Over the past six months, Electronic Arts has been a great trade, beating the S&P 500 by 12%. Its stock price has climbed to $200.22, representing a healthy 37.5% increase. This run-up might have investors contemplating their next move.

Is now the time to buy Electronic Arts, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Electronic Arts Not Exciting?

Despite the momentum, we're cautious about Electronic Arts. Here are three reasons there are better opportunities than EA and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

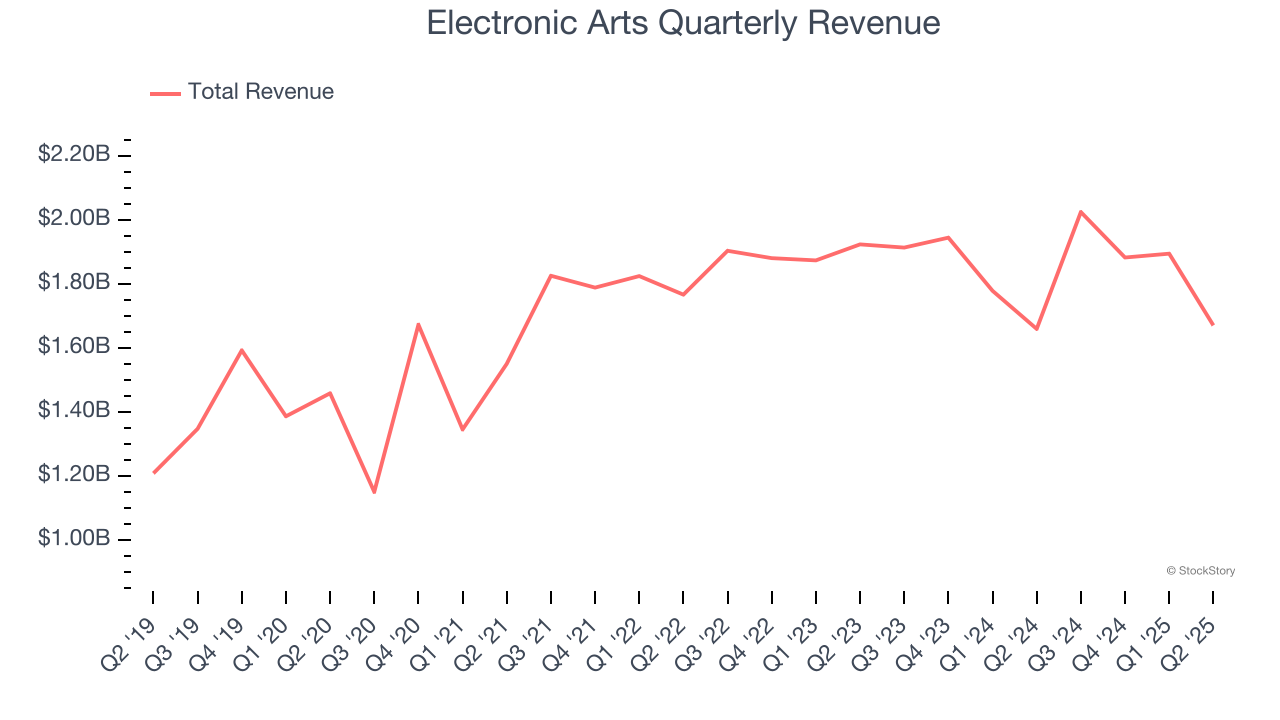

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Electronic Arts’s 1.2% annualized revenue growth over the last three years was weak. This fell short of our benchmarks.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Electronic Arts’s revenue to rise by 2.7%, close to This projection doesn't excite us and indicates its newer products and services will not lead to better top-line performance yet.

3. Shrinking EBITDA Margin

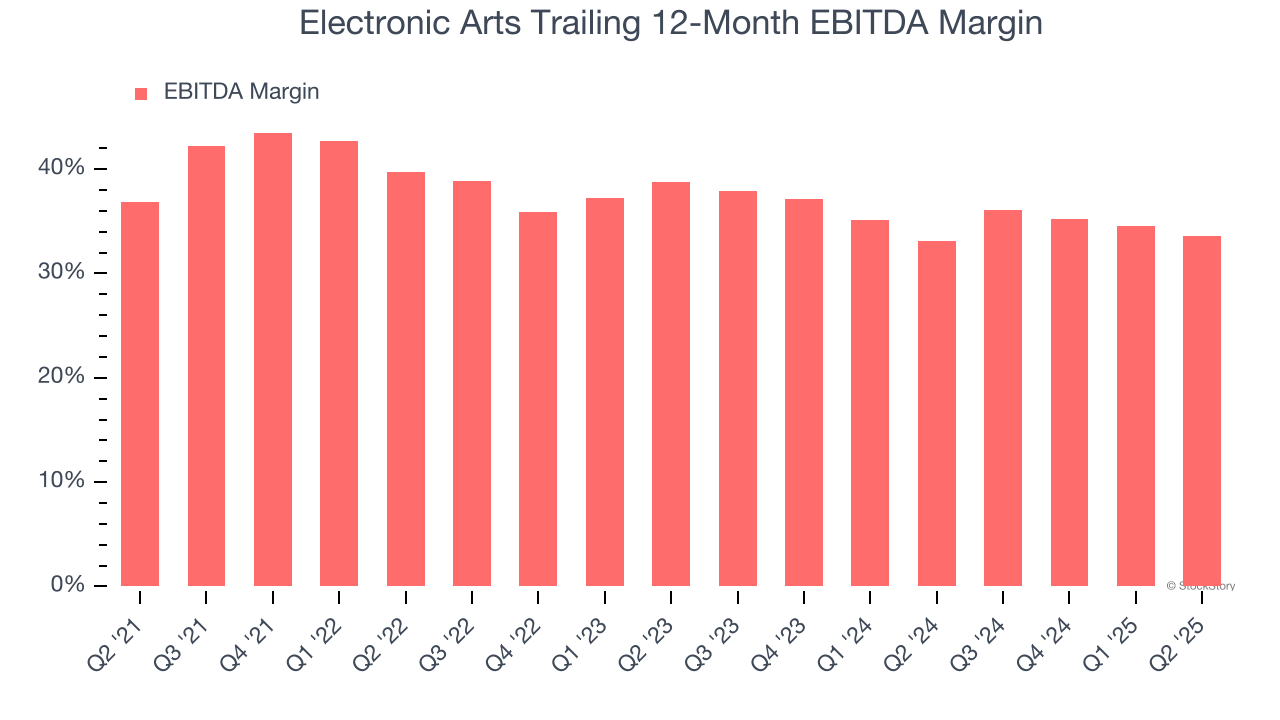

Investors regularly analyze operating income to understand a company’s profitability. Similarly, EBITDA is a common profitability metric for consumer internet companies because it excludes various one-time or non-cash expenses, offering a better perspective of the business’s profit potential.

Looking at the trend in its profitability, Electronic Arts’s EBITDA margin decreased by 6.1 percentage points over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its EBITDA margin for the trailing 12 months was 33.6%.

Final Judgment

Electronic Arts isn’t a terrible business, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 16.8× forward EV/EBITDA (or $200.22 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at a top digital advertising platform riding the creator economy.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.