Suddenly, Mark Zuckerberg-led Meta Platforms (META), which owns some of the most used social media platforms in the world, such as Instagram, WhatsApp, and Facebook, is having a tough time in the markets. The latest salvo has come from Big Short investor Michael Burry.

Burry has taken up the cudgels against the hottest trade of the times: AI. While earlier taking short calls on Nvidia (NVDA) and Palantir (PLTR) was because of structural risks (ROI concerns) and elevated valuations, hyperscalers Meta and Oracle (ORCL) have been targeted by Burry for supposedly inflating profits by extending the useful life of Nvidia chips. Burry reckons that these chips have a useful life of two to three years, while companies like Meta are assigning a useful life of five to six years. Consequently, this is lowering depreciation costs and inflating profits.

Is Burry Right?

Burry is correct in the sense that AI-centric hardware, like Nvidia's chips, is already seeing newer iterations rolling out, with the last generation Hopper series being commercially available since late 2022 and the latest Blackwell chips starting to ship.

Yet, that doesn't make the earlier cadence of chips obsolete. For example, the Hopper architecture (launched in 2022) is still highly relevant and widely used in AI and data centers. Additionally, the Ampere series (before Hopper), such as the A100 and the professional RTX A5000 GPU, retains substantial value for certain applications. The RTX A5000 combines power efficiency with high memory capacity (24 GB GDDR6) and advanced RT and Tensor cores, making it suitable for complex professional workflows such as rendering, simulation, and AI training.

Meta Has Other Things to Worry About

Thus, taking a bet against Meta because it is allegedly manipulating its books is a long shot. Rather, investors were spooked by Meta's increased capex guidance, from its earlier levels of $60 billion and $65 billion for 2025 to between $70 billion and $72 billion in its latest earnings call. Following this revelation, the META stock went below the $700 level and has not recovered since, as with an uptick of just 4.6% on a year-to-date (YTD) basis, it is the worst-performing stock among the coveted “Magnificent Seven” group.

And the bad news piled on, with the company's chief AI scientist, Yann LeCun, reportedly planning to leave and launch his own startup. LeCun is renowned as a pioneering computer scientist and AI researcher, widely recognized for his foundational work in deep learning and convolutional neural networks (CNNs). He is often called one of the "Godfathers of AI," sharing the 2018 Turing Award with Geoffrey Hinton and Yoshua Bengio for their breakthroughs in deep learning. LeCun's research laid critical groundwork for many modern AI systems, especially in machine learning, computer vision, and neural network training techniques.

LeCun’s purported exit from Meta is expected to have a negative effect because he represents one of the foremost scientific leaders driving Meta's AI innovation and vision. His visionary leadership and expertise in advancing AI research, especially in creating practical and safe AI systems, are critical assets for Meta's competitive positioning in AI development.

Notably, LeCun may not have taken Alexander Wang's elevation too well, with the latter being the Chief AI Officer and Chief Architect of Meta’s newly formed Superintelligence Labs, a division created to unify and lead all AI research, product development, and infrastructure efforts at Meta. Under the new organizational structure, LeCun reported to Wang.

Meta Continues to Operate From a Position of Strength

Notwithstanding the concerns, Meta has the wherewithal to weather these storms due to the sheer ubiquity of its platforms and a strong balance sheet. With almost half the planet being users of its platforms, Meta's revenue and earnings have grown at solid CAGRs of 28.09% and 35.39%, respectively, as it remains an advertising juggernaut.

Although the earnings missed the consensus estimates in the most recent quarter, it was due to a one-time non-cash income tax charge of $15.93 billion. Taking this into account, Meta's EPS for Q3 2025 of $1.05 reflected a year-over-year (YoY) decline of 83% (without the charge, it would have been $7.25). Consequently, this also led to the company reporting its first quarterly earnings miss in the past two years.

However, normal action was restored when it came to revenues, as the company reported sales of $51.2 billion in the quarter, which denoted an annual growth of 26%. Key operational metrics for Meta Platforms reflected notable YoY gains, including daily active users reaching 3.54 billion—an 8% increase—alongside a 14% rise in advertising impressions and a 10% uplift in average ad pricing. These advances stem from the company's seamless incorporation of artificial intelligence, which has refined content curation across its applications and, in turn, elevated user interaction and session durations within the Family of Apps ecosystem. Such progress underscores the tangible returns on Meta's AI commitments, now deeply embedded across its enterprise functions, encompassing streamlined internal processes, precision-targeted advertising via AI, enhanced feed personalization, and the rollout of its dedicated AI companion.

This should allay the Metaverse fears of investors, as the efficiency and productivity gains from investing in AI are real and have the potential to generate significant growth.

Notably, Meta generated $30 billion in net cash from operating activities in Q3 2025, up from $24.7 billion in the year-ago period. Overall, Meta closed the September 2025 quarter with a cash balance of $10.2 billion, much higher than its short-term debt levels of $2.1 billion.

Analyst Opinion on META Stock

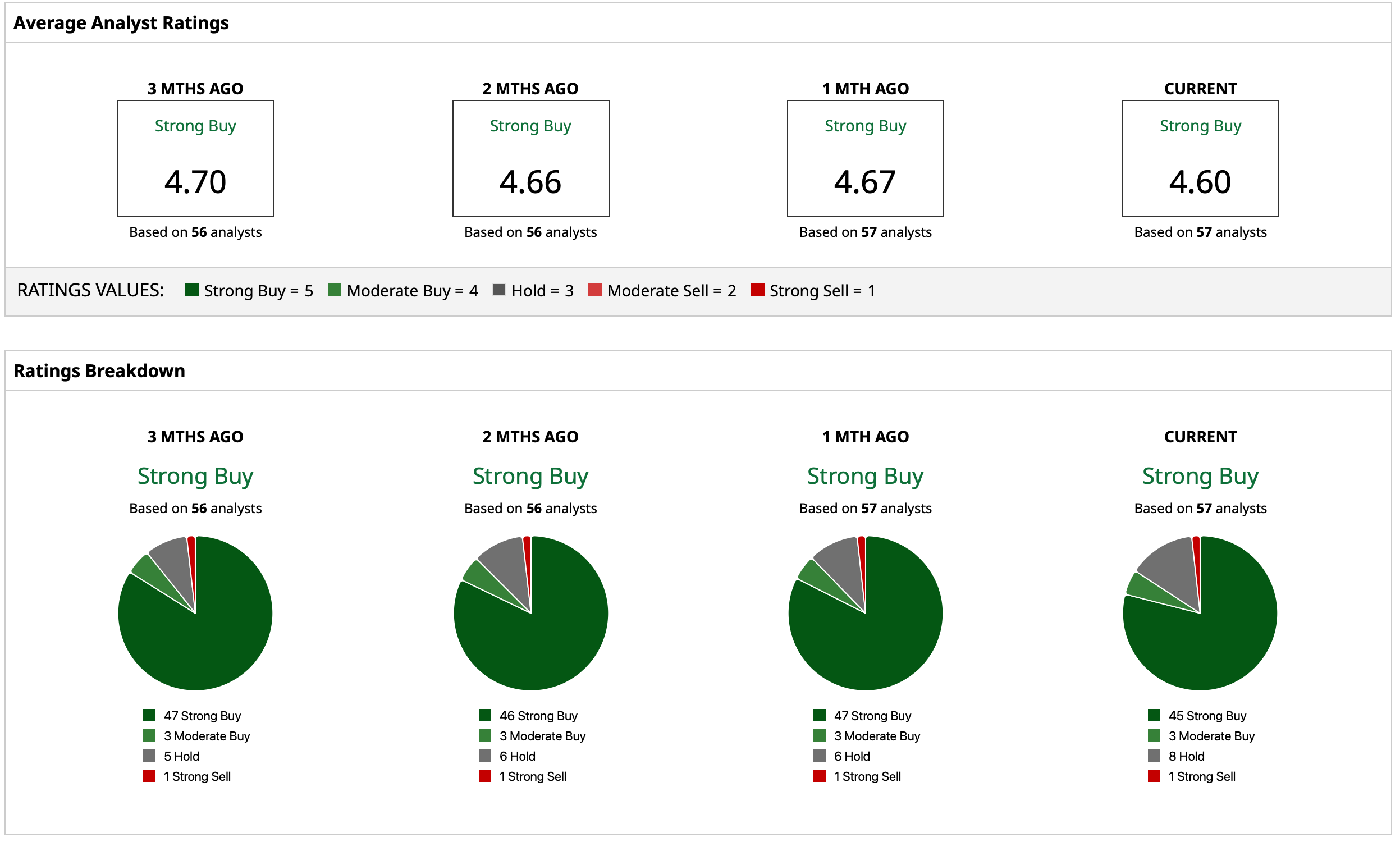

Taking all of this into account, analysts have still earmarked an overall rating of “Strong Buy” for the META stock, with a mean target price of $843.94. This represents an upside potential of about 35% from current levels. Out of 57 analysts covering the stock, 45 have a “Strong Buy” rating, three have a “Moderate Buy” rating, eight have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- CoreWeave Has a ‘Tremendous Long-Term Opportunity’ But Is Stuck in Limbo Here. Should You Buy, Sell, or Hold CRWV Stock for 2026?

- As C3.ai Explores a Sale, Should You Buy, Sell, or Hold AI Stock?

- D-Wave’s Contracts Could Be Worth ‘Millions of Dollars.’ Should You Buy QBTS Stock Now?

- Bargain Buy or Risky Bet? Bath & Body Works Slides to 52-Week Low