Since May 2025, Vail Resorts has been in a holding pattern, posting a small loss of 3.9% while floating around $146.45. The stock also fell short of the S&P 500’s 13% gain during that period.

Is now the time to buy Vail Resorts, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Vail Resorts Not Exciting?

We're cautious about Vail Resorts. Here are three reasons why MTN doesn't excite us and a stock we'd rather own.

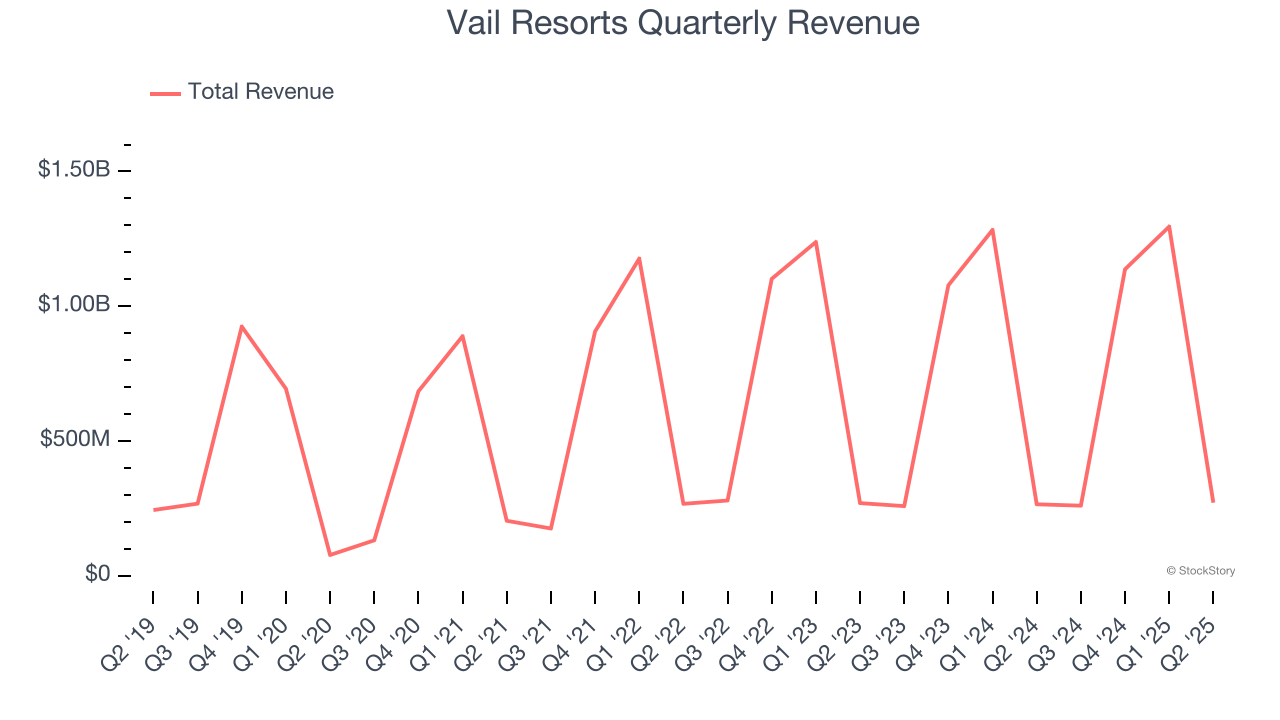

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Vail Resorts grew its sales at a sluggish 8.6% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector.

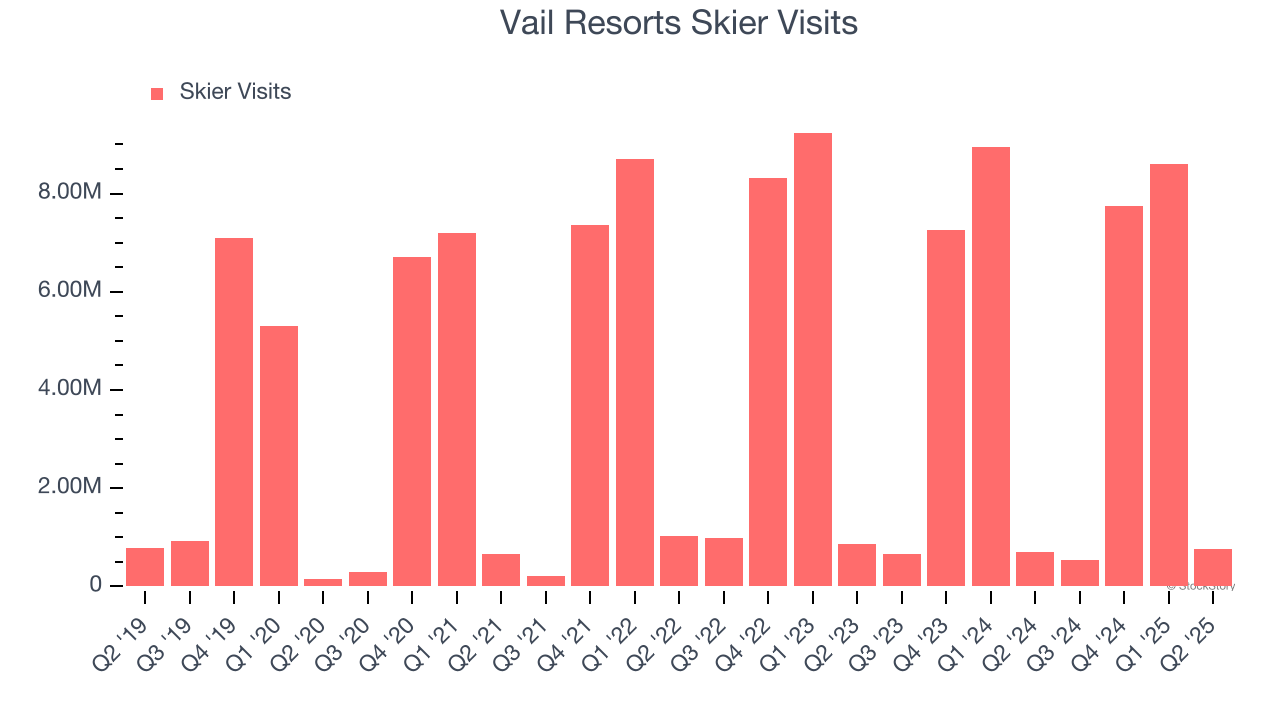

2. Decline in Skier Visits Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Vail Resorts, our preferred volume metric is skier visits). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Vail Resorts’s skier visits came in at 753,000 in the latest quarter, and over the last two years, averaged 9.4% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Vail Resorts might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Vail Resorts’s revenue to rise by 1.4%, close to its 8.6% annualized growth for the past five years. This projection doesn't excite us and indicates its newer products and services will not catalyze better top-line performance yet.

Final Judgment

Vail Resorts isn’t a terrible business, but it doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 21.6× forward P/E (or $146.45 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Vail Resorts

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.