Stewart Information Services currently trades at $73.98 per share and has shown little upside over the past six months, posting a middling return of 4.6%. The stock also fell short of the S&P 500’s 11.3% gain during that period.

Is there a buying opportunity in Stewart Information Services, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Stewart Information Services Not Exciting?

We're sitting this one out for now. Here are three reasons there are better opportunities than STC and a stock we'd rather own.

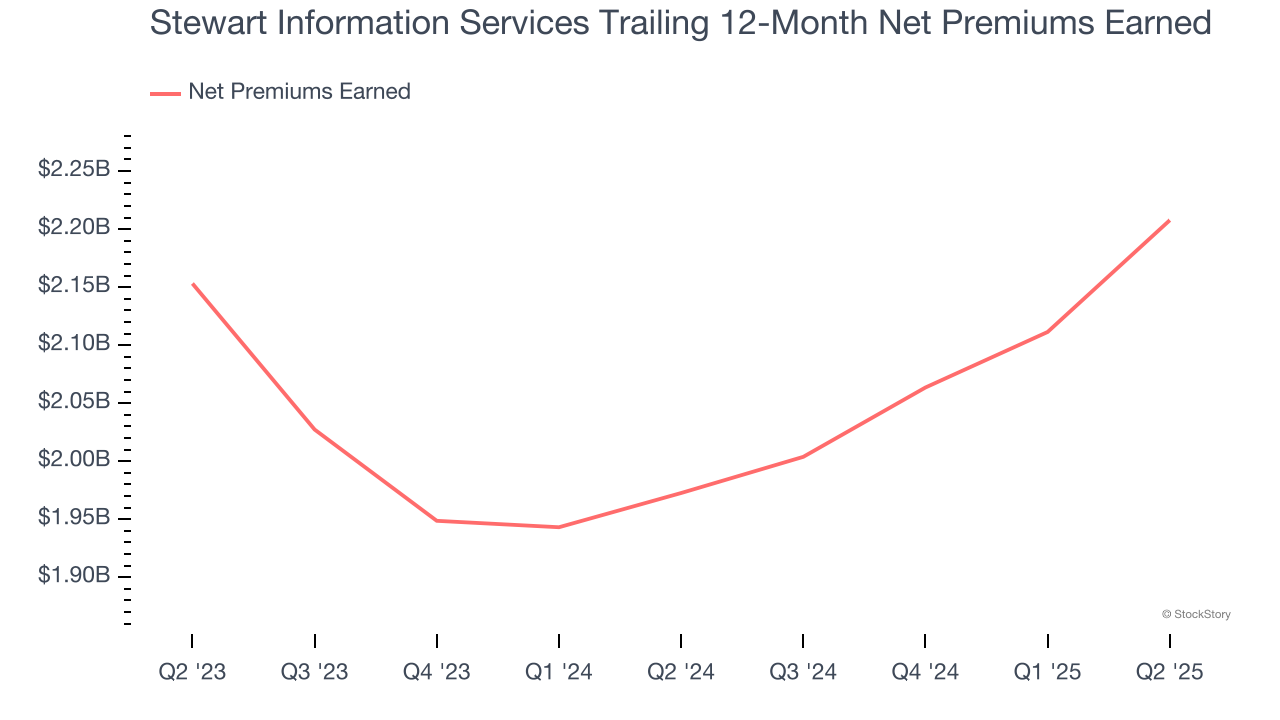

1. Net Premiums Earned Point to Soft Demand

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

Stewart Information Services’s net premiums earned has grown at a 1.3% annualized rate over the last two years, much worse than the broader insurance industry and slower than its total revenue.

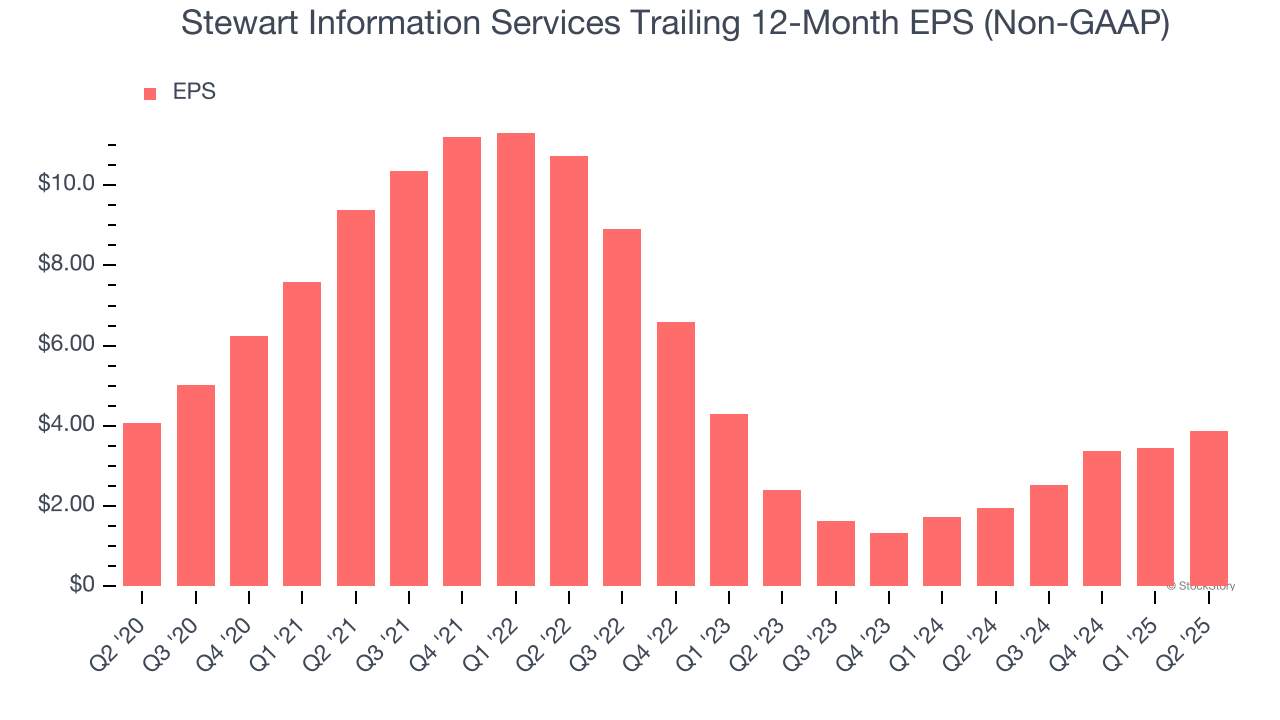

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Stewart Information Services, its EPS declined by 1% annually over the last five years while its revenue grew by 6.9%. This tells us the company became less profitable on a per-share basis as it expanded.

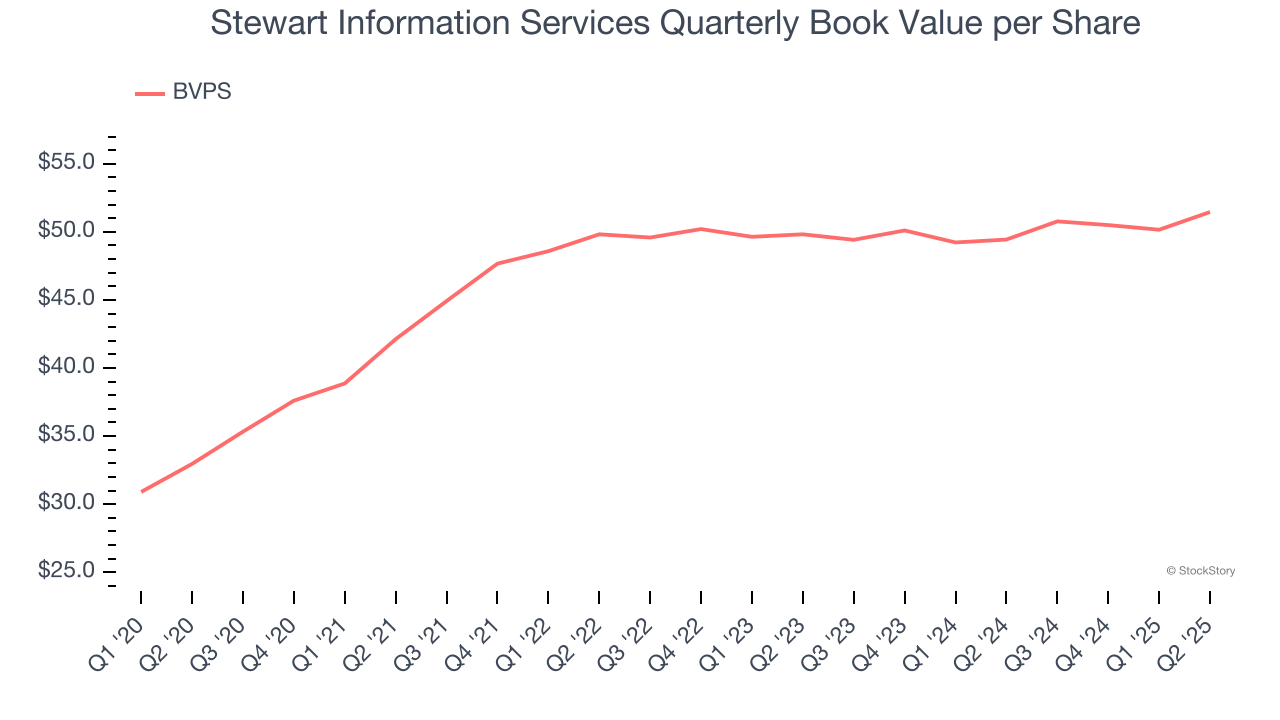

3. Substandard BVPS Growth Indicates Limited Asset Expansion

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

Although Stewart Information Services’s BVPS increased by 9.3% annually over the last five years, growth has recently decelerated to a weak 1.6% over the past two years (from $49.82 to $51.46 per share).

Final Judgment

Stewart Information Services isn’t a terrible business, but it doesn’t pass our bar. With its shares underperforming the market lately, the stock trades at 1.4× forward P/B (or $73.98 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

Stocks We Like More Than Stewart Information Services

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.