Nvidia Co. (NASDAQ: NVDA) CEO Jensen Huang sparked market whispers this week, hinting at enlisting Intel Co. (NASDAQ: INTC) to produce chips. Huang told reporters that Nvidia is "open to manufacturing with Intel" and that the company "received test chip results of their next generation process, and the results look good."

Intensifying rumors, Intel CEO Pat Gelsinger’s comments back in January about adding a new Intel Foundry Services customer can now be viewed in a new light. In conjunction with Huang's positive comments about Intel's test run, this opaque reference has spurred analysts to surmise Nvidia could consider Intel a serious foundry partner.

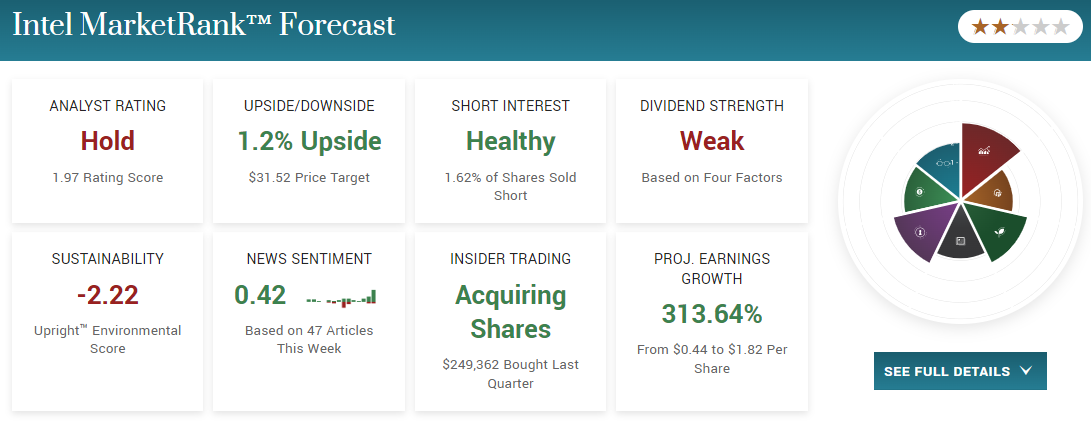

Intel stock sharply rallied on the news.

Check out MarketBeat's MarketRank Forecast for Intel.

Why Would Nvidia Use Intel?

The business of semiconductor foundries, which fabricate intricate chips for chip designers like Nvidia, is highly concentrated. Taiwan Semiconductor Manufacturing Company Ltd. (NYSE: TSM) and Samsung Electronics Co. Ltd. (OTCMKTS: SSNLF) are the only contenders capable of meeting Nvidia’s production needs.

Although Samsung plays a role, Nvidia leans heavily on Taiwan Semiconductor for its reliability and scale when producing cutting-edge chips.

But the prevailing geopolitical tensions in Taiwan, with constant threats from China of potential invasion, is a disruptive force in Nvidia's and the global chip market's supply chain. As a result, Nvidia seeks to diversify risk, potentially tapping Intel to join the ranks of its foundry partners.

Intel already supplies Nvidia chips for a likely narrow-in-scope government contract. Still, Gelsinger has set his sights much higher.

Can Intel Become a Serious Foundry?

Most investors know Intel as a chip powerhouse, designing cutting-edge chips and manufacturing them in house. For many, Intel and chips are synonymous in the way that burgers and McDonald’s are.

But Intel has lost ground over the last several years, between the company’s failure to adapt to mobile, losing ground to AMD on CPUs, and failing to compete in the discrete and data center GPU markets meaningfully.

As such, Intel (NASDAQ: INTC) stock has far underperformed peers AMD (NASDAQ: AMD) and Nvidia (NASDAQ: NVDA) over the last five years, with Intel declining 36% over that period while AMD and Nvidia skyrocketed 721% and 526%, respectively.

With the rise of AI threatening CPU shelf space in favor of GPUs, Intel’s bread and butter business is under additional threat, so the company has turned to foundry services as a potential new lifeline under CEO Pat Gelsinger.

Gelsinger is leading the pivot with the ambitious goal of placing Intel as the world’s second-largest foundry by 2030, trailing only Taiwan Semiconductor. The company aims to be a serious player in the business by 2025.

But Gelsinger and Intel will need to move mountains to make that happen. Despite the company’s extensive manufacturing experience, it’s had trouble attracting business. Past disappointments include a missed opportunity to produce smartphone chips for Qualcomm and unfruitful talks with Tesla.

Gelsinger seems unshaken by missteps acknowledging the challenges of shifting a legacy business’ core focus.

But positive test results from what is now one of the largest market cap companies in the world could give investors a reason to hold out hope for Gelsinger’s foundry plan.

However, there's room for skepticism. Nvidia is using Intel to fulfill a Department of Defense contract. Given the Biden Administration's semiconductor protectionism, it's possible that Nvidia was required to use a US foundry to fulfill the contract.

Achieving a similar scale to Taiwan Semiconductor can cost hundreds of billions of investment. After over a decade of miscalculations, many Intel bears are asking how Gelsinger can turn that around by entering a highly concentrated and capital-intensive market. While government subsidies like the CHIPS Act can help, it may be too late for Intel.

Bottom Line

The potential partnership between Nvidia and Intel could redefine Intel’s role in the global chip market, transforming it from a dwindling legacy firm to a powerhouse foundry.