The saga surrounding who will finally acquire Warner Bros. (WBD) can make an intriguing series for itself. While streaming giant Netflix (NFLX) was the first to make a formal offer to purchase the media and entertainment conglomerate's wide array of legacy assets, comprising venerable names such as Harry Potter, Game of Thrones, and Succession, among others, David Ellison-led Paramount Skydance (PSKY) emerged as the other viable contender, first with a $30/share all-cash deal and then a $32/share all-cash deal for the company.

Now, Netflix has upped the ante, making its own offer an all-cash deal, purportedly aimed at derisking the Warner Bros. shareholders from the volatility that has been seen in the Netflix stock recently and closing the deal even faster. However, a fundamental difference between the two bids of Netflix and Paramount is that while the former is only looking to purchase WBD's entertainment business (studios, premium content, IP, and streaming), Paramount has made a bid for the entire company, including its global linear networks.

About Netflix

Founded in 1997 as a DVD-by-mail business, Netflix is the world’s leading subscription video-on-demand (SVOD) platform, offering films, series, documentaries, and games across nearly every country. Its model is built on direct-to-consumer subscription, original content production, and global licensing.

Valued at a market cap of $372.8 billion, the NFLX stock has been flat over the past year. A key drag on the stock has been its bid to acquire Warner Bros., as the stock has been down by almost 13% since then. Skepticism about debt load, dilution, and integration risk has weighed down the streamer's stock.

So, does that mean the NFLX stock should be avoided now? The answer is a bit more nuanced than a definitive “Yes” or “No” and warrants a deeper dive into Netflix's fundamentals, the pros and cons of the addition of Warner to its balance sheet, and its library, while also highlighting what else the company is doing to create shareholder value.

Q4 Is Not Worrying

With an overhang of the WBD deal, it appears that Netflix cannot miss on any front, or else its shares will get whacked. Anticipating muted results after the market hours from the streamer, the company's share price nosedived by more than 5% in the pre-market and by almost a further percent in the normal trading hours. However, the results were not as bad as feared, as Netflix reported a beat on both the revenue and earnings front. Yet, the stock may open lower the next day as guidance for Q1 2026 for revenue and earnings at $12.16 billion and $0.76 per share is lower than the Street estimates of $12.19 billion and $0.81 per share.

Coming back to Q4, Netflix reported revenues of $12.05 billion (vs. a consensus estimate of $11.97 billion), which marked an annual growth rate of 17.6%. Operating margins improved to 24.5% for the quarter from 22.2% in the same quarter a year ago. Meanwhile, EPS jumped by 30.2% in the same period to $0.56 per share while also coming in slightly higher than the consensus estimate of $0.55 per share. Overall, the past two years have seen the company reporting an earnings miss on just one occasion.

Net cash from operating activities and free cash flow both witnessed increases from the previous year. In Q4 2025, Netflix's net cash from operating activities stood at $2.11 billion (+37.4% YoY), while free cash flow at $1.87 billion surged by 35.8% in the same period. Overall, the company closed the quarter with a cash balance of $9.03 billion, which was much higher than its short-term debt levels of just under a billion dollars.

Headlined by Stranger Things (120 million views), Netflix revealed that its members watched 96 billion hours of its content in the second half of the year, a YoY growth of 2%. Encouragingly, views for its originals were up 9% yearly. However, the slate for 2026 seems not to have the heft to live up to the high benchmark set by 2025, with only The Diplomat (Season 4) and Bridgerton (Season 4) having any serious hype.

Notably, even after such a sharp selloff in the stock, NFLX remains significantly overvalued. Its forward P/E, P/S, and P/CF of 34.71, 8.92, and 38.22 are all much above the sector medians of 16.04, 1.27, and 7.73, respectively. Yet, the forward PEG ratio at 1.46 is comparable to the sector median of 1.21, implying that the Street remains convinced of the growth prospects of the company.

Netflix & Chill (Or Not?)

Netflix is the number one streamer in the world, with more than 325 million subscribers on its platform. Amazon (AMZN) Prime at about 200 million and Disney+ (DIS) at about 130 million complete the podium, with Netflix clearly ahead of its peers. A strong content slate that keeps on churning out binge-worthy series, documentaries, and now sports, Netflix's presence at the pinnacle of streaming is not going anywhere soon. That is why, with the streaming world conquered, Netflix is looking for new avenues of growth by adding existing legacy content with an established brand value (read: proposed WBD acquisition), sports, and advertising.

In fact, Netflix is targeting a doubling of advertising revenue between 2025 and 2026, which would represent a major step forward in extracting value from its ad-supported tier. Live events provide another area of recurring revenue for the company, as a slew of live events on a single platform creates consumer stickiness in the form of more time spent on the platform and convenience, consequently resulting in higher lifetime value from a single consumer. At the same time, live programming is helping to curb churn rates by giving subscribers ongoing reasons to remain active. Lower churn, combined with rising ad income, creates a more resilient and profitable model overall. The market is increasingly pricing in the idea that Netflix can generate meaningfully higher revenue per user without needing substantial subscriber growth, which should drive a lasting lift in operating margins over the next several years.

Moreover, not being a slouch in AI, Netflix, in its latest quarterly results, informed that it is looking to bring a new paradigm to its advertising business by building new AI tools that will allow advertisers to create custom ads with Netflix characters. Further, the company revealed that to improve the content consumption experience of its users, Netflix is leveraging AI to “improve subtitle localization” to reach a wider audience with its content.

Thus, with operations spanning more than 190 countries, ongoing AI-driven improvements, and entry into fresh content categories, Netflix holds a formidable set of advantages. The company's sheer scale, unmatched global distribution reach, track record of original programming, and ability to personalize viewing experiences through data give it a durable competitive position in the streaming landscape.

However, stakeholders remain worried about the Warner Bros. conundrum. Although the addition of the former's bevy of popular names will further widen the gap between Netflix and the other streamers, while also putting it in a dominant position in the entertainment landscape with a presence in almost all forms of entertainment, the new all-cash offer raises the risk of Netflix turning into a heavily leveraged company.

Analyst Opinion on NFLX Stock

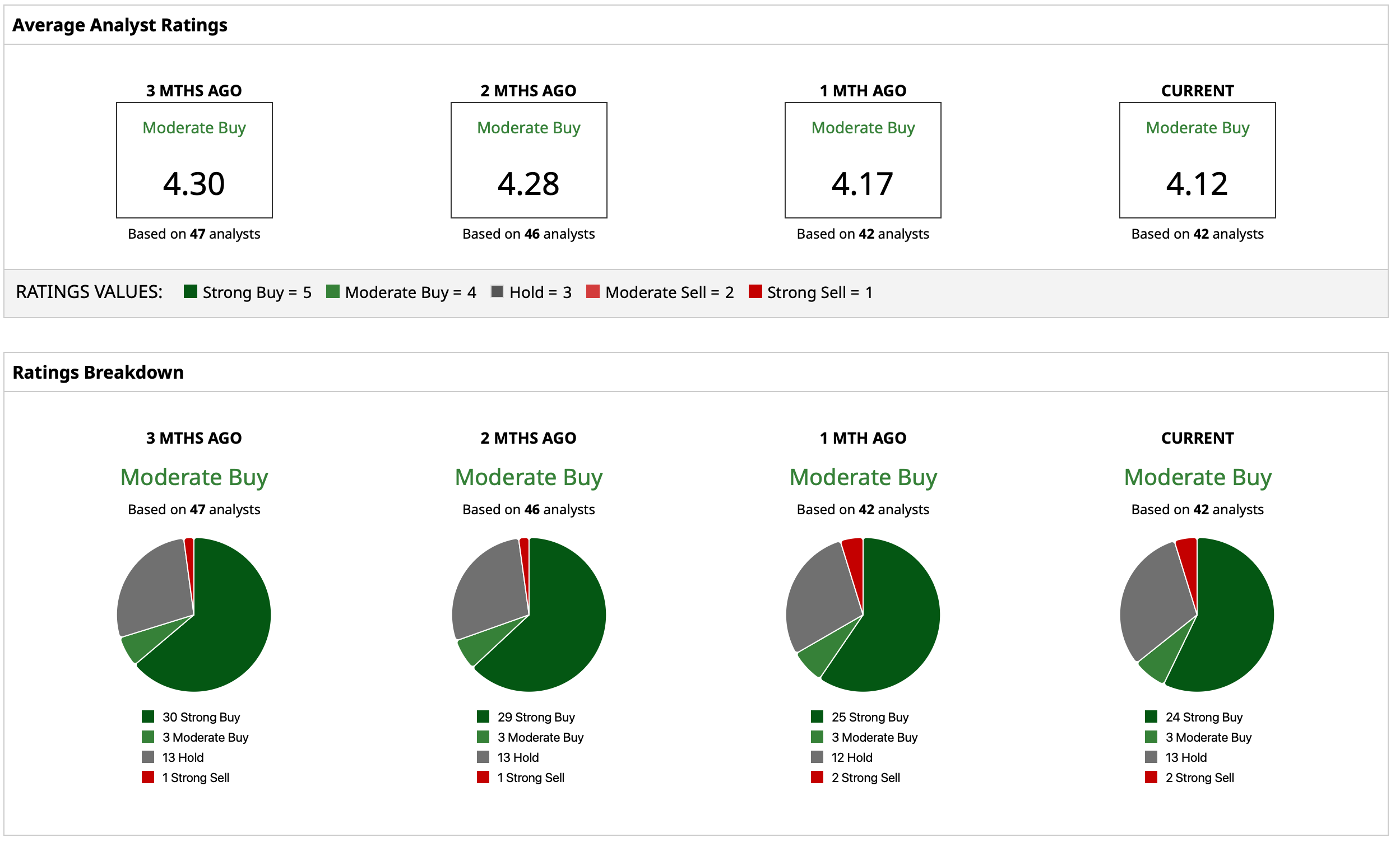

Thus, analysts remain cautiously optimistic about the NFLX stock, attributing to it a consensus rating of “Moderate Buy,” with a mean target price of $124.58. This denotes an upside potential of about 43% from current levels. Out of 42 analysts covering the stock, 24 have a “Strong Buy” rating, three have a “Moderate Buy” rating, 13 have a “Hold” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This is the Best Way to Sell Put Options for Income Without Blowing Up Your Account

- Dear IBM Stock Fans, Mark Your Calendars for January 28

- Tesla Just Revived Its Dojo3 Supercomputer. Does That Make TSLA Stock a Buy Here?

- H200 Component Production Is Halted. What That Means for Nvidia, and Should You Buy the NVDA Stock Dip Here?