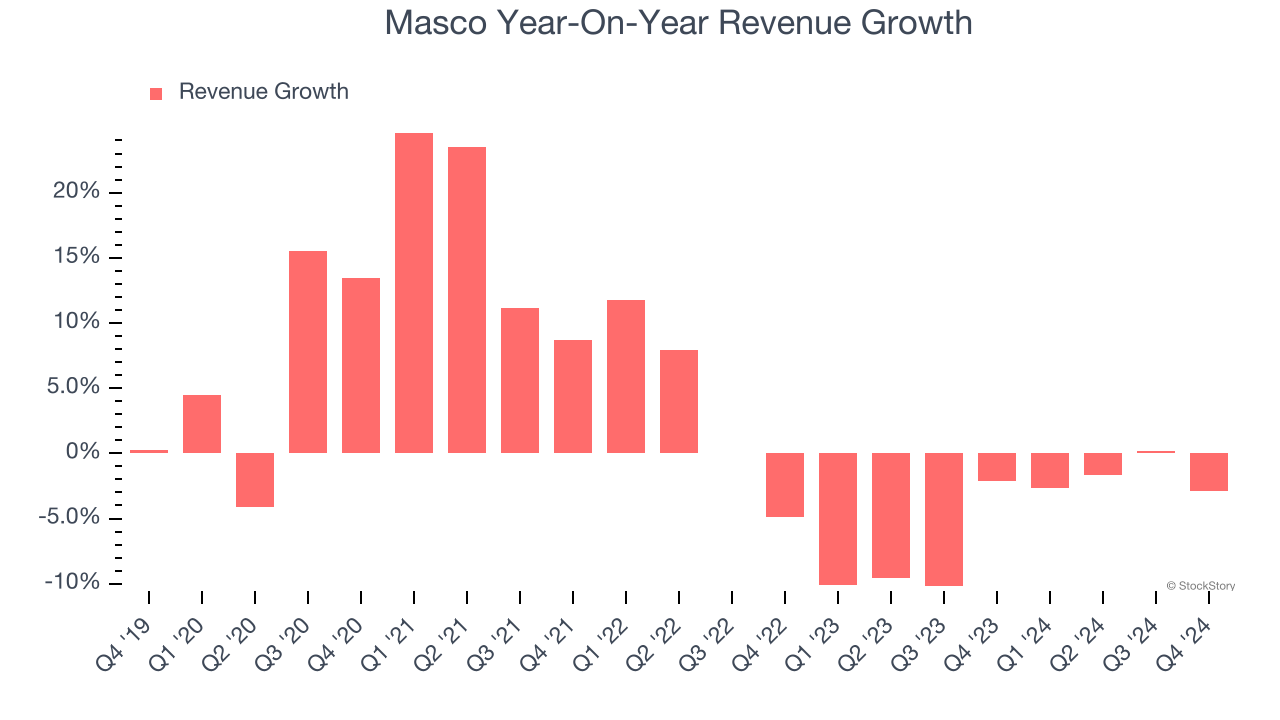

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Masco grew its sales at a sluggish 3.1% compounded annual growth rate. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Masco’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5% annually.

This quarter, Masco missed Wall Street’s estimates and reported a rather uninspiring 2.9% year-on-year revenue decline, generating $1.83 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

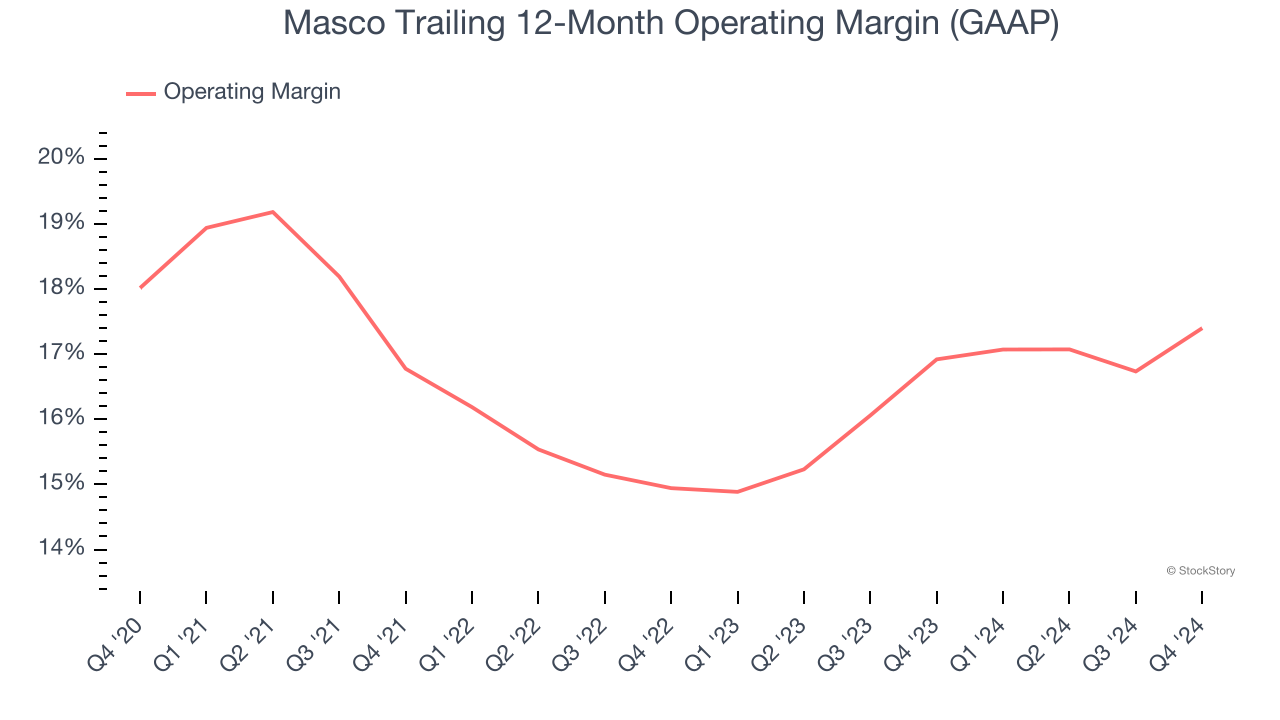

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Masco has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.8%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Masco’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years , highlighting the long-term consistency of its business.

This quarter, Masco generated an operating profit margin of 15.9%, up 2.7 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

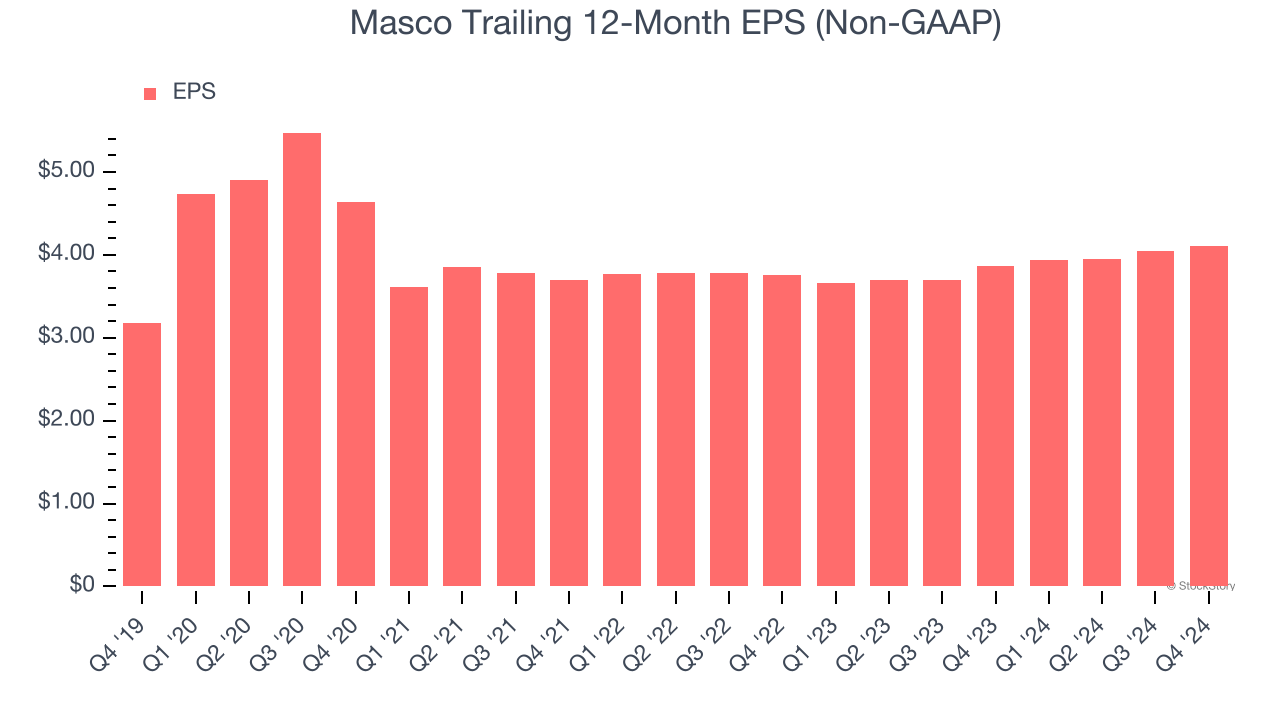

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Masco’s EPS grew at an unimpressive 5.2% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t expand.

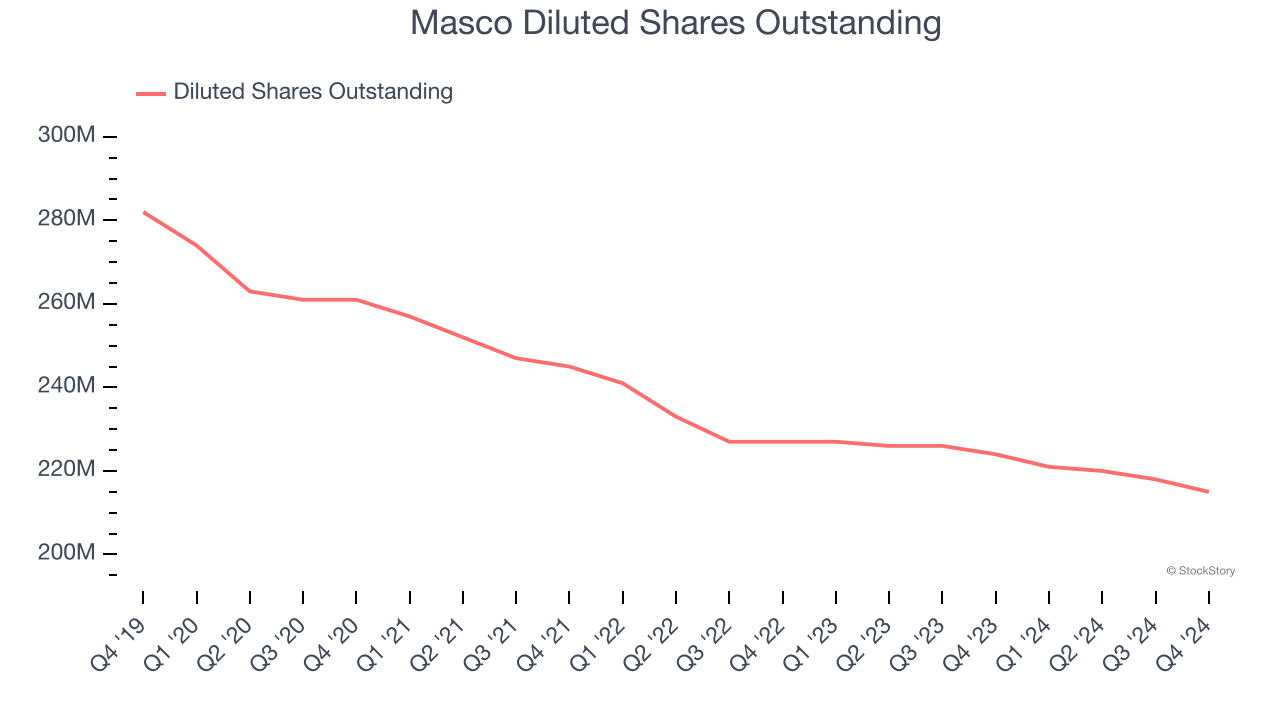

We can take a deeper look into Masco’s earnings to better understand the drivers of its performance. A five-year view shows that Masco has repurchased its stock, shrinking its share count by 23.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Masco, its two-year annual EPS growth of 4.5% is similar to its five-year trend, implying stable earnings.

In Q4, Masco reported EPS at $0.89, up from $0.83 in the same quarter last year. This print beat analysts’ estimates by 1.9%. Over the next 12 months, Wall Street expects Masco’s full-year EPS of $4.10 to grow 7.4%.

Key Takeaways from Masco’s Q4 Results

We struggled to find many positives in these results as its full-year EPS guidance missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $78.11 immediately following the results.

Big picture, is Masco a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.