GEMINI PROJECT HIGHLIGHTS:

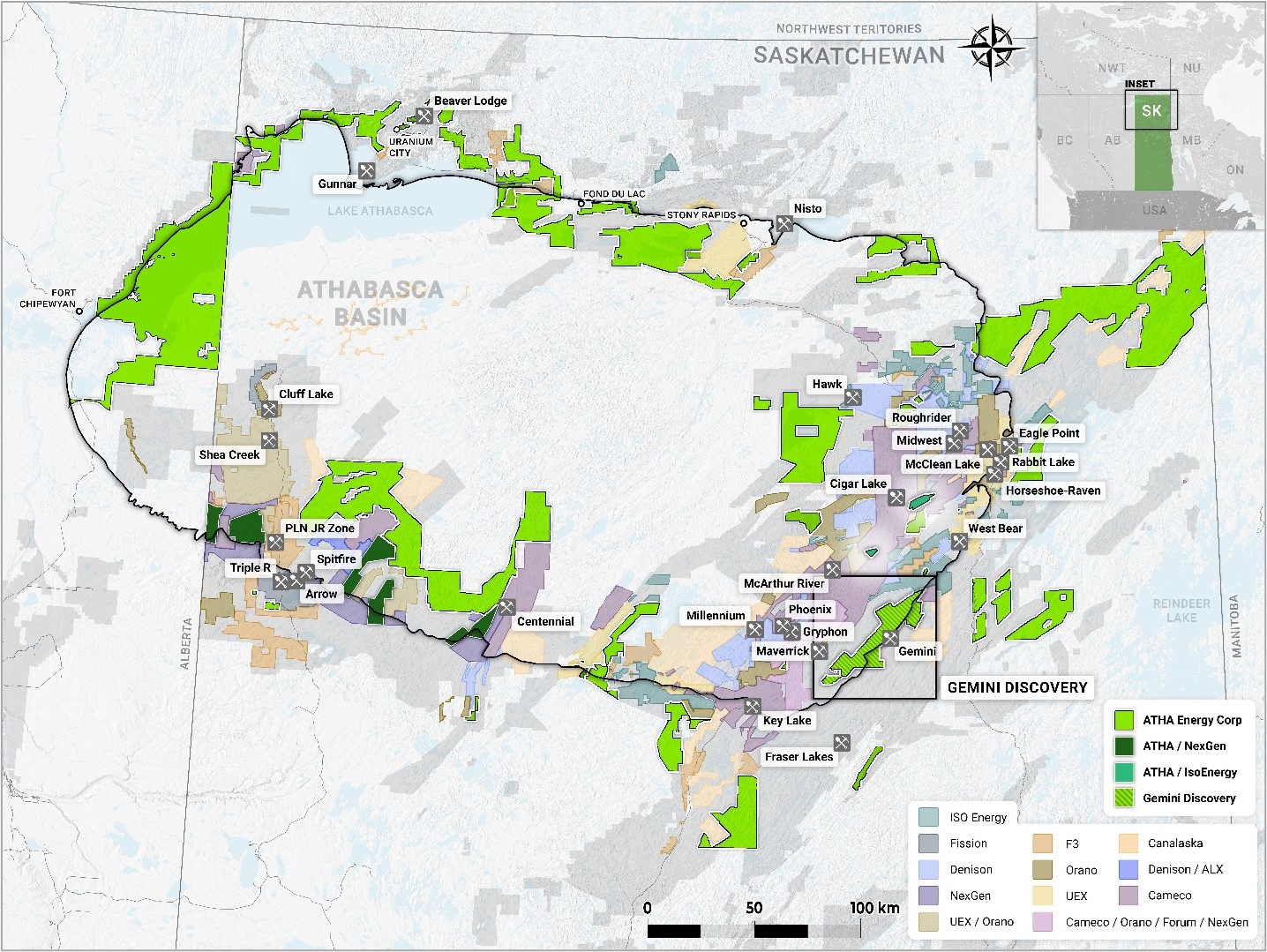

- The Gemini Project is located 31 km northeast of Cameco’s Key Lake Mine, along the southeastern margin of the uranium rich Athabasca Basin, and hosts the high-grade uranium Gemini Mineralized Zone (“GMZ”).

- GMZ is a shallow (mineralization begins at <60 m depth) basement hosted, high-grade uranium discovery, which remains open at depth and along strike.

- GMZ is analogous to uranium mineralization along Cameco’s Rabbit Lake Trend, which produced 203MM lbs of uranium concentrate. Similarities with the Rabbit Lake Trend are demonstrated by:

- The visual scale and nature of hydrothermal alteration;

- The interpreted structural control on mineralization;

- Mineralization hosted within meta-sediments (Hidden Bay assemblage within the upper Wollaston Domain) lithologies with associated alteration halos typical of high-grade uranium deposits within the Athabasca Basin;

- Uranium mineralization discovered along parallel conductor within the GMZ Trend and newly identified geophysical targets along strike to the north.

- Successive diamond drilling exploration programs at the GMZ, conducted between 2021 through to 2023, are highlighted by high-grade drillhole intersections, such as:

- GEM22-025 intersected 43.0 m grading 0.62% U3O8, including 18.0 m grading 1.16% U3O8.

- GEM23-061 intersected 5.0 m grading 1.47% U3O8, including 1.5 m grading 4.69% U3O8 and another sub-interval of 9.66% U3O8 over 0.5 m.

2024 GEMINI PROJECT EXPLORATION PROGRAM:

2024 Gemini Project Exploration Program builds upon the work completed by 92 Energy, targeting the GMZ Trend within the Gemini Project area and is comprised of three phases:

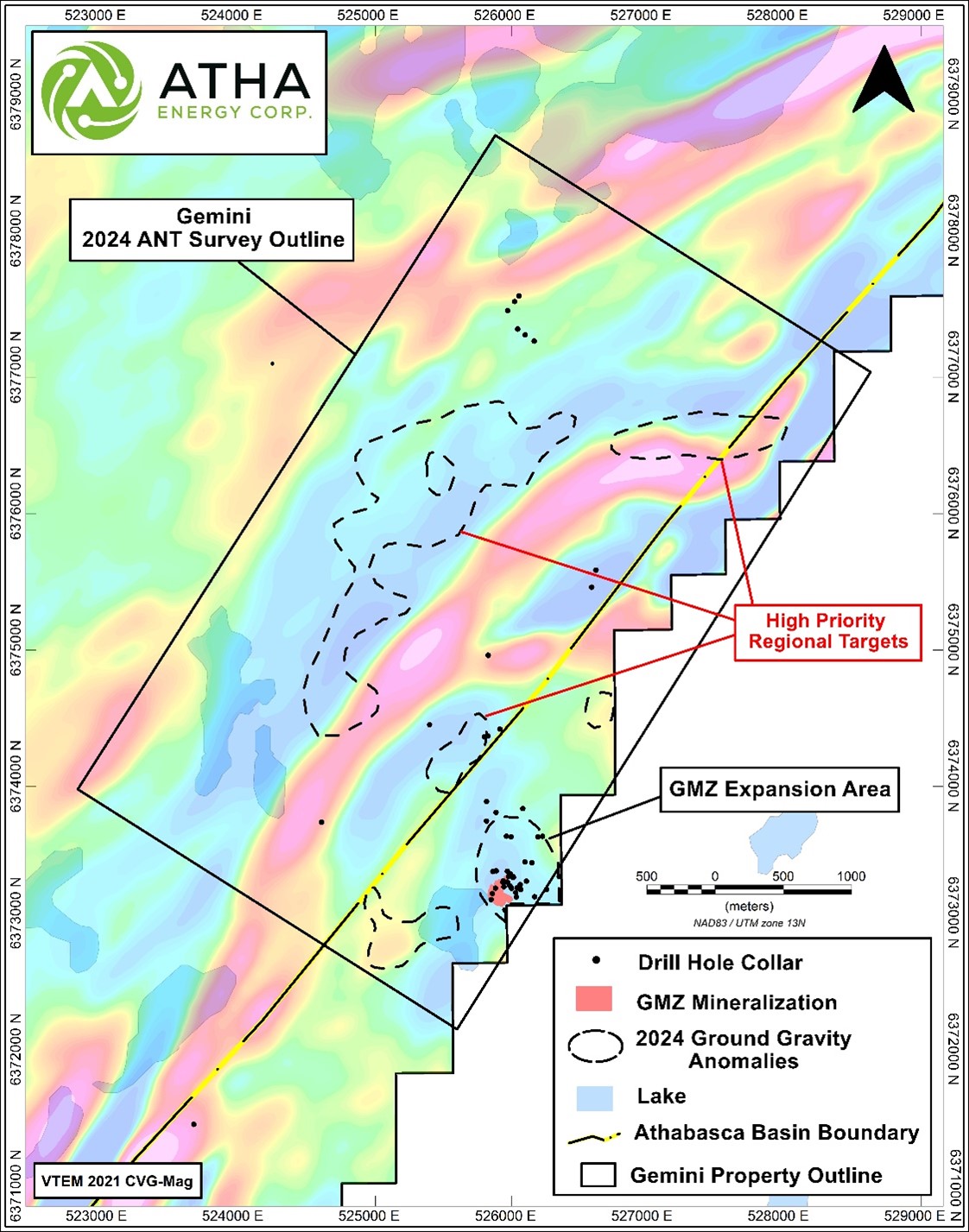

- Phase I: Geophysics (Currently On-going) – Ground Gravity Survey followed by the deployment of Fleet Space’s Exosphere ANT (Ambient Noise Tomography) System.

- Ground Gravity Survey (“GGS”) – (Completed February 2024): 92 Energy completed a comprehensive GGS focused on the GMZ and surrounding area – encompassing prospective parallel conductors. The results of the GGS were received in late March and highlight:

- The GGS demonstrates the continuation of alteration associated with the GMZ Discovery to the southwest, within the Gemini Project area.

- On parallel conductors, five large-scale gravity anomalies, which are also coincident with EM anomalies and MAG lows were identified – these anomalies are high-priority targets.

- The GGS demonstrates the continuation of alteration associated with the GMZ Discovery to the southwest, within the Gemini Project area.

- Ground Gravity Survey (“GGS”) – (Completed February 2024): 92 Energy completed a comprehensive GGS focused on the GMZ and surrounding area – encompassing prospective parallel conductors. The results of the GGS were received in late March and highlight:

- Fleet Space’s Exosphere Ambient Noise Tomography (ANT) – (Commenced April 2024): The ANT system is a non-intrusive ground-based geophysical survey system designed to measure naturally occurring seismic vibrations in the earth’s crust caused by wave action, weather, and other anthropogenic activities.

- Results of other ANT surveys completed in the Athabasca Basin have been successfully correlated with uranium mineralization and associated alteration of the surrounding rock mass.

- The ANT survey results will be gathered and uploaded to Fleet Space’s satellite network in near real-time, with anticipated completion by end of April.

- Results of other ANT surveys completed in the Athabasca Basin have been successfully correlated with uranium mineralization and associated alteration of the surrounding rock mass.

- Phase II: Target Development and Diamond Drilling Optimization (Currently Ongoing) – Comprised of two components:

- Data Compilation – Results from Phase I Geophysics, along with all data collected during previous exploration programs, and an ongoing SRK Consulting structural study on controls of uranium mineralization at GMZ will be compiled forming a comprehensive data set – producing a detailed 3D Geological model of the GMZ.

- Machine Learning and Enhanced Target Selection – 3D Geological model coupled with an internally developed proprietary Machine Learning Process. The process is designed to further de-risk and advance exploration targets at the GMZ and surrounding area prior to commencement of Phase III – Diamond Drilling Exploration.

- Data Compilation – Results from Phase I Geophysics, along with all data collected during previous exploration programs, and an ongoing SRK Consulting structural study on controls of uranium mineralization at GMZ will be compiled forming a comprehensive data set – producing a detailed 3D Geological model of the GMZ.

- Phase III: Diamond Drilling (Commencing Mid – Q3, 2024) – The diamond drilling exploration program is comprised of ~8,000 m and focuses on two key objectives:

- GMZ Expansion – ~4,000 m allocated to expanding the mineralization footprint immediately adjacent to the GMZ by testing prospective uranium-bearing structures.

- GMZ Trend Exploration – ~4,000 m allocated to testing of known regional high-priority targets.

- GMZ Expansion – ~4,000 m allocated to expanding the mineralization footprint immediately adjacent to the GMZ by testing prospective uranium-bearing structures.

VANCOUVER, British Columbia, April 11, 2024 (GLOBE NEWSWIRE) -- ATHA Energy Corp. (TSX.V: SASK) (FRA: X5U) (OTCQB: SASKF) (“ATHA” or the “Company”), holder of the largest uranium exploration portfolio in two of the highest-grade uranium districts in the world, is pleased to announce plans for its 2024 Gemini Project Exploration Program. At the 100%-owned Gemini Project located in the Athabasca Basin, Saskatchewan, the Company will deploy a three phased exploration approach. Phases I & II are designed to increase the probability of discovery and optimize capital expenditure during the Company’s Phase III diamond drill program, slated to begin mid Q3, 2024. The 2024 Gemini Project Exploration Program is in addition to the Company’s previously announced 2024 exploration programs at the Angilak Project in Nunavut and regional exploration on nine of its wholly owned high-priority projects within its four Athabasca Basin Exploration Districts (North Rim, Cable Bay, East Rim and West Rim). See March 20th, 2024, news release for more detail. The Company’s full 2024 Exploration Program comprising activities in Nunavut and Saskatchewan represents one of the largest uranium focused exploration programs globally and is the most significant undertaken by ATHA Energy.

EXPLORATION OUTLOOK

The Company’s core objective is discovery and development of its portfolio of uranium focused projects. With the acquisition of Latitude Uranium and 92 Energy, ATHA Energy’s portfolio now totals 8.1 million acres across Canada’s three most prospective jurisdictions for uranium discovery and development. The Company’s portfolio is highly diversified across the exploration risk curve. With projects ranging from development stage like Angilak, which host’s the Lac 50 Deposit – one of the largest, highest grade uranium deposits outside of the Athabasca Basin; post discovery projects like Gemini – which contains GMZ – a recent shallow, basement style, high-grade uranium discovery; through to highly prospective greenfields projects with numerous uranium occurrences and high-priority de-risked geophysical targets. ATHA’s exploration approach is designed to provide maximum exploration exposure by investing at scale in a large number of early-stage projects, derisking those targets, and seeking to deliver advanced exploration upside through the expansion of known uranium deposits and additional discoveries. ATHA intends to leverage its robust cash position to pursue a fully-funded growth strategy.

GEMINI PROJECT – SASKATCHEWAN

With the acquisition of 92 Energy by ATHA Energy, which includes the 100%-owned Gemini Project (Figure 1), the Company’s objective is to build upon the work completed by 92 Energy. The 2024 Gemini Project Exploration Program’s objective is expansion of mineralization at the GMZ and discovery of additional zones of mineralization within the GMZ Trend. The program has three progressive Phases designed to increase the probability of discovery and optimise capital expenditure. Phase I Geophysics will provide additional data needed to identify areas of expansion at GMZ and de-risk regional targets within the GMZ Trend. Phase II Target Development and Diamond Drilling Optimization compiles all available data collected during exploration programs at the Gemini Project. The comprehensive data set will then be used in development of 3D geological model and coupled with machine learning technologies to further enhance and de-risk targets. Phase III Diamond Drilling will target expansion of the mineralized footprint at GMZ and discovery of additional zones of uranium mineralization within the GMZ Trend (Figure 2).

Figure 1: ATHA Energy Land Package and Location of the Gemini Project

Figure 2: 2024 Gemini Project Exploration Program Area of Focus

Phases I and II are currently ongoing and are anticipated to be finalized by end of Q2, 2024. Phase III is scheduled to commence in mid-Q3, 2024, with preparations already underway. The Company has secured all necessary permits and approvals.

Troy Boisjoli, CEO added: “It’s fitting that the one-year anniversary (April 11th, 2024) of ATHA’s public listing coincides with the beginning of a new chapter for the Company. Over the last year ATHA has achieved many significant milestones, including: amassing the largest portfolio of prospective uranium exploration projects globally, completion of the largest EM survey in the history of the Athabasca Basin, the acquisition of the Latitude Uranium (which includes the Angilak Project, hosting one of the largest high-grade uranium projects outside of the Athabasca Basin), and now the acquisition of 92 Energy (including the Gemini Project). ATHA’s 2024 Exploration Programs focus on development and discovery across its unparalleled portfolio of uranium projects. Our plans for 2024 are designed to execute on the Company’s core objective, to discover and develop Canada’s next generation of uranium assets, under the backdrop of the best emerging uranium market ever.”

Cliff Revering, VP Exploration added: “The addition of 92 Energy’s portfolio, and in particular the Gemini Project and newly discovered GMZ uranium mineralized corridor, brings significant exploration upside to ATHA. The 2024 exploration program on the Gemini Project is designed to build on the previous exploration success by applying industry-leading techniques and technologies to further identify and characterize prospective targets ahead of drilling, maximizing the potential to expand the mineralization footprint within the GMZ mineralized corridor and Gemini Project.”

Hybrid Financial

ATHA Energy is also pleased to announce that it has retained Hybrid Financial Ltd. (“Hybrid”) to provide marketing services to the Company. Hybrid has been engaged to heighten market and brand awareness for ATHA Energy and to broaden the Company's reach within the investment community.

The services to be provided by Hybrid include phone calls to, and email communications with, qualified North American Investment Professionals (the “Services”). Hybrid has agreed to comply with all applicable securities laws and the policies of the TSX Venture Exchange (the “TSXV”) in providing the Services.

Hybrid has been engaged by the Company for an initial period of six months starting April 11, 2024 (the “Initial Term”) and then shall be renewed automatically for successive three-month periods thereafter, unless terminated by the Company in accordance with the Agreement. Hybrid will be paid a monthly fee of $15,000, plus applicable taxes, during the Initial Term. No securities of ATHA are being granted to Hybrid under the terms of its engagement.

The contact information for Hybrid is Hybrid Financial Ltd, 222 Bay Street, PO Box 37, Suite 2600, Toronto, ON M5K 1B7; Phone: 1-888-246-9446

NSS Share Issuance

Pursuant to the Athabasca Basin Properties Sale and Purchase Agreement dated September 20, 2022, as amended by an amending letter dated December 6, 2023, between ATHA and The New Saskatchewan Syndicate ("NSS”), ATHA has issued to NSS an aggregate of 5,000,000 ATHA Shares as of the date hereof.

Qualified Person

The scientific and technical information contained in this news release have been reviewed and approved by Cliff Revering, P.Eng., the Vice President, Exploration of ATHA, who is a "qualified person" as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About ATHA

ATHA is a Canadian mineral company engaged in the acquisition, exploration, and development of uranium assets in the pursuit of a clean energy future. With a strategically balanced portfolio including three 100%-owned post discovery uranium projects (the Angilak Project located in Nunavut, and CMB Discoveries in Labrador hosting historical resource estimates of 43.3 million lbs and 14.5 million lbs U3O8 respectively, and the newly discovered basement hosted GMZ high-grade uranium discovery located in the Athabasca Basin). In addition, the Company holds the largest cumulative prospective exploration land package (8.1 million acres) in two of the world’s most prominent basins for uranium discoveries - ATHA is well positioned to drive value. ATHA also holds a 10% carried interest in key Athabasca Basin exploration projects operated by NexGen Energy Ltd. and IsoEnergy Ltd. For more information visit www.athaenergy.com.1,2,3

About Hybrid Financial

Hybrid Financial connects issuers to the investment community across North America. Using a data driven approach, Hybrid provides its clients with comprehensive coverage of both American and Canadian markets. Hybrid Financial has offices in Toronto and Montreal.

For more information, please contact:

Troy Boisjoli

Chief Executive Officer

Email: info@athaenergy.com

www.athaenergy.com

Historical Mineral Resource Estimates

All mineral resources estimates presented in this news release are considered to be “historical estimates” as defined under NI 43-101, and have been derived from the following (See notes below). In each instance, the historical estimate is reported using the categories of mineral resources and mineral reserves as defined by the CIM Definition Standards for Mineral Reserves, and mineral reserves at that time, and these “historical estimates” are not considered by ATHA to be current. In each instance, the reliability of the historical estimate is considered reasonable, but a Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource, and ATHA is not treating the historical estimate as a current mineral resource. The historical information provides an indication of the exploration potential of the properties but may not be representative of expected results.

Notes on the Historical Mineral Resource Estimate for the Angilak Deposit:

- This estimate is considered to be a “historical estimate” under NI 43-101 and is not considered by any of to be current. See below for further details regarding the historical mineral resource estimate for the Angilak Property.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability.

- The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues.

- The quality and grade of the reported inferred resource in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred resources as an indicated or measured mineral resource, and it is uncertain if further exploration will result in upgrading them to an indicated or measured resource category.

- Contained value metals may not add due to rounding.

- A 0.2% U3O8 cut-off was used.

- The mineral resource estimate contained in this press release is considered to be “historical estimates” as defined under NI 43-101 and is not considered to be current.

- The “historical estimate” is derived from a Technical Report entitled “Technical Report and Resource Update For The Angilak Property, Kivalliq Region, Nunavut, Canada”, prepared by Michael Dufresne, M.Sc., P.Geol. of APEX Geosciences, Robert Sim, B.Sc., P.Geo. of SIM Geological Inc. and Bruce Davis, Ph.D., FAusIMM of BD Resource Consulting Inc., dated March 1, 2013 for ValOre Metals Corp.

- As disclosed in the above noted technical report, the historical estimate was prepared under the direction of Robert Sim, P.Geo, with the assistance of Dr. Bruce Davis, FAusIMM, and consists of three-dimensional block models based on geostatistical applications using commercial mine planning software. The project limits area based in the UTM coordinate system (NAD83 Zone14) using nominal block sizes measuring 5x5x5m at Lac Cinquante and 5x3x3 m (LxWxH) at J4. Grade (assay) and geological information is derived from work conducted by Kivalliq during the 2009, 2010, 2011 and 2012 field seasons. A thorough review of all the 2013 resource information and drill data by a Qualified Person, along with the incorporation of subsequent exploration work and results, which includes some drilling around the edges of the historical resource subsequent to the publication of the 2013 technical report, would be required in order to verify the Angilak Property historical estimate as a current mineral resource.

- The historical mineral resource estimate was calculated in accordance with NI 43-101 and CIM standards at the time of publication and predates the current CIM Definition Standards for Mineral Resources and Mineral Reserves (May, 2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (November, 2019).

- A thorough review of all historical data performed by a Qualified Person, along with additional exploration work to confirm results would be required to produce a current mineral resource estimate prepared in accordance with NI 43-101.

- Notes on the Historical Mineral Resource Estimate for the Moran Lake Deposit:

- Jeffrey A. Morgan, P.Geo. and Gary H. Giroux, P.Eng. completed a NI 43-101 technical report titled “Form 43-101F1 Technical Report on the Central Mineral Belt (CMB) Uranium Project, Labrador, Canada, Prepared for Crosshair Exploration & Mining Corp.” and dated July 31, 2008, with an updated mineral resource estimate for the Moran Lake C-Zone along with initial mineral resources for the Armstrong and Area 1 deposits. They modelled three packages in the Moran Lake Upper C-Zone (the Upper C Main, Upper C Mylonite, and Upper C West), Moran Lake Lower C-Zone, two packages in Armstrong (Armstrong Z1 and Armstrong Z3), and Trout Pond. These mineral resources are based on 3D block models with ordinary kriging used to interpolate grades into 10 m x 10 m x 4 m blocks. A cut-off grade of 0.015% U3O8 was used for all zones other than the Lower C Zone which employed a cut-off grade of 0.035%. A thorough review of all historical data performed by a Qualified Person, along with additional exploration work to confirm results, would be required to produce a current mineral resource estimate prepared in accordance with NI 43-101 standards.

3. Notes on the Historical Mineral Resource Estimate for the Anna Lake Deposit:

- The mineral resource estimate contained in this table is considered to be a “historical estimate” as defined under NI 43-101, and is not considered to be current and is not being treated as such. A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources. A qualified person would need to review and verify the scientific information and conduct an analysis and reconciliation of historical drill and geological data in order to verify the historical estimate as a current mineral resource.

- Reported by Bayswater Uranium Corporation in a Technical Report entitled “Form 43-101 Technical Report on the Anna Lake Uranium Project, Central Mineral Belt, Labrador, Canada”, prepared by R. Dean Fraser, P.Geo. and Gary H. Giroux, P.Eng., dated September 30, 2009.

- A 3-dimensional geologic model of the deposit was created for the purpose of the resource estimate using the Gemcom/Surpac modeling software. A solid model was created using a minimum grade x thickness cutoff of 3 meters grading 0.03% U3O8. Intersections not meeting this cutoff were generally not incorporated into the model. The shell of this modeled zone was then used to constrain the mineralization for the purpose of the block model. Assay composites 2.5 meters in length that honoured the mineralized domains were used to interpolate grades into blocks using ordinary kriging. An average specific gravity of 2.93 was used to convert volumes to tonnes. The specific gravity data was acquired in-house and consisted of an average of seventeen samples collected from the mineralised section of the core. The resource was classified into Measured, Indicated or Inferred using semi-variogram ranges applied to search ellipses. All resources estimated at Anna Lake fall under the “Inferred” category due to the wide spaced drill density. An exploration program would need to be conducted, including twinning of historical drill holes in order to verify the Anna Lake Project estimate as a current mineral resource.

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. These forward-looking statements or information may relate to ATHA’s proposed exploration program, including statements with respect to the expected benefits of ATHA’s proposed exploration program, any results that may be derived from ATHA’s proposed exploration program, the timing, scope, nature, breadth and other information related to ATHA’s proposed exploration program, any results that may be derived from the diversification of ATHA’s portfolio, the successful integration of the businesses of ATHA, Latitude Uranium and 92 Energy, the prospects of ATHA’s projects, including mineral resources estimates and mineralization of each project, the prospects of ATHA’s business plans and any expectations with respect to defining mineral resources or mineral reserves on any of ATHA’s projects, and any expectation with respect to any permitting, development or other work that may be required to bring any of the projects into development or production.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, assumptions that the anticipated benefits of ATHA’s proposed exploration program will be realized, that no additional permit or licenses will be required in connection with ATHA’s exploration programs, the ability of ATHA to complete its exploration activities as currently expected and on the current anticipated timelines, including ATHA’s proposed exploration program, that that ATHA will be able to execute on its current plans, that ATHA’s proposed explorations will yield results as expected, the synergies between ATHA, 92 Energy and Latitude Uranium’s assets, and that general business and economic conditions will not change in a material adverse manner. Although each of ATHA and 92E have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Such statements represent the current view of ATHA with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by ATHA, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: inability of ATHA to realize the benefits anticipated from the exploration and drilling targets described herein or elsewhere; in ability of ATHA to complete current exploration plans as presently anticipated or at all; inability for ATHA to economically realize on the benefits, if any, derived from the exploration program; failure to complete business plans as it currently anticipated; overdiversification of ATHA’s portfolio; failure to realize on benefits, if any, of a diversified portfolio; unanticipated changes in market price for ATHA shares; changes to ATHA’s current and future business and exploration plans and the strategic alternatives available thereto; growth prospects and outlook of the business of ATHA; any impacts of COVID-19 on the business of ATHA and the ability to advance the Company projects and its proposed exploration program; risks inherent in mineral exploration including risks related worker safety, weather and other natural occurrences, accidents, availability of personnel and equipment, and other factors; aboriginal title; failure to obtain regulatory and permitting approvals; no known mineral resources/reserves; reliance on key management and other personnel; competition; changes in laws and regulations; uninsurable risks; delays in governmental and other approvals, community relations; stock market conditions generally; demand, supply and pricing for uranium; and general economic and political conditions in Canada, Australia and other jurisdictions where ATHA conducts business. Other factors which could materially affect such forward-looking information are described in the filings of ATHA with the Canadian securities regulators which are available on ATHA’s profile on SEDAR+ at www.sedarplus.ca. ATHA does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/920c5cd9-4403-49b6-8138-3327bf700474

https://www.globenewswire.com/NewsRoom/AttachmentNg/de492ff5-ced5-4128-ab0b-4bd98600933d