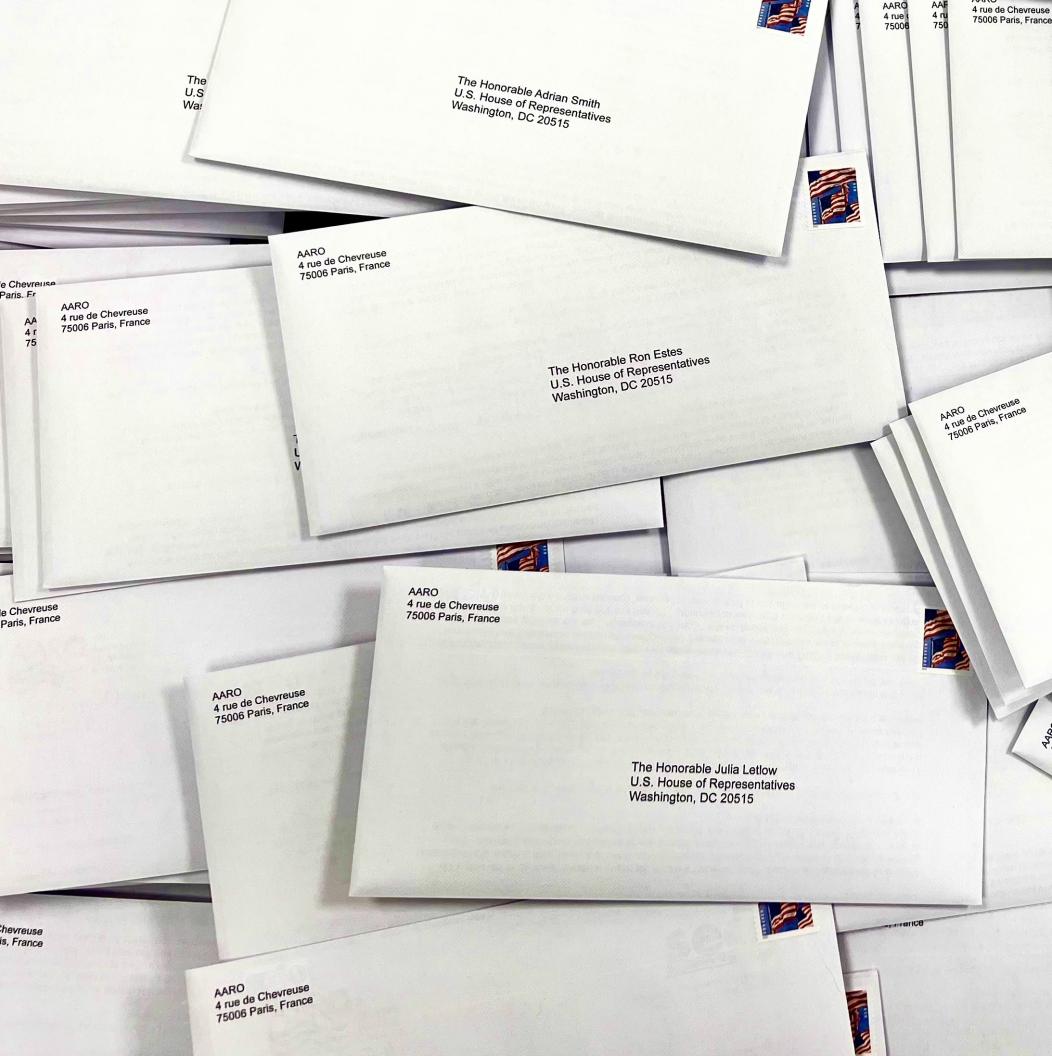

AARO and SEAT have written letters to 535 Senators and Representatives with comments from their respective constituents regarding the legal and regulatory challenges faced by American citizens living overseas.

WASHINGTON - April 27, 2023 - PRLog -- AARO, the Association of Americans Resident Overseas, in conjunction with SEAT, Stop Extraterritorial American Taxation, today launched their Dear 535 Campaign to inform members of Congress of the legal and regulatory challenges faced by American citizens living overseas.

This campaign is a major effort by AARO in its mission to seek fair treatment for Americans abroad by the U.S. government and build awareness in the U.S. of the issues affecting fellow Americans overseas. The campaign is a major effort by SEAT to fulfill its mission to educate policymakers and members of the public about the effects of U.S. extraterritorial taxation.

Overseas Americans seek to live like everyone else, with families, homes, retirement plans, banking and investment accounts, and small businesses. However, they face legal and regulatory incompatibilities that result in punitive taxation, impediments to home ownership and retirement planning, and loss of bank and investment accounts.

These issues are personalized through the actual comments of expatriate Americans who responded to surveys conducted by AARO and SEAT. Survey results showed overseas Americans face ongoing problems with onerous U.S. regulations and legislation. Major issues exposed by the surveys include:

- Impossibility of compliance – "The sheer complexity of US tax policy for citizens abroad is an ongoing case of perpetual stress and anxiety."

- Access to banks – "I have been turned down to more banks and brokerages than I can count due to my US citizenship."

- Financial uncertainty – "I cannot start my own business, I cannot jointly own a home with my spouse in my country of residence, I cannot invest or save for retirement."

- Double taxation – "We pay significant fees for tax preparation, and do owe US taxes on foreign income earned. This is income that we already paid on IN THE COUNTRY WHERE IT WAS EARNED."

- High costs – "It's very expensive to file taxes correctly abroad."

- Reduced job opportunities – "I am disadvantaged in the labor market because many employers do not want the complexity of a U.S. citizen as an employee."

- Affected personal relationships – "I have been delaying proposing marriage to my non-American life partner to avoid exposing her to extraterritorial American taxation."

"Many resident Americans think that overseas Americans are necessarily wealthy and that they live overseas to avoid U.S. taxes. The reality is that overseas Americas are ordinary people who live overseas for ordinary reasons – to join a romantic partner or for work, as examples. Congress regularly adopts laws without considering the impact they will have for overseas Americans. It is important for members of Congress to know the impacts that their laws have for their constituents and all Americans living overseas," says Laura Snyder, president of SEAT.

You can learn more about the campaign at Dear 535 Campaign

About the organizations:

The Association of Americans Resident Overseas (AARO) is an international, non-partisan association with members from over 40 States living in 36 countries that seeks fair treatment for Americans abroad by advocating the issues that negatively affect their lives. AARO also informs its members of their rights and responsibilities as Americans. To learn more please visit AARO

Stop Extraterritorial American Taxation (SEAT) is an independent, nonpartisan organization whose mission is to provide an educational platform about the effects of U.S. extraterritorial taxation. Learn more at SEAT.

Doris Speer

AARO - The Association of Americans Resident Overseas

+33 1 47 20 24 15

contact@aaro.org

Laura Snyder

SEAT – Stop Extraterritorial American Taxation

+33 6 61 75 11 31

info@seatnow.org

Photos: (Click photo to enlarge)

Read Full Story - AARO and SEAT Announce Launch of Dear 535 Campaign to Congress | More news from this source

Press release distribution by PRLog