Ross Stores, Inc. (ROST), headquartered in Dublin, California, operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd's DISCOUNTS brand names. Valued at $61.8 billion by market cap, ROST offers designer apparel, accessories, footwear, and home fashions at discount prices.

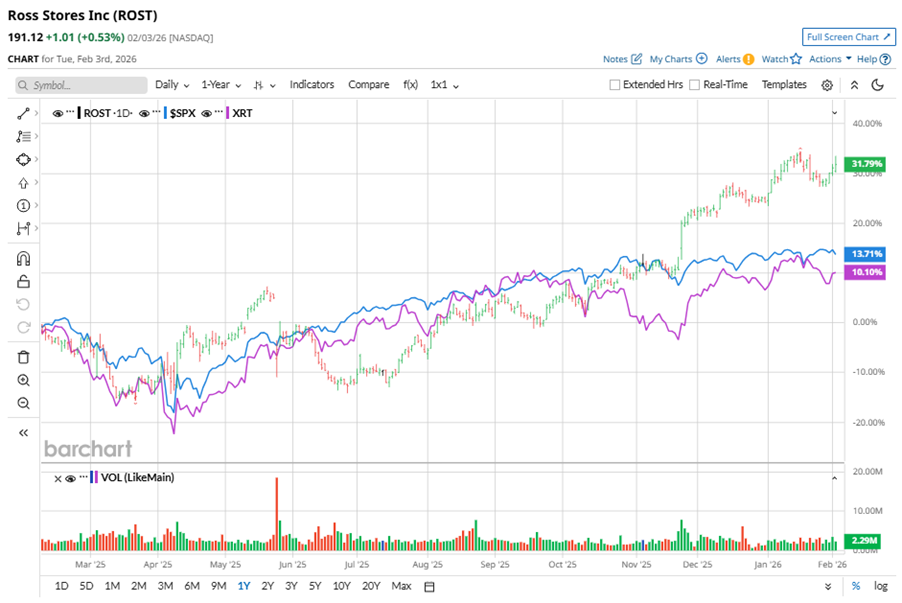

Shares of this leading off-price retailer have outperformed the broader market over the past year. ROST has gained 30% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.4%. In 2026, ROST stock is up 6.1%, surpassing the SPX’s 1.1% gains on a YTD basis.

Zooming in further, ROST has also outpaced the SPDR S&P Retail ETF (XRT). The exchange-traded fund has gained about 11.8% over the past year. Moreover, the stock’s returns on a YTD basis outshine the ETF’s 3.3% gains over the same time frame.

On Nov. 20, 2025, ROST reported its Q3 results, and its shares closed up more than 8% in the following trading session. Its EPS of $1.58 exceeded Wall Street expectations of $1.40. The company’s revenue was $5.6 billion, topping Wall Street forecasts of $5.4 billion. ROST expects full-year EPS to be $6.38 to $6.46.

For the current fiscal year, ended in January, analysts expect ROST’s EPS to grow 2.4% to $6.47 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

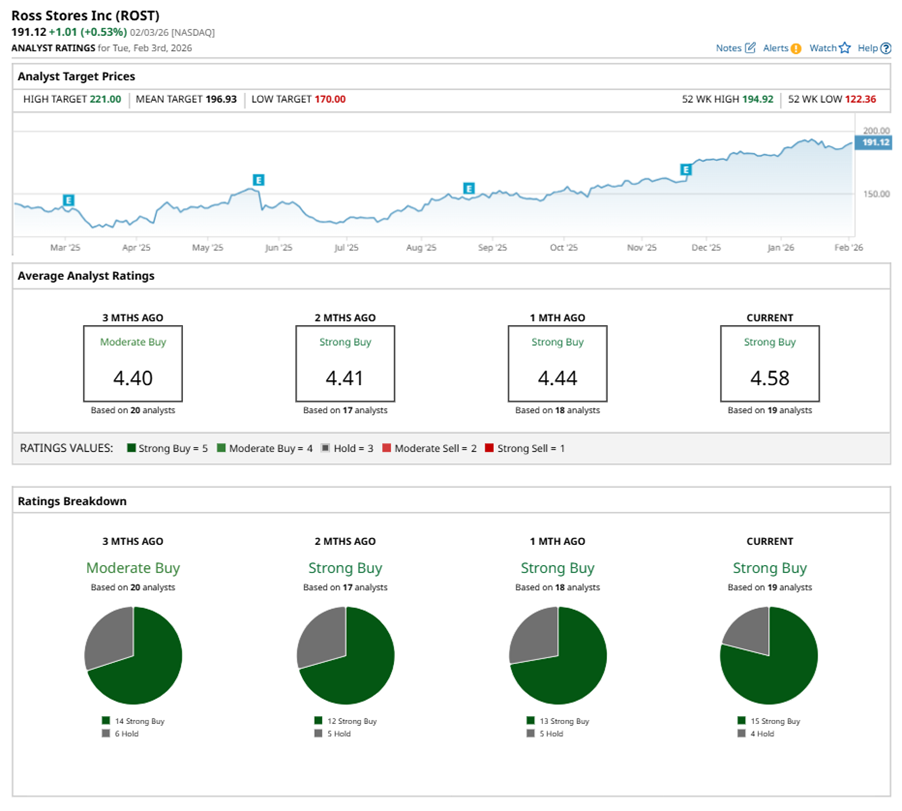

Among the 19 analysts covering ROST stock, the consensus is a “Strong Buy.” That’s based on 15 “Strong Buy” ratings, and four “Holds.”

This configuration is more bullish than a month ago, with 13 analysts suggesting a “Strong Buy.”

On Jan. 27, Corey Tarlowe from Jefferies Financial Group Inc. (JEF) reiterated a “Buy” rating on ROST with a price target of $210, implying a potential upside of 9.9% from current levels.

The mean price target of $196.93 represents a 3% premium to ROST’s current price levels. The Street-high price target of $221 suggests an upside potential of 15.6%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Qualcomm Stock Fans, Mark Your Calendars for February 4

- Palantir CEO Alex Karp Says ‘Inexplicable Growth in Revenue, but Not Inexplicable Growth in Customers’ Is Ahead. What Does That Mean for PLTR Stock?

- FuboTV Stock Plunges Deep Into Oversold Territory on Reverse Stock Split News. Should You Buy the Dip?

- Even More Layoffs Are Coming at Amazon. What Does That Mean for AMZN Stock?