LONDON - June 23, 2021 - (Newswire.com)

Ubisecure, through its automated RapidLEI service, has quickly become the most popular Legal Entity Identifier (LEI) Issuer worldwide, issuing more than 1 in 5 new LEIs every month. Today, the company announces its next LEI innovation with the launch of LEI Everywhere™.

LEI Everywhere makes LEIs more accessible to Financial Institutions and KYC/AML service providers by enabling a clear and simplified path to obtaining and maintaining LEIs:

-

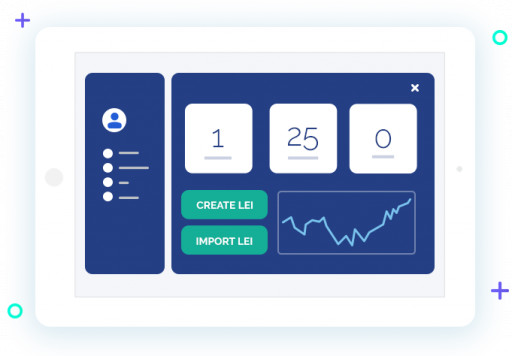

Technical implementation of the Global LEI Foundation (GLEIF) Validation Agent role through the RapidLEI API and SaaS dashboard

-

Enhanced verification for both initial LEI registration and subsequent renewals, assisting KYC (Know Your Customer), AML (Anti-Money Laundering), Customer Due Diligence (CDD), Enhanced Due Diligence (EDD) onboarding and client refresh cycles

- Reduced annual fees - initial registrations at $11.99 and renewals at $5.99 (prices include annual GLEIF fee)

LEI Everywhere is available to GLEIF-approved Validation Agents (VA). VAs are financial institutions such as banks and also fintech, regtech, KYC/AML data providers, and Trust Service Provider like Certification Authorities and Business Registries. For organisations not yet approved as VAs, the LEI Everywhere program helps take suitable candidates through the GLEIF VA approval process.

Paul Tourret, Corporate Development Officer with Ubisecure & RapidLEI, likened the introduction of LEI Everywhere to the successful push made by many Internet stakeholders to encrypt the web: "Back in 2014, organisations like Let's Encrypt and Cloudflare launched solutions that made SSL/TLS more accessible by introducing automated Certificate issuance and installation, and also removed the commercial barriers usually associated with mass issuing Certificates. At the time, only 50% of websites used SSL/TLS, now that number is almost 100%. We have always seen strong parallels between SSL/TLS and LEIs, and LEI Everywhere gets us one step closer to a world where every Legal Entity can demonstrate an accurate, up-to-date, referenceable, and usable organisation identity."

By making it easier and less costly to obtain and maintain the LEI, it democratises the LEI for end clients, thereby driving adoption and benefiting the global LEI ecosystem. Increased ubiquity will introduce further organisation identity use cases, reduce identity fraud, help digitise manual processes, better streamline KYC/AML, and drive additional regulation adoption.

Outside of the current 160+ regulations using LEIs, KYC and onboarding has emerged as a strong LEI use case. Many Financial Institutions are utilising LEI to streamline and enhance client onboarding and client refresh. Strong industry evidence released by the GLEIF and researched by McKinsey & Company supports that banks in particular can greatly benefit from using LEIs to reduce client onboarding costs. LEI Everywhere will specifically help drive the KYC/AML use case:

Easier: availability of the LEI issuance API provides the ability to mass issue LEIs (and manage LEI lifecycle) to all clients seamlessly.

Less costly: leveraging existing KYC processes dramatically reduces back-end costs. Savings are passed on to the VA. The low price points allow LEIs to be bundled with other services.

Leveraging existing KYC/AML processes means the VA can obtain the LEI whilst simultaneously removing the duplication of data validation processes. In many cases, LEI Everywhere will augment existing organisation identity data pools with accurate Legal Entity reference data and associated identity attributes. KYC/AML service providers will attract new corporate customers who wish to use services that harness the LEI.

LEI Everywhere offers initial one-year LEI registrations at $11.99 and automated subsequent renewals at $5.99. All listed prices include the annual GLEIF fee.

LEI Everywhere is available immediately to GLEIF-approved VAs, and organisations interested in becoming VAs. Interested Financial Institutions and KYC/AML providers can talk to the RapidLEI team or a local RapidLEI Registration Agent about the next steps.

For more information visit the LEI Everywhere solution page at https://rapidlei.com/gleif-validation-agents.

About Ubisecure and RapidLEI

Ubisecure is accredited by the Global Legal Entity Identifier Foundation (GLEIF) to issue Legal Entity Identifiers (LEI). RapidLEI is a Ubisecure service that automates the LEI lifecycle to deliver LEIs quickly and easily. As of June 2021, over 90,000 organisations have chosen RapidLEI to issue their global organisation identifier. As well as pioneering the LEI Everywhere™ program, the company is a technology innovator and provides Identity & Access Management (IAM) software and cloud services for Customers, Workforce, & Organisation Identity use cases. Enterprises and Governments use Ubisecure IAM solutions to enhance user experience and security through improved registration, authentication, authorisation, and identity data management. Ubisecure also provides solutions to companies maintaining their own customer identity pools (such as banks and mobile network operators) to become Identity Providers (IdP) for strong authentication and federation services.

For more information about Ubisecure visit www.ubisecure.com

Ubisecure LEI: 529900T8BM49AURSDO55

Contact:

Steve Waite, CMO Ubisecure

steve.waite@ubisecure.com

+ 1 (617) 917-3577

Press Release Service by Newswire.com

Original Source: LEI Everywhere™ Increases Availability of Legal Entity Identifiers With Easier Registration and Lower Cost