What a fantastic six months it’s been for Fresh Del Monte Produce. Shares of the company have skyrocketed 46.7%, hitting $33.97. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Fresh Del Monte Produce, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We’re glad investors have benefited from the price increase, but we don't have much confidence in Fresh Del Monte Produce. Here are three reasons why there are better opportunities than FDP and a stock we'd rather own.

Why Do We Think Fresh Del Monte Produce Will Underperform?

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE: FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

1. Long-Term Revenue Growth Flatter Than a Pancake

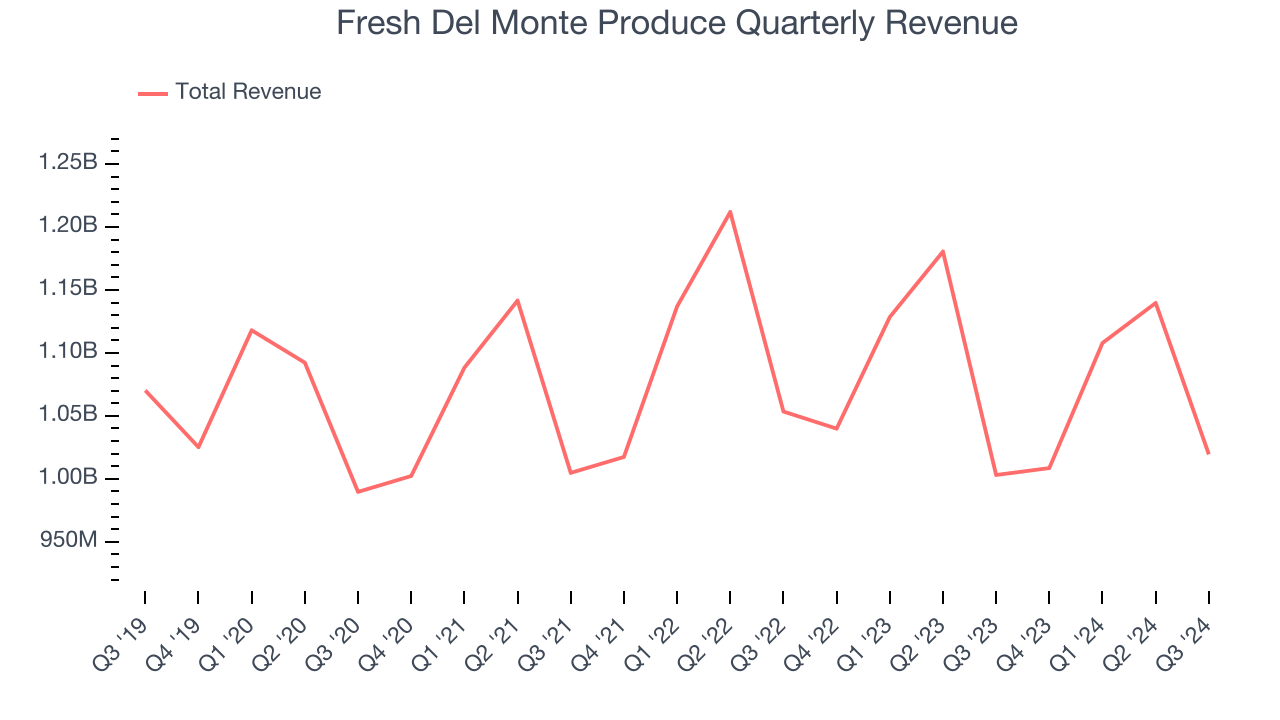

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Fresh Del Monte Produce struggled to consistently increase demand as its $4.28 billion of sales for the trailing 12 months was close to its revenue three years ago. This fell short of our benchmarks and signals it’s a low quality business.

2. Low Gross Margin Reveals Weak Structural Profitability

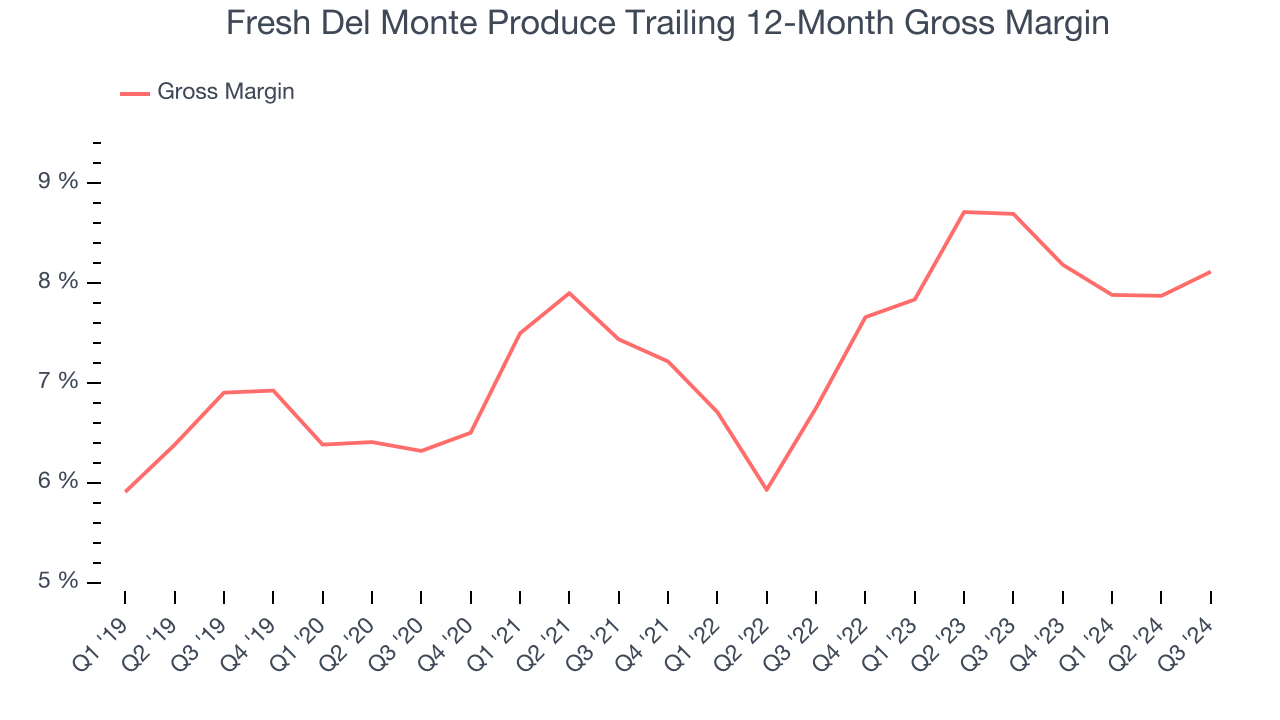

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Fresh Del Monte Produce has poor unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 8.4% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $91.59 went towards paying for raw materials, production of goods, transportation, and distribution.

3. Previous Growth Initiatives Haven’t Paid Off Yet

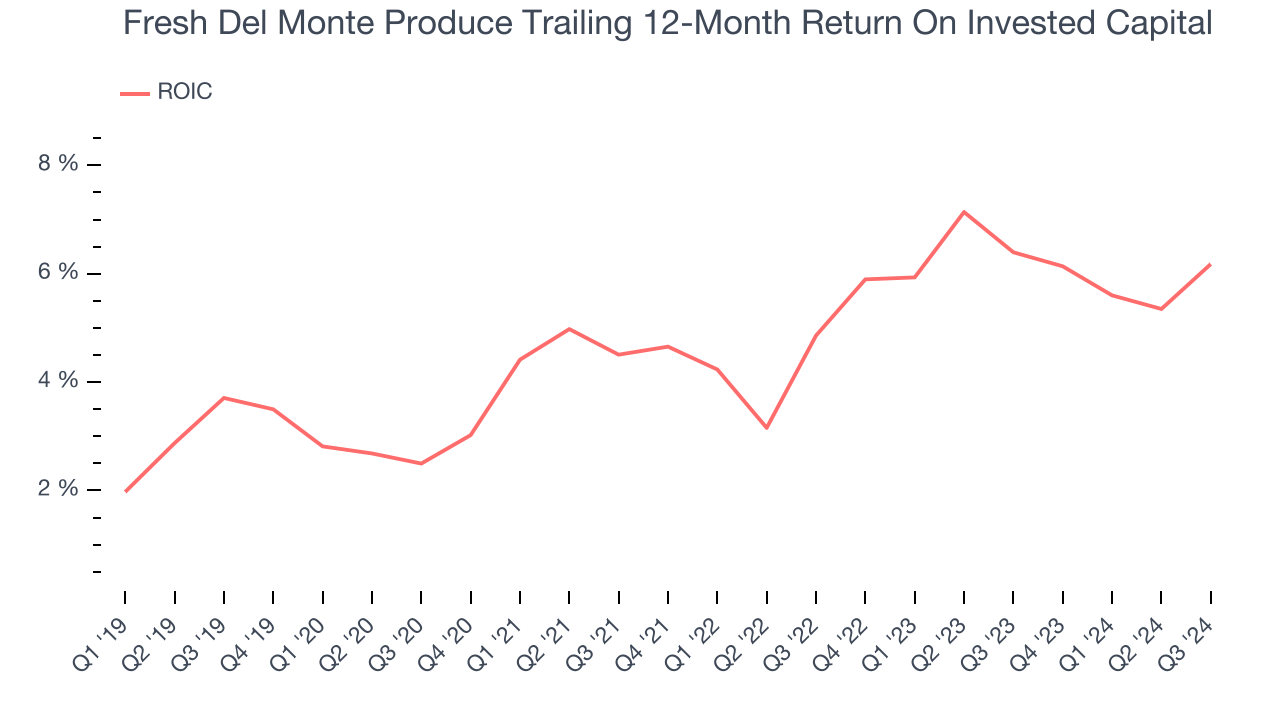

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Fresh Del Monte Produce’s five-year average ROIC was 4.9%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a mediocre job investing in profitable growth initiatives.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Fresh Del Monte Produce, we’ll be cheering from the sidelines. After the recent rally, the stock trades at 29.6x forward EV-to-EBITDA (or $33.97 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. Let us point you toward CrowdStrike, the most entrenched endpoint security platform.

Stocks We Like More Than Fresh Del Monte Produce

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.