Richmond, Virginia-based Dominion Energy, Inc. (D) produces and distributes energy products. Valued at $51.4 billion by market cap, the company offers natural gas and electric energy transmission, gathering, and storage solutions. The company provides electricity and natural gas to 7.5 million customers in 18 states.

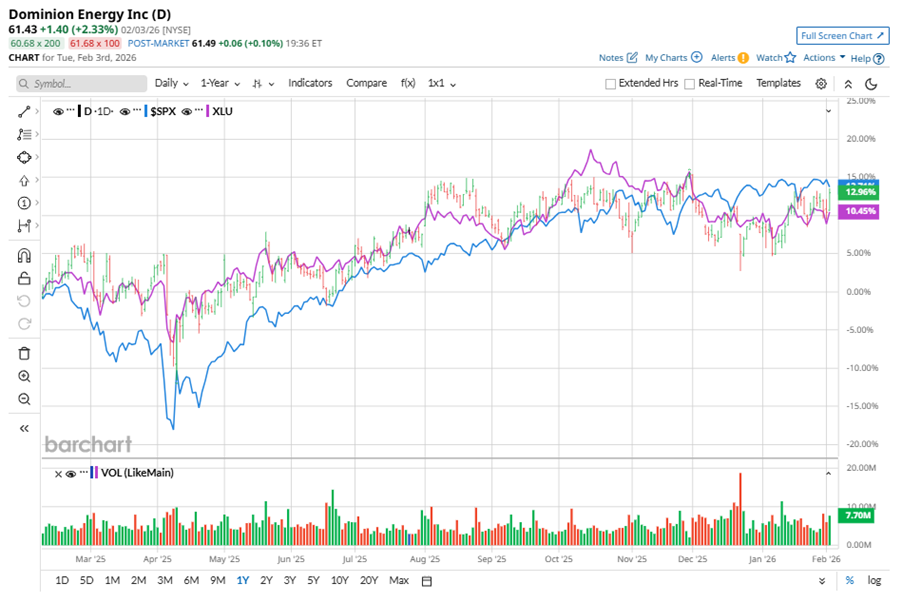

Shares of this leading energy company have underperformed the broader market over the past year. D has gained 9.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.4%. However, in 2026, D’s stock is up 4.9%, surpassing SPX’s 1.1% rise on a YTD basis.

Narrowing the focus, D’s underperformance is also apparent compared to the Utilities Select Sector SPDR Fund (XLU). The exchange-traded fund has gained about 10.5% over the past year. However, D’s returns on a YTD basis outshine the ETF’s 1.3% gains over the same time frame.

On Oct. 31, 2025, D shares closed down more than 1% after reporting its Q3 results. Its adjusted EPS of $1.06 surpassed Wall Street expectations of $0.93. The company’s revenue was $4.5 billion, topping Wall Street forecasts of $4.2 billion. D expects full-year adjusted EPS in the range of $3.33 to $3.48.

For the current fiscal year, ended in December 2025, analysts expect D’s EPS to grow 22.7% to $3.40 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

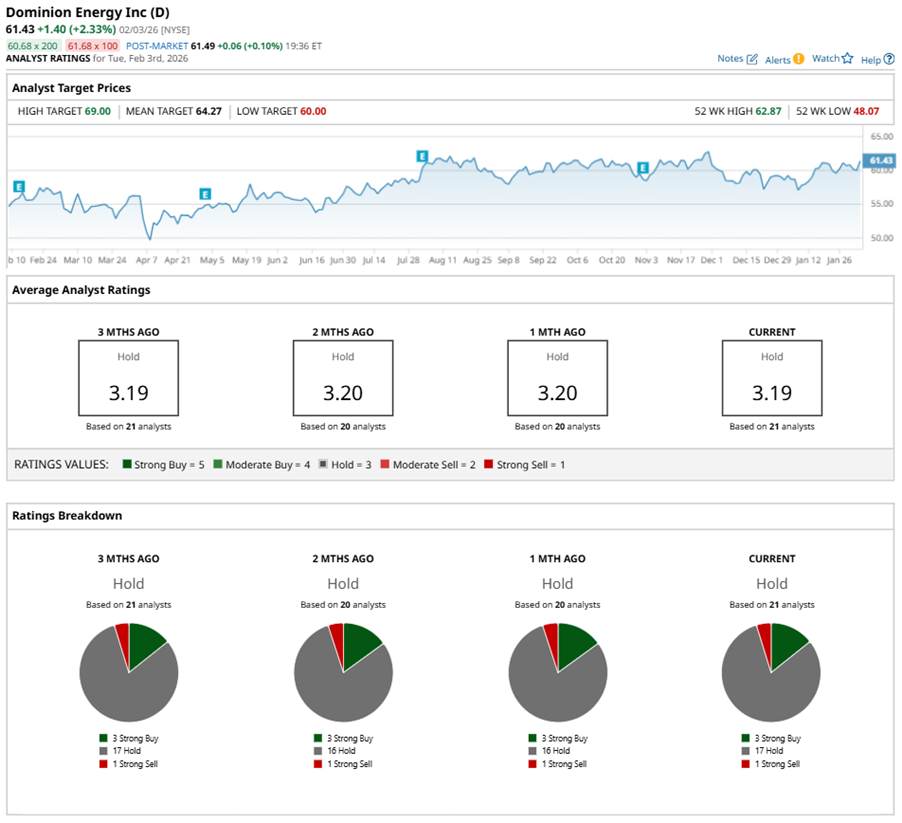

Among the 21 analysts covering D stock, the consensus is a “Hold.” That’s based on three “Strong Buy” ratings, 17 “Holds,” and one “Strong Sell.”

The configuration is relatively stable over the past three months.

On Feb. 2, Barclays PLC (BCS) analyst Nicholas Campanella maintained a “Buy” rating on D and set a price target of $63, implying a potential upside of 2.6% from current levels.

The mean price target of $64.27 represents a 4.6% premium to D’s current price levels. The Street-high price target of $69 suggests an upside potential of 12.3%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Palantir CEO Alex Karp Says ‘Inexplicable Growth in Revenue, but Not Inexplicable Growth in Customers’ Is Ahead. What Does That Mean for PLTR Stock?

- FuboTV Stock Plunges Deep Into Oversold Territory on Reverse Stock Split News. Should You Buy the Dip?

- Even More Layoffs Are Coming at Amazon. What Does That Mean for AMZN Stock?

- Dear Google Stock Fans, Mark Your Calendars for February 4