Electrical supply company WESCO (NYSE: WCC) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 12.9% year on year to $6.20 billion. Its non-GAAP profit of $3.92 per share was 2.3% above analysts’ consensus estimates.

Is now the time to buy WESCO? Find out by accessing our full research report, it’s free for active Edge members.

WESCO (WCC) Q3 CY2025 Highlights:

- Revenue: $6.20 billion vs analyst estimates of $5.91 billion (12.9% year-on-year growth, 4.9% beat)

- Adjusted EPS: $3.92 vs analyst estimates of $3.83 (2.3% beat)

- Adjusted EBITDA: $423 million vs analyst estimates of $412.8 million (6.8% margin, 2.5% beat)

- Operating Margin: 5.6%, in line with the same quarter last year

- Free Cash Flow was -$95.9 million, down from $279.5 million in the same quarter last year

- Organic Revenue rose 12.1% year on year vs analyst estimates of 7.1% growth (504.3 basis point beat)

- Market Capitalization: $11.11 billion

"We delivered very strong results in the third quarter and again outperformed the market with our leading portfolio of products, services, and solutions. Sales growth accelerated this year, with organic sales up 6% in the first quarter, 7% in the second quarter, and 12% in the third quarter. Our record sales performance was led by 18% organic growth in CSS, 12% organic growth in EES, and a return to growth in UBS. Total data center sales were $1.2B, setting another new quarterly mark, and were up about 60% versus the prior year. Our Utility business also continued to show signs of improvement with increased investor-owned utility sales growth in the third quarter. Adjusted EPS grew 9.5% versus the prior year and 16% versus the second quarter, with both gross margin and operating margin improving sequentially. Working capital days continued to show improvement versus the prior year, with record sales per workday in September resulting in an increase in accounts receivable. We are building on our positive business momentum as we enter the fourth quarter and begin to prepare for continued market-leading growth in 2026," said John Engel, Chairman, President, and CEO.

Company Overview

Based in Pittsburgh, WESCO (NYSE: WCC) provides electrical, industrial, and communications products and augments them with services such as supply chain management.

Revenue Growth

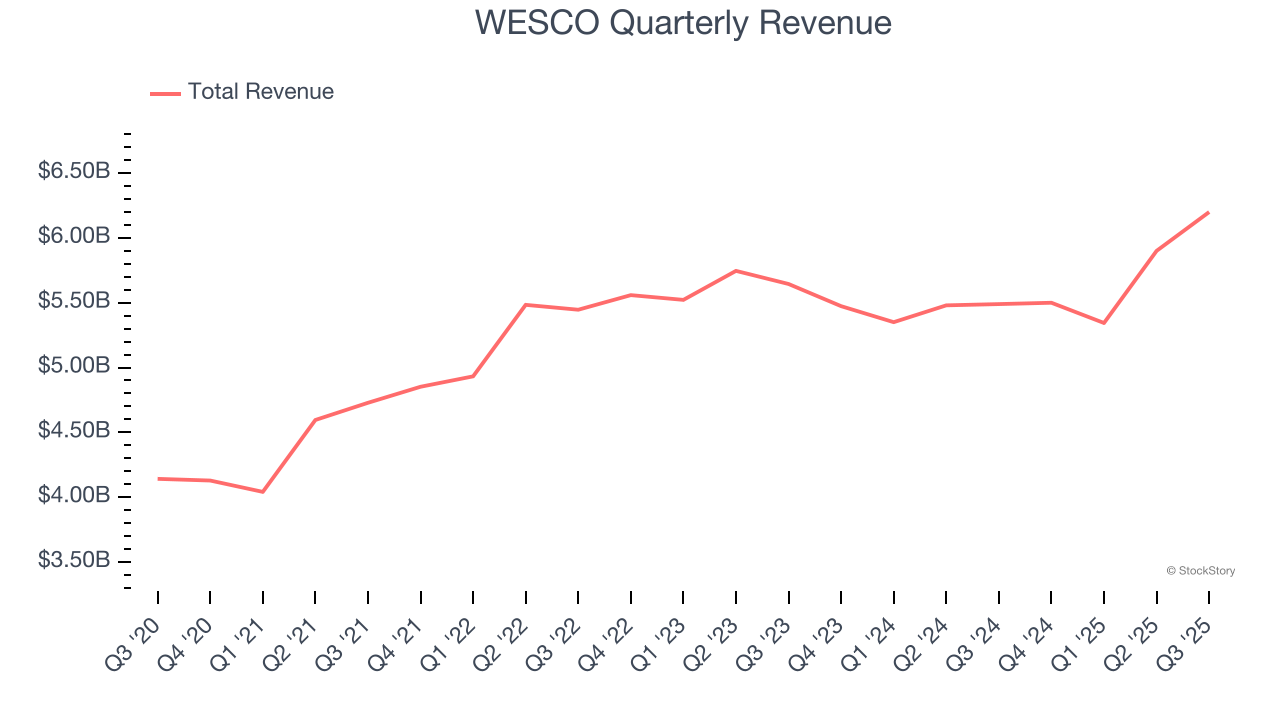

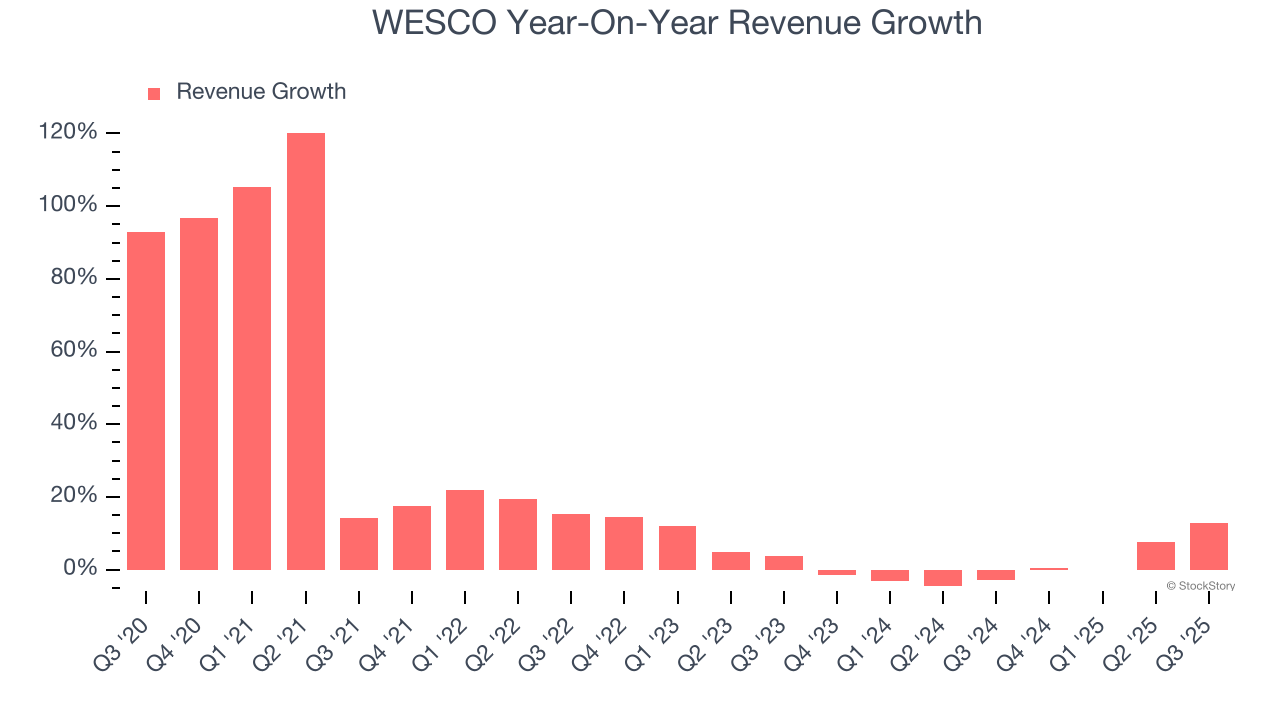

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, WESCO’s sales grew at an incredible 17.4% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. WESCO’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1% over the last two years was well below its five-year trend.

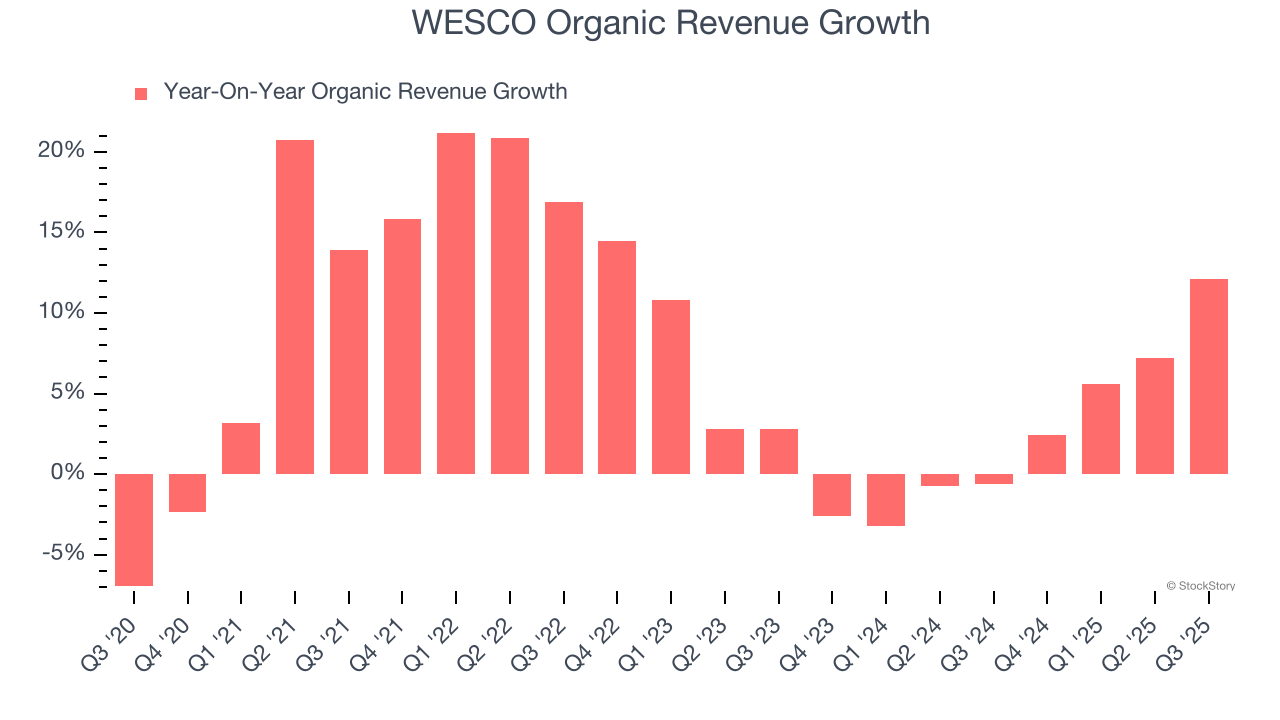

WESCO also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, WESCO’s organic revenue averaged 2.5% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, WESCO reported year-on-year revenue growth of 12.9%, and its $6.20 billion of revenue exceeded Wall Street’s estimates by 4.9%.

Looking ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

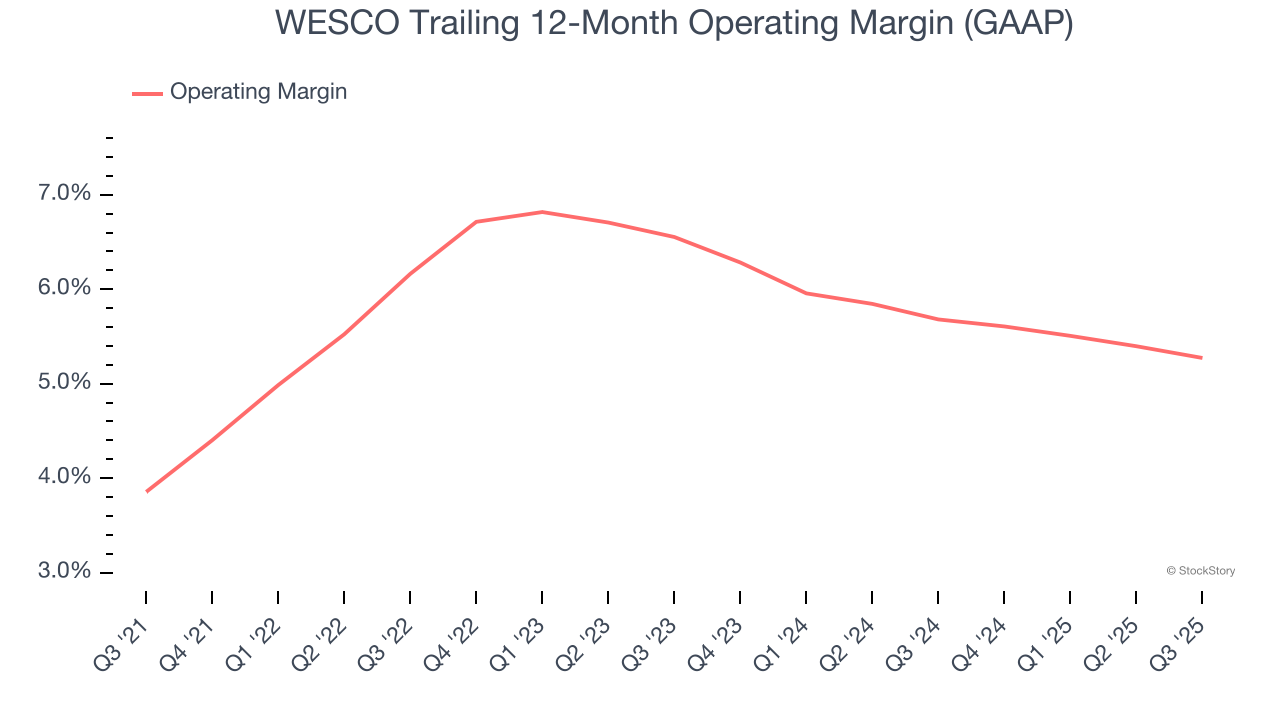

WESCO was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, WESCO’s operating margin rose by 1.4 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, WESCO generated an operating margin profit margin of 5.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

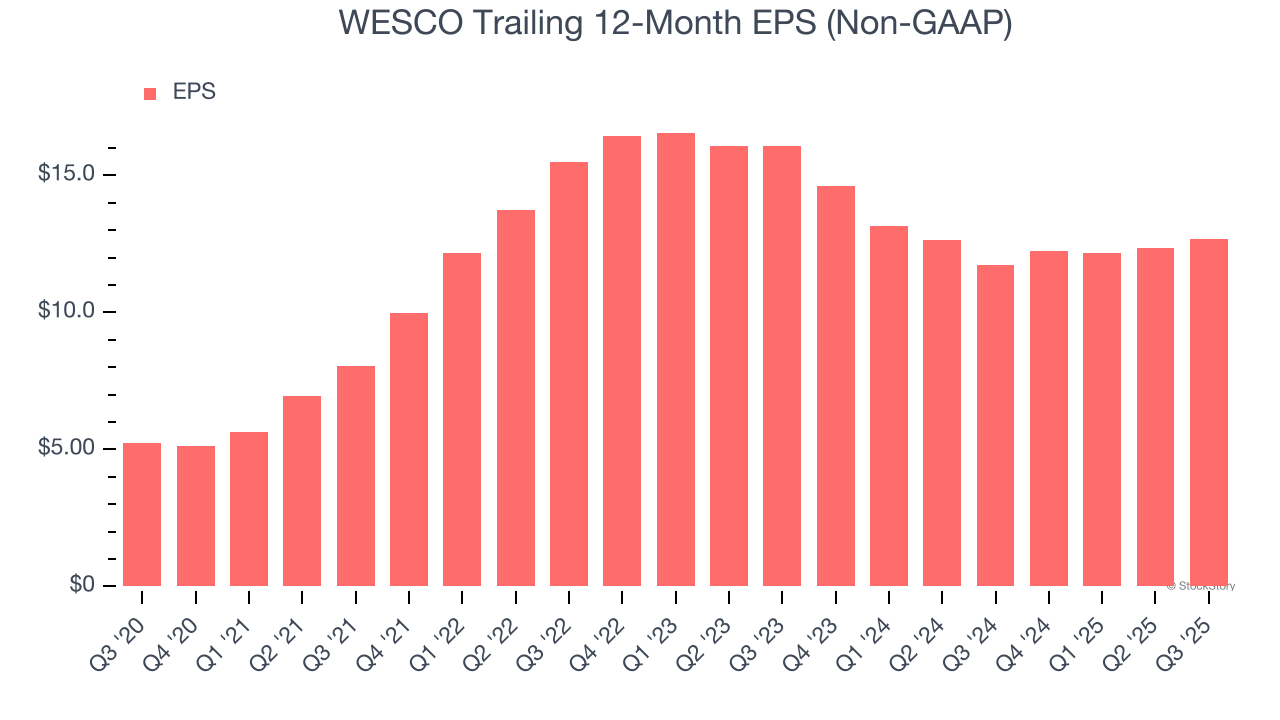

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

WESCO’s EPS grew at an astounding 19.4% compounded annual growth rate over the last five years, higher than its 17.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

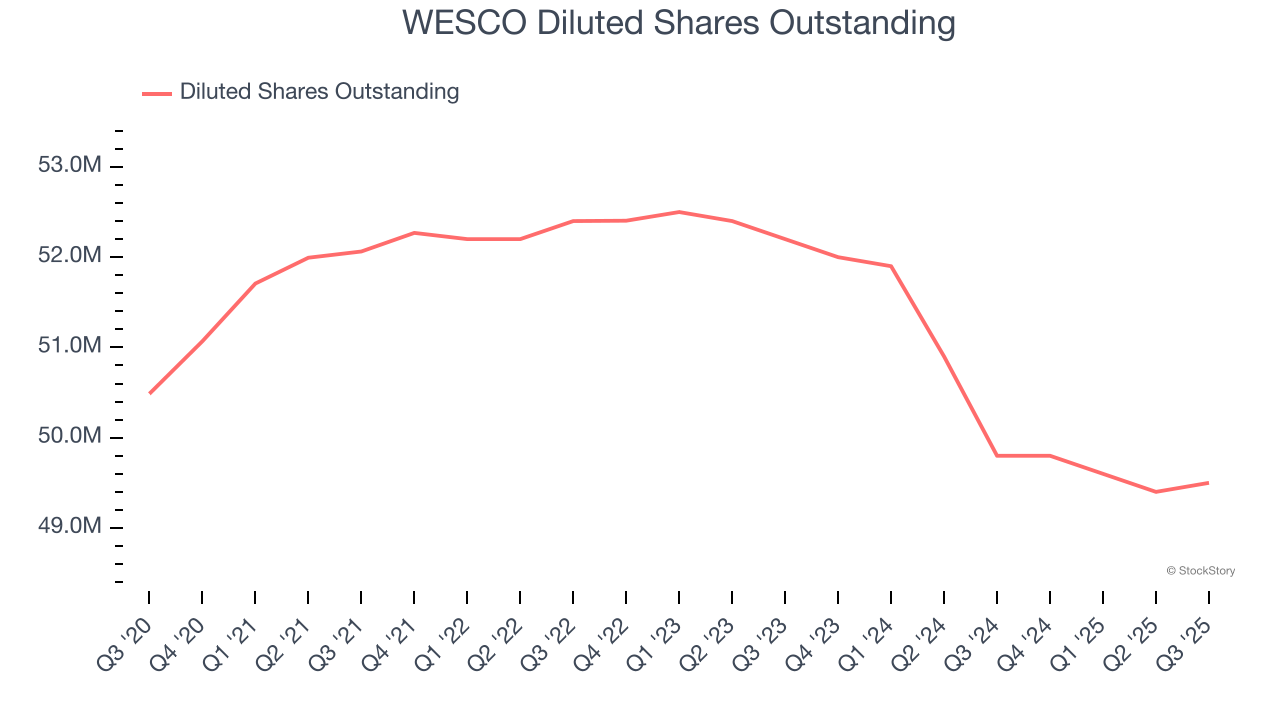

We can take a deeper look into WESCO’s earnings to better understand the drivers of its performance. As we mentioned earlier, WESCO’s operating margin was flat this quarter but expanded by 1.4 percentage points over the last five years. On top of that, its share count shrank by 2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For WESCO, its two-year annual EPS declines of 11.2% mark a reversal from its (seemingly) healthy five-year trend. We hope WESCO can return to earnings growth in the future.

In Q3, WESCO reported adjusted EPS of $3.92, up from $3.58 in the same quarter last year. This print beat analysts’ estimates by 2.3%. Over the next 12 months, Wall Street expects WESCO’s full-year EPS of $12.68 to grow 24.9%.

Key Takeaways from WESCO’s Q3 Results

We were impressed by how significantly WESCO blew past analysts’ organic revenue expectations this quarter. We were also excited its revenue and EPS outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 2.1% to $233 immediately following the results.

Sure, WESCO had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.