Fulton Financial has been treading water for the past six months, recording a small loss of 3% while holding steady at $18.52. The stock also fell short of the S&P 500’s 5.6% gain during that period.

Is now the time to buy Fulton Financial, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Fulton Financial Not Exciting?

We're cautious about Fulton Financial. Here are three reasons why we avoid FULT and a stock we'd rather own.

1. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Fulton Financial’s net interest income to rise by 3.1%, a deceleration versus its 9.6% annualized growth for the past two years. This projection is below its 9.6% annualized growth rate for the past two years.

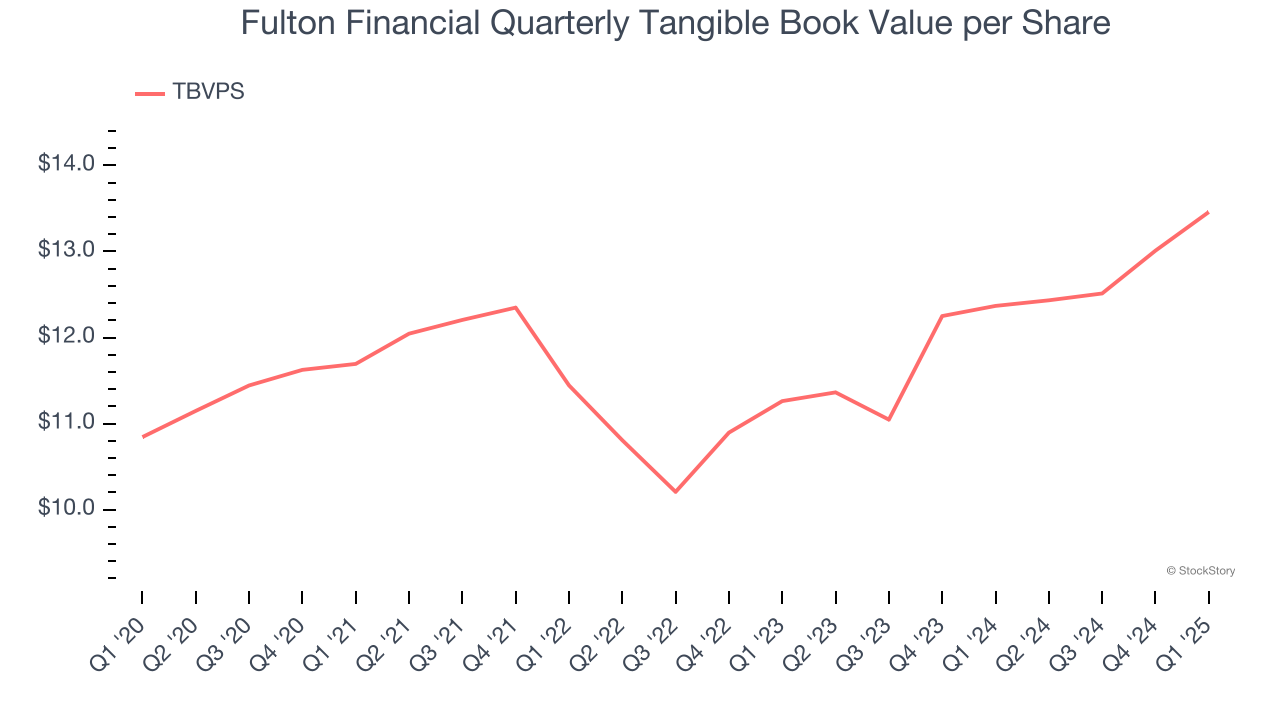

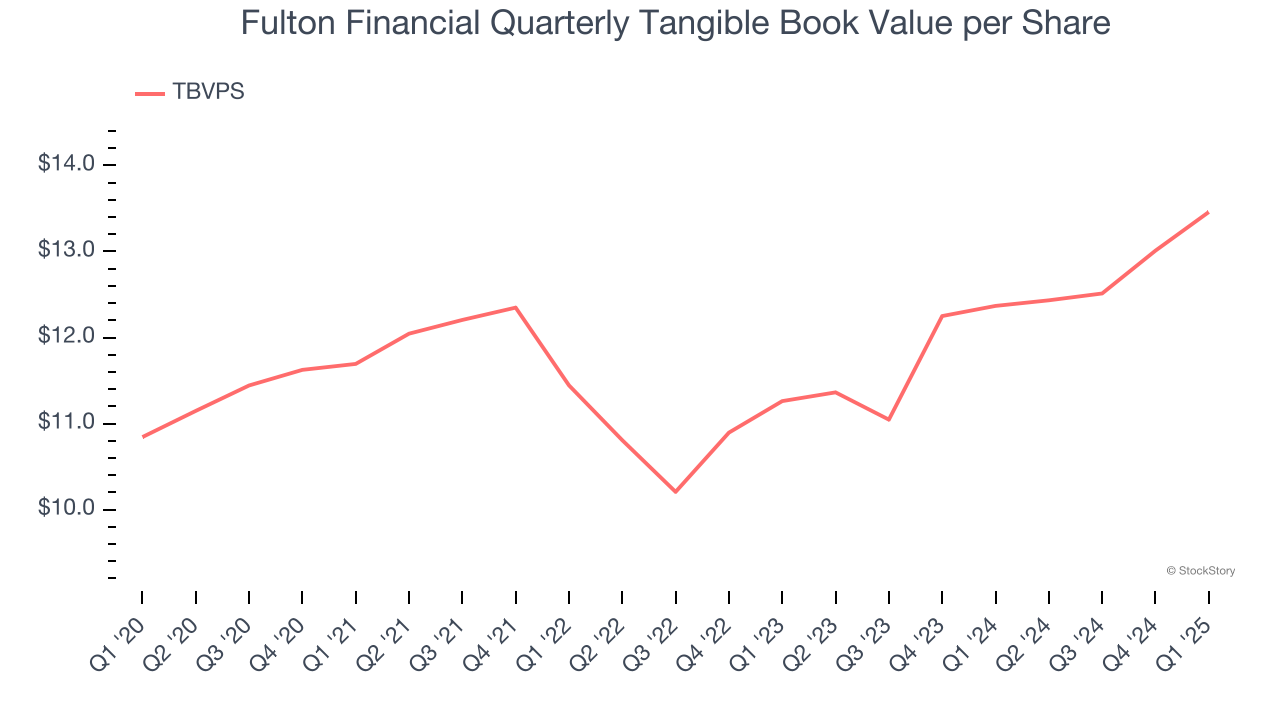

2. Substandard TBVPS Growth Indicates Limited Asset Expansion

For banks, tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

To the detriment of investors, Fulton Financial’s TBVPS grew at a mediocre 9.3% annual clip over the last two years.

3. Projected TBVPS Growth Is Slim

A bank’s tangible book value per share (TBVPS) increases when it generates higher net interest margins and keeps credit losses low, allowing it to compound shareholder value over time.

Over the next 12 months, Consensus estimates call for Fulton Financial’s TBVPS to grow by 7.3% to $14.44, mediocre growth rate.

Final Judgment

Fulton Financial isn’t a terrible business, but it doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 1× forward P/B (or $18.52 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.