Mexican fast-food chain Chipotle (NYSE: CMG) met Wall Streets revenue expectations in Q3 CY2025, with sales up 7.5% year on year to $3.00 billion. Its non-GAAP profit of $0.29 per share was in line with analysts’ consensus estimates.

Is now the time to buy Chipotle? Find out by accessing our full research report, it’s free for active Edge members.

Chipotle (CMG) Q3 CY2025 Highlights:

- Company called out "persistent macroeconomic pressures"

- Revenue: $3.00 billion vs analyst estimates of $3.02 billion (7.5% year-on-year growth, in line)

- Adjusted EPS: $0.29 vs analyst estimates of $0.29 (in line)

- 2025 same-store sales guidance: "declines in the low-single digit range" (lowered from previous view of flat)

- Operating Margin: 15.9%, down from 16.9% in the same quarter last year

- Free Cash Flow Margin: 13.5%, up from 10.7% in the same quarter last year

- Same-Store Sales were flat year on year (6% in the same quarter last year)

- Market Capitalization: $53.98 billion

"While we continue to see persistent macroeconomic pressures, our extraordinary value proposition and brand strength remain strong," said Scott Boatwright, Chief Executive Officer, Chipotle.

Company Overview

Born from a desire to offer quick meals with fresh, flavorful ingredients, Chipotle (NYSE: CMG) is a fast-food chain known for its healthy, Mexican-inspired cuisine and customizable dishes.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $11.79 billion in revenue over the past 12 months, Chipotle is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost.

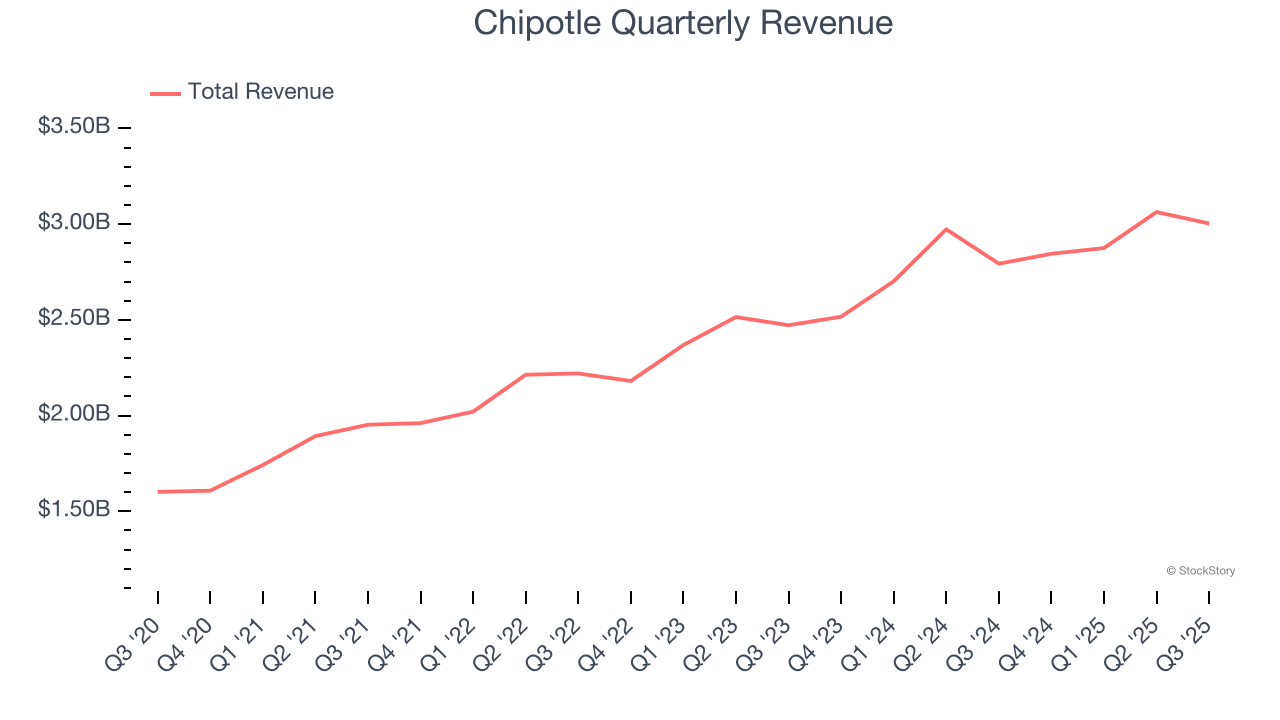

As you can see below, Chipotle grew its sales at an impressive 14% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Chipotle grew its revenue by 7.5% year on year, and its $3.00 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.2% over the next 12 months, a slight deceleration versus the last six years. We still think its growth trajectory is attractive given its scale and indicates the market is forecasting success for its menu offerings.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

Number of Restaurants

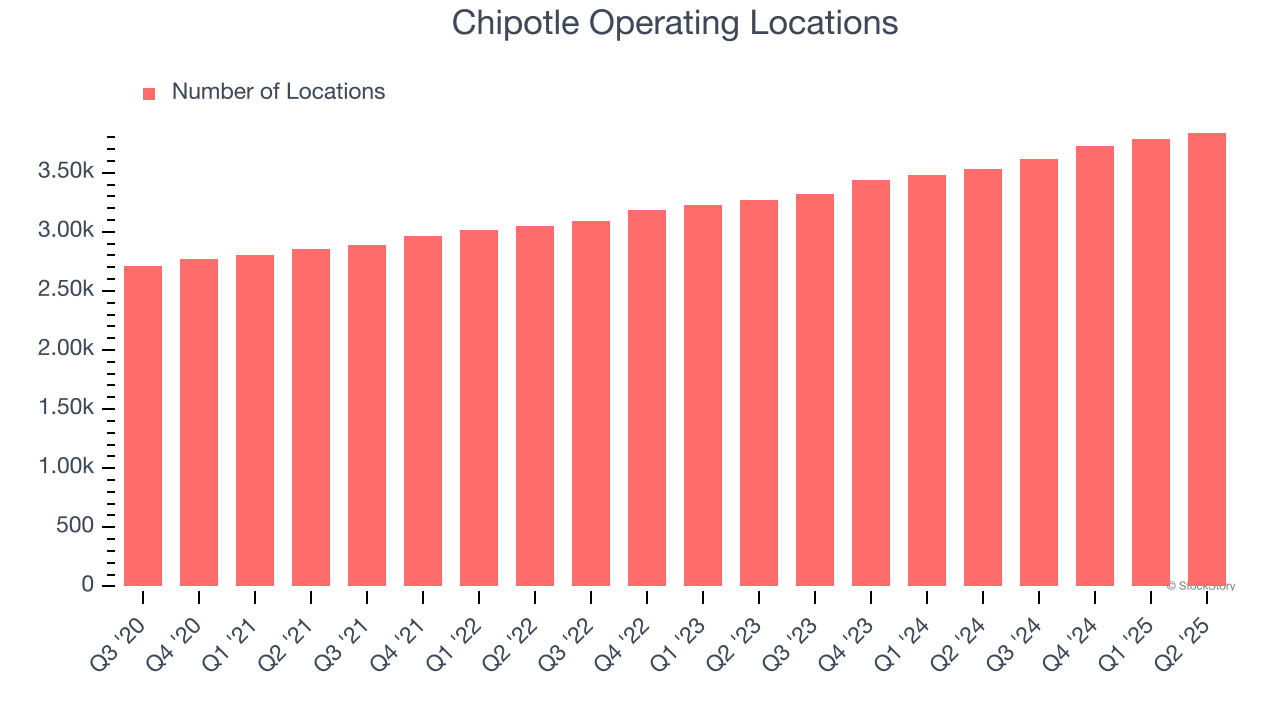

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Chipotle opened new restaurants at a rapid clip over the last two years, averaging 8.4% annual growth, much faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Note that Chipotle reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

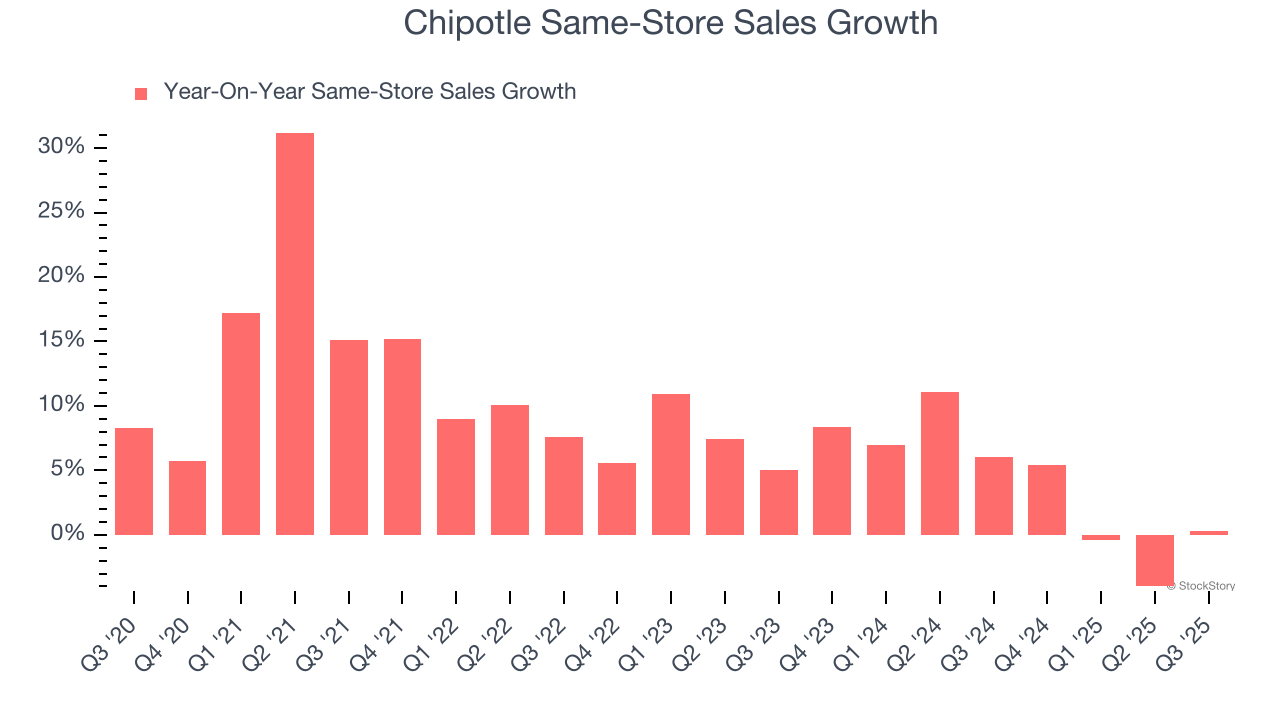

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

Chipotle’s demand has been spectacular for a restaurant chain over the last two years. On average, the company has increased its same-store sales by an impressive 4.2% per year. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop because it gives Chipotle multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Chipotle’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Chipotle can reaccelerate growth.

Key Takeaways from Chipotle’s Q3 Results

We struggled to find many positives in these results. Revenue and EPS were both just in line. Looking ahead, the company lowered full-year same-store sales guidance and is now expecting a decline for 2025. Overall, this quarter could have been better. The stock traded down 13.5% to $34.40 immediately following the results.

The latest quarter from Chipotle’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.