NVIDIA's (NASDAQ: NVDA) stock price has skyrocketed in recent years, driven by its association with artificial intelligence (AI) and the massive spending on data center expansion. The AI boom has made NVIDIA a market darling, but its valuation has soared alongside its stock price.

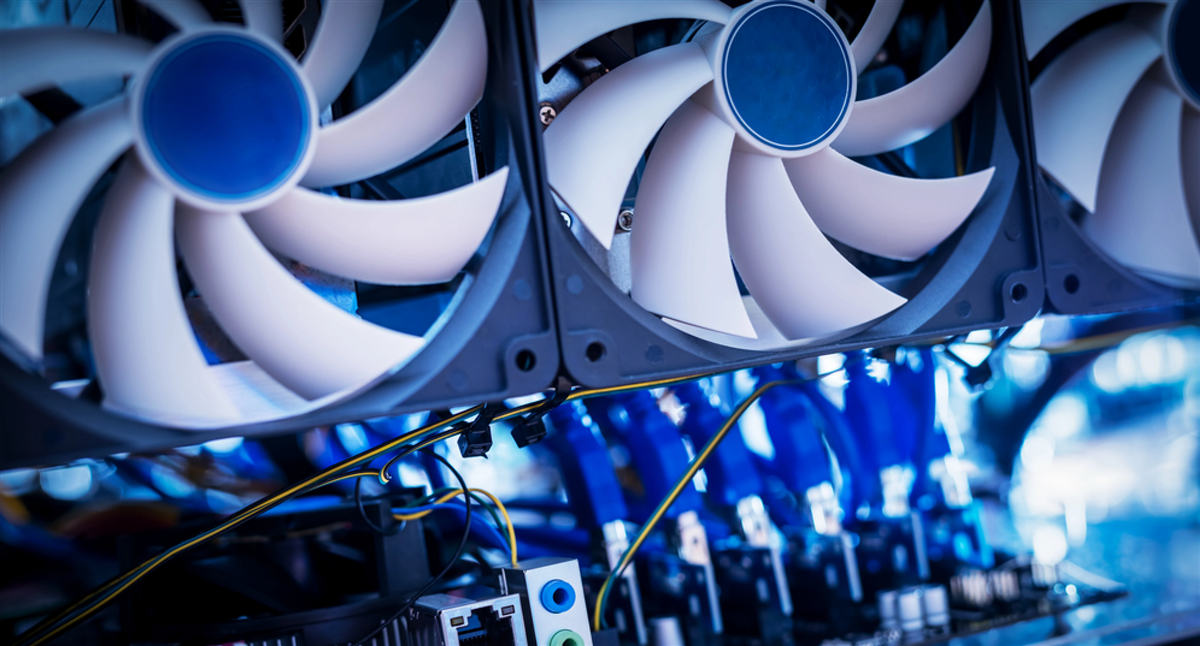

Johnson Controls (NYSE: JCI) offers a cool alternative for investors wary of buying hot stocks at premium valuations. This heating, ventilation, and air-conditioning (HVAC) specialist provides a compelling entry point into the AI-driven data center boom without the hefty price tag.

Johnson Controls is a behind-the-scenes player in this revolution, providing essential infrastructure for the data centers that power AI advancements.

Analysts See a Cool Future for Johnson Controls

Johnson Controls has recently received some positive ratings from analysts and hedge funds. Bank of America (NYSE: BAC) analysts upgraded the stock to a Buy rating and increased the price target to $80 from $76. In contrast, Morgan Stanley (NYSE: MS) analysts initiated coverage on Johnson Controls with an $85 price target and an overweight rating.

Both firms cited positive indicators involving Johnson Controls’ end-market exposure. Bank of America’s analyst asserted that Johnson Controls will generate 14% of its revenue from data centers this year. At the same time, Morgan Stanley’s analyst said the company’s solutions help building owners create efficiency gains. Robust HVAC solutions are needed to maintain a controlled environment in data centers so equipment can perform optimally. As a result, the data center market represents a key growth opportunity for Johnson Controls.

In addition to its data center focus, Johnson Controls has a solid growth opportunity coming from the trend of retrofitting buildings as owners strive to cut costs and reduce their carbon footprint. These efficiency gains are also being driven by the increasing use of digital technology in buildings, and the company continues to see strong adoption of its OpenBlue digital platform.

Johnson Controls' Growth Signals: More Than Just Cooling

While Johnson Controls' earnings report for the third quarter of 2024 may have been underperforming, the company continues to see strong growth in orders and backlog. This indicates the business is well positioned for continued growth.

During its Q3 earnings call, CEO George Oliver highlighted “strong demand for our data center solutions,” adding, "We have built a leading position in data centers in North America due to a unique and compelling customer value proposition.” This strong demand is backed by concrete data. The company reported an impressive 10% increase in its Building Solutions backlog for North America, reaching $9 billion at the end of Q3.

These numbers demonstrate the growing appetite for Johnson Controls’ products and services in the data center sector. The company's OpenBlue digital platform is also playing a key role in driving this growth. OpenBlue is a suite of intelligent building solutions that helps building owners manage their buildings more efficiently and sustainably. The platform integrates building management systems, analytics, and AI to optimize energy consumption, reduce costs, and improve tenant comfort. This digital strategy is helping Johnson Controls gain a competitive advantage in the data center market, and the company’s focus on this sector could lead to continued growth in the years to come.

Restructuring and Strategic Focus: JCI's New Era of Efficiency

Johnson Controls' recent restructuring is another key factor that could contribute to a positive stock price performance. The company has agreed to sell its residential and light commercial HVAC business to Bosch in a transaction valued at $8.1 billion. This strategic move will allow Johnson Controls to streamline its operations and focus on its higher-growth commercial and industrial HVAC segments.

The divestiture of these businesses will reduce Johnson Controls' overall sales by approximately 20%, but it will also significantly improve its profitability and efficiency. This move will enable the company to channel its resources toward its core businesses, which are better positioned for growth.

This restructuring comes at a pivotal time for the company. Former CEO George Oliver announced his retirement in conjunction with the company’s third-quarter report. This strategic shift indicates that the company is making a decisive move towards a more focused and efficient business model. The company's next CEO will have the opportunity to capitalize on these changes, which could significantly improve Johnson Controls’ financial performance.

With a more focused approach, Johnson Controls can capitalize on the increasing demand for its data center solutions and its growing role in the race to net zero. This move sets the stage for the company to generate significant shareholder returns.

Johnson Controls: A Consistent Dividend Payer

Johnson Controls’ dividend payout history dates back to 1887. Its consistent dividend payouts reflect the company's commitment to shareholder returns. In September 2024, the company's board of directors declared a quarterly dividend of $0.37 per share. The dividend is payable on October 18, 2024, to shareholders of record at the close of business on September 25, 2024. This represents an annualized dividend of $1.48, offering a yield of 2.18%.

Johnson Controls has provided guidance indicating that it expects to continue its consistent dividend payments. As the company continues to restructure and focus on its core businesses, it anticipates generating higher cash flow, supporting its ability to continue to pay a consistent dividend. The company’s dividend payout ratio, currently at 59.92%, indicates that it is committed to its dividend policy, and this commitment should be a key factor in the company's ability to attract and retain investors looking for a steady stream of income.

Johnson Controls: A Cool Play on the AI Revolution

Johnson Controls may not have the same buzz as NVIDIA, but the company is quietly positioned to benefit from the growth of data centers and the race to net zero. The company's recent restructuring further underscores its commitment to a more focused and efficient business model. As the company divests its non-core businesses, it is well-positioned to capitalize on its strengths in data center solutions, green building technology, and digital solutions. If Johnson Control’s management team continues to execute its strategy shift effectively, investors can expect cool returns for years to come.