Video game publisher Electronic Arts (NASDAQ: EA) announced better-than-expected revenue in Q3 CY2025, but sales fell by 9.2% year on year to $1.84 billion. Its GAAP profit of $0.54 per share was 52.7% above analysts’ consensus estimates.

Is now the time to buy Electronic Arts? Find out by accessing our full research report, it’s free for active Edge members.

Electronic Arts (EA) Q3 CY2025 Highlights:

- Electronic Arts (EA) is being acquired by a consortium of investors, including PIF, Silver Lake, and Affinity Partners, in a $55 billion all-cash deal that will take the company private. The transaction, announced in late September 2025, is expected to close in the quarter ending June 30, 2026.

- Revenue: $1.84 billion vs analyst estimates of $1.82 billion (9.2% year-on-year decline, 1% beat)

- EPS (GAAP): $0.54 vs analyst estimates of $0.35 (52.7% beat)

- Operating Margin: 10.9%, down from 19% in the same quarter last year

- Free Cash Flow was $87 million, up from -$55 million in the previous quarter

- Market Capitalization: $49.99 billion

“Across our broad portfolio — from EA SPORTS to Battlefield, The Sims, and skate. — our teams continue to create high-quality experiences that connect and inspire players around the world,” said Andrew Wilson, CEO of Electronic Arts.

Company Overview

Best known for its Madden NFL and FIFA sports franchises, Electronic Arts (NASDAQ: EA) is one of the world’s largest video game publishers.

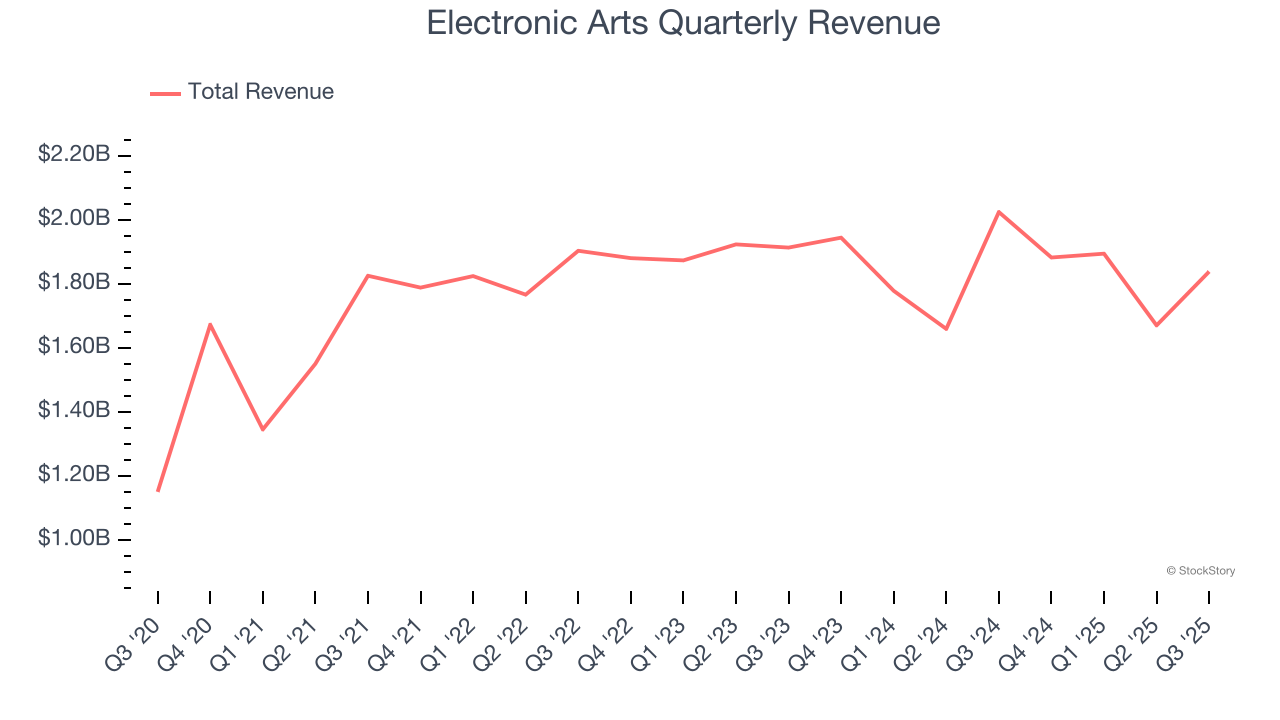

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Electronic Arts struggled to consistently increase demand as its $7.29 billion of sales for the trailing 12 months was close to its revenue three years ago. This wasn’t a great result, but there are still things to like about Electronic Arts.

This quarter, Electronic Arts’s revenue fell by 9.2% year on year to $1.84 billion but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

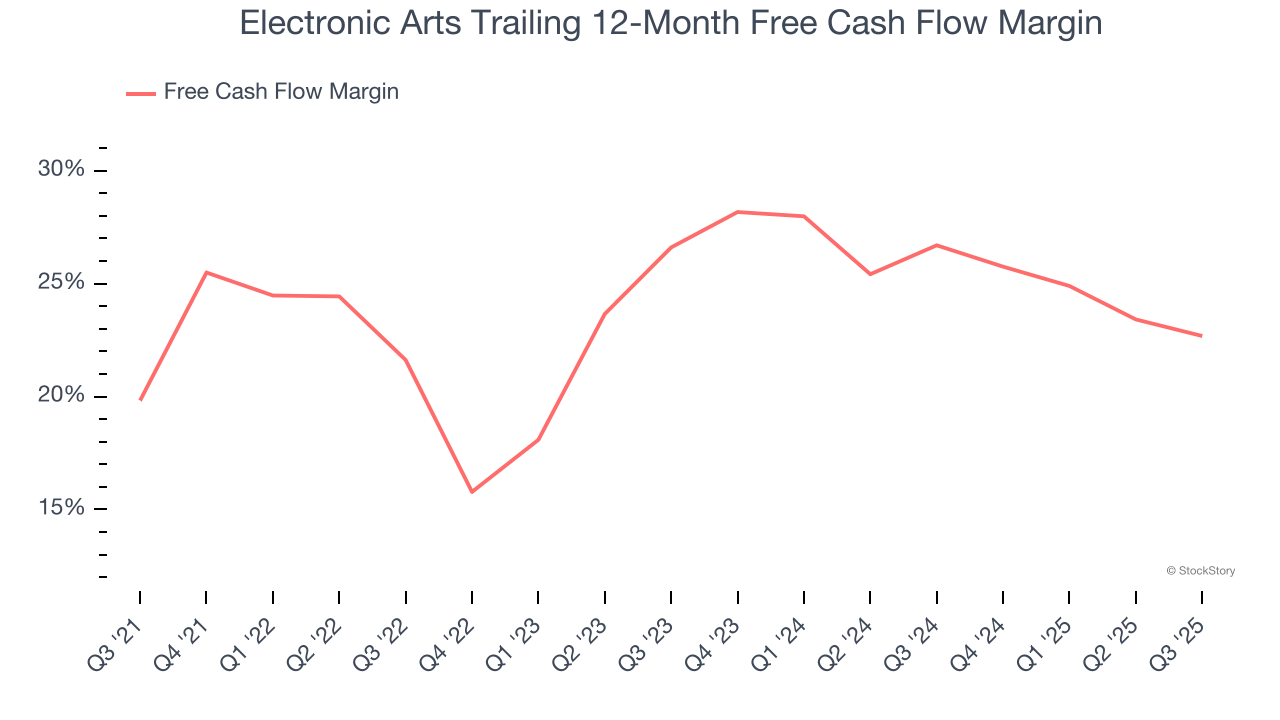

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Electronic Arts has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging 24.7% over the last two years.

Taking a step back, we can see that Electronic Arts’s margin expanded by 1.1 percentage points over the last few years. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Electronic Arts’s free cash flow clocked in at $87 million in Q3, equivalent to a 4.7% margin. The company’s cash profitability regressed as it was 4.4 percentage points lower than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

Key Takeaways from Electronic Arts’s Q3 Results

Electronic Arts (EA) is being acquired by a consortium of investors, including PIF, Silver Lake, and Affinity Partners, in a $55 billion all-cash deal that will take the company private. The transaction, announced in late September 2025, is expected to close in the quarter ending June 30, 2026.