Personal care company The Honest Company (NASDAQ: HNST) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 6.7% year on year to $92.57 million. Its GAAP profit of $0.01 per share was $0.02 above analysts’ consensus estimates.

Is now the time to buy The Honest Company? Find out by accessing our full research report, it’s free for active Edge members.

The Honest Company (HNST) Q3 CY2025 Highlights:

- Revenue: $92.57 million vs analyst estimates of $99.53 million (6.7% year-on-year decline, 7% miss)

- EPS (GAAP): $0.01 vs analyst estimates of -$0.01 ($0.02 beat)

- Adjusted EBITDA: $3.52 million vs analyst estimates of $1.74 million (3.8% margin, significant beat)

- EBITDA guidance for the full year is $22 million at the midpoint, below analyst estimates of $28.34 million

- Operating Margin: 0.3%, in line with the same quarter last year

- Free Cash Flow was -$624,000, down from $14.99 million in the same quarter last year

- Market Capitalization: $370.5 million

“While third quarter revenue was softer than anticipated, our team’s disciplined execution delivered profitability improvement resulting in positive net income. In response to a challenging macroeconomic environment, our teams are acting decisively to strengthen performance across our portfolio. Our strategy remains focused on building a stronger and more scaled Honest brand, advancing operational efficiency and strengthening financial profitability,” said Chief Executive Officer, Carla Vernón.

Company Overview

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ: HNST) sells diapers and wipes, skin care products, and household cleaning products.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $383.1 million in revenue over the past 12 months, The Honest Company is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

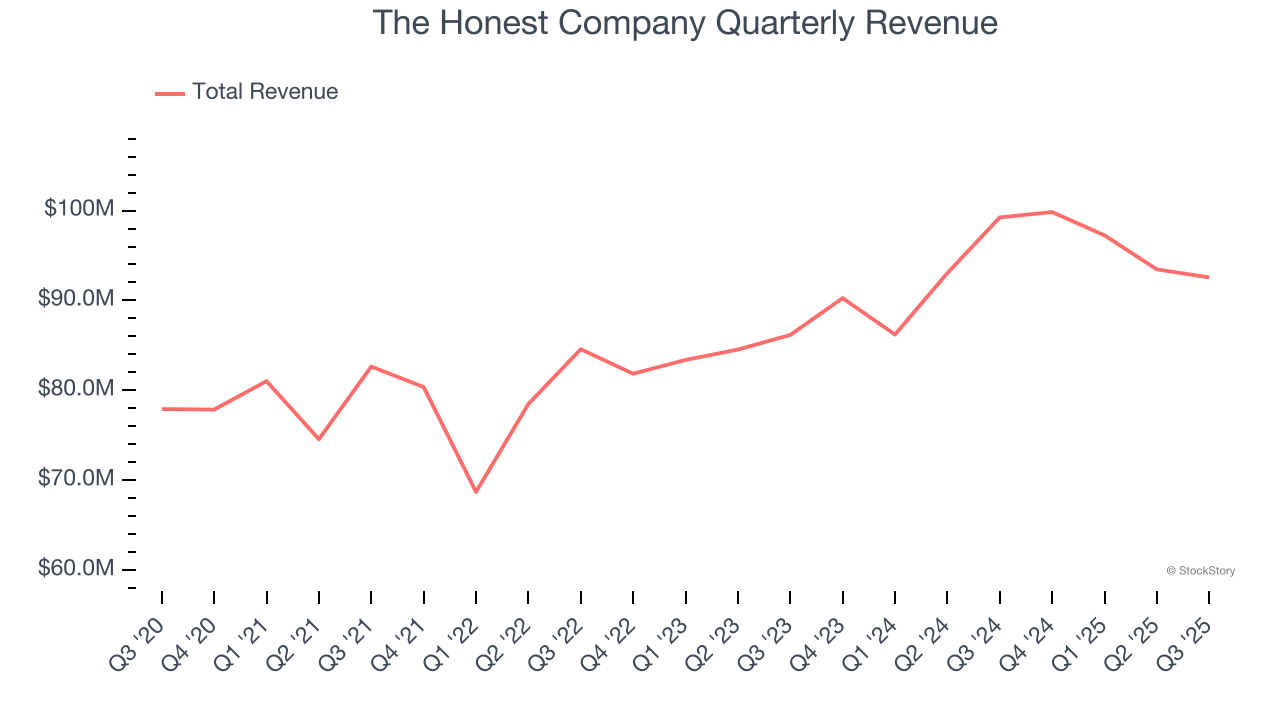

As you can see below, The Honest Company’s 7.1% annualized revenue growth over the last three years was decent. This shows its offerings generated slightly more demand than the average consumer staples company, a useful starting point for our analysis.

This quarter, The Honest Company missed Wall Street’s estimates and reported a rather uninspiring 6.7% year-on-year revenue decline, generating $92.57 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 7.2% over the next 12 months, similar to its three-year rate. This projection is above the sector average and indicates its newer products will help maintain its historical top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

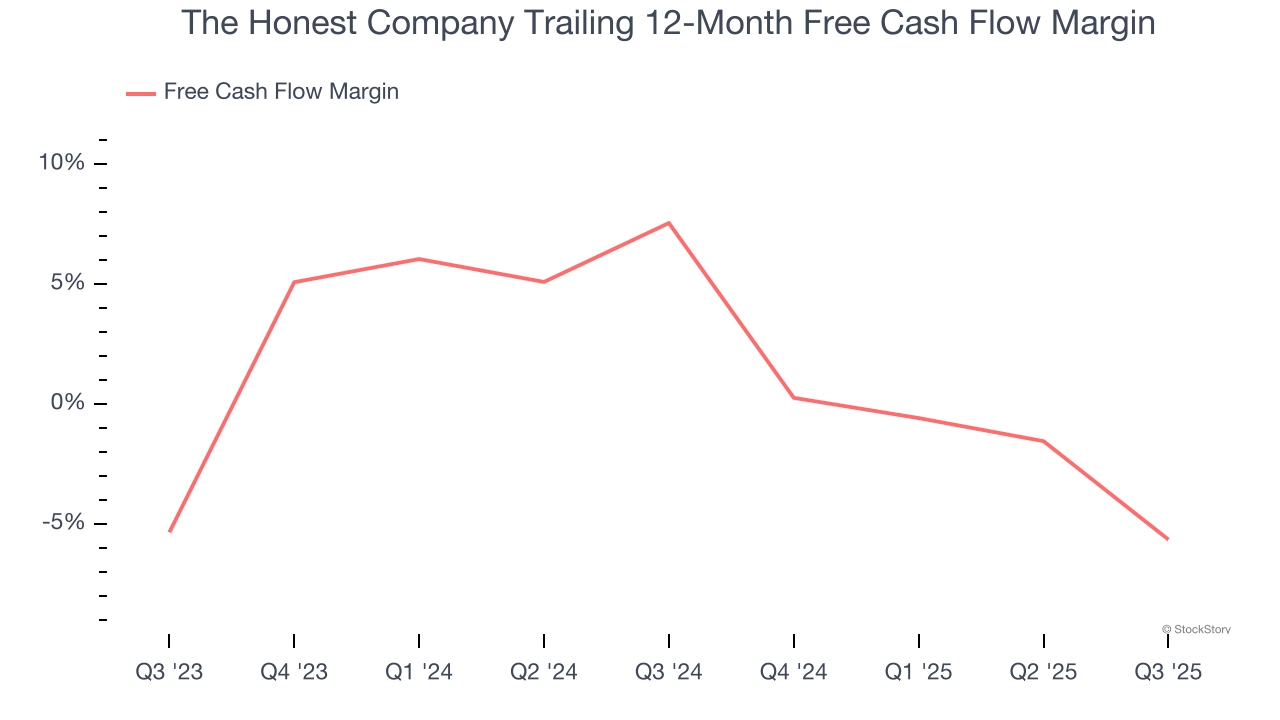

The Honest Company broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that The Honest Company’s margin dropped by 13.2 percentage points over the last year. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

The Honest Company broke even from a free cash flow perspective in Q3. The company’s cash profitability regressed as it was 15.8 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from The Honest Company’s Q3 Results

It was good to see The Honest Company beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year EBITDA guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 12.6% to $2.89 immediately following the results.

So should you invest in The Honest Company right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.