Saint Paul, Minnesota-based 3M Company (MMM) is a diversified technology company with a market cap of $81.4 billion. It develops a wide range of products serving industrial, safety, consumer, and electronics markets.

This industrial company has underperformed the broader market over the past 52 weeks. Shares of MMM have gained marginally over this time frame, while the broader S&P 500 Index ($SPX) has surged 14.3%. Moreover, on a YTD basis, the stock is down 4.4%, compared to SPX’s 1.4% uptick.

Narrowing the focus, MMM has also lagged behind the State Street Industrial Select Sector SPDR ETF (XLI), which soared 19.5% over the past 52 weeks and 6.6% on a YTD basis.

On Jan. 20, shares of MMM plunged 7% after its Q4 earnings release, despite delivering better-than-expected results. Both its revenue of $6.1 billion and adjusted EPS of $1.83 topped analyst estimates. However, investor sentiment was weighed down by rising geopolitical tensions between the U.S. and Europe over Greenland, which contributed to a broader market pullback and pressured MMM shares.

For fiscal 2026, ending in December, analysts expect MMM’s EPS to grow 6.3% year over year to $8.57. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

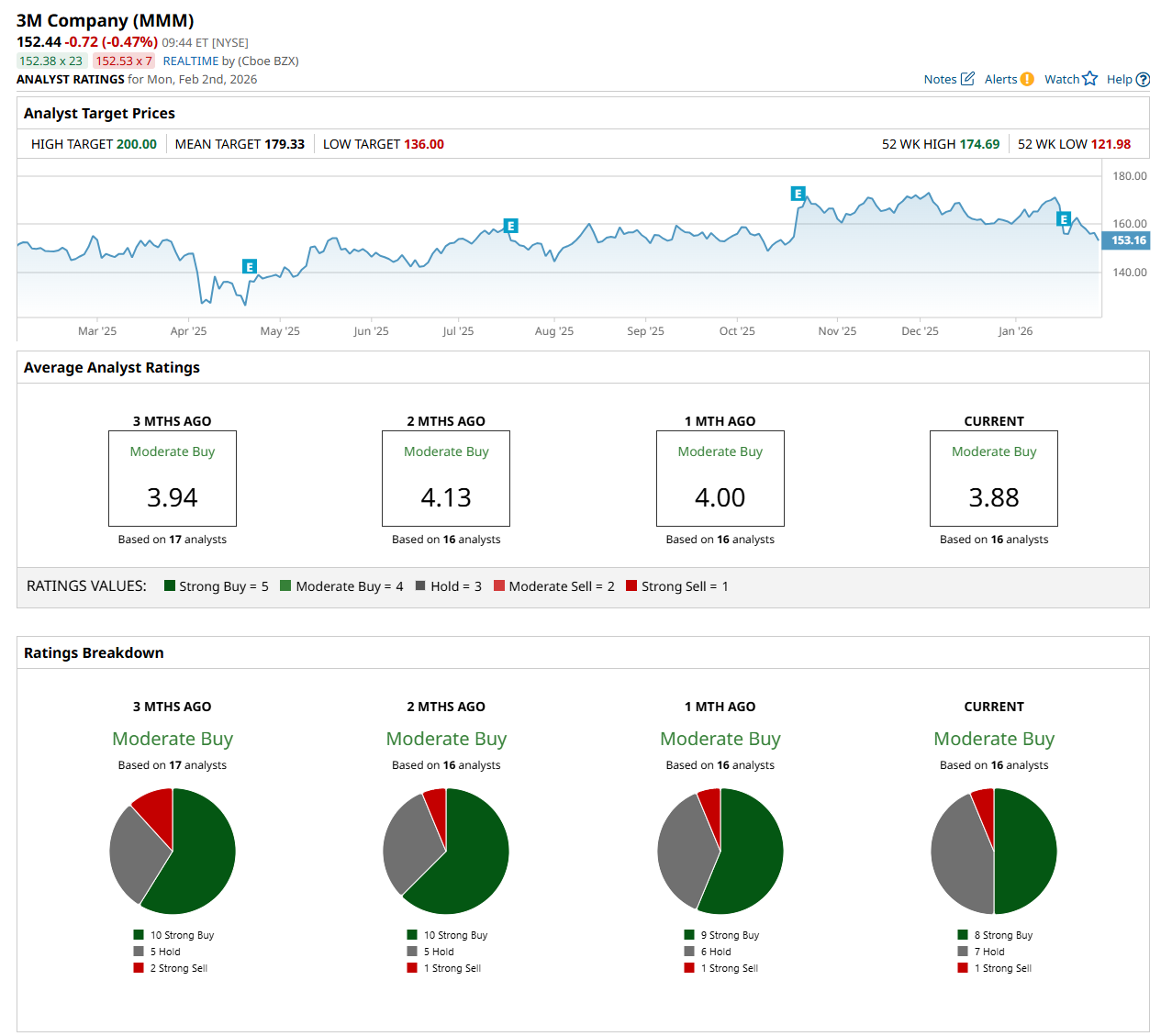

Among the 16 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy,” seven “Hold,” and one “Strong Sell” ratings.

The configuration is slightly less bullish than a month ago, with nine analysts suggesting a “Strong Buy” rating.

On Jan. 21, RBC Capital analyst Deane Dray maintained an “Underperform” rating on MMM and raised its price target to $136.

The mean price target of $179.33 represents a 17.6% premium from MMM’s current price levels, while the Street-high price target of $200 suggests a 31.2% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AMD’s Q4 Earnings Are Set To Impress: Should You Buy, Sell, Or Hold?

- ‘Solar Is Everything’: Tesla’s Elon Musk Says Other Energy Sources Are a Waste of Time, Like ‘a Caveman Throwing Some Twigs Into the Fire’

- Could Meta Platforms Stock Hit $1,000 in 2026?

- Groundhog Day Gloom? Why the Nasdaq Is Shaking Off Phil's Shadow and Facing Reality