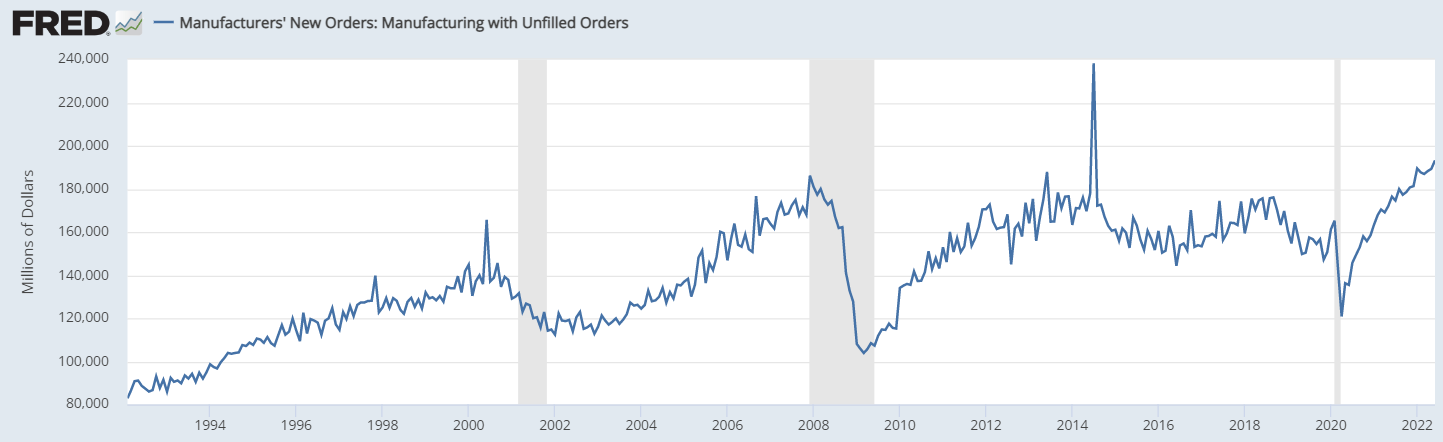

Not adjusted for inflation but not showing signs of recession:

Not adjusted for inflation but not showing signs of recession:

Saudi Arabia sets Aug crude prices to Asia at near-record high | Reuter

The official selling price (OSP) for August-loading Arab Light to Asia was raised by $2.80 a barrel from July to $9.30 a barrel over Oman/Dubai quotes, state oil producer Saudi Aramco (2222.SE) said on Monday, close to the record high premium of $9.35 per barrel hit in May.Putin and MBS discuss oil less than week after Biden visit to Saudi Arabia (axios.com)

The post Durable goods orders, oil prices, Saudi OSP’s appeared first on Mosler Economics / Modern Monetary Theory.