Andy Kierz/Business Insider

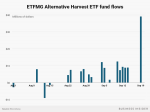

- The only marijuana ETF in the US has seen massive inflows amid the cannabis craze.

- Over the past month alone, MJ saw inflows of more than $139 million. The funds' total market value has skyrocketed nearly ten-fold since it pivoted to marijuana from real estate.

- Follow ETFMG’s Alternative Harvest ETF in real-time here.

Weed stocks have been on fire recently, and for US investors not wanting to pick a single name, there’s only one exchange-traded fund option.

ETFMG’s Alternative Harvest ETF has nearly doubled in less than a month, and investors have poured hundreds of millions of dollars into the ETF this year. The fund currently has a market value of $707.19 million — up more than 10 times from when it first switched to cannabis from Latin American real estate in December.

At the same time, the ETF has seen $139 million worth of inflows over the past month alone.

Most of the fund’s holdings are medical marijuana companies, though some of its biggest holdings — Canopy Growth, Tilray, Cronos, and Aurora Cannabis — have recreational arms which collectively make up 40% of its investments. There are also some smaller companies, especially pharmaceutical firms, that have entered the space and are also held by the fund.

According to its prospectus, the fund "tracks the performance of the exchange-listed common stock of companies across the globe, including U.S. companies, that are engaged in the legal cultivation of cannabis, or the legal production, marketing or distribution of cannabis products for medical or non-medical purpose," as well as tobacco firms and agricultural-science companies whose products may have applications for marijuana cultivation.

In the past month, some of MJ’s top holdings have soared to record highs amid the cannabis craze. Tilray recently dethroned Canopy Growth as the most-valuable pot stock after receiving the US government’s first license to export marijuana to California for a medical study. Canopy has risen 82% since the beginning of the year, thanks in part to a $4 billion investment from global beer and spirits maker Constellation Brands. Aurora, also held by MJ, soared 50% this week, after a Bloomberg report said it had been in talks with Coca-Cola.

Of course, there's a reason it's the only US-listed marijuana ETF, and most of its holdings are based in Canada: cannabis is still illegal at a federal level in the US.

"Any such change in the federal government’s enforcement of current federal laws could adversely affect the ability of the companies in which the Fund invests to possess or cultivate marijuana, including in connection with pharmaceutical research, or it could shrink the customer pool for certain of the Fund’s portfolio companies," the prospectus’ risk section says.

"Any of these outcomes would negatively affect the profitability and value of the Fund’s investments."

Shares of MJ were down about 5% Friday, corresponding to a 23% drop in Tilray’s stock price, the ETF’s top holding.

NOW WATCH: 3 surprising ways humans are still evolving

See Also: