Electric vehicle pioneer Tesla (NASDAQ: TSLA) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 3.1% year on year to $24.9 billion. Its non-GAAP profit of $0.50 per share was 10.8% above analysts’ consensus estimates.

Is now the time to buy Tesla? Find out by accessing our full research report, it’s free.

Tesla (TSLA) Q4 CY2025 Highlights:

- Vehicles Delivered: 418,227 vs analyst estimates of 428,536 (2.4% miss)

- Revenue: $24.9 billion vs analyst estimates of $25.12 billion (0.9% miss)

- Operating Profit (GAAP): $1.41 billion vs analyst estimates of $1.29 billion (8.8% beat)

- EPS (non-GAAP): $0.50 vs analyst estimates of $0.45 (10.8% beat)

- Automotive Revenue: $17.69 billion vs analyst estimates of $17.92 billion (1.3% miss)

- Energy Revenue: $3.84 billion vs analyst estimates of $3.86 billion (small miss)

- Services Revenue: $3.37 billion vs analyst estimates of $3.38 billion (small miss)

- Gross Margin: 20.1%, up from 16.3% in the same quarter last year

- Operating Margin: 5.7%, in line with the same quarter last year

- Free Cash Flow Margin: 5.7%, down from 7.9% in the same quarter last year

- Market Capitalization: $1.43 trillion

Revenue Growth

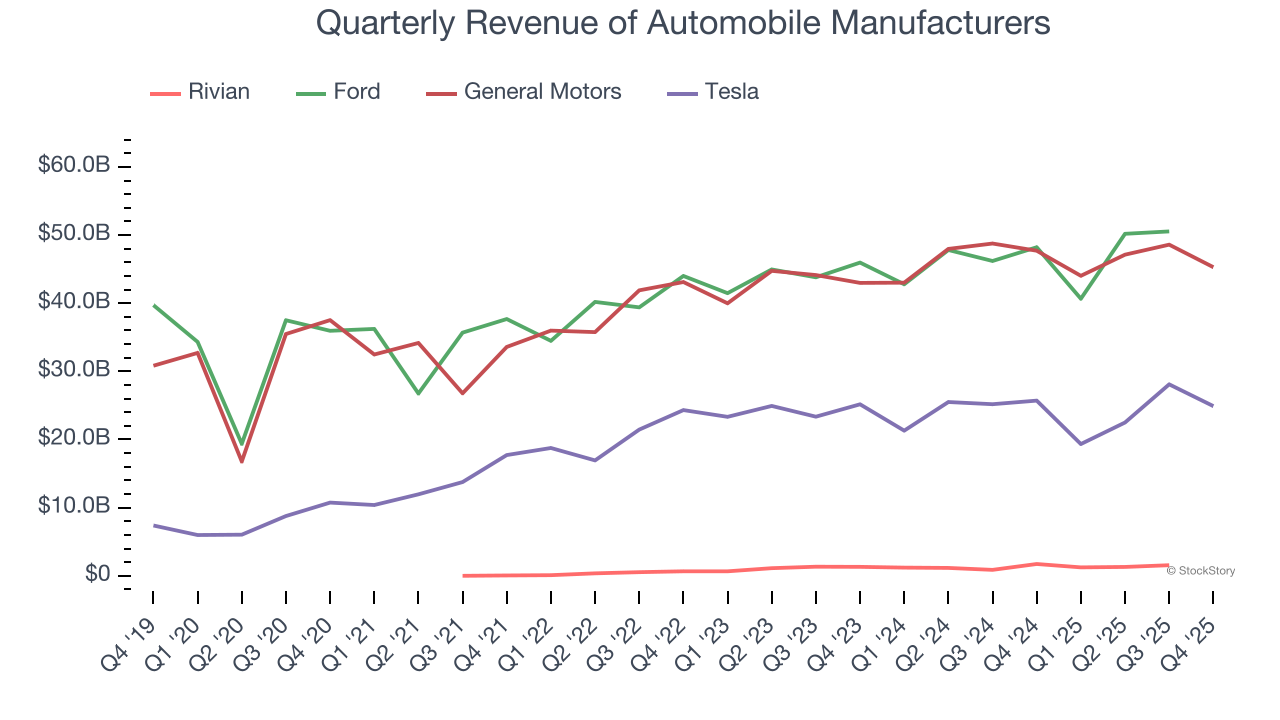

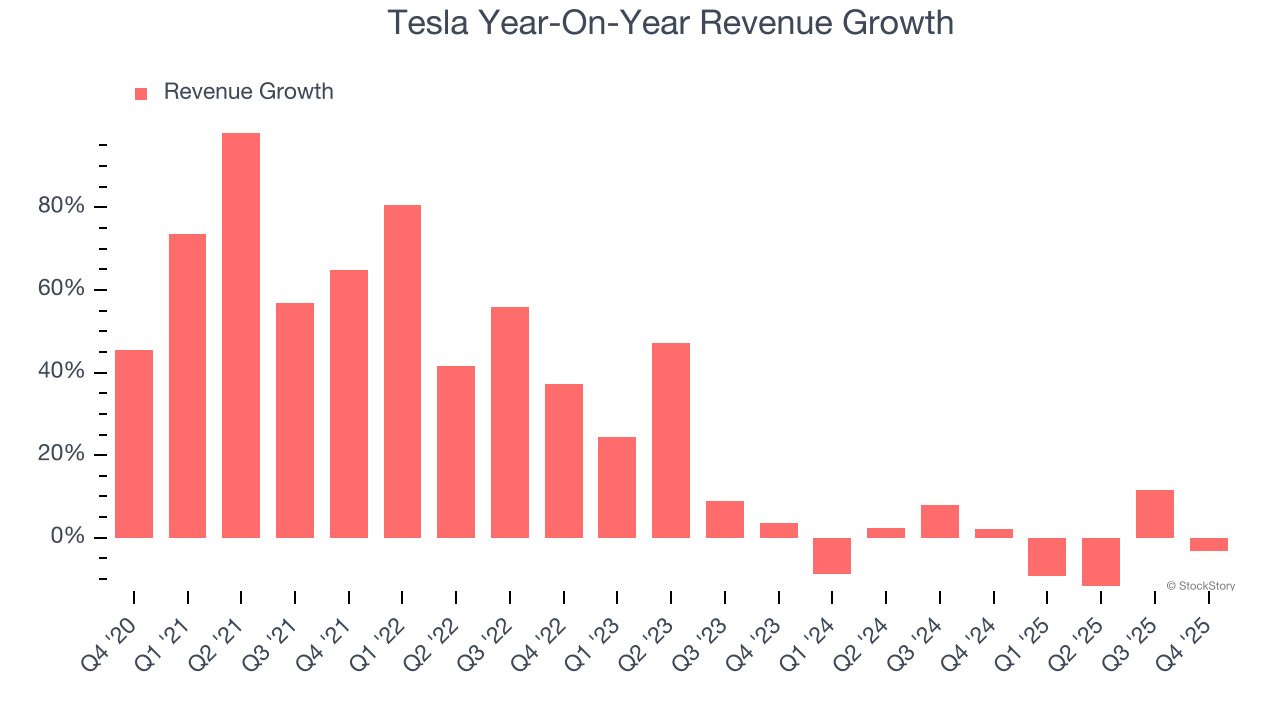

Tesla shows that fast growth and massive scale can coexist despite conventional wisdom. The company’s revenue base of $31.54 billion five years ago has tripled to $94.83 billion in the last year, translating into an incredible 24.6% annualized growth rate.

Over the same period, Tesla’s automotive peers Rivian, General Motors, and Ford put up annualized growth rates of 76.9%, 8.6%, and 9.2%, respectively. Just note that while Rivian has the most similar vehicles to Tesla, comparisons aren’t exactly apples-to-apples because it’s growing from a much smaller revenue base.

We at StockStory emphasize long-term growth, but for disruptive companies like Tesla, a half-decade historical view may miss emerging trends in autonomous vehicles and energy. Tesla’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1% over the last two years.

This quarter, Tesla missed Wall Street’s estimates and reported a rather uninspiring 3.1% year-on-year revenue decline, generating $24.9 billion of revenue. Looking ahead, sell-side This projection is admirable for a company of its scale and illustrates the market is baking in success for its newer products.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Automotive: Act One

Revenue: The Race For Dominance

Tesla is primarily an automobile manufacturer today and generates 73.3% of its revenue through the sale and leasing of EVs. It historically produced expensive, high-end EVs, but after years of operating losses, has shifted its focus to the mass market with affordable vehicles. The Model 3 and Model Y (released in 2017 and 2019) are the headliners of this story, and we’ll dive into their impacts below.

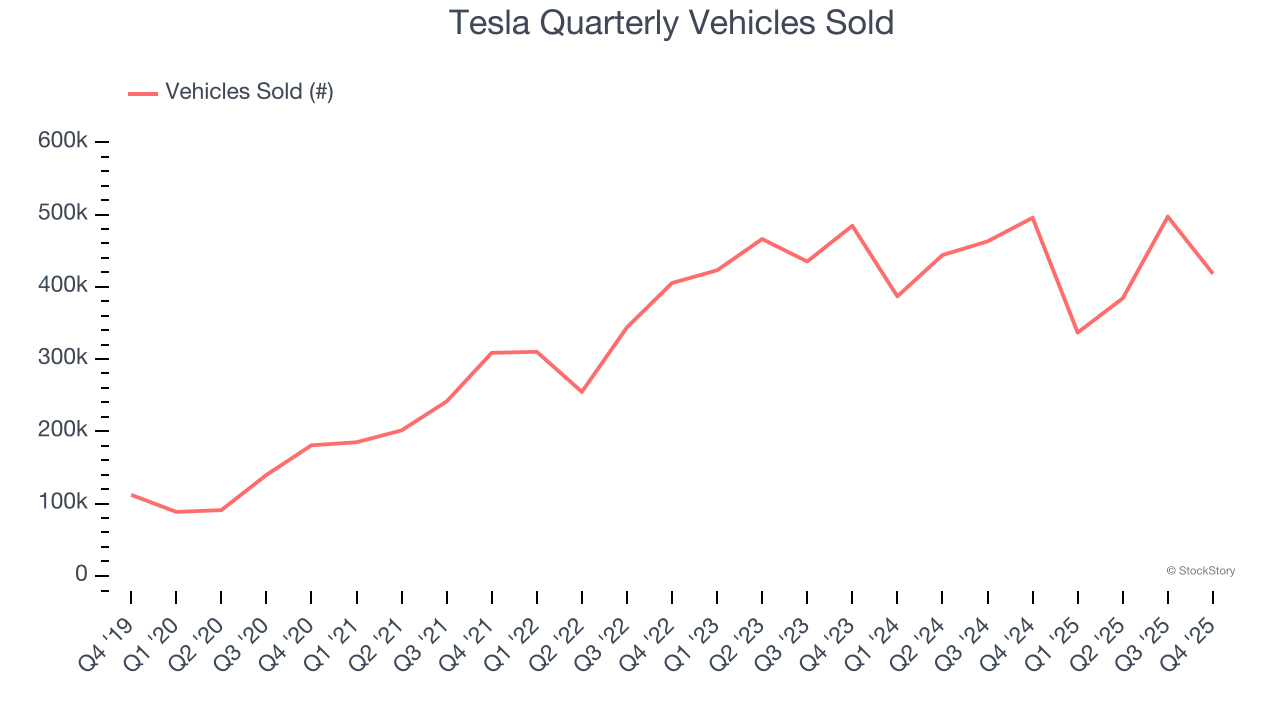

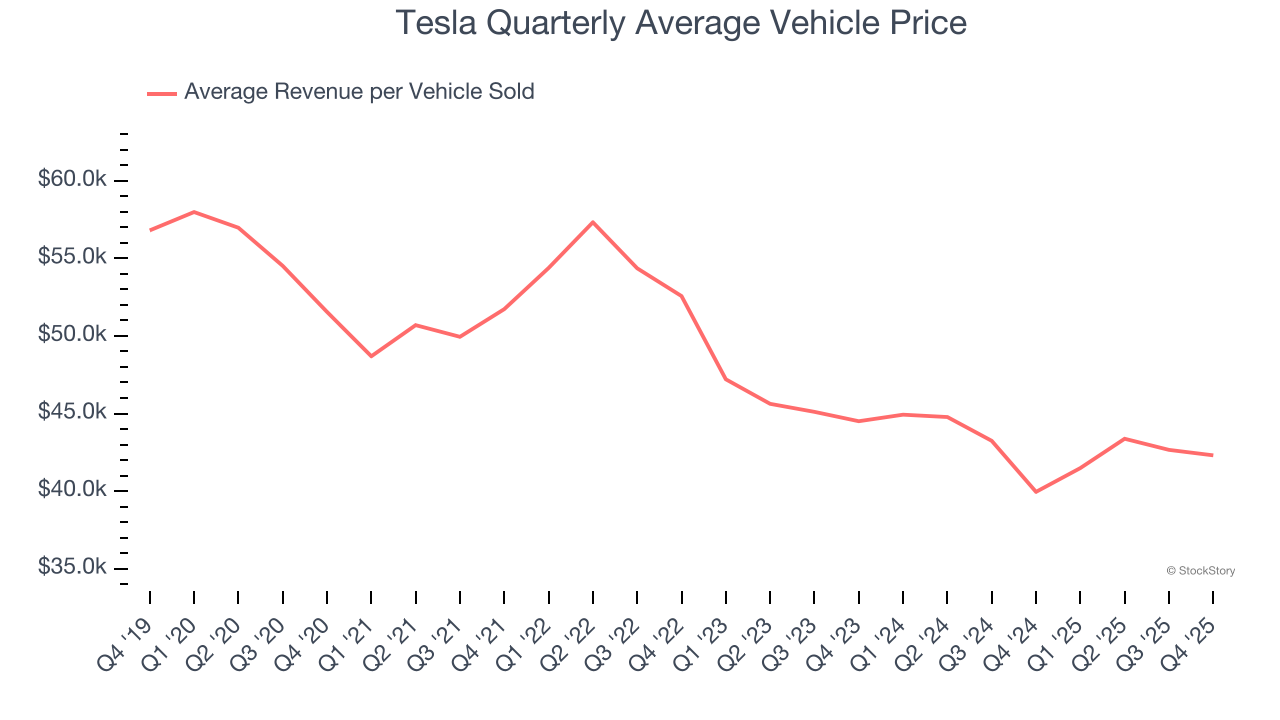

Over the last five years, Tesla’s vehicles sold grew by 26.8% annually to 1.64 million units in the last year. This is above the its 20.6% annualized growth rate for Automotive revenue, implying that its average vehicle price fell.

Specifically, Tesla's average revenue per vehicle sold was $42,494 for the trailing 12 months, noticeably lower than the $54,510 price tag in 2020.

These unit and pricing trends uncover three facets of the company’s automotive business:

1) It has achieved its goal of selling more Model 3 and Model Y vehicles, which carry lower price tags than other models, 2) the scaling production of its mass-market models is boosting manufacturing efficiency because it lowers the fixed cost per vehicle sold, and 3) rather than increasing profitability by reaping the cost-saving benefits, Tesla is passing them to customers through price reductions.

In Q4, Tesla’s vehicles sold shrank by 15.6% year on year to 418,227 units and missed Wall Street’s expectations. Putting this print side-by-side with its 10.6% Automotive revenue decline suggests an average vehicle price of $42,305, up from $39,950 in the same quarter last year.

Unit Economics: The Impact Of Price Cuts

There’s no denying automobile manufacturing is a tough business. Few upstarts succeed because incumbents like General Motors and Ford can afford to break even on the initial sale of vehicles and instead make money on parts and servicing, which come many years down the line.

Tesla does not disclose the operating profitability of its segments, but we can analyze the gross margins of its various divisions to see how it stacks up. For Automotive, this metric reflects how much revenue is left after paying for the raw materials, components, and direct labor costs that go into manufacturing and producing its vehicles.

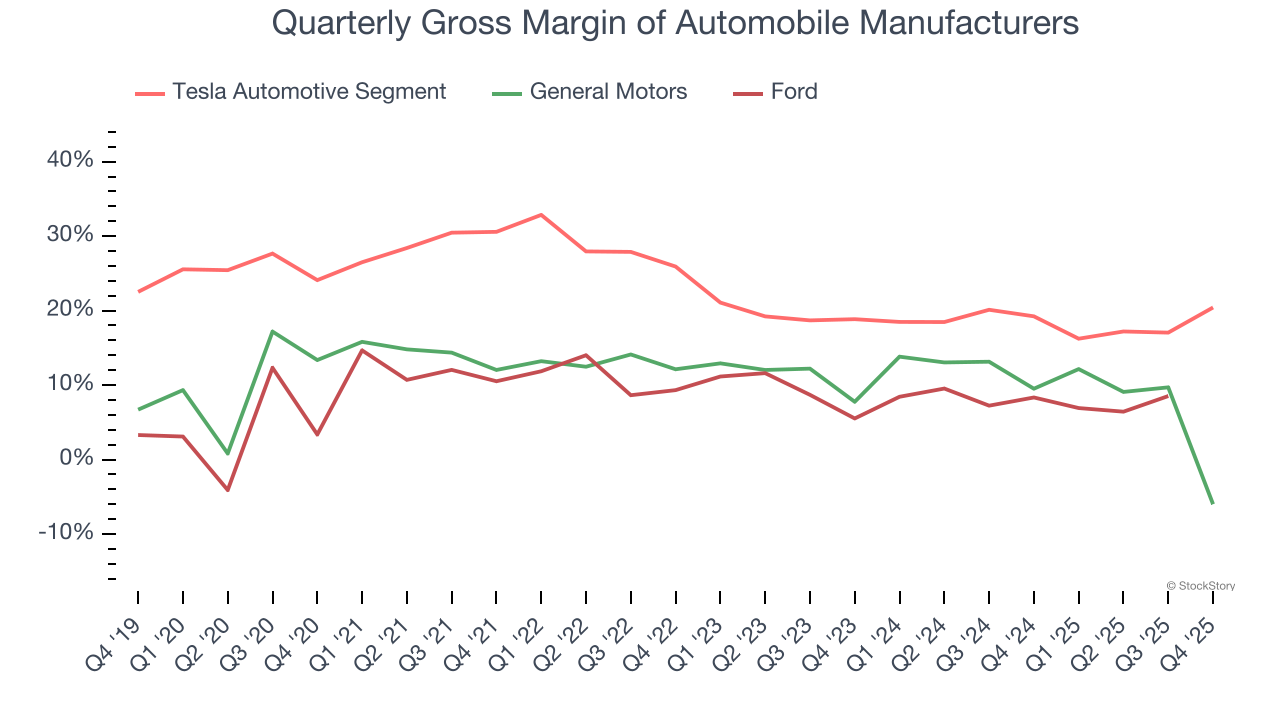

Thankfully for investors, Tesla has crossed the chasm as its Automotive segment boasted an average gross margin of 22.2% over the last five years. While it may be low in absolute terms, Tesla’s margin was best in class for the industry and illustrates its superior pricing power and procurement capabilities. Its breathing room also explains why the company can squeeze its competitors by slashing prices.

Looking under the hood, Automotive’s annual gross margin fell from 25.6% five years ago to 17.8% in the last year. This is a direct result of its price cuts and shows the company is sacrificing higher profits today to increase its installed base and potentially secure longer-term recurring revenue streams. The trend improved this quarter as its gross margin rose to 20.4%, but we wouldn’t put too much weight on short-term results.

Key Takeaways from Tesla’s Q4 Results

We enjoyed seeing Tesla beat analysts’ operating income expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed and its revenue fell short of Wall Street’s estimates, as Automotive missed while Services and Energy was in line. Overall, this quarter was mixed. The stock traded up 2% to $439.12 immediately after reporting.

Is Tesla an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).