NMI Holdings currently trades at $40.70 per share and has shown little upside over the past six months, posting a middling return of 0.8%. The stock also fell short of the S&P 500’s 13.6% gain during that period.

Is now the time to buy NMIH? Find out in our full research report, it’s free for active Edge members.

Why Is NMI Holdings a Good Business?

Founded in the aftermath of the 2008 housing crisis to bring new capacity to the mortgage insurance market, NMI Holdings (NASDAQ: NMIH) provides mortgage insurance that protects lenders against losses when homebuyers default on their mortgage loans.

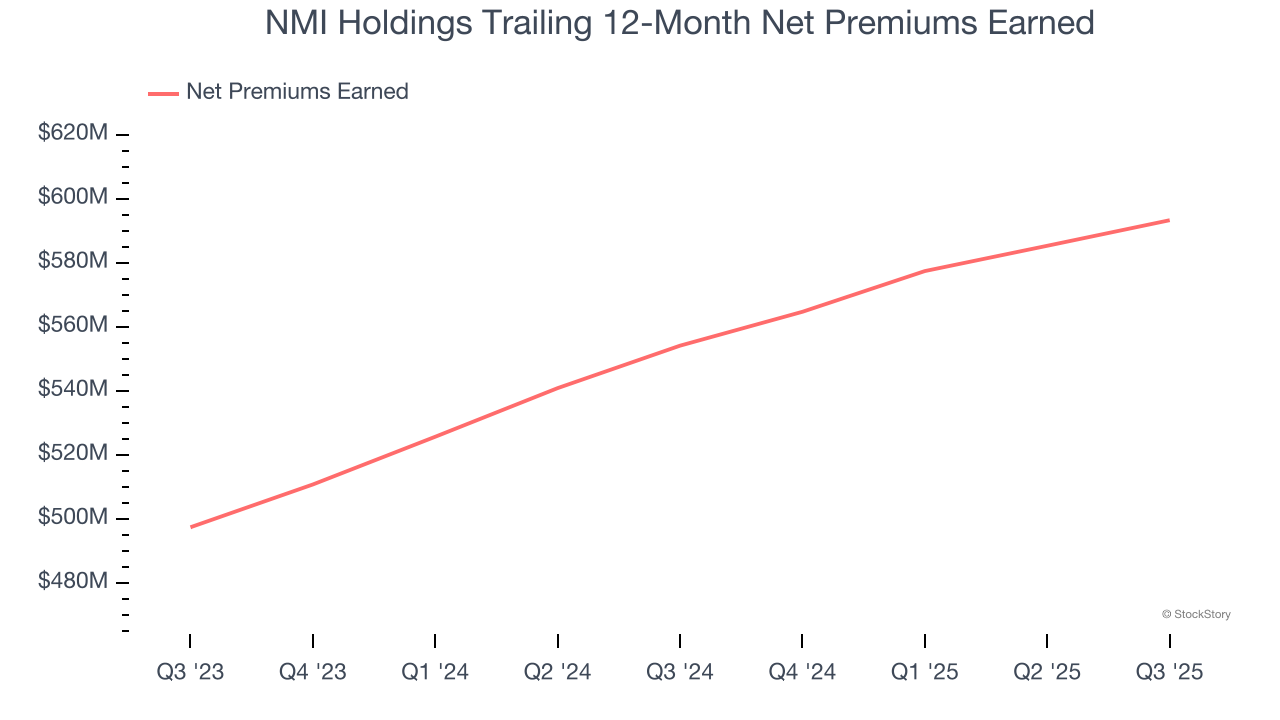

1. Net Premiums Earned Drive Additional Growth Opportunities

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore gross premiums less what’s ceded to reinsurers as a risk mitigation and transfer strategy.

NMI Holdings’s net premiums earned has grown at a 9.2% annualized rate over the last two years, a step above the broader insurance industry.

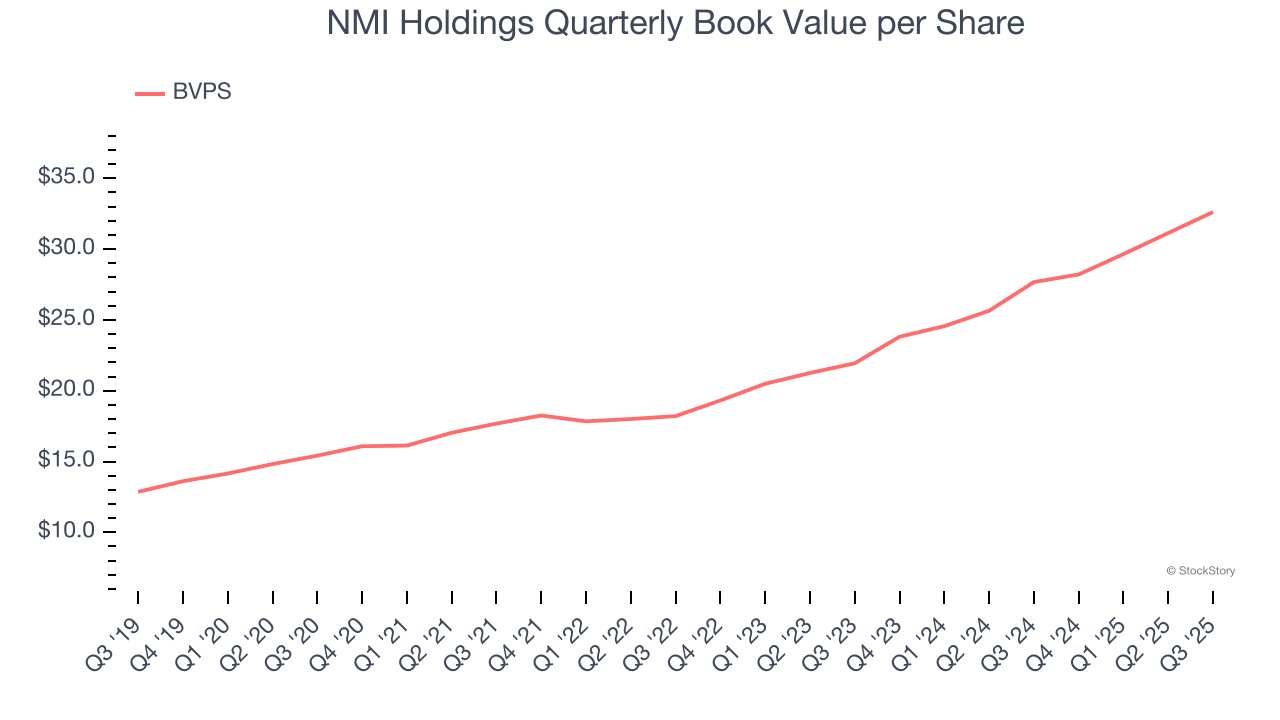

3. Growing BVPS Reflects Strong Asset Base

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

NMI Holdings’s BVPS increased by 16.2% annually over the last five years, and growth has recently accelerated as BVPS grew at an excellent 21.9% annual clip over the past two years (from $21.94 to $32.62 per share).

Final Judgment

These are just a few reasons why NMI Holdings ranks highly on our list. With its shares underperforming the market lately, the stock trades at 1.2× forward P/B (or $40.70 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than NMI Holdings

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.