Online auto marketplace CarGurus (NASDAQ: CARG) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 5.5% year on year to $241.1 million. Guidance for next quarter’s revenue was better than expected at $243 million at the midpoint, 1.7% above analysts’ estimates. Its GAAP profit of $0.51 per share was 3.2% below analysts’ consensus estimates.

Is now the time to buy CarGurus? Find out by accessing our full research report, it’s free.

CarGurus (CARG) Q4 CY2025 Highlights:

- Revenue: $241.1 million vs analyst estimates of $239.2 million (5.5% year-on-year growth, 0.8% beat)

- EPS (GAAP): $0.51 vs analyst expectations of $0.53 (3.2% miss)

- Adjusted EBITDA: $88.47 billion vs analyst estimates of $87.28 million (36,694% margin, significant beat)

- Revenue Guidance for Q1 CY2026 is $243 million at the midpoint, above analyst estimates of $238.9 million

- EBITDA guidance for Q1 CY2026 is $76 million at the midpoint, below analyst estimates of $78.33 million

- Operating Margin: 28.7%, up from 23.3% in the same quarter last year

- Free Cash Flow Margin: 31.7%, up from 26.8% in the previous quarter

- Paying Dealers: 34,409, up 2,399 year on year

- Market Capitalization: $2.70 billion

“2025 was a pivotal year for CarGurus as we delivered strong financial performance while expanding our products and use cases across both dealer workflows and the consumer journey,” said Jason Trevisan, Chief Executive Officer at CarGurus.

Company Overview

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ: CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

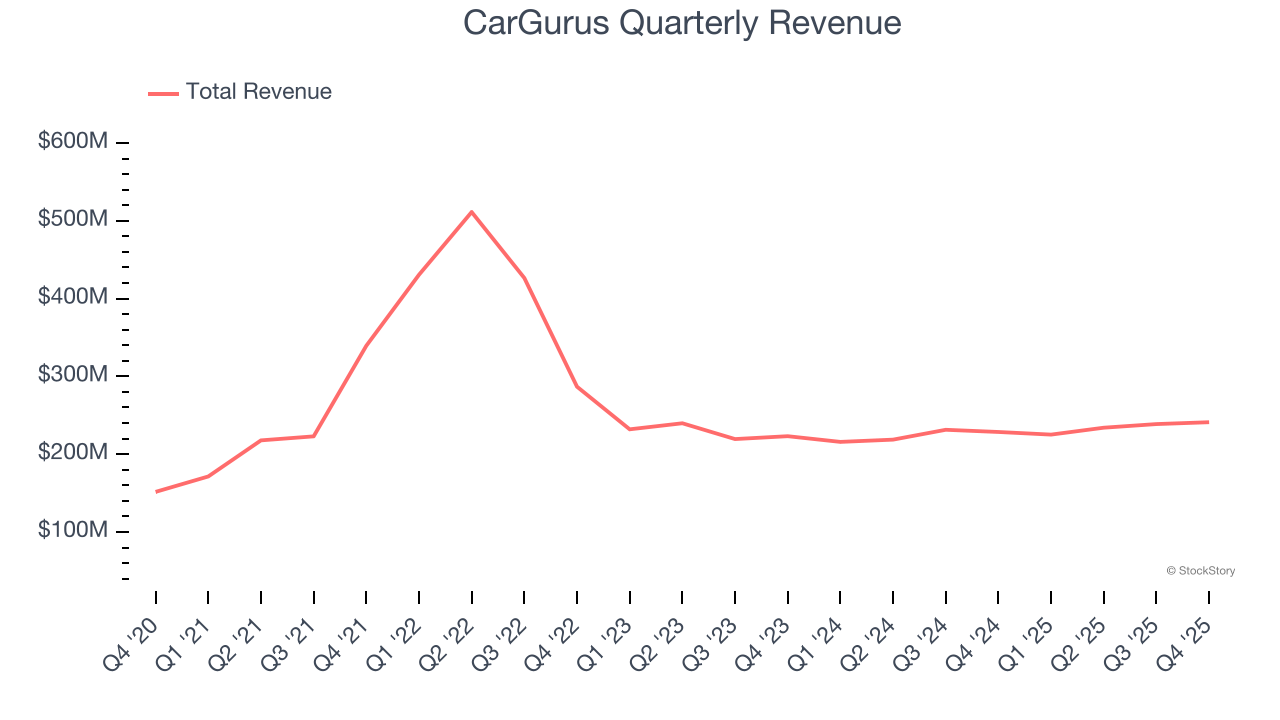

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. CarGurus’s demand was weak over the last three years as its sales fell at a 17.2% annual rate. This wasn’t a great result, but there are still things to like about CarGurus.

This quarter, CarGurus reported year-on-year revenue growth of 5.5%, and its $241.1 million of revenue exceeded Wall Street’s estimates by 0.8%. Company management is currently guiding for a 7.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

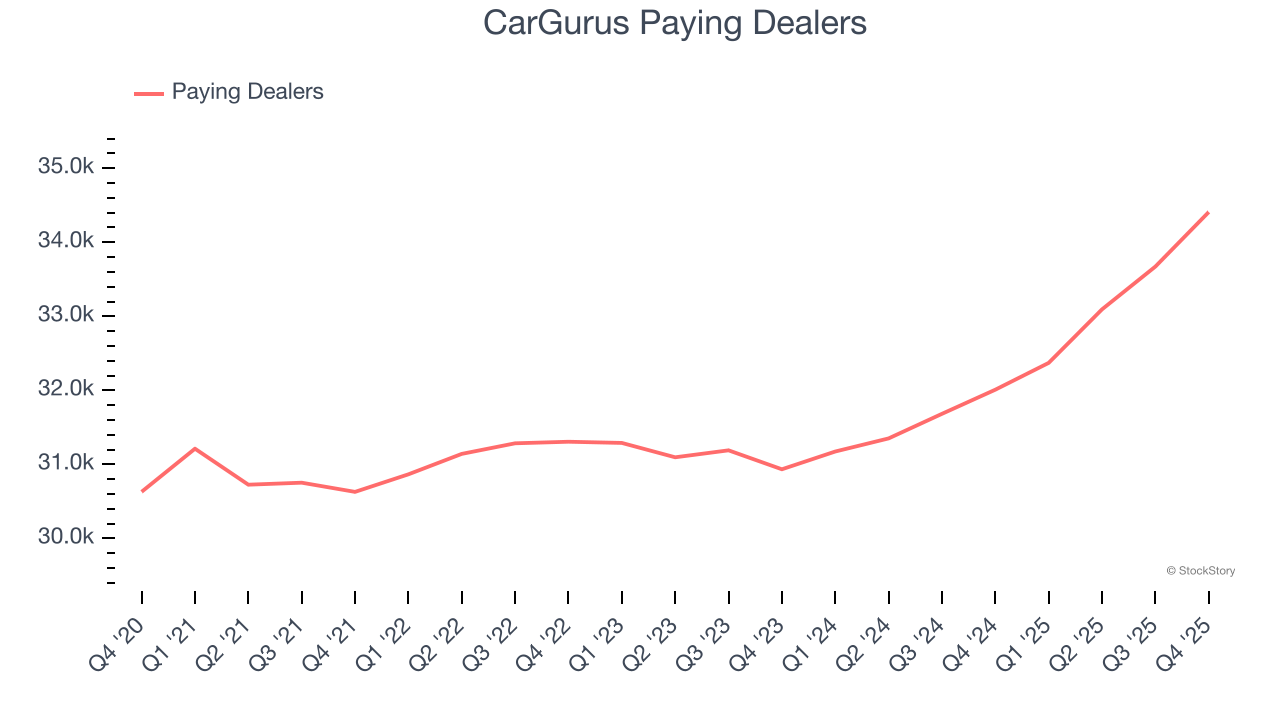

Paying Dealers

User Growth

As an online marketplace, CarGurus generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, CarGurus’s paying dealers, a key performance metric for the company, increased by 3.6% annually to 34,409 in the latest quarter. This growth rate lags behind the hottest consumer internet applications. If CarGurus wants to accelerate growth, it likely needs to engage users more effectively with its existing offerings or innovate with new products.

In Q4, CarGurus added 2,399 paying dealers, leading to 7.5% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

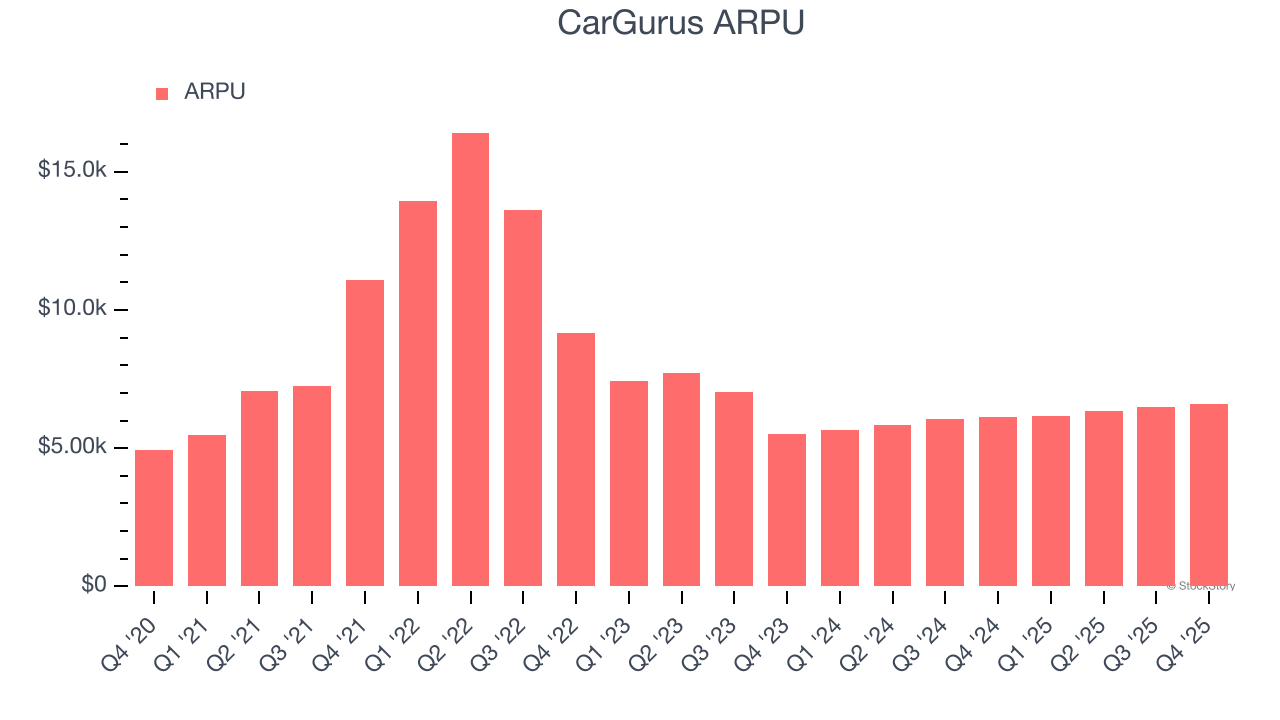

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and CarGurus’s take rate, or "cut", on each order.

CarGurus’s ARPU fell over the last two years, averaging 2.2% annual declines. This isn’t great when combined with its weaker paying dealers performance. If CarGurus tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether user growth would be sustainable.

This quarter, CarGurus’s ARPU clocked in at $6,616. It grew by 7.7% year on year, mirroring the performance of its paying dealers.

Key Takeaways from CarGurus’s Q4 Results

We were impressed by how significantly CarGurus blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 1.9% to $27.90 immediately after reporting.

Big picture, is CarGurus a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).