Valued at a market cap of $140.5 billion, Stryker Corporation (SYK) is a leading medical technology company that develops innovative products and solutions across orthopaedics, medical and surgical equipment, and neurotechnology. The Portage, Michigan-based company is known for its cutting-edge implants, robotic surgical systems, advanced hospital equipment, and life-saving devices.

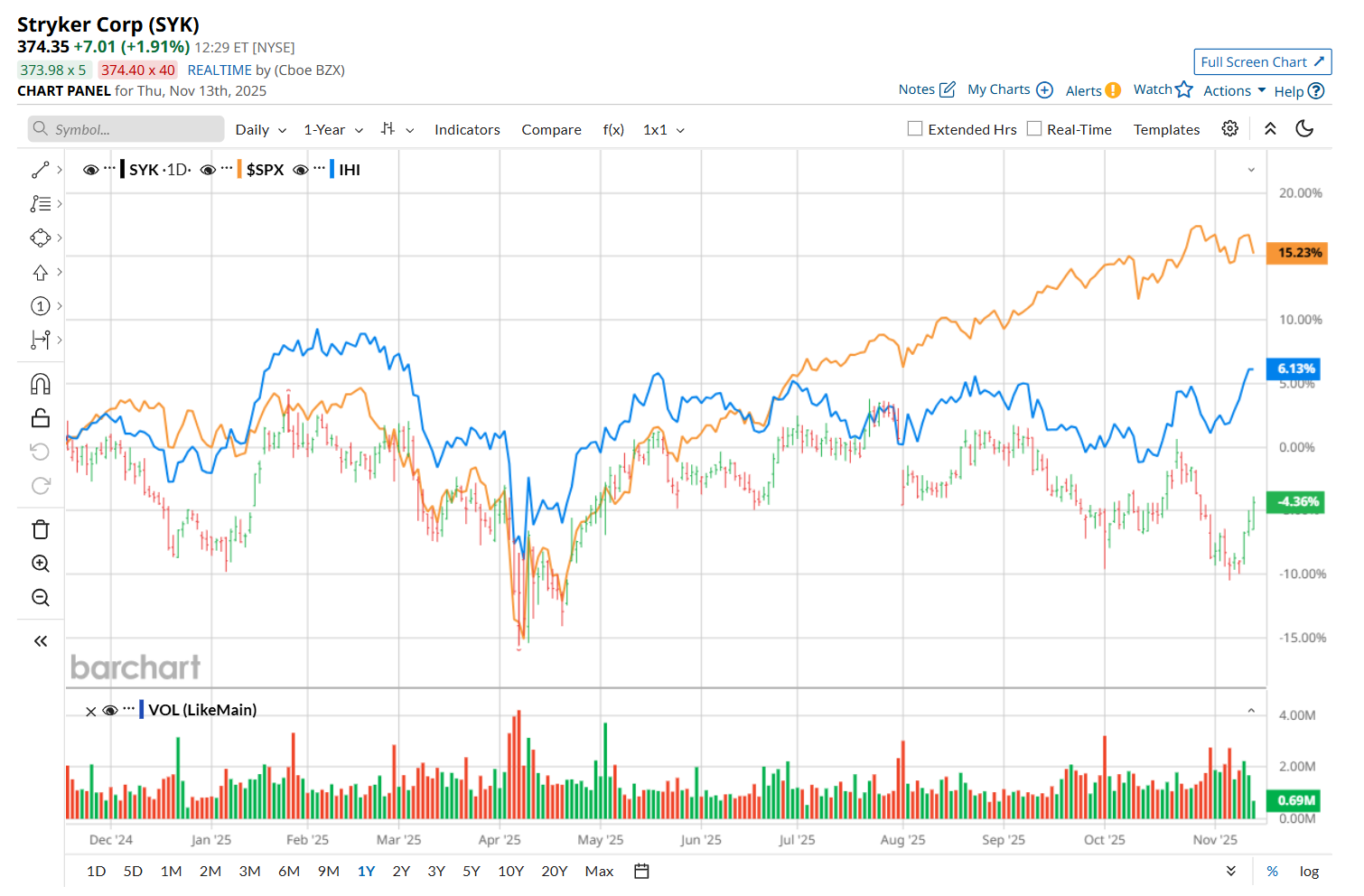

This healthcare giant has lagged behind the broader market over the past 52 weeks. Shares of SYK have declined 4.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.1%. Moreover, on a YTD basis, the stock is up 3.5%, compared to SPX’s 15.1% return.

Narrowing the focus, SYK has also underperformed the iShares U.S. Medical Devices ETF’s (IHI) 5.3% uptick over the past 52 weeks and 8.3% YTD rise.

On Oct. 30, SYK posted better-than-expected Q3 results, yet its shares plunged 3.5% in the following trading session. On the upside, the company’s overall revenue improved 10.2% year-over-year to $6.1 billion and marginally surpassed the consensus estimates. Moreover, its adjusted EPS of $3.19 grew 11.1% from the year-ago quarter, topping analyst expectations of $3.14. Additionally, SYK raised its fiscal 2025 guidance, now expecting organic net sales growth of 9.8% to 10.2% and adjusted EPS to be between $13.50 and $13.60.

However, investors appeared to focus on a decline in margins. The company's operating margin contracted to 18.7% from 19.7% recorded in the prior-year quarter, making investors jittery.

For the current fiscal year, ending in December, analysts expect SYK’s EPS to grow 11.2% year over year to $13.56. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

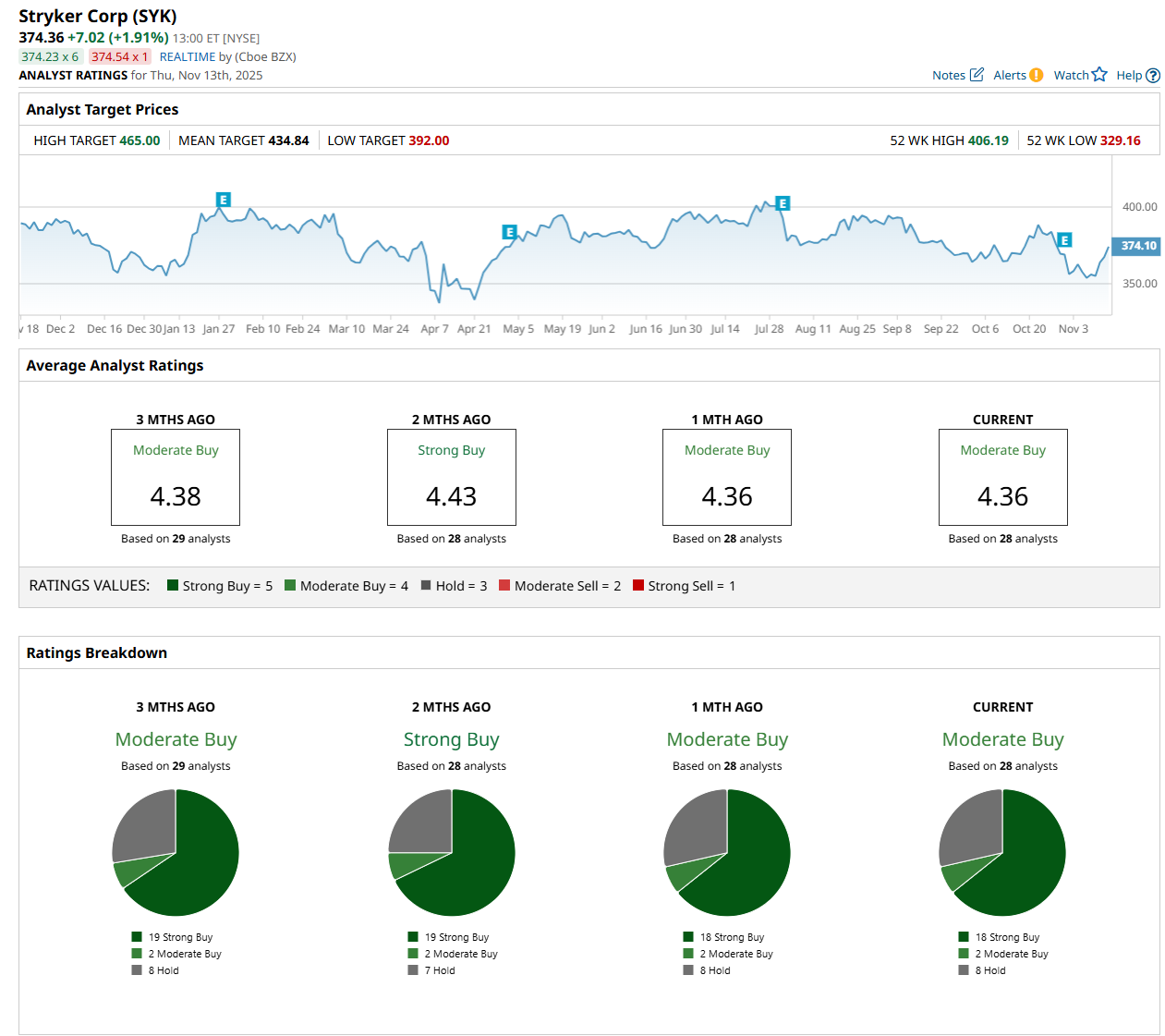

Among the 28 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 18 “Strong Buy,” two "Moderate Buy,” and eight "Hold” ratings.

This configuration is slightly less bullish than two months ago, with 19 analysts suggesting a “Strong Buy” rating.

On Nov. 10, Travis Steed from Bank of America Corporation (BAC) maintained a “Buy” rating on SYK, with a price target of $450, indicating a 20.2% potential upside from the current levels.

The mean price target of $434.84 represents a 16.2% premium from SYK’s current price levels, while the Street-high price target of $465 suggests an ambitious 24.2% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart