With a market cap of $189.6 billion, Abbott Laboratories (ABT) is a global healthcare company that discovers, develops, manufactures, and sells a wide range of medical products across pharmaceuticals, diagnostics, nutrition, and medical devices. It serves patients worldwide with solutions spanning disease treatment, testing and diagnostics, nutrition, cardiovascular care, diabetes management, and neuromodulation.

Shares of the Abbott Park, Illinois-based company have underperformed the broader market over the past 52 weeks. ABT stock has decreased 15.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.4%. Moreover, the stock has declined nearly 13% on a YTD basis, compared to SPX's 1.1% rise.

Looking closer, shares of the maker of infant formula, medical devices and drugs have also lagged behind the State Street Health Care Select Sector SPDR ETF's (XLV) 5.9% return over the past 52 weeks.

Abbott shares tumbled 10% on Jan. 22 after the company reported Q4 2025 revenue of $11.46 billion, missing Wall Street estimates despite adjusted EPS of $1.50 meeting expectations. Investors were concerned by weak performance in key segments, particularly Nutrition, where Q4 sales fell 8.9% reported (9.1% organic), and Diagnostics, which declined 2.5% reported, reflecting lower volumes and fading COVID-19 testing demand. The selloff was amplified by Abbott’s 2026 organic sales growth outlook of 6.5% - 7.5%, which came in below prior consensus.

For the fiscal year ending in December 2026, analysts expect ABT’s adjusted EPS to grow 10.3% year-over-year to $5.68. The company's earnings surprise history is promising. It topped or met the consensus estimates in the last four quarters.

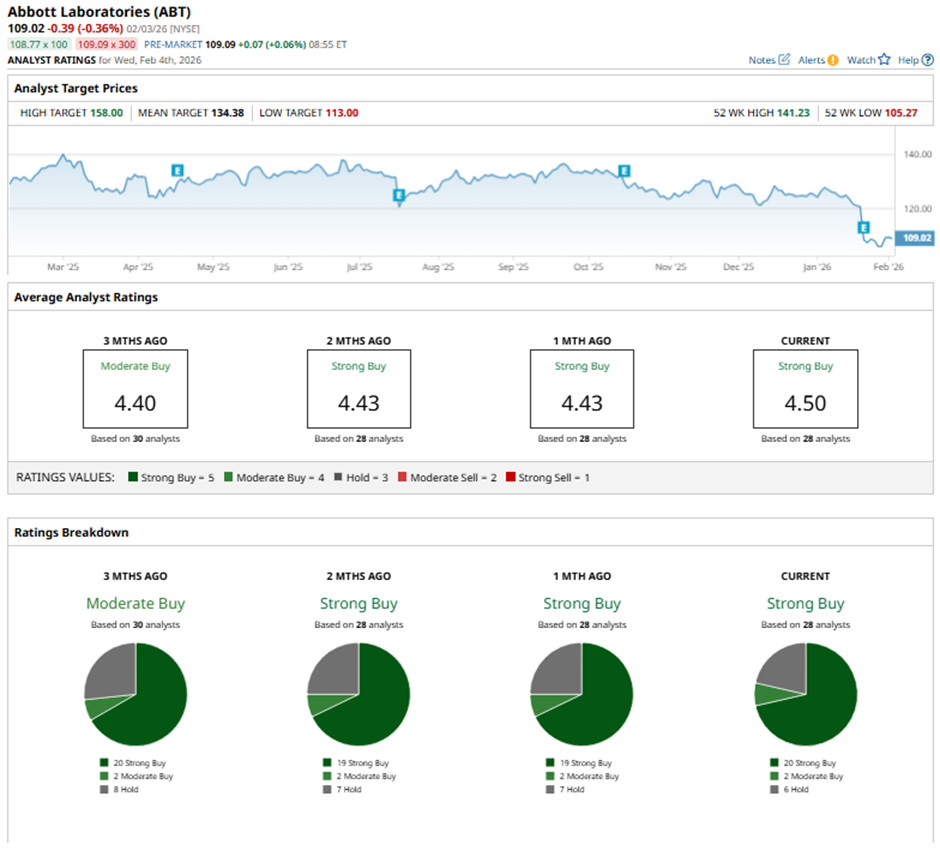

Among the 28 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 20 “Strong Buy” ratings, two “Moderate Buys,” and six “Holds.”

On Jan. 23, Wells Fargo analyst Larry Biegelsen lowered Abbott’s price target to $122 and maintained an “Overweight” rating.

The mean price target of $134.38 represents a premium of 23.3% to ABT's current price. The Street-high price target of $158 suggests a 44.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Qualcomm Stock Fans, Mark Your Calendars for February 4

- Palantir CEO Alex Karp Says ‘Inexplicable Growth in Revenue, but Not Inexplicable Growth in Customers’ Is Ahead. What Does That Mean for PLTR Stock?

- FuboTV Stock Plunges Deep Into Oversold Territory on Reverse Stock Split News. Should You Buy the Dip?

- Even More Layoffs Are Coming at Amazon. What Does That Mean for AMZN Stock?