State Farm Ranks Highest in Individual Life Insurance Satisfaction

The life insurance industry is at an inflection point. Experiencing persistently slow growth and facing generational shift that is increasingly reliant on converting Millennial1 and Gen Z customers, the industry is working hard to improve customer communications and build trust with new customer segments. According to the J.D. Power 2024 U.S. Individual Life Insurance Study,SM released today, insurers still have a lot of work to do, with the majority of customers indicating their insurer makes things unnecessarily complicated—a problem that is particularly acute among the youngest generation of customers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241010964448/en/

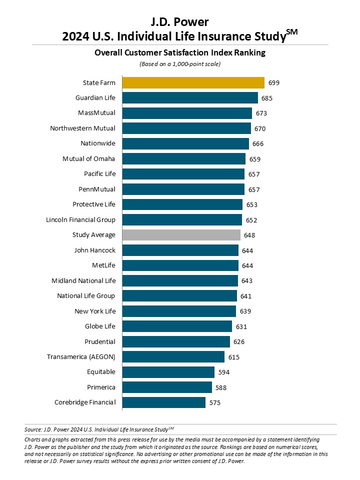

J.D. Power 2024 U.S. Individual Life Insurance Study (Graphic: Business Wire)

“Life insurers are facing new communication challenges as they court younger consumers,” said Breanne Armstrong, director of insurance intelligence at J.D. Power. “Currently, only 29% of life insurance customers ‘strongly agree’ that their insurer makes complex policies simpler, and Gen Z has the lowest incidence of saying their agent or advisor explains things in terms they can easily understand. The old model of text-heavy binders and jargon-filled informational packets will no longer cut it. Younger customers are looking for simpler guides, diagrams and easy-to-understand definitions when evaluating policies.”

Following are some key findings of the 2024 studies:

- Complexity keeps many customers from fully understanding their policies: Just 29% of life insurance customers say they “strongly agree” their insurer makes complex policies simpler and just 61% say their agent or advisor explains things in terms they can understand. Among members of Gen Z, that number falls to 57%. Overall, 64% of life insurance customers say they fully understand their policies.

- Rethinking the life insurance statement: When asked what insurers could do to make life insurance statements easier to understand, most customers say: “reduce complexity/make statements easier to read.” Among younger customers in the Gen Z and Millennial segments, customers are looking for a guide or diagram on how to read the statement or links to educational videos and materials that explain how to read it.

- Disconnect between current policy and future needs: Fewer than three-fourths (72%) of life insurance customers say their policy completely meets their future needs. Insurers can increase this rate dramatically by tailoring communications to specific customer needs, delivering the right frequency of communication and ensuring that the policy is completely understood.

Study Rankings

State Farm ranks highest among individual life insurance providers for a fifth consecutive year, with a score of 699. Guardian Life (685) ranks second and MassMutual (673) ranks third.

The U.S. Individual Life Insurance Study was redesigned for 2024. Scores are not comparable year over year with previous studies. The study measures the experiences of customers of the largest individual life insurance companies in the United States across eight core dimensions (in order of importance): trust; value for price; ease of doing business; people; product offerings; ability to get service; problem resolution; and digital channels. The 2024 study is based on responses from 4,731 individual life insurance customers and was fielded from April through July 2024.

For more information about the U.S. Individual Life Insurance Study, visit https://www.jdpower.com/business/healthcare/us-individual-life-insurance-study.

See the online press release at http://www.jdpower.com/pr-id/2024120.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

_______________

1 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2006). Millennials (1982-1994) are a subset of Gen Y

View source version on businesswire.com: https://www.businesswire.com/news/home/20241010964448/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com