Mastercard Incorporated (MA), headquartered in Purchase, New York, provides transaction processing and other payment-related products and services. Valued at $494.5 billion by market cap, the company offers payment processing services for credit and debit cards, electronic cash, automated teller machines, and travelers checks.

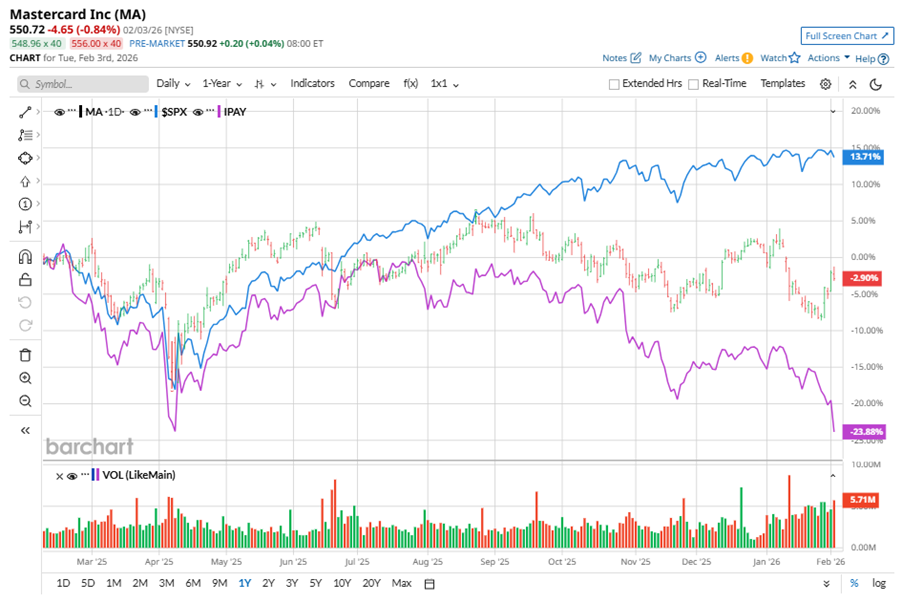

Shares of this payments giant have underperformed the broader market over the past year. MA has declined 2.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.4%. In 2026, MA stock is down 3.5%, compared to SPX’s 1.1% rise on a YTD basis.

Narrowing the focus, MA’s outperformance is apparent compared to the Amplify Digital Payments ETF (IPAY). The exchange-traded fund has declined about 23.7% over the past year. Moreover, MA’s single-digit losses on a YTD basis outshine the ETF’s 10.9% dip over the same time frame.

On Jan. 29, MA shares closed up more than 4% after reporting its Q4 results. Its adjusted EPS of $4.76 surpassed Wall Street expectations of $4.20. The company’s revenue was $8.8 billion, topping Wall Street forecasts of $8.7 billion.

For the current fiscal year, ending in December, analysts expect MA’s EPS to grow 13.4% to $19.28 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

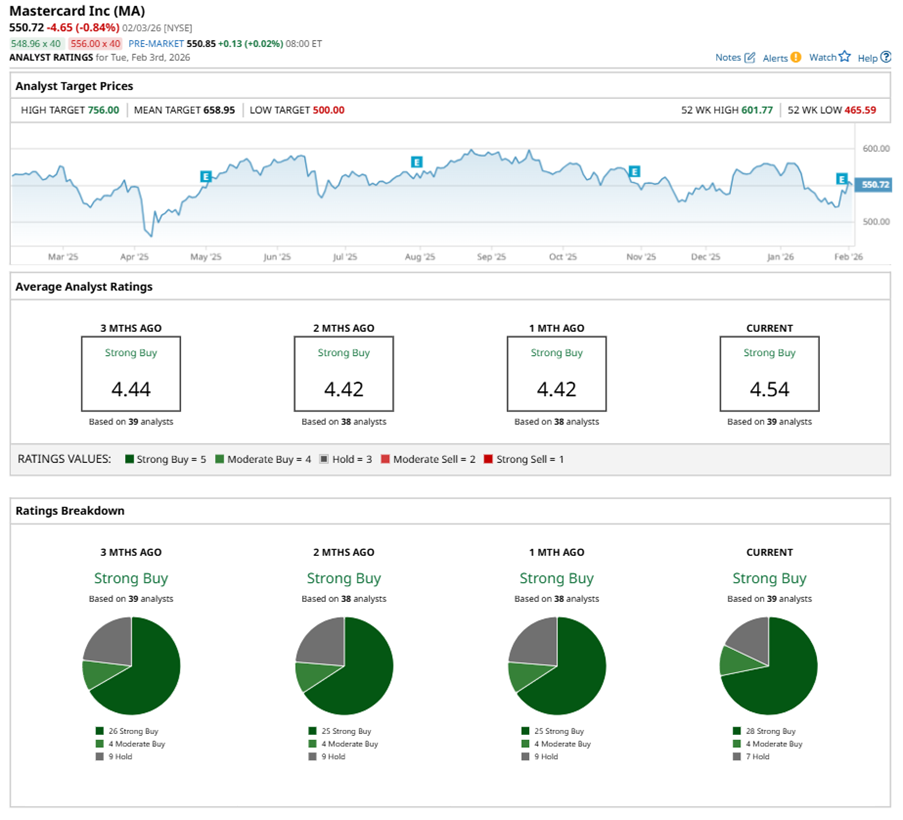

Among the 39 analysts covering MA stock, the consensus is a “Strong Buy.” That’s based on 28 “Strong Buy” ratings, four “Moderate Buys,” and seven “Holds.”

This configuration is more bullish than a month ago, with 25 analysts suggesting a “Strong Buy.”

On Feb. 2, Daiwa analyst Kazuya Nishimura upgraded MA to an “Outperform” rating with a price target of $610, implying a potential upside of 10.8% from current levels.

The mean price target of $658.95 represents a 19.7% premium to MA’s current price levels. The Street-high price target of $756 suggests an ambitious upside potential of 37.3%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Qualcomm Stock Fans, Mark Your Calendars for February 4

- Palantir CEO Alex Karp Says ‘Inexplicable Growth in Revenue, but Not Inexplicable Growth in Customers’ Is Ahead. What Does That Mean for PLTR Stock?

- FuboTV Stock Plunges Deep Into Oversold Territory on Reverse Stock Split News. Should You Buy the Dip?

- Even More Layoffs Are Coming at Amazon. What Does That Mean for AMZN Stock?