Grain futures markets traders on Friday got their first major USDA economic data in well over a month and then promptly sold off to end the trading week. The agency’s monthly supply and demand report (WASDE) was not significantly bearish, it’s just that grain traders were hoping for and even had priced in a bullish report.

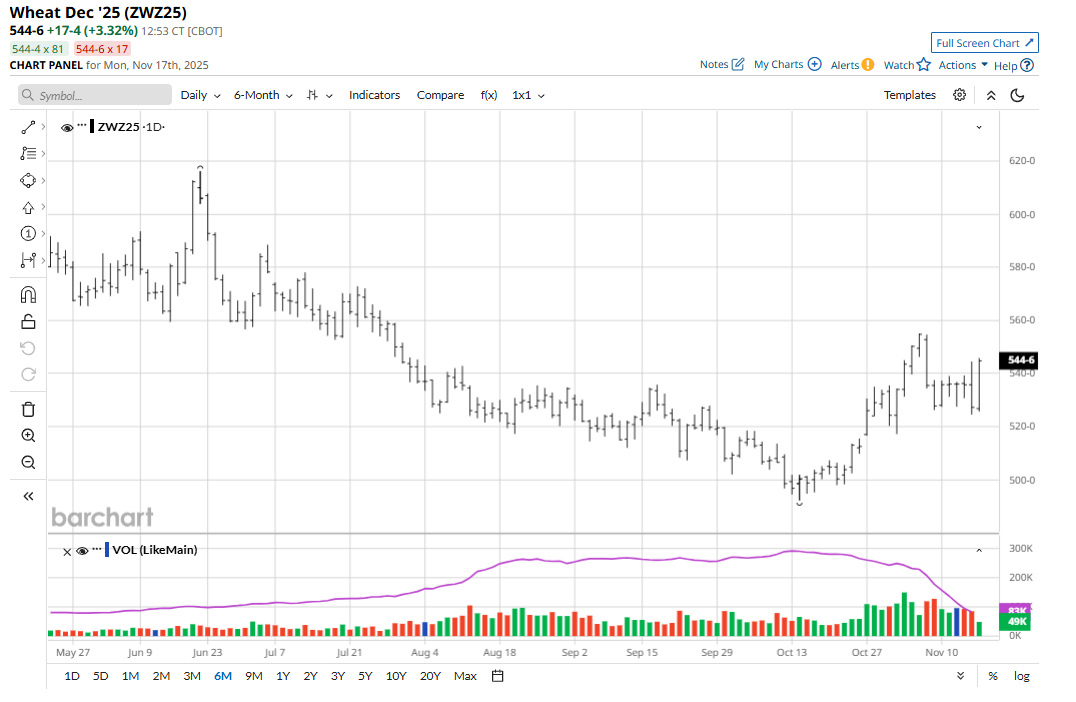

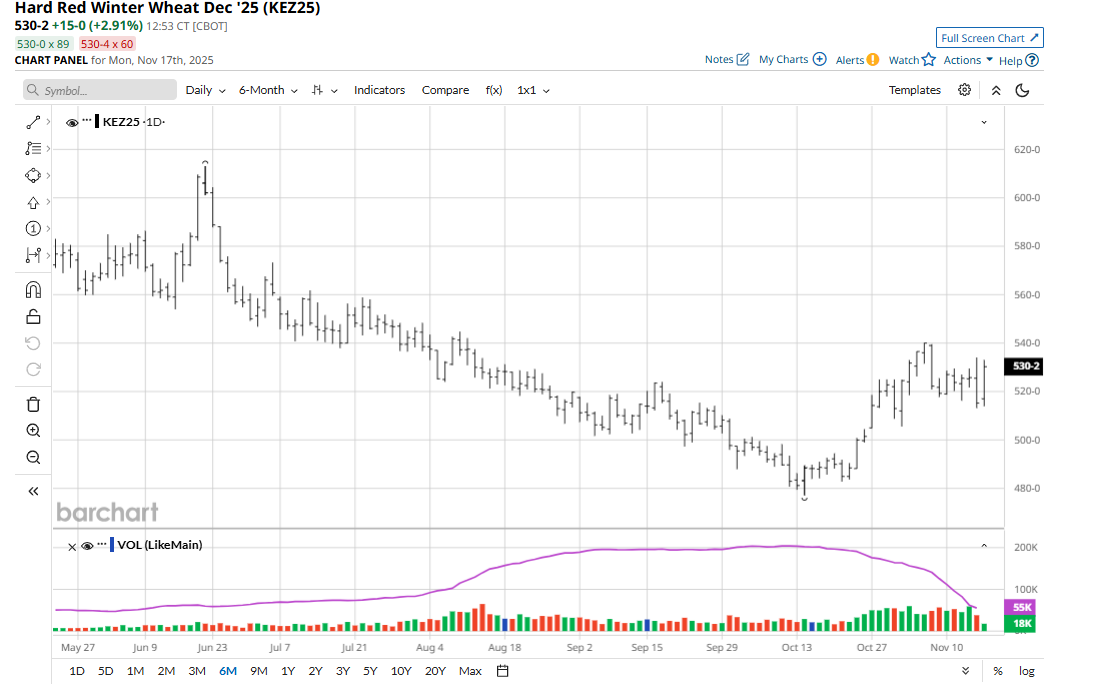

Also, given the recent rallies in corn (ZCZ25), soybean (ZSF26), and winter wheat (KEZ25) (ZWZ25) futures markets, they were due for some corrective, profit-taking pressure from shorter-term traders.

No significant near-term chart damage was inflicted with Friday’s back-slides in grain prices. However, good follow-through selling pressure early this week would likely produce near-term technical damage that would begin to suggest corn, soybeans, and winter wheat markets have put in near-term price tops. Let’s break down each market.

Corn Gains Nearly 50 Cents a Bushel Since Mid-August

December corn futures on Friday fell 11 1/4 cents to $4.30 1/4 but for the week gained 3 cents. Friday’s November USDA supply and demand report showed the agency cut its U.S. corn crop estimate 62 million bushels (bu.) from the September report. The average yield declined 0.7 bu. to 186.0 bu. per acre, though still 6.7 bu. above last year’s record. USDA matched the Sept. 30 U.S. figure for 2024-25 ending stocks and increased total U.S. supplies by 144 million bu. USDA increased U.S. corn exports by 100 million bu. to a record-breaking 3.075 billion bushels. Global corn carryover was pegged by USDA at 291.7 MMT for 2024-25, up 7.5 MMT from September; and at 281.3 MMT for 2025-26, down 60,000 MT.

The focus of corn and soybean traders is turning more to growing weather in South American corn and soybean regions. Some areas in Brazil and Argentina are already too dry. It’s not surprising in any given year to see weather markets quickly develop in the months of December through March due to South America corn and soybean crop concerns because of too-dry conditions.

Strong domestic and export demand for U.S. corn, as confirmed with Friday’s USDA data, should at least keep a floor under corn futures prices in the coming weeks and months. The resumption of USDA export sales data will be welcomed by corn traders. More trade deals being inked between the U.S. and other countries should also improve global demand for U.S. corn.

Soybeans Hit a 17-Month High Early Friday

January soybean futures on Friday fell 22 1/2 cents to $11.24 1/2 but for the week were up 7 1/2 cents. December soybean meal futures on Friday lost $5.90 to $322.50 but on the week were up $4.40.

Friday’s monthly USDA supply and demand report for November showed a reduced U.S. soybean production estimate by 48 million bu. from the previous report. The U.S. average yield declined half a bushel to 53.0 bu. per acre, though still up 2.3 bu. from last year. The agency adjusted U.S. soybean ending stocks to match the Sept. 30 figure. The cut to carry-in and modest decline in U.S. production led to a 61 million-bu. cut to total supplies. USDA cut U.S. soybean exports 50 million bu. to 1.635 million bushels.

It’s been nearly three weeks since the U.S.-China trade truce and soybean traders are still trying to figure out how much Chinese demand for U.S. soybeans will be coming in the months ahead. China officials this week danced around any specific U.S. soybean numbers they committed to buy. However, recent reports suggest China is presently flush with soybean stocks, which does not bode well for the U.S. soybean purchase amounts from China that were touted by President Donald Trump’s administration after the trade truce was announced.

Winter Wheat Bulls Need to Step Up This Week

December soft red winter wheat futures on Friday fell 8 1/2 cents to $5.27 1/4 and for the week down 1/2 cent. December hard red winter wheat lost 10 1/2 cents to $5.15 1/4 and was down 4 cents for the week. Friday’s technically bearish weekly low closes in December SRW and HRW wheat futures, including bearish “outside days” down on the daily bar charts, set the table for follow-through chart-based selling pressure early this week. Wheat bulls, especially, need to show price strength early this week, which would keep the speculative, chart-based bears at bay.

USDA in Friday’s supply and demand report estimated U.S. wheat carryover up 57 million bu. from the September report. The agency raised total U.S. wheat supplies 57 million bu. with production up. On the demand side, USDA left total use unchanged from September at 2.054 billion bu. USDA puts the 2024-25 national average on-farm cash wheat price at $5.00, down a dime from September.

Wheat traders will be closely examining weekly USDA export sales data that will resume soon, now that the U.S. government is open. Global demand for U.S. wheat will need to continue to improve in the coming months for the futures markets to sustain price uptrends. New U.S. trade deals with its world counterparts may help to improve global demand for U.S. wheat.

December Cotton Futures Hit a Contract Low Friday

December cotton (CTZ25) futures on Friday fell 41 points to 62.49 cents, hit a new contract low, and for the week were down 113 points. The cotton market’s two-week-old price downdraft and new for-the-move lows have the speculative technical traders confident, and they are likely to continue to play the short side in the near term. Part of the selling pressure in cotton Friday came amid solid losses in the grain futures markets.

Friday’s USDA monthly supply and demand report leaned price bearish. The report showed U.S. cotton production at 14.115 million bales; the trade expected 13.52 million bales and compares to 13.22 million bales in September and 14.413 million bales in 2024. U.S. cotton carryover increased by 700,000 bales from the September report. Total U.S. supplies rose 890,000 bales from September due to the larger crop. USDA raised total use 200,000 bales due to a 200,000-bale boost to exports (which now stand at 12.2 million bales). USDA puts the 2024-25 national average on-farm cash cotton price at 62 cents, down from 64 cents in September.

The general marketplace late last week heard some hawkish comments from several Federal Reserve officials that called into question whether the FOMC will make cut rates on Dec. 10. That turned the stock market wobbly, which if such continues in the coming weeks, could dent consumer confidence and demand for apparel heading into the holiday gift-buying season. That would be a bearish scenario for the cotton futures market.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.