The past six months have been a windfall for Acuity Brands’s shareholders. The company’s stock price has jumped 50.6%, hitting $359.63 per share. This run-up might have investors contemplating their next move.

Is now still a good time to buy AYI? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free for active Edge members.

Why Does Acuity Brands Spark Debate?

One of the pioneers of smart lights, Acuity (NYSE: AYI) designs and manufactures light fixtures and building management systems used in various industries.

Two Positive Attributes:

1. Elite Gross Margin Powers Best-In-Class Business Model

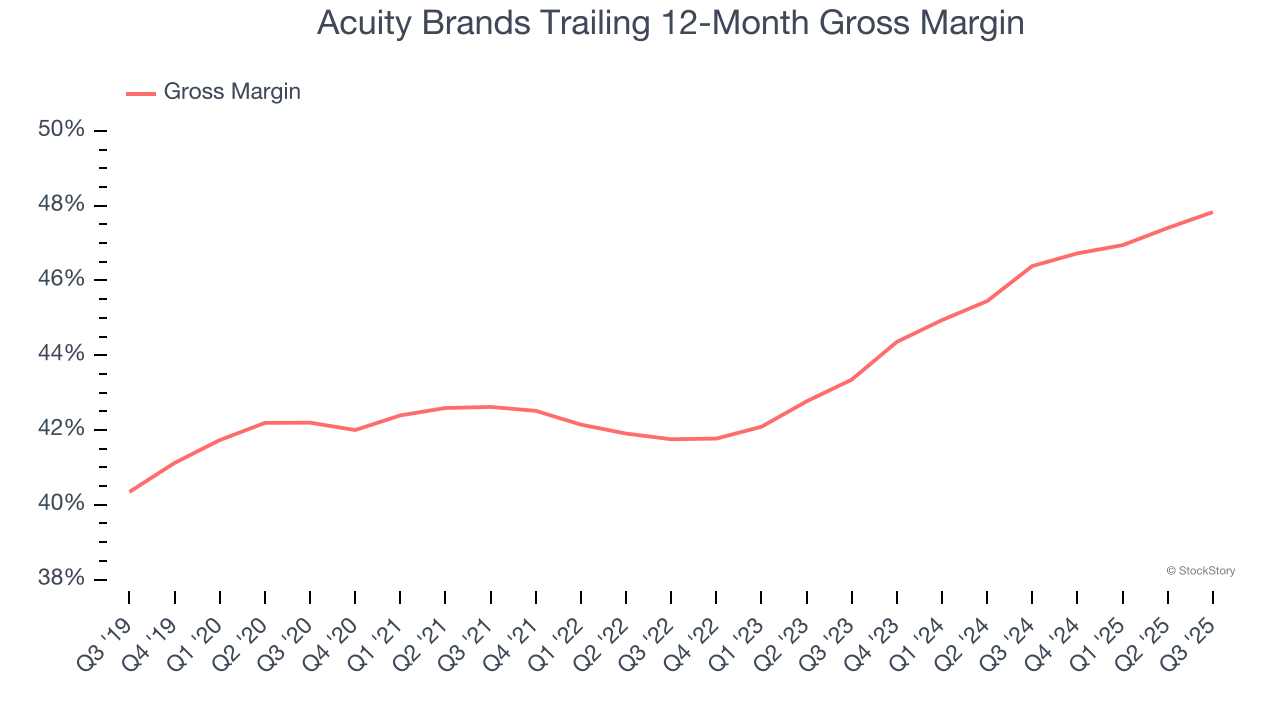

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Acuity Brands has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 44.5% gross margin over the last five years. Said differently, roughly $44.48 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

2. Outstanding Long-Term EPS Growth

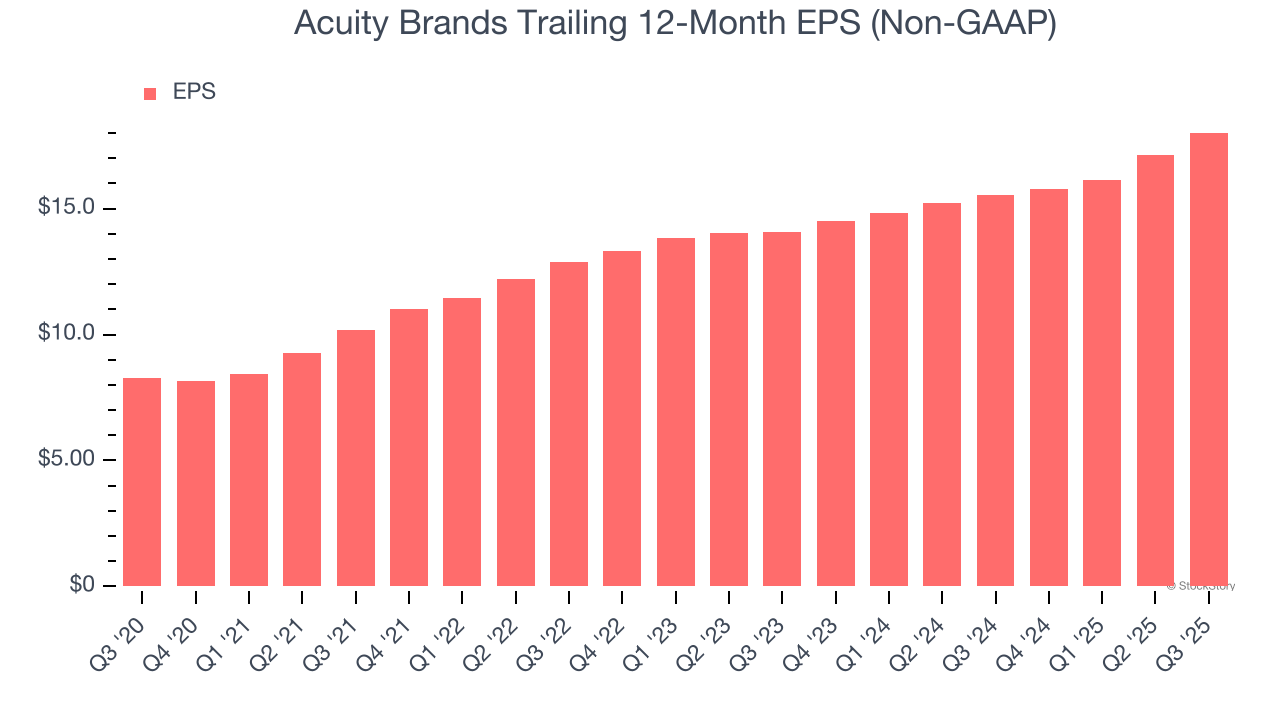

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Acuity Brands’s EPS grew at a spectacular 16.9% compounded annual growth rate over the last five years, higher than its 5.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Core Business Falling Behind as Demand Plateaus

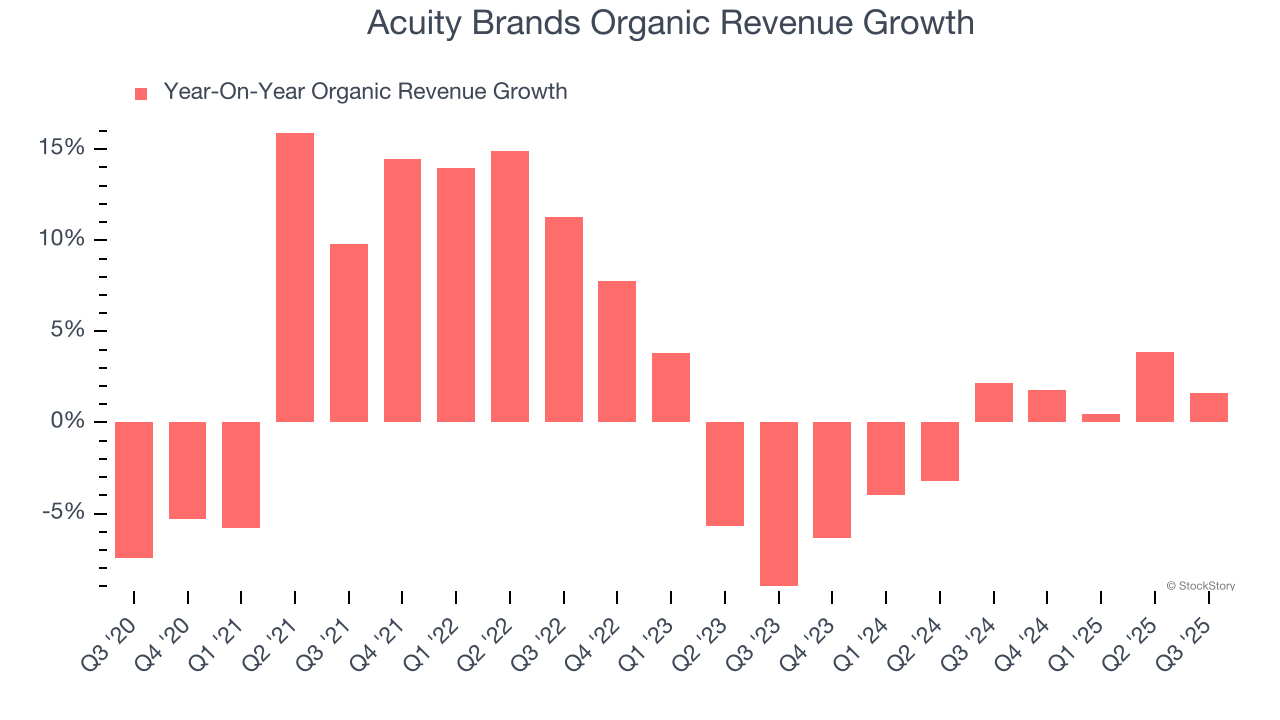

Investors interested in Electrical Systems companies should track organic revenue in addition to reported revenue. This metric gives visibility into Acuity Brands’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Acuity Brands failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Acuity Brands might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

Final Judgment

Acuity Brands has huge potential even though it has some open questions, and after the recent surge, the stock trades at 18× forward P/E (or $359.63 per share). Is now the time to buy despite the apparent froth? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.