After an accident, the decisions you make in the days, weeks, and months ahead can dramatically impact your financial recovery. While the average personal injury settlement hovers around $55,000, many victims walk away with far less than they deserve because of avoidable mistakes.

Getting proper personal injury legal guidance early in the process can mean the difference between a settlement that covers your losses and one that leaves you struggling to pay medical bills for years.

This comprehensive financial checklist will help you understand the most costly errors and how to avoid them.

The Financial Reality of Personal Injury Claims

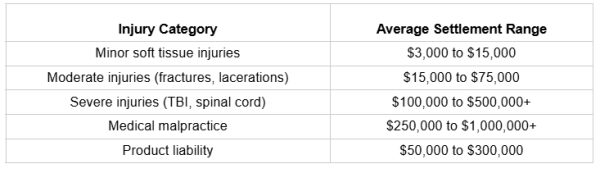

Before diving into the mistakes, it is important to understand what is at stake. Personal injury settlements vary widely based on injury severity, documentation quality, and how well you protect your claim.

Average Settlement Amounts by Injury Type

According to recent data, approximately 90 to 95 percent of personal injury cases settle before trial. About two thirds of claimants receive compensation through settlement, with the average payout among surveyed plaintiffs reaching $52,900. However, roughly half of all personal injury plaintiffs receive $24,000 or less.

The gap between high and low settlements often comes down to the mistakes victims make after their accident.

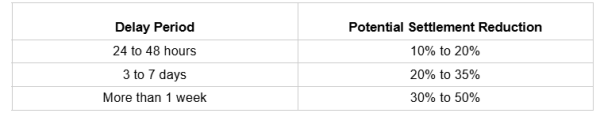

Mistake #1: Delaying Medical Treatment

Perhaps no mistake damages settlement value more than waiting to see a doctor after an accident. Insurance companies meticulously analyze treatment timelines, and any gap between your accident and first medical visit becomes ammunition against your claim.

Financial Impact of Treatment Delays

Research indicates that delayed treatment can reduce settlement value by 30 to 50 percent in catastrophic injury cases. Insurance adjusters argue that if you were truly injured, you would have sought immediate care.

Checklist: Protecting Your Claim Through Medical Documentation

- Seek medical attention within 24 hours of the accident

- Visit an emergency room or urgent care, not just your primary physician

- Report every symptom, including seemingly minor ones

- Follow all treatment recommendations without exception

- Attend every follow up appointment

- Keep copies of all medical records and bills

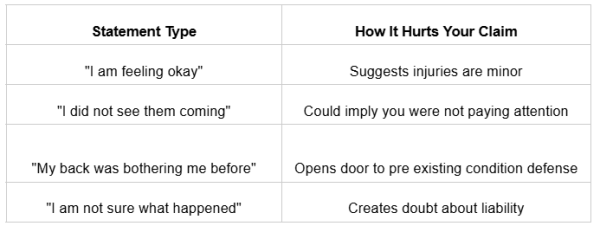

Mistake #2: Giving Recorded Statements Without Legal Counsel

Insurance adjusters may seem friendly and helpful, but their primary goal is minimizing payouts. When they ask for a recorded statement, they are building a case against you, not for you.

Early recorded statements routinely reduce settlement value by 30 percent or more by locking in limited injury descriptions before full diagnoses emerge. A simple phrase like "I am feeling better" can be used as evidence that your injuries are not serious.

What Adjusters Hope You Will Say

At Scheuerman Law, we advise clients to direct all insurance communications through their attorney. This single step can prevent statements that undermine your claim before it even gets started.

Mistake #3: Accepting the First Settlement Offer

Insurance companies know that accident victims face immediate financial pressure from medical bills and lost wages. They exploit this pressure by offering quick, lowball settlements that seem attractive in the moment but fall far short of fair compensation.

Why First Offers Are Almost Always Too Low

The initial offer typically covers only:

- Current medical bills (not future treatment)

- A fraction of pain and suffering

- Immediate lost wages (not long term earning capacity)

What first offers usually exclude:

- Future medical expenses

- Ongoing rehabilitation costs

- Reduced earning capacity

- Emotional distress damages

- Long term impact on quality of life

Studies show that injured victims who retain skilled personal injury lawyers receive settlements that are statistically three times higher than those who handle claims alone. Insurance companies are more likely to lowball unrepresented claimants during the settlement process.

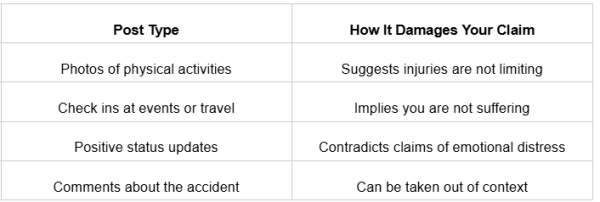

Mistake #4: Posting on Social Media

Social media has become one of the most common ways personal injury cases are undermined. Insurance companies routinely investigate claimants' online profiles, looking for anything that contradicts injury claims.

Social Media Red Flags Insurance Companies Exploit

That family vacation photo or gym check in can become evidence that your injuries are not as severe as claimed. Insurance investigators will comb through years of posts looking for anything useful.

Checklist: Social Media During Your Claim

- Set all profiles to maximum privacy settings

- Avoid posting anything about your accident

- Do not discuss your case or injuries online

- Ask friends and family not to tag you in posts

- Assume everything you post will be seen by the defense

Mistake #5: Failing to Document Non-Economic Damages

Many claimants focus exclusively on medical bills and lost wages while neglecting to document pain, suffering, and emotional distress. These non-economic damages often represent the largest portion of a fair settlement.

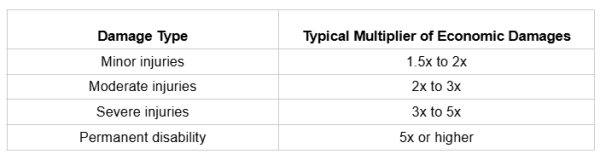

Potential Value of Non-Economic Damages

If non economic damages are not properly asserted and documented, they may never appear in settlement calculations. This omission can reduce awards by 40 to 60 percent, especially in cases involving disfigurement, loss of independence, or chronic pain.

How to Document Pain and Suffering

Keep a daily journal recording:

- Pain levels on a scale of 1 to 10

- Activities you cannot perform

- Sleep disturbances

- Emotional struggles (anxiety, depression, fear)

- Impact on relationships and social life

- Missed events and experiences

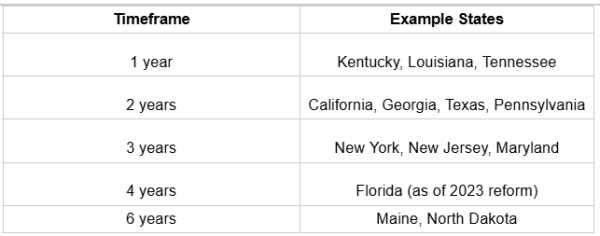

Mistake #6: Missing Critical Deadlines

Every state has strict deadlines called statutes of limitations that limit how long you have to file a personal injury claim. Missing these deadlines permanently bars you from recovering compensation, regardless of how strong your case may be.

Common Statute of Limitations by State

Beyond the statute of limitations, other critical deadlines exist for preserving evidence, filing insurance claims, and responding to legal documents. Missing any of these can weaken or destroy your case.

Mistake #7: Not Disclosing Prior Injuries

Many accident victims make the mistake of hiding prior injuries, thinking this information will hurt their claim. In reality, failing to disclose prior injuries does far more damage than the injuries themselves.

Insurance companies have access to databases that reveal all prior injury claims you have made. When they discover undisclosed information, they use it to attack your credibility, arguing that if you lied about prior injuries, you might be lying about current ones too.

Mark Scheuerman of Scheuerman Law explains: "Prior injuries do not eliminate your opportunity for settlement. What eliminates opportunity is dishonesty. Be upfront with your legal team about your complete medical history so we can address these issues strategically."

Mistake #8: Settling Before Maximum Medical Improvement

Accepting a settlement before you understand the full extent of your injuries can leave you responsible for thousands in future medical expenses. Once you sign a release, you cannot go back and ask for more money, even if your condition worsens.

What Maximum Medical Improvement Means

Maximum medical improvement (MMI) is the point at which your condition has stabilized and is unlikely to improve significantly with additional treatment. Settling before reaching MMI means:

- Future surgeries come out of your pocket

- Long term rehabilitation costs are not covered

- Permanent limitations may not be compensated

- You bear the risk if complications develop

Your Financial Protection Checklist

Use this checklist to protect your settlement value:

Immediately After the Accident

- Seek medical attention within 24 hours

- Document the scene with photos and videos

- Collect witness contact information

- File a police report if applicable

- Do not admit fault to anyone

During Your Recovery

- Follow all medical recommendations

- Attend every appointment

- Keep a daily pain and impact journal

- Preserve all receipts and bills

- Avoid social media posts

Throughout the Claims Process

- Do not give recorded statements without an attorney

- Never accept the first settlement offer

- Disclose all prior injuries honestly

- Wait until reaching maximum medical improvement

- Know your state's deadlines

Final Thoughts

The difference between a fair settlement and an inadequate one often comes down to the actions you take after an accident. Insurance companies spend billions annually finding ways to reduce what they pay claimants. Your best defense is understanding their tactics and avoiding the mistakes that give them leverage.

If you have been injured due to someone else's negligence, do not navigate this process alone. The decisions you make today will impact your financial recovery for years to come.

Protecting your claim starts with getting the right information and support from the beginning.