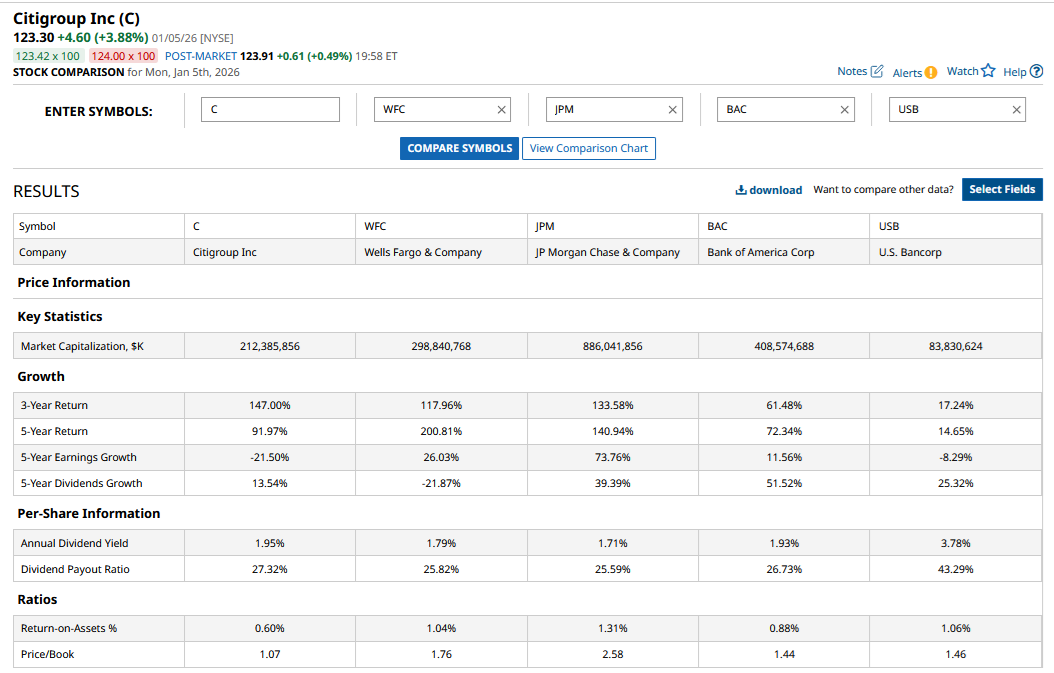

It is not often that we see high-yield dividend stocks outperforming the markets by a wide margin. However, last year, Citigroup (C), which boasted one of the highest dividend yields among its large-cap banking peers, rose 66%, which was not only significantly higher than the broader market but also higher than other banks.

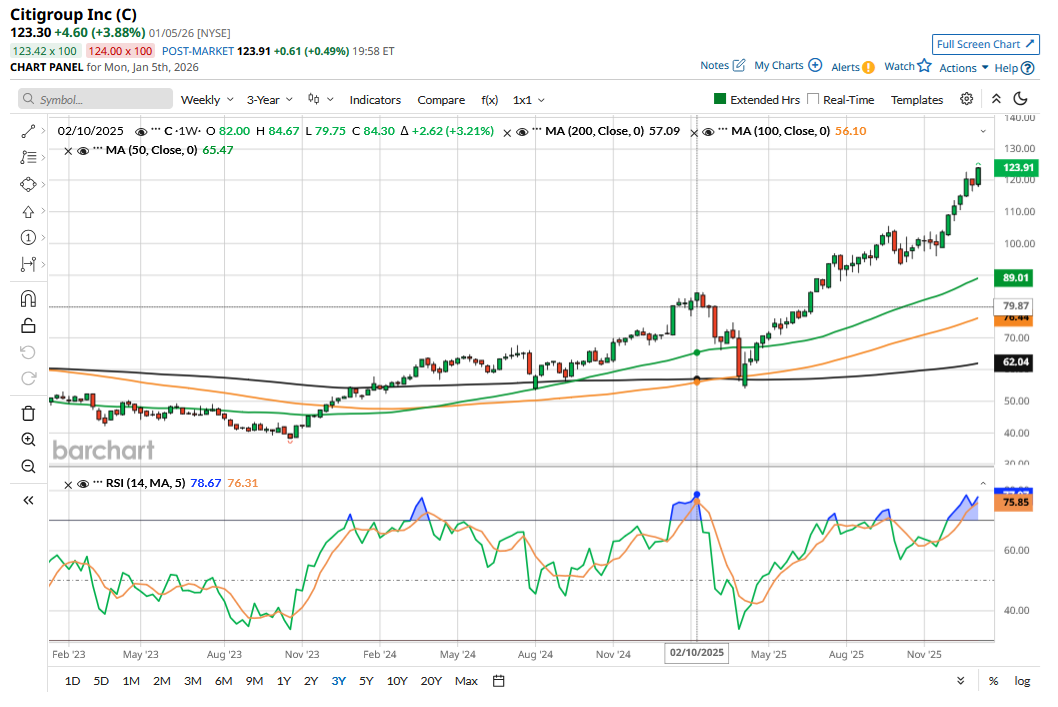

The stock has been strong in recent years and is up 150% over the last three years, which is well ahead of the KBW Bank Invesco ETF (KBWB). In my previous article, I had noted that Citi looked like a good buy despite the rally. In this one, we’ll examine whether the stock can continue its good run or if investors would be better off selling the stock.

C Stock 2026 Forecast

While Citi has a consensus rating of “Moderate Buy” from the 25 analysts tracked by Barchart, it trades above its mean target price of $117.92. The disconnect is primarily because of the recent rally in Citi shares and lagging analyst action. The sell-side community is, however, getting incrementally bullish on Citi, and last month J.P. Morgan upgraded the stock from a “Neutral” to “Overweight.”

Other brokerages have also been raising their target price. Wells Fargo analyst Mike Mayo raised his target price to a new Street high of $150, which is 21.6% higher than the Jan. 5 closing prices. Among others, Piper Sandler and Truist have raised Citi’s target price to $130 and $123 recently. More analysts should follow suit after Citi reports its Q4 2025 earnings later this month.

Citi’s Turnaround Gains Traction

As I noted previously, Citi has been a play on the turnaround. As part of the turnaround, Citi has flattened its organizational structure, reduced bureaucracy, and cut its workforce to lower its cost base. It has also exited consumer banking in several international markets, which helped free capital. The bank has consolidated into five core businesses to reduce complexity and focus its energies on key businesses.

Citi continues to make progress on the turnaround and has secured board approval to exit its remaining business in Russia. While the sale would mean an after-tax hit of $1.1 billion, J.P. Morgan sees the move as positive to Citi’s capital ratios given Russia’s higher risk weightage.

Previously, in November, Citi announced further actions in its turnaround and said that it would integrate the retail bank with the wealth business. America’s third-biggest bank by assets has also merged branded credit cards and retail services businesses into U.S. Consumer Cards, which is now one of the five core businesses.

The turnaround plan has received a thumbs-up from the market, which is reflected in Citi’s valuations. The stock, which used to trade even below its tangible book value, now trades above the book value of $108.41 that it reported at the end of September. Currently, Citi trades at a price-to-book value multiple of 1.14x (based on Q3 book value), which, while still not exorbitant, leaves little on the table for outsized gains of the kind we saw over the last two years.

Citi Might Increase Dividends

Meanwhile, over the last few quarters, Citi doubled down on share buybacks, which made perfect sense since the stock was trading below its tangible book value. With the stock now back above not only tangible book value but also total book value, I believe Citi might not be as aggressive in repurchases and instead focus on increasing shareholder payouts through dividends.

Currently, Citi pays a quarterly dividend of 60 cents per share, which implies a forward yield of 1.95%. The yield is slightly lower than Bank of America (BAC) and only a tad ahead of J.P. Morgan Chase (JPM).

From both a dividend as well as a capital appreciation perspective, I believe the Citi story has more or less played out, and returns would be muted going forward. While I don’t find Citi’s outlook as terribly bad and see it rising further from these levels, the risk-reward is quite balanced at these levels, which would put a lid on upside. I used the recent rise in Citi shares to book profits and trim my positions and would stay on the sidelines and wait for the stock to drop before adding back shares.

On the date of publication, Mohit Oberoi had a position in: C . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Dividend Stock Gained 66% Last Year. Is The 2026 Forecast as Bright?

- Worried About a K-Shaped Economy? Buy This Top Dividend ETF for 2026.

- These 2 Dividend Payers Are Some of the Best Stocks to Buy for 2026

- 'Project Catalyst' Is Coming for This High-Yield Dividend Star. Should You Buy Shares in 2026 to Profit?