The WD-40 Company (NASDAQ: WDFC) stock price entered a reversal in mid-2023, and it is in full swing today. The move advanced more than 65% before the Q1 release and still has ample room to run. The outlook has risks and hurdles, but the combination of solid results, cautious guidance and sell-side interest suggests this stock will move to a three-year high, adding another 10% to share prices. Add in its exposure to emerging markets, the sustained annual distribution increases and share repurchases, and this stock could continue to rally higher all year.

WD-40 Company advances on results; outlook cautious

WD-40 Company had a robust quarter, with revenue growing 12.4% to $140.42 million, outpacing consensus by 450 basis points on strength in all regions. Americas and APAC grew by 10% and 6%, respectively, but the star is EIMEA. EIMEA grew by 20% and should continue to lead the company’s growth in 2024. Emerging markets, a pillar of the company’s growth strategy, are expected to outpace domestic GDP growth by more than two-to-one in 2024 and may do so for the next few years.

On a product basis, the core maintenance and WD-40 product sales grew by 14%, offset by a 4% decline in harvest brands. Harvest brands include WD-40 branded cleaning products that generate solid cash flows but have become an increasingly small portion of the business.

The company revealed plans that may include selling or spinning off the harvest retail segment, which presents additional opportunities for investors. Such a move would improve the already sound balance sheet by increasing its cash position and, by extension, its ability to grow core business and deliver capital returns to investors.

The margin is also good. The company produced the widest Q1 margin in years, adding leverage to the top-line performance. The GAAP earnings came in at $1.28, due in part to an FX tailwind, to outpace consensus by 2800 basis points. This is why guidance may be cautious. The company reiterated its outlook for FY earnings despite business momentum and the top and bottom line strengths, setting the bar low.

“We have started fiscal year 2024 firing on all cylinders, with significant volume-related sales growth across all three trade blocs,” said Steve Brass, WD-40 Company’s president and chief executive officer. “... Overall, we are incredibly pleased with our solid first quarter performance and it provides us confidence that we will achieve our 2024 financial goals.”

WD-40 Company capital returns are safe

WD-40 Company capital returns aren’t market-leading but sufficient to satisfy most investors. The yield runs near 1.5%, aligning with the broad market S&P 500 average, and is compounded by share repurchases. Repurchases are also small but reliable, leaving ample cash flow to sustain operations and grow the business without leaning heavily on debt. There is debt on the balance sheet, but leverage is very low, and the cash position is solid. Repurchases in Q1 were about $2.4 million or about 0.75% of the market cap; there is $47.6 million left on the current authorization.

WD-40 Company has two analysts, one tracked by Marketbeat, and they rate the stock at Buy. The latest revision is from DA Davidson, which upped its price target at the end of 2023. Their new target is $276, or about 7% above the post-release price action, and it may move higher now that guidance is in. Institutions also favor this stock, holding about 92% of the shares and buying on balance in all four quarters of 2023.

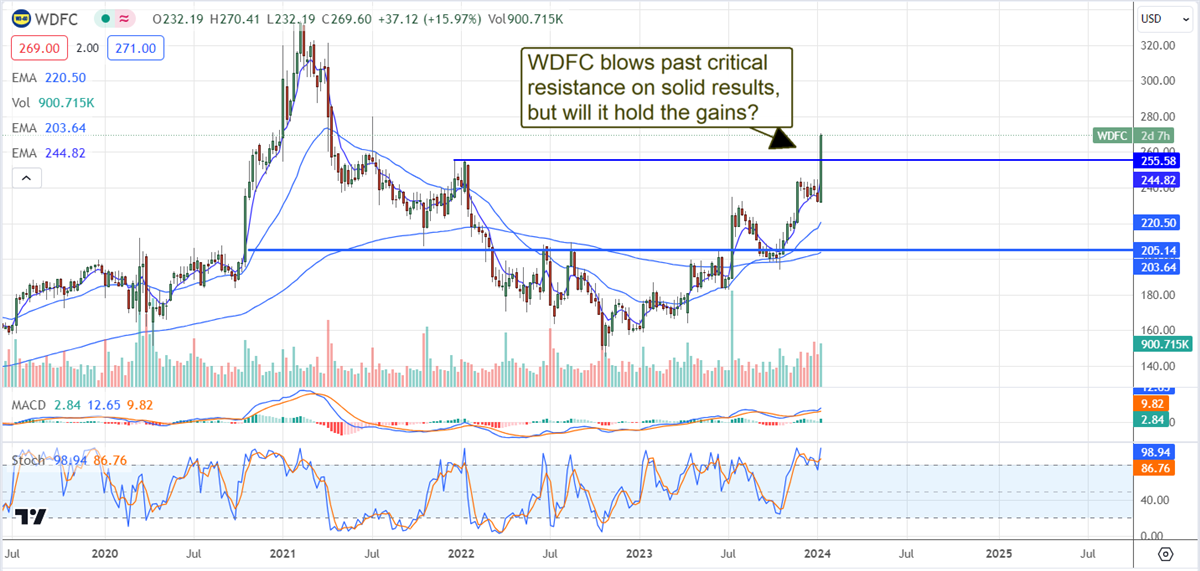

The technical outlook: WD-40 Company at a critical turning point

The WD-40 Company is in a solid reversal and indicated higher, but there are some hurdles to overcome. Among them is resistance at the $255 level. This level coincides with an 18-month high and may cap gains for the foreseeable future. In that scenario, the stock could fall to retest support near $242 or lower. If the market can get above $255, it could continue to the top of the long-term trading range above $300, good for another 20%.