Confluent trades at $30.88 per share and has stayed right on track with the overall market, gaining 10.9% over the last six months. At the same time, the S&P 500 has returned 11.5%.

Is now the time to buy CFLT? Find out in our full research report, it’s free.

Why Does CFLT Stock Spark Debate?

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ: CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

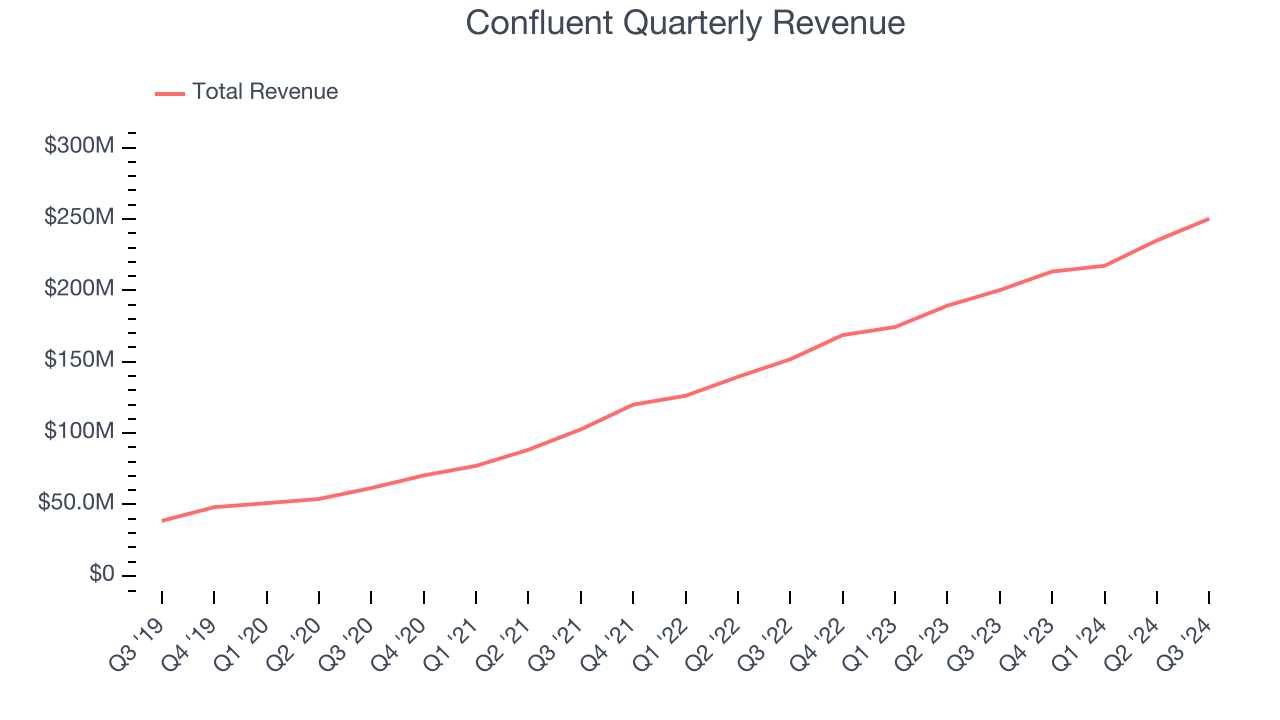

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Confluent grew its sales at an exceptional 39.4% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

2. Billings Surge, Boosting Cash On Hand

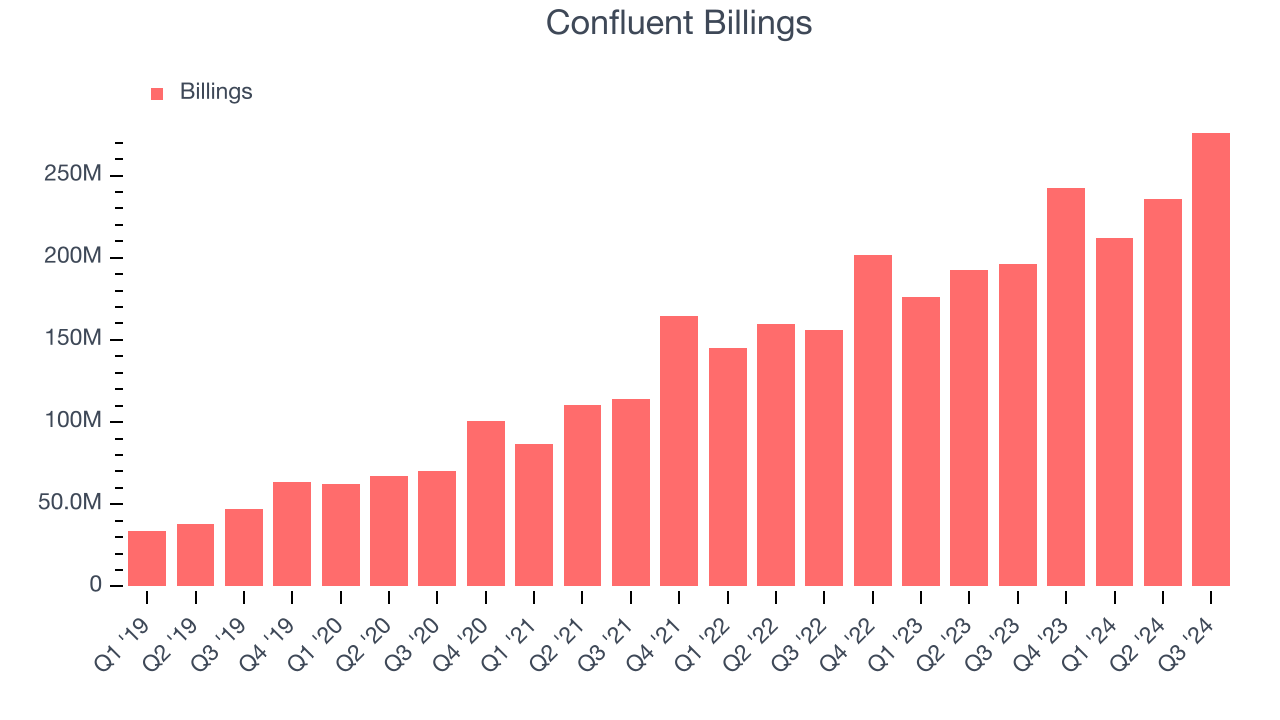

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Confluent’s billings punched in at $276.1 million in Q3, and over the last four quarters, its year-on-year growth averaged 26%. This performance was impressive, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

One Reason to be Careful:

Operating Losses Sound the Alarms

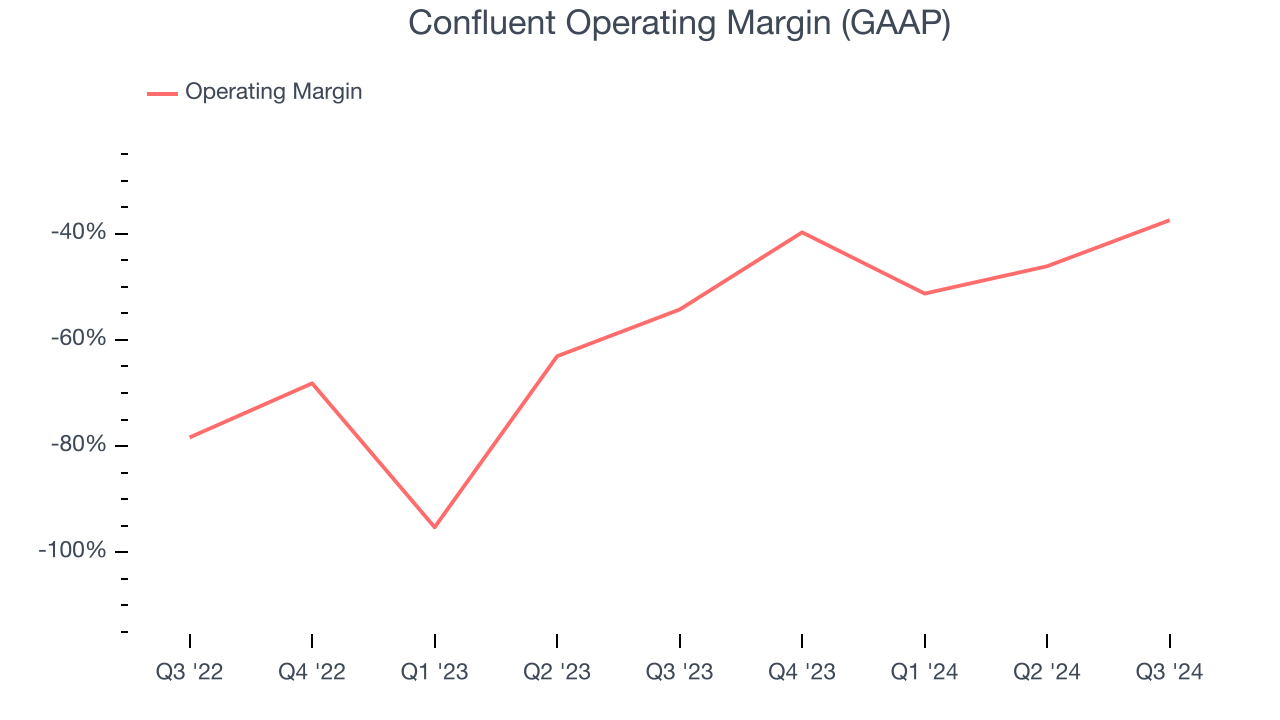

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Confluent’s expensive cost structure has contributed to an average operating margin of negative 43.5% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Final Judgment

Confluent’s positive characteristics outweigh the negatives, but at $30.88 per share (or 9.2× forward price-to-sales), is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Confluent

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.