Toronto, Ontario--(Newsfile Corp. - September 18, 2025) - SonicStrategy Inc., the blockchain infrastructure subsidiary of Spetz Inc. (CSE: SPTZ) (OTCQB: DBKSF) a publicly traded infrastructure company focused on the Sonic blockchain, is pleased to announce the successful launch of its second institutional-grade validator on the Sonic network.

SonicStrategy's new validator is built on enterprise-grade hardware designed for speed, reliability, and security. Each validator node runs on servers equipped with multi-core CPUs, 32-128 GB of memory, and fast NVMe storage exceeding 1 TB to handle Sonic's high throughput. Nodes are deployed in secure data centers with redundant power and 1 Gbps network connectivity, ensuring consistent performance and uptime.

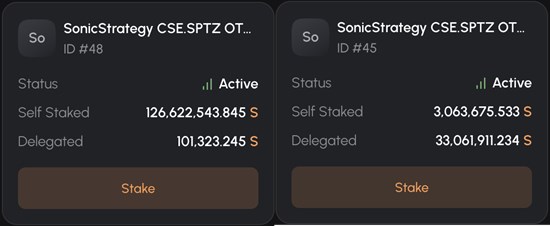

The new validator, launched on September 16, 2025, has been seeded with 126.6 million Sonic tokens ($S) directly from the Company treasury, instantly making it the largest self-stake validator on the network and the 3rd largest by total stake, according to SonicScan.org. Together with SonicStrategy's existing validator, currently ranked #12 as of this release, the Company now operates two of the largest validators in the Sonic ecosystem.

In total, SonicStrategy holds 135 million $S tokens directly. Every $0.01 change in the price of $S results in an approximate $1.86 million CAD change, upward or downward, in the Company's balance sheet value. In addition, the Company's two validators are generating approximately $7,500 in daily staking rewards, equivalent to an annualized revenue run-rate of roughly $2.7 million CAD at current prices. Actual earnings are subject to token price fluctuations, validator operating costs, and other expenses.

SonicStrategy Scale and Token Exposure

- Total Sonic Exposure: ~168M $S across validators, DeFi strategies, and treasury

- First Validator: 36.1M $S staked (3.1M self-staked, 33.1M third-party delegated)

- Second Validator: 126.6M $S staked (126.6M self-staked, ~101.3K third-party delegated)

- Holdings/DeFi Strategies: 5.3m $S

- Other Holdings: 3.711 BTC

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1512/266967_6df4e559b409baa8_001full.jpg

SonicStrategy's validator operations generate daily staking rewards that flow directly into the Company's treasury. SonicStrategy currently earns ~4.24% annually of staked tokens and 15% of the rewards earned by delegators on the SonicStrategy validators. These earnings provide recurring and compounding revenue for the Company while reinforcing the security and decentralization of the Sonic network.

"Launching our second validator with over 126.6 million Sonic staked is a major step in scaling our infrastructure footprint," said Mitchell Demeter, CEO of SonicStrategy. "Becoming the largest self-staked validator strengthens our credibility with third-party delegators and maximizes our revenue opportunities by gaining more delegators. Operating both the 3rd and 12th largest overall validators underscores our role as a cornerstone participant in the Sonic ecosystem while generating meaningful on-chain earnings that support our treasury growth."

By operating multiple large validators, SonicStrategy:

- Strengthens its role in securing and decentralizing the Sonic blockchain

- Generates predictable, recurring yield from validator rewards

- Expands its visibility and influence within the Sonic ecosystem

- Reinforces its position as the only publicly traded company providing direct institutional access to Sonic validator economics

For more information, visit:

SonicStrategy: www.sonicstrategy.io

About Spetz Inc. (dba SonicStrategy)

Spetz Inc. (CSE: SPTZ) (OTCQB: DBKSF) (dba SonicStrategy) is the parent company of SonicStrategy Inc., a public-market gateway to the Sonic blockchain ecosystem. Spetz provides investors with compliant exposure to staking infrastructure and DeFi strategies across the Sonic network.

Company Contacts:

Investor Relations

Email: investors@sonicstrategy.io

Phone: 1-800-927-8745

Mitchell Demeter, CEO

Email: mitchell@sonicstrategy.io

NEITHER THE CANADIAN SECURITIES EXCHANGE, NOR THEIR REGULATION SERVICES PROVIDERS HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Note Regarding Forward-Looking Statements

Certain information herein constitutes "forward-looking information" under Canadian securities laws, reflecting management's expectations regarding objectives, plans, strategies, future growth, results of operations, and business prospects of the Company. Words such as "may", "plans," "expects," "intends," "anticipates," "believes," and similar expressions identify forward-looking statements, which are qualified by the inherent risks and uncertainties surrounding future expectations.

Forward-looking statements are based on a number of estimates and assumptions that, while considered reasonable by management, are subject to business, economic, and competitive uncertainties and contingencies. The Company cautions readers not to place undue reliance on these statements, as forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from projected outcomes. Factors influencing these outcomes include economic conditions, regulatory developments, competition, capital availability, and business execution risks. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, including the Company's intention to apply to up-list its common shares on the Nasdaq Capital Markets and if such application is made, that the Company would be successful.

The forward-looking information contained in this press release represents Spetz's expectations as of the date of this release and is subject to change. Spetz does not undertake any obligation to update forward-looking statements, except as required by law.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, and shall not constitute an offer, solicitation or sale in any state, province, territory or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state, province, territory or jurisdiction. None of the securities issued in the Private Placement will be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), and none of them may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act.

Staking rewards and validator earnings are subject to a variety of risks, including but not limited to changes in token price, validator performance, network participation rates, and overall blockchain activity. The value of the Company's Sonic token holdings is highly volatile, and balance sheet exposure may fluctuate materially with changes in market prices. There can be no assurance that current validator rewards or token valuations will be sustained in the future.

No securities regulatory authority has either approved or disapproved the contents of this press release.

We seek Safe Harbor.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/266967