Contemporary clothing brand Guess (NYSE: GES) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 13.4% year on year to $738.5 million. Its non-GAAP profit of $0.34 per share was 9.1% below analysts’ consensus estimates.

Is now the time to buy Guess? Find out by accessing our full research report, it’s free.

Guess (GES) Q3 CY2024 Highlights:

- Revenue: $738.5 million vs analyst estimates of $747.4 million (13.4% year-on-year growth, 1.2% miss)

- Adjusted EPS: $0.34 vs analyst expectations of $0.37 (9.1% miss)

- Management lowered its full-year Adjusted EPS guidance to $1.93 at the midpoint, a 24.8% decrease

- Operating Margin: 5.7%, down from 8.4% in the same quarter last year

- Free Cash Flow was -$107.4 million compared to -$24.07 million in the same quarter last year

- Market Capitalization: $933.9 million

Company Overview

Flexing the iconic upside-down triangle logo with a question mark, Guess (NYSE: GES) is a global fashion brand known for its trendy clothing, accessories, and denim wear.

Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

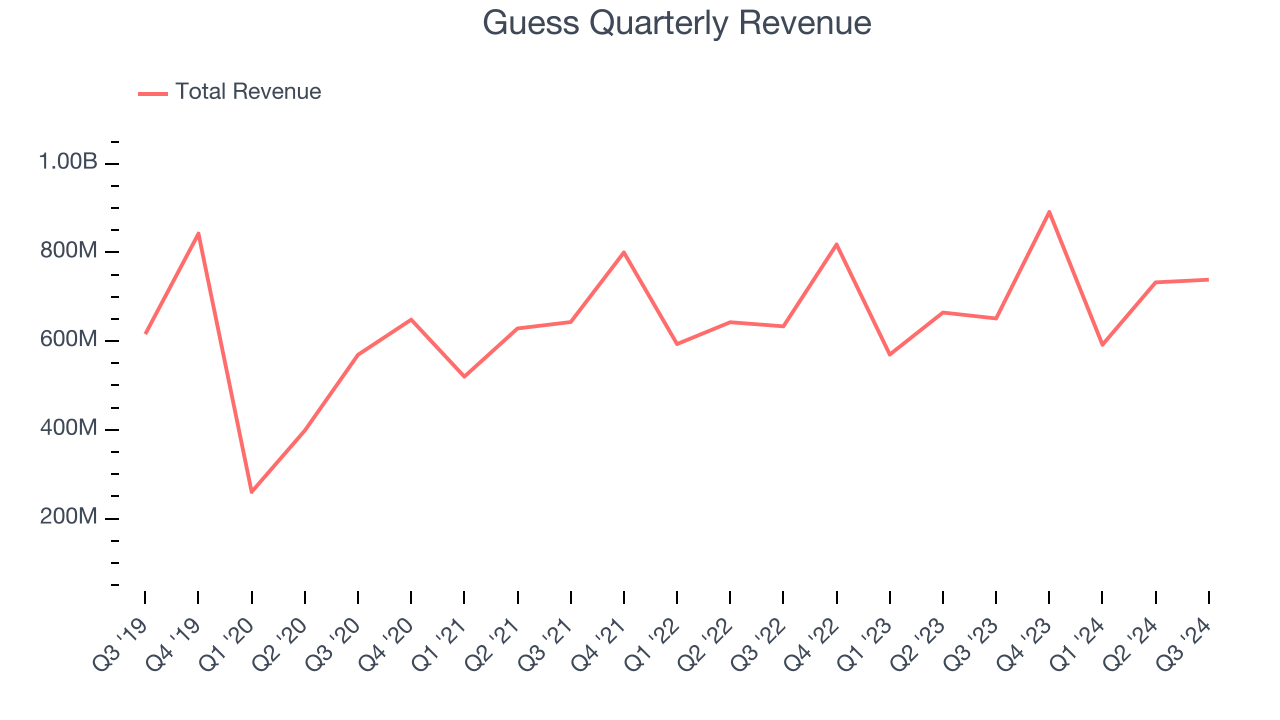

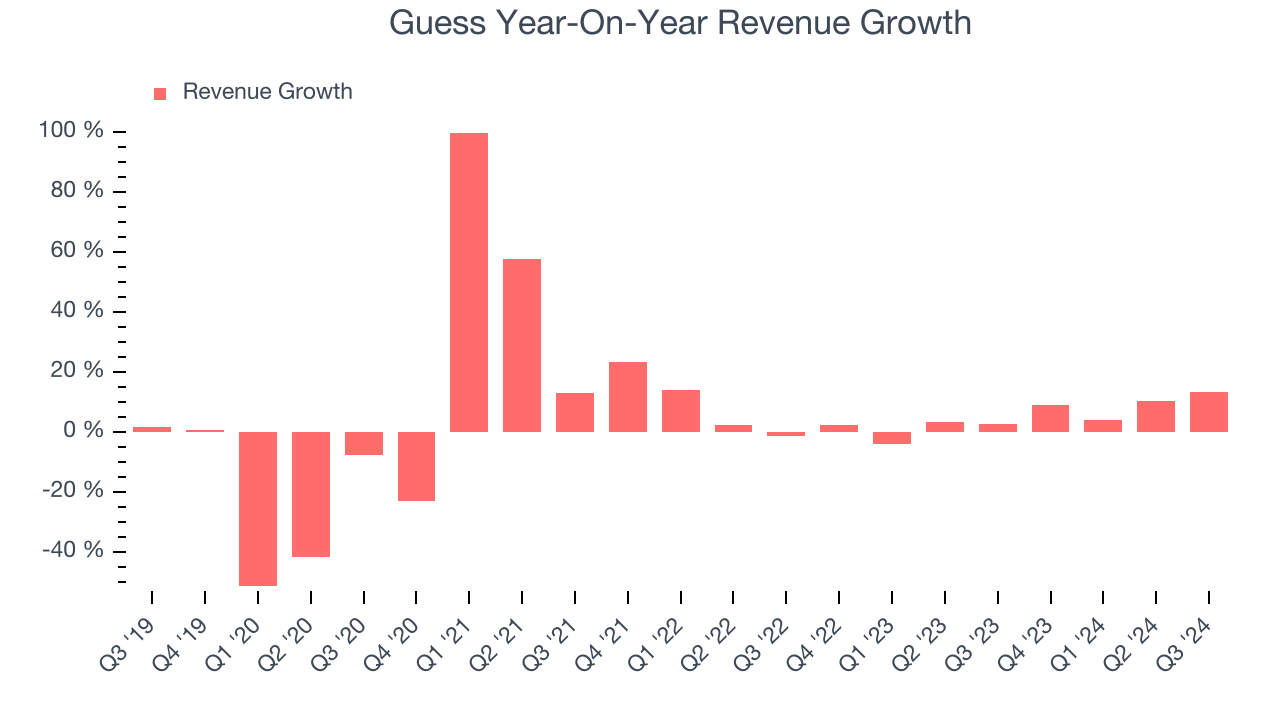

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Guess’s sales grew at a weak 2% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Guess’s annualized revenue growth of 5.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Guess’s revenue grew by 13.4% year on year to $738.5 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow by 5.8% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not accelerate its top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

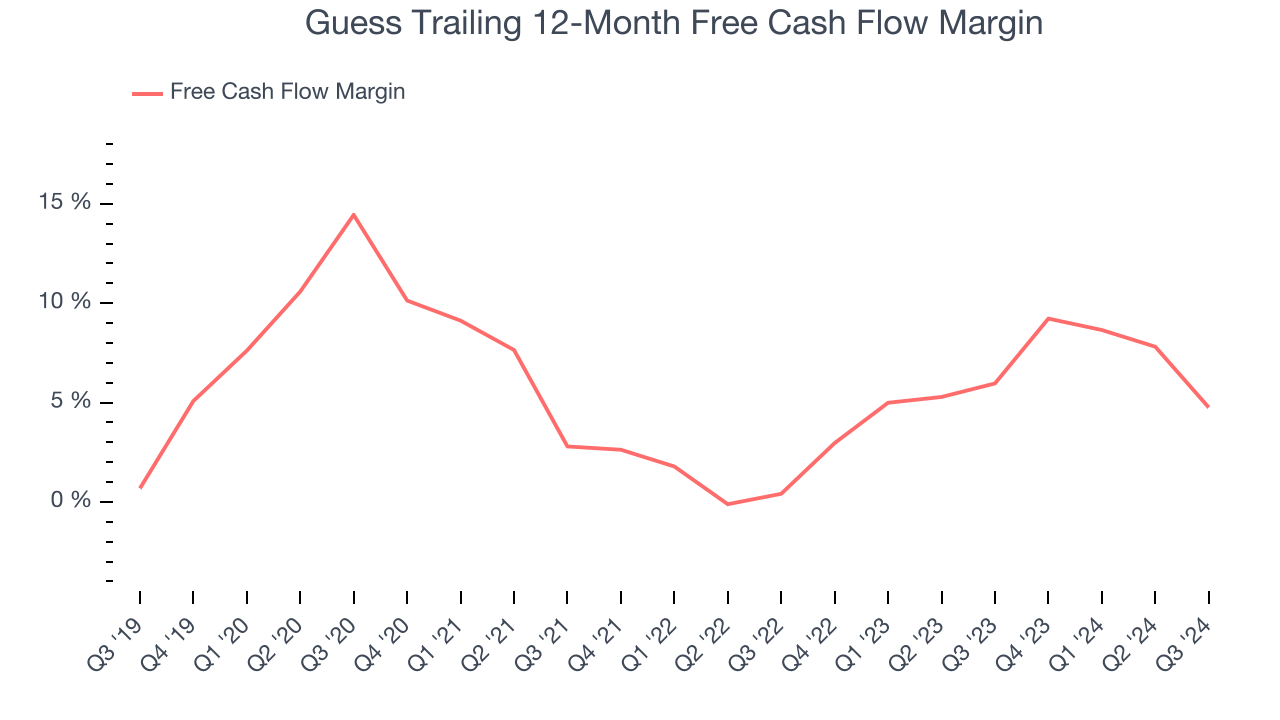

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Guess has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.3%, subpar for a consumer discretionary business.

Guess burned through $107.4 million of cash in Q3, equivalent to a negative 14.5% margin. The company’s cash burn increased from $24.07 million of lost cash in the same quarter last year . These numbers deviate from its longer-term margin, raising some eyebrows.

Key Takeaways from Guess’s Q3 Results

We struggled to find many resounding positives in these results. Its full-year EPS guidance missed significantly and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 7.9% to $16 immediately after reporting.

Guess underperformed this quarter, but does that create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.