Qualcomm (QCOM) stock is slipping on Feb. 5, after the semiconductor giant issued disappointing Q2 guidance, citing a global memory shortage it believes will remain an overhang on smartphone production in 2026.

At the time of writing, QCOM shares sit decisively below their key moving averages (MAs), signaling the downward pressure is unlikely to subside anytime soon.

Still, the relative strength index (RSI) and options data warrants buying Qualcomm stock, now down 25% versus its year-to-date high.

Where Options Data Suggests Qualcomm Stock Is Headed

While Qualcomm’s moving averages suggest the bearish momentum is here to stay, its 14-day RSI tells a different story altogether.

Following the post-earnings decline, the relative strength index sits at about 22, indicating extremely oversold conditions that often trigger a relief rally.

Additionally, options data remains skewed to the upside as well, suggesting traders expect recent weakness to prove temporary only.

According to Barchart, the upper price on contracts expiring mid-April currently sits at about $152, signaling potential for a more than 10% rally in QCOM stock within the next three months.

QCOM Shares Are Well-Positioned to Weather the Memory Shortage

Qualcomm shares are worth buying on the post-earnings pullback also because Cristiano Amon, the company’s chief executive, confirmed demand for high-end smartphones remains strong.

This suggests the cited memory shortage means deferred revenue — not lost sales — for the Nasdaq-listed firm.

Moreover, it’s reasonable to assume that the supply crunch will predominantly hit low-end phones, but QCOM drives most of its profits from high-margin flagship smartphones instead.

Finally, a diversified portfolio, including fast-growing Automotive and PC segments means the company has multiple levers it can pull to offset temporary weakness in one of its businesses.

All in all, the aforementioned insights reinforce that this semiconductor stock is much better positioned to weather the memory shortage than it’s getting credit for.

Wall Street Remains Bullish on Qualcomm

What’s also worth mentioning is that the post-earnings decline has failed to spook Wall Street firms.

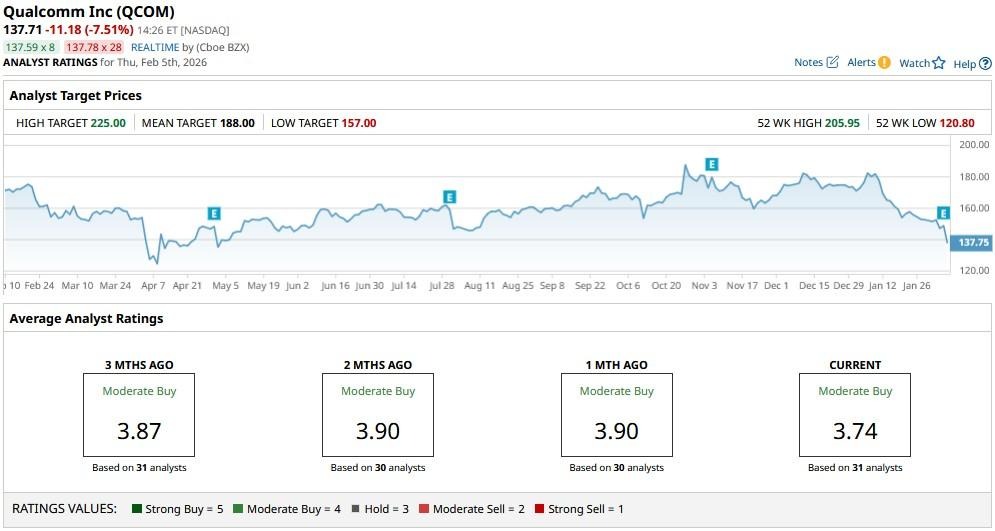

The consensus rating on QCOM shares remains at a “Moderate Buy” with the mean target of roughly $188 indicating potential upside of more than 35% from current levels.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nio Says Profitability Is Just Around the Corner. Should You Buy NIO Stock Here?

- As Analysts Forecast 50% Upside, Is Now the Time to Buy the Dip in AMD?

- Is There a Light at the End of the Tunnel for Qualcomm Stock? What Options Data, Technicals Tell Us.

- This Overlooked Biotech Giant Could Surprise Investors This Quarter