As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the home builders industry, including Taylor Morrison Home (NYSE: TMHC) and its peers.

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

The 11 home builders stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was below.

While some home builders stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.3% since the latest earnings results.

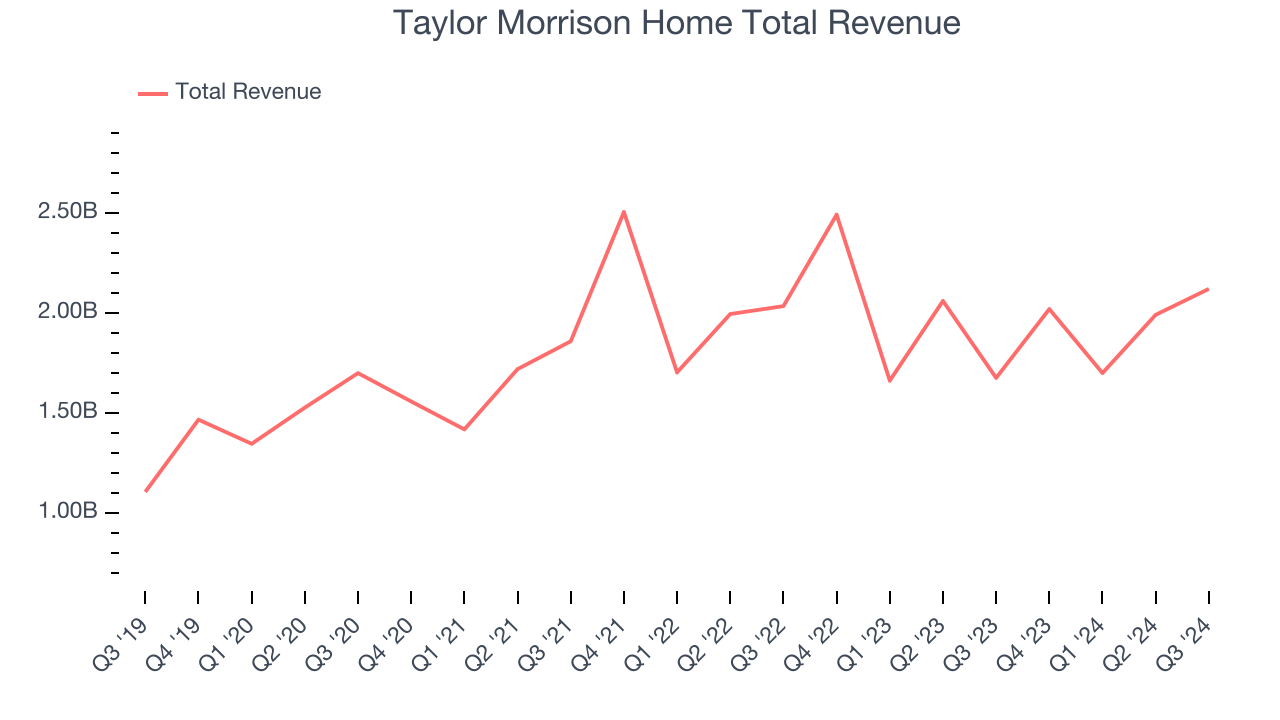

Taylor Morrison Home (NYSE: TMHC)

Named “America’s Most Trusted Home Builder” in 2019, Taylor Morrison Home (NYSE: TMHC) builds single family homes and communities across the United States.

Taylor Morrison Home reported revenues of $2.12 billion, up 26.6% year on year. This print exceeded analysts’ expectations by 7.8%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates.

"In the third quarter, our team delivered better-than-expected results, which clearly demonstrated the benefits of our diversified consumer and geographic strategy, as well as our team's impressive execution in the face of continued interest rate volatility, economic uncertainty and hurricane-related disruptions," said Sheryl Palmer, Taylor Morrison CEO and Chairman.

Interestingly, the stock is up 7% since reporting and currently trades at $69.44.

Is now the time to buy Taylor Morrison Home? Access our full analysis of the earnings results here, it’s free.

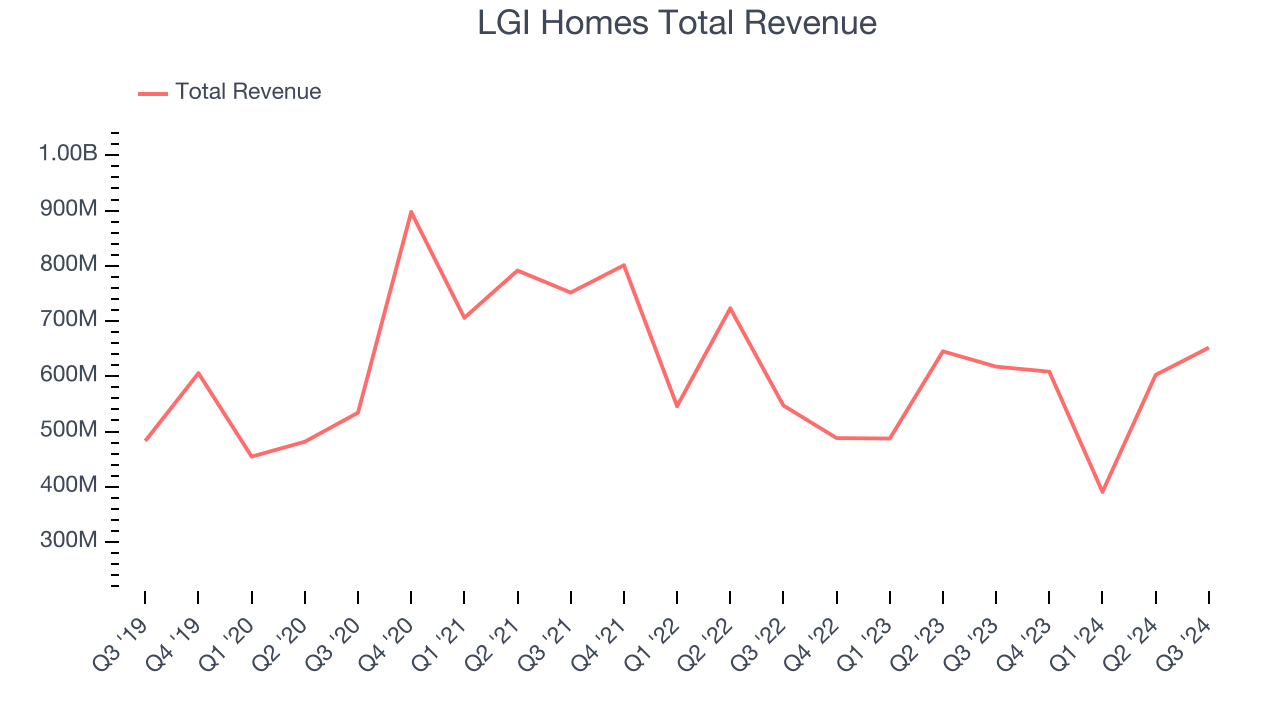

Best Q3: LGI Homes (NASDAQ: LGIH)

Based in Texas, LGI Homes (NASDAQ: LGIH) is a homebuilding company specializing in constructing affordable, entry-level single-family homes in desirable communities across the United States.

LGI Homes reported revenues of $651.9 million, up 5.6% year on year, outperforming analysts’ expectations by 1.6%. The business had a stunning quarter with a solid beat of analysts’ backlog estimates and an impressive beat of analysts’ adjusted operating income estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $102.73.

Is now the time to buy LGI Homes? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: D.R. Horton (NYSE: DHI)

One of the largest homebuilding companies in the U.S., D.R. Horton (NYSE: DHI) builds a variety of new construction homes across multiple markets.

D.R. Horton reported revenues of $10 billion, down 4.8% year on year, falling short of analysts’ expectations by 1.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and a significant miss of analysts’ EBITDA estimates.

D.R. Horton delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 10.2% since the results and currently trades at $161.98.

Read our full analysis of D.R. Horton’s results here.

NVR (NYSE: NVR)

Known for its unique land acquisition strategy, NVR (NYSE: NVR) is a respected homebuilder and mortgage company in the United States.

NVR reported revenues of $2.73 billion, up 6.4% year on year. This number surpassed analysts’ expectations by 1.2%. More broadly, it was a satisfactory quarter as it also logged an impressive beat of analysts’ backlog estimates.

The stock is down 7.3% since reporting and currently trades at $8,947.

Read our full, actionable report on NVR here, it’s free.

Installed Building Products (NYSE: IBP)

Founded in 1977, Installed Building Products (NYSE: IBP) is a company specializing in the installation of insulation, waterproofing, and other complementary building products for residential and commercial construction.

Installed Building Products reported revenues of $760.6 million, up 7.7% year on year. This number was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it also logged a solid beat of analysts’ adjusted operating income estimates but a miss of analysts’ EPS estimates.

The stock is down 7.1% since reporting and currently trades at $211.24.

Read our full, actionable report on Installed Building Products here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.