Knightscope, Inc. (Nasdaq: KSCP), a leading developer of autonomous security robots and blue light emergency communication systems, today released the transcript and video of the First Quarter Town Hall Update that occurred at 1pm Pacific Time on 15 May 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230516005518/en/

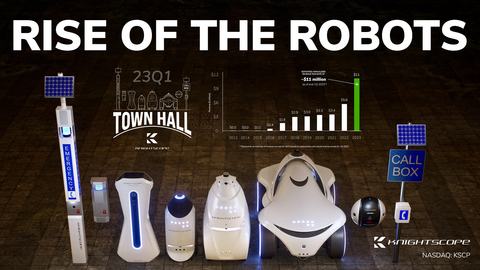

Knightscope Releases First Quarter Town Hall Update Transcript and Video (Graphic: Business Wire)

TRANSCRIPT

William Santana Li: In the spirit of continuing to engage our original investor base, welcome our new investors from the public markets, and improve our communication with our friends on Wall Street, we are going to devote part of this Town Hall to reviewing some financial highlights from our recently filed quarterly report on Form 10-Q for the first quarter 2023, as well as share some current events that may be of interest to our stockholders and potential investors.

This Town Hall format is intended to provide an informal forum for our audience to ask questions – from Wall Street to Main Street, from Silicon Valley to Washington D.C. If we are going to achieve our long-term mission of making the U.S. the safest country in the world, we are going to need the entire country engaged, and today is part of it.

Of course, any and all figures presented today in this presentation should be read in full context of the Company’s recent regulatory filings and risk factors available at ir.knightscope.com.

Now to the numbers.

Last year in 2022, we recorded $5.6M in aggregate revenue (from both service and product) for the year, reflecting an over 60% growth rate from the prior year. Additionally, at the end of 2022 we built up a backlog of approximately $3.9M in new orders, and by March 19, 2023, as reported in the 2022 10-K, that number had increased to $5.2M, which is almost the same amount of the revenue for the entirety of 2022. The significant top line and backlog increases are attributed to our acquisition of CASE Emergency Systems during the fourth quarter of 2022.

With respect to the 1st quarter 2023, there are 3 key points:

First, I am pleased to report that for the 1st quarter of 2023, we recorded approximately $2.9M in revenue over the first 3 months of the year, which is an over 300% improvement over the 1st quarter of 2022. This included a year-over-year increase in service revenue of approximately 85%. Service revenue includes our ASR Machine-as-a-Service revenue as well as maintenance and support revenue related to the blue light towers and call boxes, which was the primary driver of the significant increase as compared to the first quarter of 2022. Product revenue relates to emergency communication device sales and contributed approximately $1.1M in Q1 2023. Despite the ongoing drag from supply chain issues, this reflects an annualized revenue run rate of approximately $11M.

Second, with our focus on top line revenue growth and cost reductions taking effect during the first quarter, we had a significant positive swing from a gross loss in 1Q 2022 of $549,000, to a gross loss during 1Q 2023 of $213,000, a nearly $336,000 improvement. The increase in gross margins is primarily attributable to the positive margins generated by our product sales. On a percentage basis, gross margins moved from a negative 58% gross margin to negative 7% gross margin, and our plans are in place to continue to improve our service and product margins as we scale up.

Comparing first quarter of 2022 to first quarter of 2023, on a per share basis, we improved significantly from a 30-cent loss per common share to a 6 cent loss. Last year we noted our plan was to achieve profitability in the next 24 months, and we have made positive movements in that direction.

We plan to continue growing the Company, and we believe our sales pipeline is strong, and increasing sales will allow us to grow, drive economies of scale, and better leverage our fixed cost base.

Third, during the first quarter 2023, despite supply chain challenges, we were able to reduce our backlog of new orders from its peak of $5.2M reported in our 2022 10-K down to $4.7M in about 30 days. However, given the ongoing positive demand for our technologies, our multi-million dollar backlog of orders is continuing to increase.

We are, therefore, focused on transitioning our production strategy from a work cell environment, which was appropriate for smaller volumes, to a more traditional assembly line process, set up to accommodate a larger volume of units with new processes to optimize throughput, for the manufacturing of our Autonomous Security Robots, here in Silicon Valley.

Our cash on hand at the end of 2022 was $4.8M and our cash and cash equivalents at the end of Q1 2023 was approximately $2.4M. We seek to improve our cash position through a seven-fold plan which is underway and includes:

- Continuing to grow our top line revenue with new service contracts and product sales

- Leveraging our financing partnerships with Dimension Funding and Balboa Capital to fund new orders upfront, improving our cash flow

- Accelerating delivery of our backlog of orders

- Continuing to use our At-The-Market program, managed by H.C. Wainwright

- Realizing cost savings from the cost cuts implemented in January 2023

- Reducing our variable costs related to our ASRs, such as telecommunications, service, and cloud costs to improve margins

- Exploring a possible non-dilutive debt offering to continue to fuel our growth

As a follow-on to the 10 Town Hall Marathon we conducted last month, we’ll now transition to the live portion of the Town Hall for questions from our long-time investors, new retail investors, institutions and analysts. Thank you!

VIDEO

The recorded portion of the Town Hall as transcribed above (the question and answer portion was not recorded) is available to review at www.knightscope.com/rise - please scroll to the Rise of the Robots section and select Episode 6.

About Knightscope

Knightscope is an advanced public safety technology company that builds fully autonomous security robots and blue light emergency communications systems that help protect the places people live, work, study and visit. Knightscope’s long-term ambition is to make the United States of America the safest country in the world. Learn more about us at www.knightscope.com. Follow Knightscope on Facebook, Twitter, LinkedIn and Instagram.

Forward-Looking Statements

This press release may contain “forward-looking statements” about Knightscope’s future expectations, plans, outlook, projections and prospects. Such forward-looking statements can be identified by the use of words such as “should,” “may,” “intends,” “anticipates,” “believes,” “estimates,” “projects,” “forecasts,” “expects,” “plans,” “proposes” and similar expressions. Forward-looking statements contained in this press release include, but are not limited to, statements about the Company’s path to profitability, the Company’s targeted annualized revenue run rate, the Company’s plans for top-line growth, the Company’s ability to deliver on its backlog of new orders, the benefits of the Company’s planned streamlining of its operations and rightsizing of its combined workforce and the Company’s ability to achieve improved margins. Although Knightscope believes that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, among other things, the risk that the restructuring costs and charges may be greater than anticipated; the risk that the Company’s restructuring efforts may adversely affect the Company’s internal programs and the Company’s ability to recruit and retain skilled and motivated personnel, and may be distracting to employees and management; the risk that the Company’s restructuring efforts may negatively impact the Company’s business operations and reputation with or ability to serve customers; the risk that the Company’s restructuring efforts may not generate their intended benefits to the extent or as quickly as anticipated. Readers are urged to carefully review and consider any cautionary statements and other disclosures, including the statements made under the heading “Risk Factors” in Knightscope’s Annual Report on Form 10-K for the year ended December 31, 2022. Forward-looking statements speak only as of the date of the document in which they are contained, and Knightscope does not undertake any duty to update any forward-looking statements, except as may be required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230516005518/en/

Contacts

Public Relations:

Stacy Stephens

Knightscope, Inc.

(650) 924-1025

Corporate Communications:

IBN (InvestorBrandNetwork)

Los Angeles, California

www.InvestorBrandNetwork.com

(310) 299-1717 Office

Editor@InvestorBrandNetwork.com